Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with #4 please. A savings account earns compound interest at an annual effective interest rate i. Given that i_[2, 4, 5] = 20%,

Need help with #4 please.

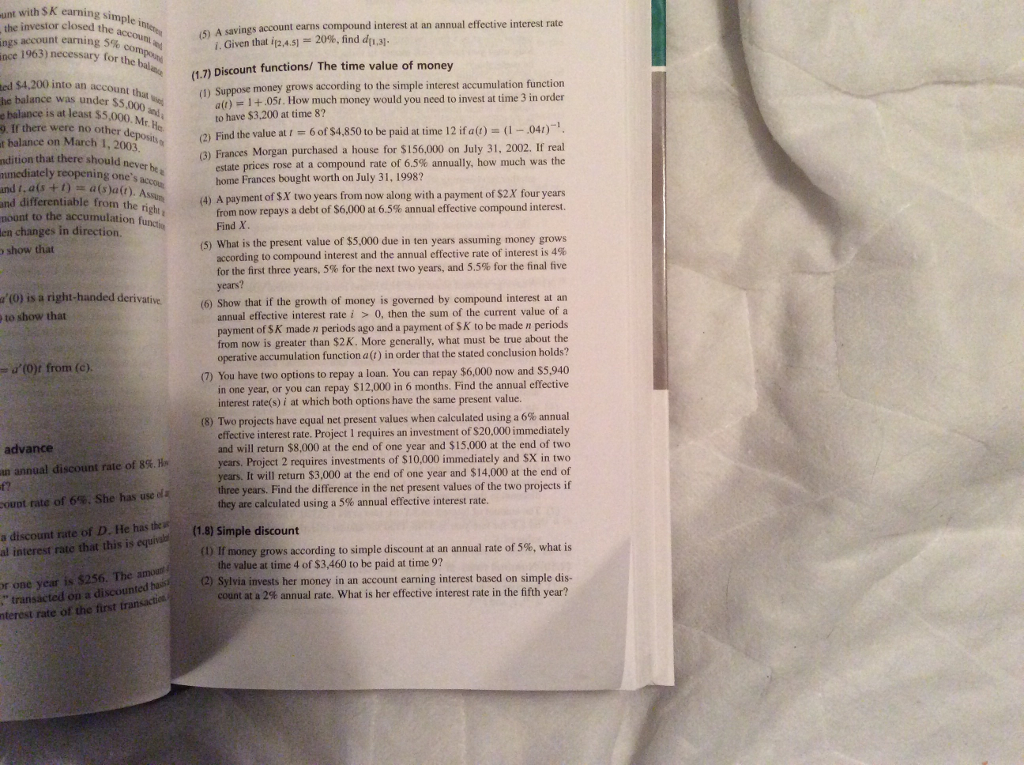

A savings account earns compound interest at an annual effective interest rate i. Given that i_[2, 4, 5] = 20%, find d_[1, 3]. Suppose money grows according to the simple interest accumulation function a(t) = 1 + 0.5t. How much money would you need to invest at time 3 in order to have $3, 200 at time 8? Find the value at r = 6 of $4, 850 to be paid at time 12 if a (t) = (1 - 04t)^-1. Frances Morgan purchased a house for $156, 000 on July 31, 2002. If real estate prices rose at a compound rate of 6.5% annually, how much was the home Frances bought worth on July 31. 1998? A payment of $X two years from now along with a payment of $2X four years from now repays a debt of $6, 000 at 6.5% annual effective compound interest. Find X. What is the present value of $5, 000 due in ten years assuming money grows according to compound interest and the annual effective rate of interest is 4% for the first three years. 5% for the next two years, and 5.5% for the final five years? Show that if the growth of money is governed by compound interest at an annual effective interest rate i > 0, then the sum of the current value of a payment of $K made n periods ago and a payment of $K lobe made n periods from now is greater than $2 K. More generally, what must be true about the operative accumulation function a(t) in order that the stated conclusion holds? You have two options to repay a loan. You can repay $6, 000 now and $5, 940 in one year, or you can repay $12, 000 in 6 months. Find the annual effective interest rate(s) i at which both options have the same present value. Two projects have equal net present values when calculated using a 6% annual effective interest rate. Project I requires an investment of $20, 000 immediately and will return $8, 000 at the end of one year and $15, 000 at the end of two years. Project 2 requires investments of $10, 000 immediately and $X in two years It will return $3, 000 at the end of one year and $14, 000 at the end of three years. Find the difference in the net present values of the two projects if they are calculated using a 5% annual effective interest rate. If money grows according to simple discount at an annual rate of 5% what is the value at time 4 of $3, 460 to be paid at time 9? Sylvia invests her money in an account earning interest based on simple discount at a 2% annual rate. What is her effective interest rate in the fifth year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started