Answered step by step

Verified Expert Solution

Question

1 Approved Answer

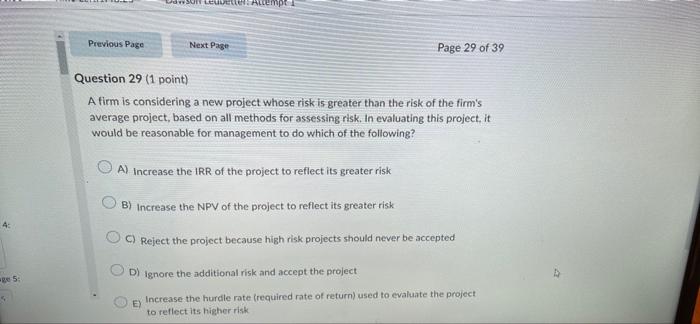

need help with 29 and 30 ge 5: S DrawSOIT LEDetter: Altempe Previous Page Next Page Page 29 of 39 Question 29 (1 point) A

need help with 29 and 30

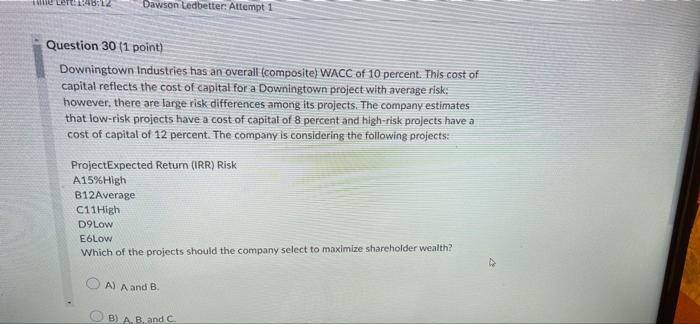

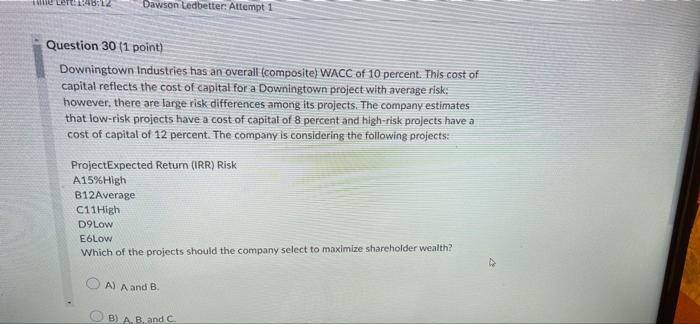

ge 5: S DrawSOIT LEDetter: Altempe Previous Page Next Page Page 29 of 39 Question 29 (1 point) A firm is considering a new project whose risk is greater than the risk of the firm's average project, based on all methods for assessing risk. In evaluating this project, it would be reasonable for management to do which of the following? A) Increase the IRR of the project to reflect its greater risk B) Increase the NPV of the project to reflect its greater risk C) Reject the project because high risk projects should never be accepted D) Ignore the additional risk and accept the project E) Increase the hurdle rate (required rate of return) used to evaluate the project. to reflect its higher risk Dawson Ledbetter: Attempt 1 Question 30 (1 point) Downingtown Industries has an overall (composite) WACC of 10 percent. This cost of capital reflects the cost of capital for a Downingtown project with average risk: however, there are large risk differences among its projects. The company estimates that low-risk projects have a cost of capital of 8 percent and high-risk projects have a cost of capital of 12 percent. The company is considering the following projects: ProjectExpected Return (IRR) Risk A15% High B12Average C11High D9Low E6Low Which of the projects should the company select to maximize shareholder wealth? A) A and B. B) A. B. and C The Left: 1:48:12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started