Need help with 1-a and 1-b. Thank you

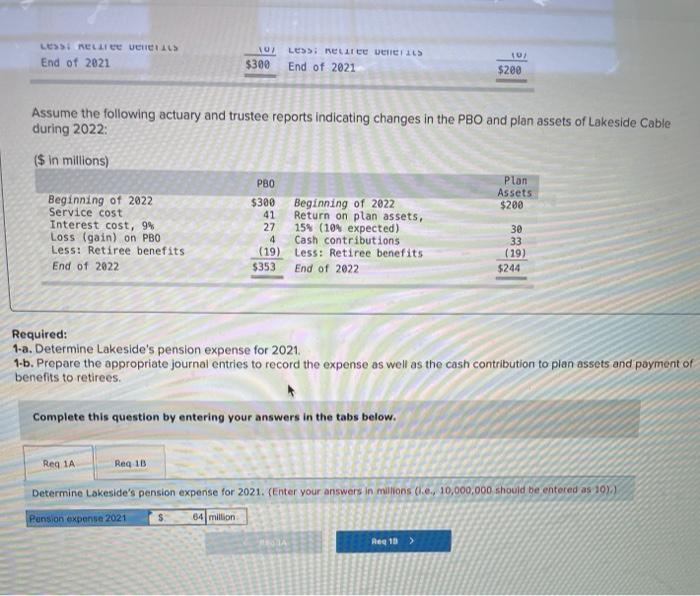

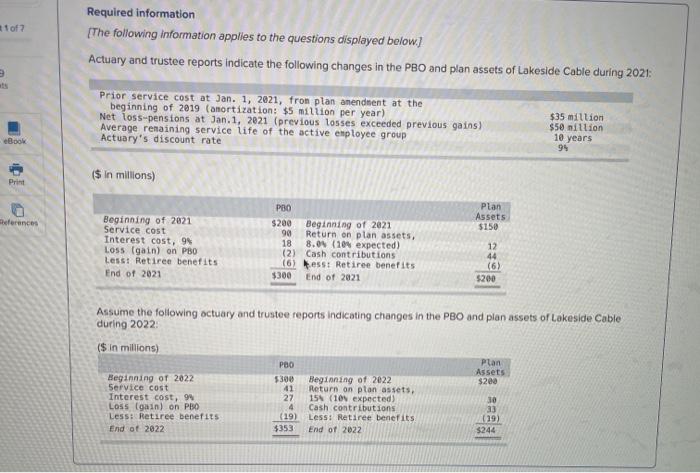

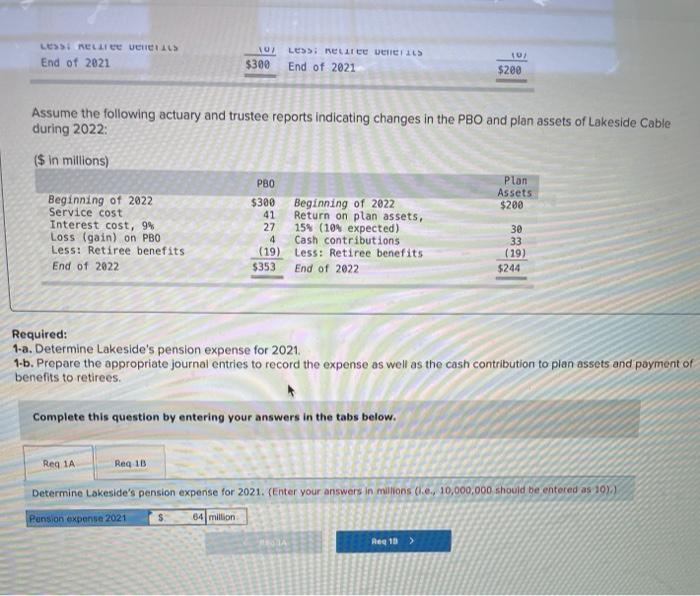

1 of 7 Required information [The following information applies to the questions displayed below) Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2021: Prior service cost at Jan. 1, 2021, fron plan amendment at the beginning of 2019 (amortization: $5 million per year) Net loss-pensions at Jan. 1, 2021 (previous tosses exceeded previous gains) Average renaining service life of the active employee group Actuary's discount rate $35 million $50 million 10 years 94 Book ($ in millions) Print PBO References Plan Assets $150 Beginning of 2021 Service cost Interest cost, 99 Loss (gain) on PBO Less: Retiree benefits End of 2021 $200 Beginning of 2021 90 Return on plan assets, 18 8.01 (104 expected) (2) Cash contributions (6) ess: Retiree benefits $300 End of 2021 12 44 (6) 5200 Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2022 ($ in millions) plan Assets $200 Beginning of 2022 Service cost Interest cost, Loss (gain) on PBO Less: Retiree benefits End of 2022 PBO 5300 41 27 4 (19) $353 Beginning of 2022 Return on plan assets, 154 (100 expected) Cash contributions Less: Retiree benefits End of 2022 30 23 (19) $244 LESS RELLE UNTIL End of 2021 07 $300 LES RELLE DERES End of 2021 10 $200 Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2022 ($ in millions) PBO Plan Assets Beginning of 2022 $300 Beginning of 2022 $200 Service cost 41 Return on plan assets, Interest cost, 9% 27 154 (104 expected) 30 Loss (gain) on PBO Cash contributions 33 Less: Retiree benefits (19) Less: Retiree benefits (19) End of 2022 $353 End of 2022 $244 4 Required: 1-a. Determine Lakeside's pension expense for 2021. 1-b. Prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees. Complete this question by entering your answers in the tabs below. Reg 1A Req 10 Determine Lakeside's pension expense for 2021. (Enter your answers in milions (l. 10,000,000 should be entered as 10%) Pansion expense 2021 Heq 70 > S 64 million

Need help with 1-a and 1-b. Thank you

Need help with 1-a and 1-b. Thank you