*** Need help with 6b-13 and Closing Entries

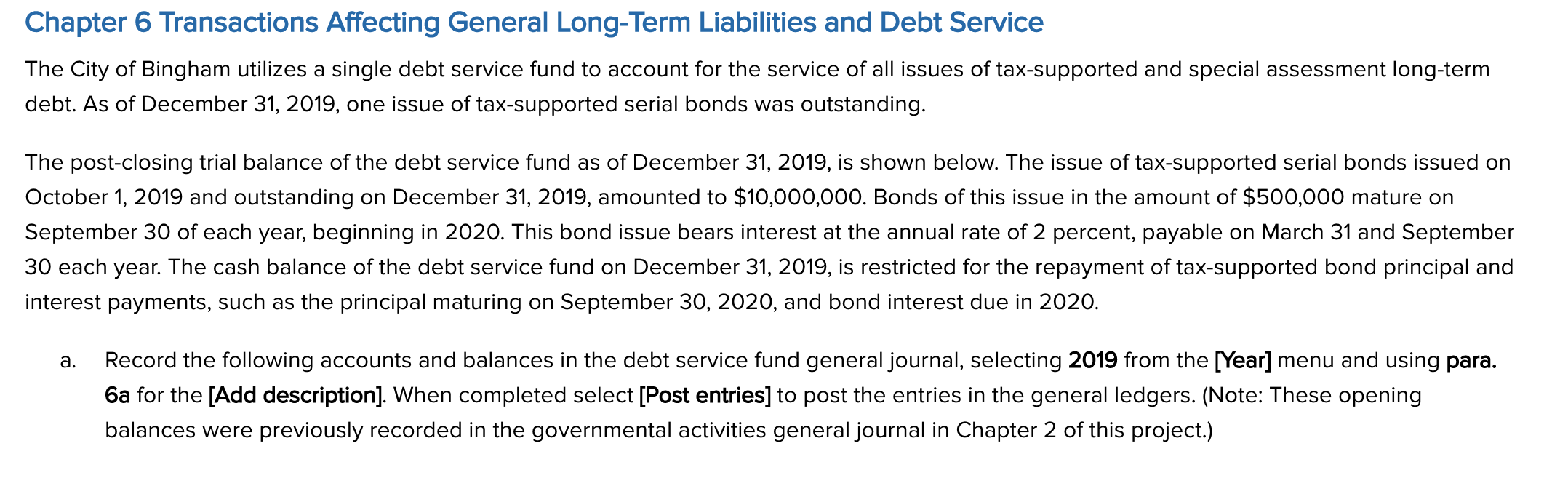

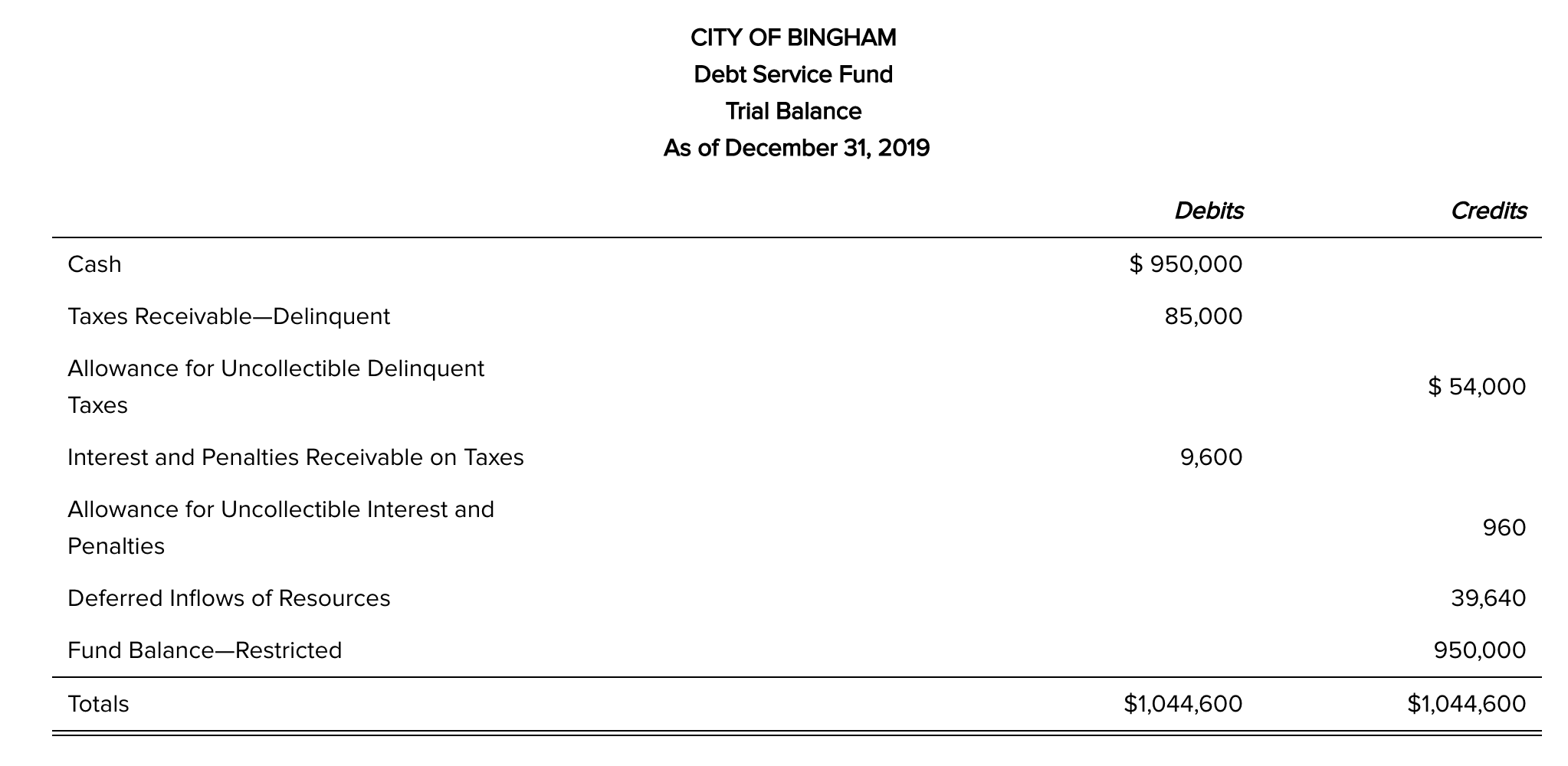

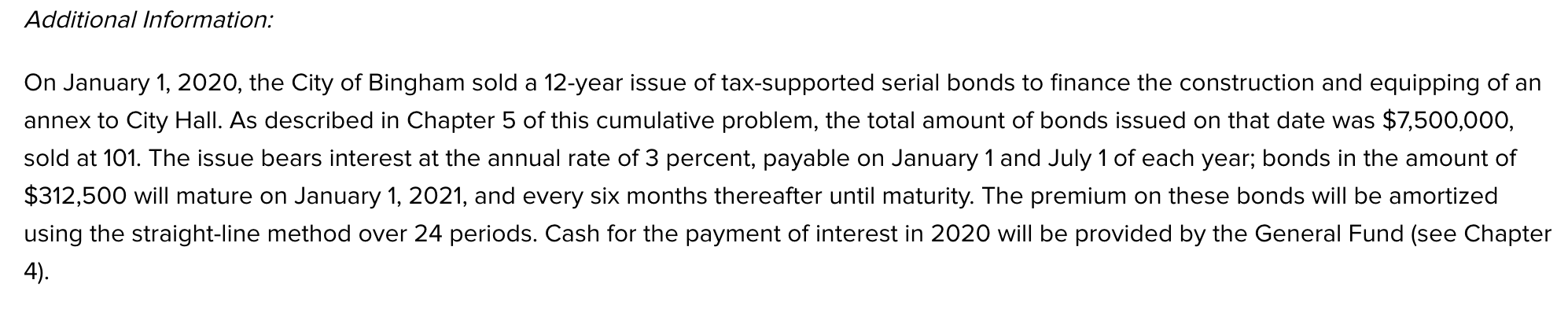

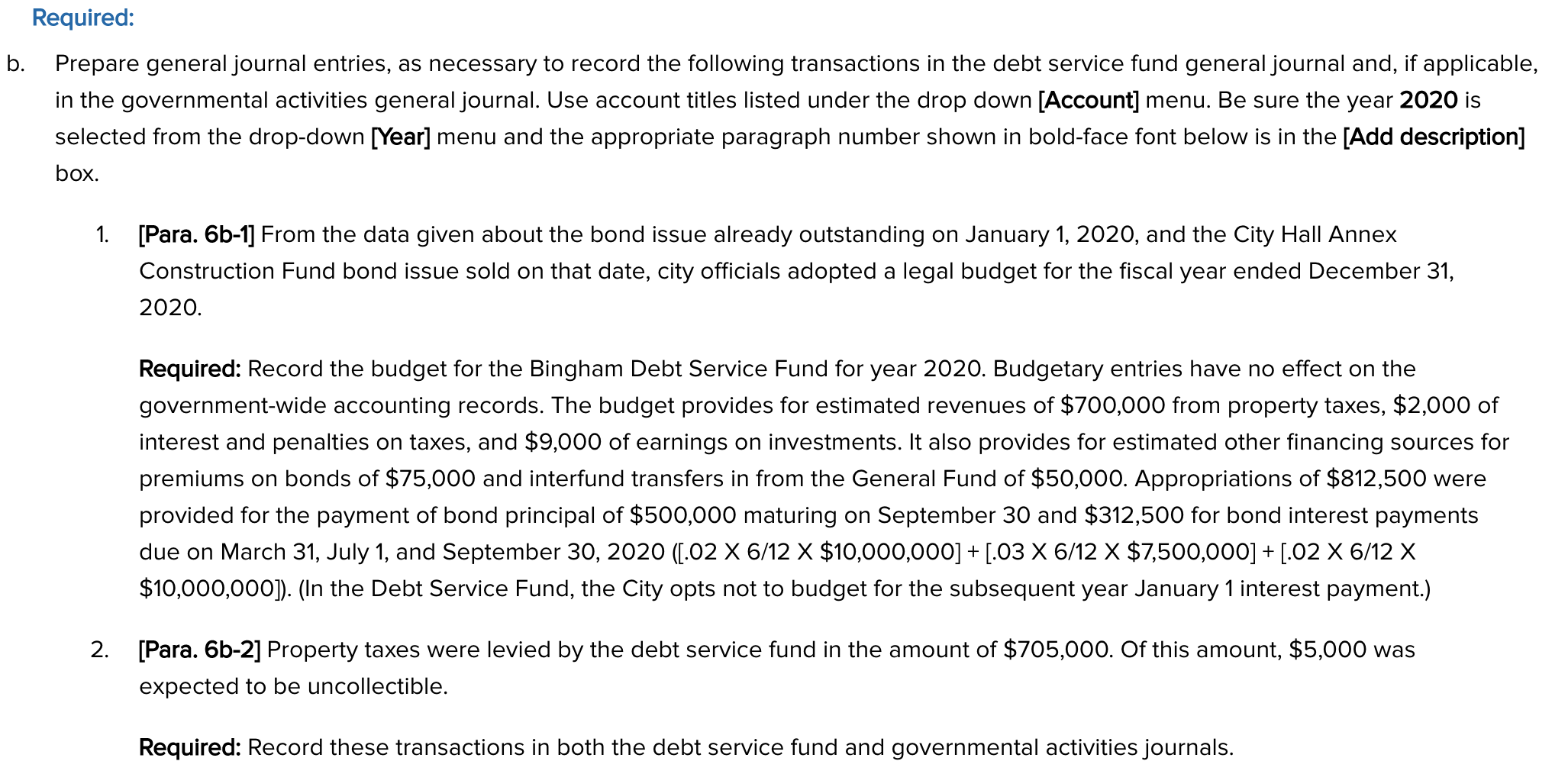

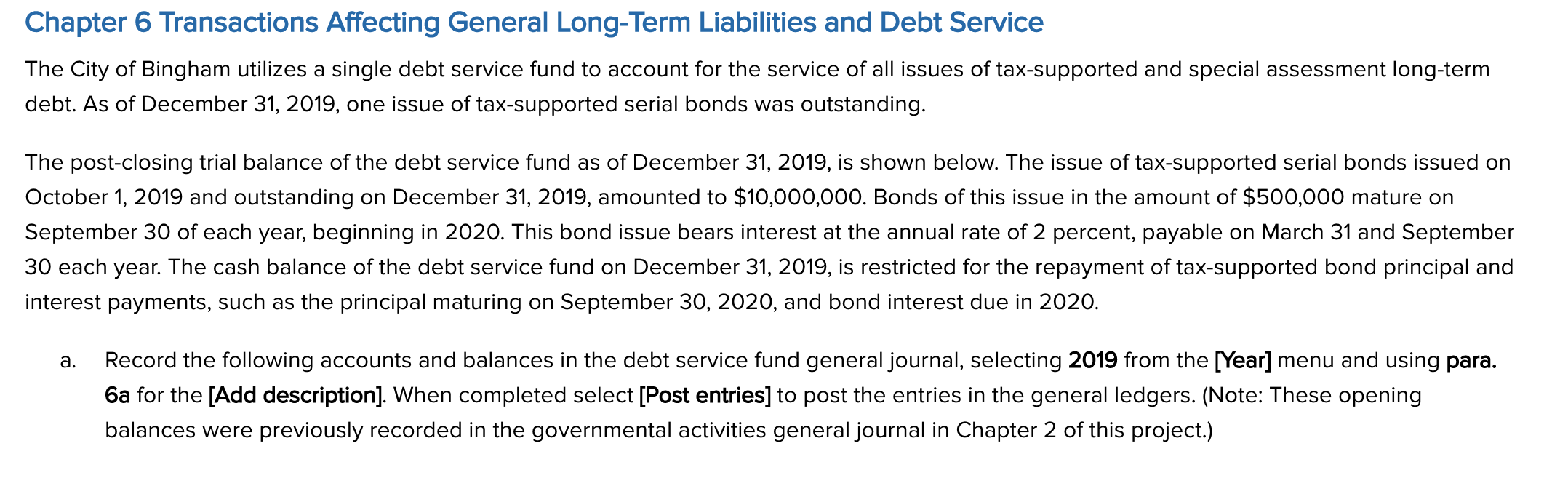

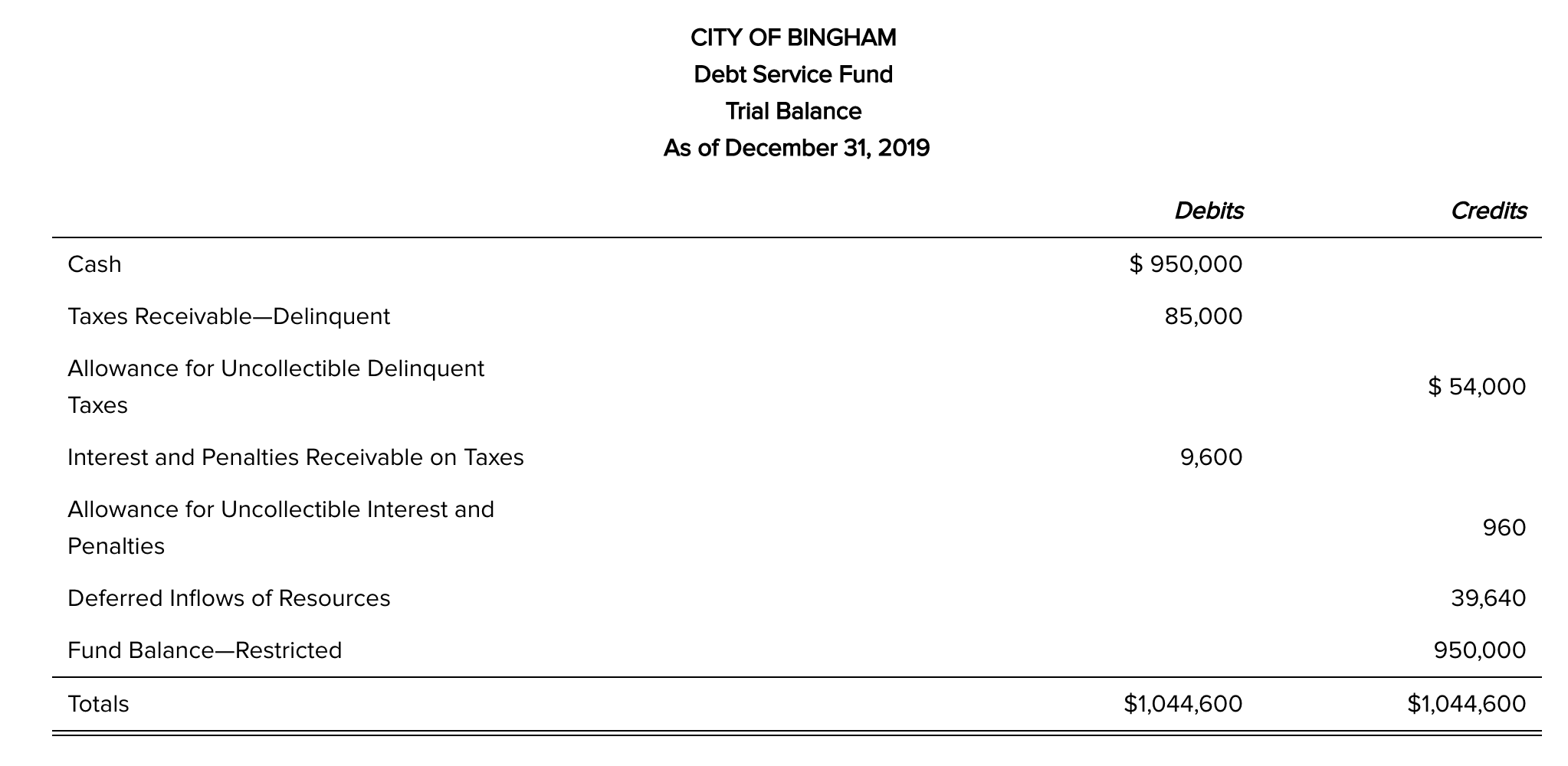

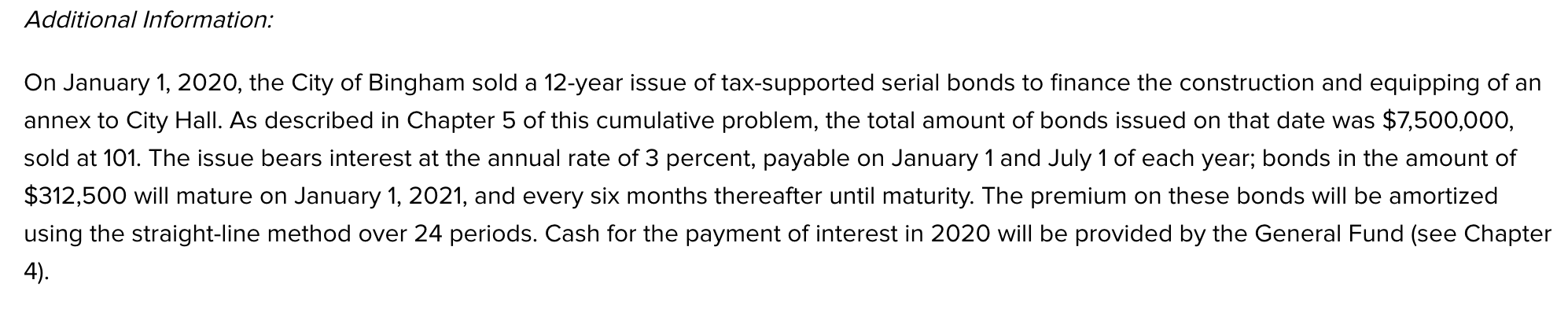

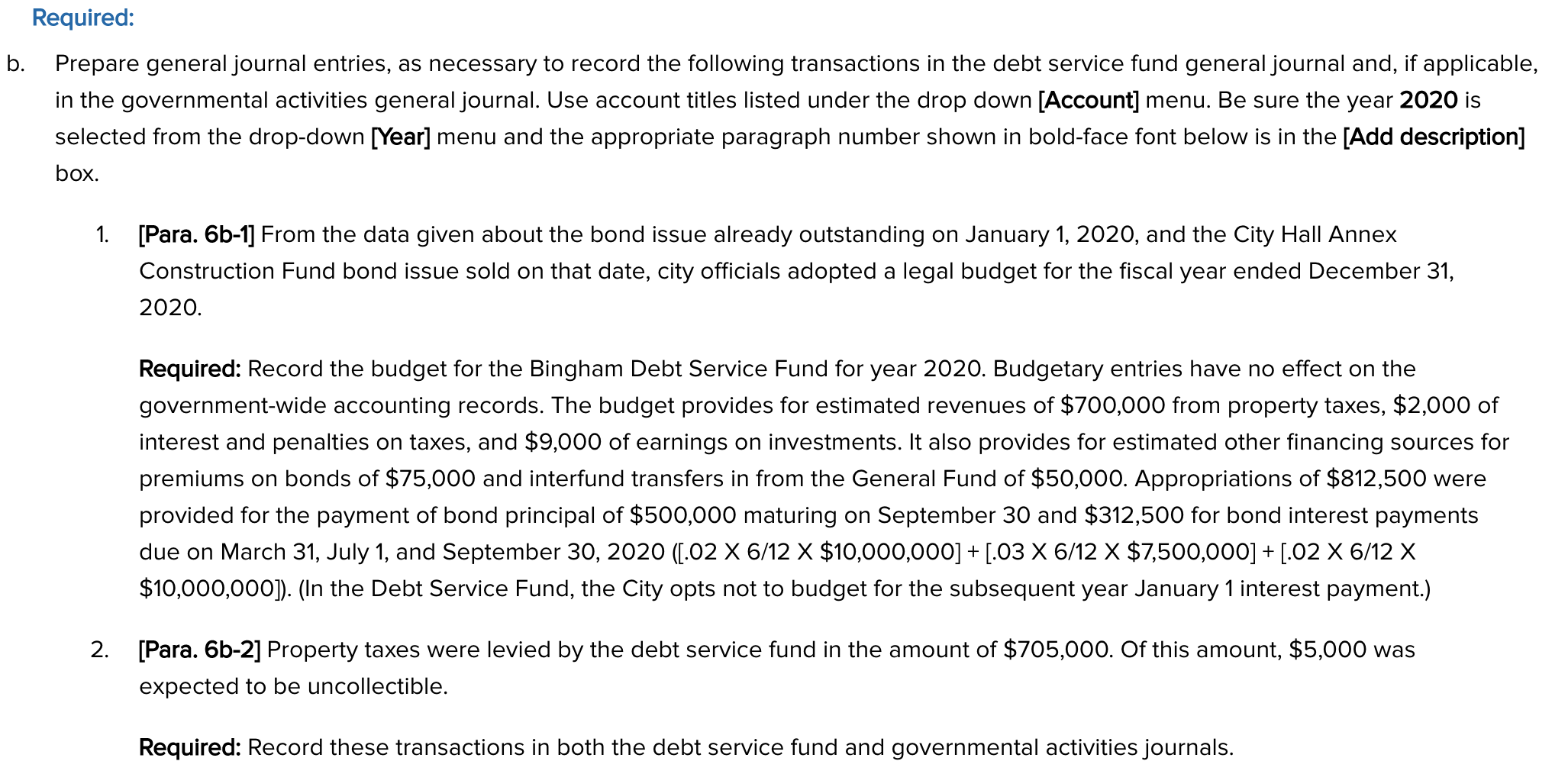

Chapter 6 Transactions Affecting General Long-Term Liabilities and Debt Service The City of Bingham utilizes a single debt service fund to account for the service of all issues of tax-supported and special assessment long-term debt. As of December 31, 2019, one issue of tax-supported serial bonds was outstanding. The post-closing trial balance of the debt service fund as of December 31, 2019, is shown below. The issue of tax-supported serial bonds issued on October 1, 2019 and outstanding on December 31, 2019, amounted to $10,000,000. Bonds of this issue in the amount of $500,000 mature on September 30 of each year, beginning in 2020. This bond issue bears interest at the annual rate of 2 percent, payable on March 31 and September 30 each year. The cash balance of the debt service fund on December 31, 2019, is restricted for the repayment of tax-supported bond principal and interest payments, such as the principal maturing on September 30, 2020, and bond interest due in 2020. a. Record the following accounts and balances in the debt service fund general journal, selecting 2019 from the [Year] menu and using para. 6a for the [Add description]. When completed select [Post entries] to post the entries in the general ledgers. (Note: These opening balances were previously recorded in the governmental activities general journal in Chapter 2 of this project.) CITY OF BINGHAM Debt Service Fund Trial Balance As of December 31, 2019 Debits Credits Cash $ 950,000 Taxes Receivable-Delinquent 85,000 Allowance for Uncollectible Delinquent Taxes $ 54,000 Interest and Penalties Receivable on Taxes 9,600 Allowance for Uncollectible Interest and Penalties 960 Deferred Inflows of Resources 39,640 Fund Balance-Restricted 950,000 Totals $1,044,600 $1,044,600 Additional Information: On January 1, 2020, the City of Bingham sold a 12-year issue of tax-supported serial bonds to finance the construction and equipping of an annex to City Hall. As described in Chapter 5 of this cumulative problem, the total amount of bonds issued on that date was $7,500,000, sold at 101. The issue bears interest at the annual rate of 3 percent, payable on January 1 and July 1 of each year; bonds in the amount of $312,500 will mature on January 1, 2021, and every six months thereafter until maturity. The premium on these bonds will be amortized using the straight-line method over 24 periods. Cash for the payment of interest in 2020 will be provided by the General Fund (see Chapter Required: b. Prepare general journal entries, as necessary to record the following transactions in the debt service fund general journal and, if applicable, in the governmental activities general journal. Use account titles listed under the drop down [Account] menu. Be sure the year 2020 is selected from the drop-down [Year] menu and the appropriate paragraph number shown in bold-face font below is in the [Add description] box. 1. [Para. 6b-1] From the data given about the bond issue already outstanding on January 1, 2020, and the City Hall Annex Construction Fund bond issue sold on that date, city officials adopted a legal budget for the fiscal year ended December 31, 2020. Required: Record the budget for the Bingham Debt Service Fund for year 2020. Budgetary entries have no effect on the government-wide accounting records. The budget provides for estimated revenues of $700,000 from property taxes, $2,000 of interest and penalties on taxes, and $9,000 of earnings on investments. It also provides for estimated other financing sources for premiums on bonds of $75,000 and interfund transfers in from the General Fund of $50,000. Appropriations of $812,500 were provided for the payment of bond principal of $500,000 maturing on September 30 and $312,500 for bond interest payments due on March 31, July 1, and September 30, 2020 ([.02 X 6/12 X $10,000,000] + [.03 X 6/12 X $7,500,000] + [.02 X 6/12 X $10,000,000]). (In the Debt Service Fund, the City opts not to budget for the subsequent year January 1 interest payment.) 2. [Para. 6b-2] Property taxes were levied by the debt service fund in the amount of $705,000. Of this amount, $5,000 was expected to be uncollectible. Required: Record these transactions in both the debt service fund and governmental activities journals. 3. [Para. 6b-3] Cash in the amount of the $75,000 premium on the bonds sold on January 1, 2020 was received and recorded in the debt service fund. Required: Record this transaction in the debt service fund. No entry is required at this time in the governmental activities general journal since the bond issue, including the related premium and accrued interest, was recorded in the governmental activities general journal in transaction 5a-1. 4. [Para. 6b-4] Temporary investments were purchased in the amount of $500,000. Required: Record this transaction in both the debt service fund and governmental activities journals. 5. [Para. 66-5] Checks were written and mailed to bondholders for interest payable on March 31, 2020. Required: Record this transaction in both the debt service fund and governmental activities journals. In the governmental activities general journal, debit Accrued Interest Payable for the portion of these amounts expensed on December 31, 2019, the end of the preceding fiscal year. 6. [Para. 6b-6] Current taxes receivable were collected in the amount of $675,000. Also, delinquent taxes receivable were collected in the amount of $10,000, along with Interest and Penalties Receivable on Taxes of $600. Required: Record these transactions in both the debt service fund and governmental activities journals. (Remember to recognize revenue in the debt service fund for the delinquent taxes and interest and penalties collected by reducing the deferred inflows of resources.) 7. [Para. 6b-7] Interest on temporary investments was received in cash in the amount of $7,500. Required: Record this transaction in both the debt service fund and governmental activities journals. 8. [Para. 6b-8] Temporary investments amounting to $300,000 were sold at par. Required: Record this transaction in both the debt service fund and governmental activities journals. 9. [Para. 6b-9] On July 1, the debt service fund received $50,000 from the General Fund for interest payment on the 3% serial bonds. Checks were written and mailed to bondholders for the interest payment due July 1, 2020. Required: Record the transfer in the debt service fund and the interest payment in both the debt service fund and governmental activities journals. At the government-wide level, $3,125 was debited for amortization of the premium on the 3% serial bonds. 10. [Para. 6b-10] Cash to close the City Hall Annex Construction Fund was received in the amount of $4,000. (See Chapter 5, para. 5a-18). The city council authorized a budget amendment for this unexpected transfer. Required: Record the budget amendment and transfer in the debt service fund. This transaction involves two governmental funds, thus it has no effect on the governmental activities general journal. 11. [Para. 6b-11] On September 30, the debt service fund made the principal and interest payments associated with the 2% serial bond. Required: Record this transaction in both the debt service fund and governmental activities journals. 12. [Para. 6b-12] The uncollected balance of current taxes receivable and the related estimated uncollectible account were reclassified as delinquent. Property tax revenues and deferred inflows of resources were adjusted for unavailable revenues. Interest and penalties of $1,200 were accrued, of which $120 was estimated to be uncollectible. Required: Record this transaction in both the debt service fund and governmental activities journals. In the debt service fund net receivables and interest and penalties should be also be recorded as deferred inflows of resources, rather than revenues. 13. [Para. 6b-13] At December 31, 2020, accrued interest expense on the two outstanding bond issues was recorded in the governmental activities general journal. Amortization of the premium on the 3% bonds sold was also recorded in the amount of $3,125. Required: Record the accrual in the governmental activities journal. 14. Verify the accuracy of all your preceding journal entries in the debt service fund and governmental activities general journals, then click [Post entries] of each entity to post the entries to the respective general ledgers. For the debt service fund only, make the entries needed to close the budgetary and operating statement accounts at the end of fiscal year 2020 and post them to the fund's general ledger. (Note: You must click on the box for [Closing Entry] to check mark it; "Closing Entry" checkbox appears next to the [Add credit] field for the account being closed. Be sure the checkmark is present for each account being closed.) Click [Post entries] to post the closing entry. Closing entries will be made in the governmental activities general journal in Chapter 9 of this cumulative problem. Ignore those entries for now. Export the post-closing trial balance for year 2020 to an Excel worksheet and use Excel to prepare a balance sheet for the debt service fund as of December 31, 2020. (See Illustration 4-4 in the textbook for an example of an appropriate format of a governmental fund balance sheet.). In addition, print the post-closing trial balance from the [Reports] drop-down menu. Chapter 6 Transactions Affecting General Long-Term Liabilities and Debt Service The City of Bingham utilizes a single debt service fund to account for the service of all issues of tax-supported and special assessment long-term debt. As of December 31, 2019, one issue of tax-supported serial bonds was outstanding. The post-closing trial balance of the debt service fund as of December 31, 2019, is shown below. The issue of tax-supported serial bonds issued on October 1, 2019 and outstanding on December 31, 2019, amounted to $10,000,000. Bonds of this issue in the amount of $500,000 mature on September 30 of each year, beginning in 2020. This bond issue bears interest at the annual rate of 2 percent, payable on March 31 and September 30 each year. The cash balance of the debt service fund on December 31, 2019, is restricted for the repayment of tax-supported bond principal and interest payments, such as the principal maturing on September 30, 2020, and bond interest due in 2020. a. Record the following accounts and balances in the debt service fund general journal, selecting 2019 from the [Year] menu and using para. 6a for the [Add description]. When completed select [Post entries] to post the entries in the general ledgers. (Note: These opening balances were previously recorded in the governmental activities general journal in Chapter 2 of this project.) CITY OF BINGHAM Debt Service Fund Trial Balance As of December 31, 2019 Debits Credits Cash $ 950,000 Taxes Receivable-Delinquent 85,000 Allowance for Uncollectible Delinquent Taxes $ 54,000 Interest and Penalties Receivable on Taxes 9,600 Allowance for Uncollectible Interest and Penalties 960 Deferred Inflows of Resources 39,640 Fund Balance-Restricted 950,000 Totals $1,044,600 $1,044,600 Additional Information: On January 1, 2020, the City of Bingham sold a 12-year issue of tax-supported serial bonds to finance the construction and equipping of an annex to City Hall. As described in Chapter 5 of this cumulative problem, the total amount of bonds issued on that date was $7,500,000, sold at 101. The issue bears interest at the annual rate of 3 percent, payable on January 1 and July 1 of each year; bonds in the amount of $312,500 will mature on January 1, 2021, and every six months thereafter until maturity. The premium on these bonds will be amortized using the straight-line method over 24 periods. Cash for the payment of interest in 2020 will be provided by the General Fund (see Chapter Required: b. Prepare general journal entries, as necessary to record the following transactions in the debt service fund general journal and, if applicable, in the governmental activities general journal. Use account titles listed under the drop down [Account] menu. Be sure the year 2020 is selected from the drop-down [Year] menu and the appropriate paragraph number shown in bold-face font below is in the [Add description] box. 1. [Para. 6b-1] From the data given about the bond issue already outstanding on January 1, 2020, and the City Hall Annex Construction Fund bond issue sold on that date, city officials adopted a legal budget for the fiscal year ended December 31, 2020. Required: Record the budget for the Bingham Debt Service Fund for year 2020. Budgetary entries have no effect on the government-wide accounting records. The budget provides for estimated revenues of $700,000 from property taxes, $2,000 of interest and penalties on taxes, and $9,000 of earnings on investments. It also provides for estimated other financing sources for premiums on bonds of $75,000 and interfund transfers in from the General Fund of $50,000. Appropriations of $812,500 were provided for the payment of bond principal of $500,000 maturing on September 30 and $312,500 for bond interest payments due on March 31, July 1, and September 30, 2020 ([.02 X 6/12 X $10,000,000] + [.03 X 6/12 X $7,500,000] + [.02 X 6/12 X $10,000,000]). (In the Debt Service Fund, the City opts not to budget for the subsequent year January 1 interest payment.) 2. [Para. 6b-2] Property taxes were levied by the debt service fund in the amount of $705,000. Of this amount, $5,000 was expected to be uncollectible. Required: Record these transactions in both the debt service fund and governmental activities journals. 3. [Para. 6b-3] Cash in the amount of the $75,000 premium on the bonds sold on January 1, 2020 was received and recorded in the debt service fund. Required: Record this transaction in the debt service fund. No entry is required at this time in the governmental activities general journal since the bond issue, including the related premium and accrued interest, was recorded in the governmental activities general journal in transaction 5a-1. 4. [Para. 6b-4] Temporary investments were purchased in the amount of $500,000. Required: Record this transaction in both the debt service fund and governmental activities journals. 5. [Para. 66-5] Checks were written and mailed to bondholders for interest payable on March 31, 2020. Required: Record this transaction in both the debt service fund and governmental activities journals. In the governmental activities general journal, debit Accrued Interest Payable for the portion of these amounts expensed on December 31, 2019, the end of the preceding fiscal year. 6. [Para. 6b-6] Current taxes receivable were collected in the amount of $675,000. Also, delinquent taxes receivable were collected in the amount of $10,000, along with Interest and Penalties Receivable on Taxes of $600. Required: Record these transactions in both the debt service fund and governmental activities journals. (Remember to recognize revenue in the debt service fund for the delinquent taxes and interest and penalties collected by reducing the deferred inflows of resources.) 7. [Para. 6b-7] Interest on temporary investments was received in cash in the amount of $7,500. Required: Record this transaction in both the debt service fund and governmental activities journals. 8. [Para. 6b-8] Temporary investments amounting to $300,000 were sold at par. Required: Record this transaction in both the debt service fund and governmental activities journals. 9. [Para. 6b-9] On July 1, the debt service fund received $50,000 from the General Fund for interest payment on the 3% serial bonds. Checks were written and mailed to bondholders for the interest payment due July 1, 2020. Required: Record the transfer in the debt service fund and the interest payment in both the debt service fund and governmental activities journals. At the government-wide level, $3,125 was debited for amortization of the premium on the 3% serial bonds. 10. [Para. 6b-10] Cash to close the City Hall Annex Construction Fund was received in the amount of $4,000. (See Chapter 5, para. 5a-18). The city council authorized a budget amendment for this unexpected transfer. Required: Record the budget amendment and transfer in the debt service fund. This transaction involves two governmental funds, thus it has no effect on the governmental activities general journal. 11. [Para. 6b-11] On September 30, the debt service fund made the principal and interest payments associated with the 2% serial bond. Required: Record this transaction in both the debt service fund and governmental activities journals. 12. [Para. 6b-12] The uncollected balance of current taxes receivable and the related estimated uncollectible account were reclassified as delinquent. Property tax revenues and deferred inflows of resources were adjusted for unavailable revenues. Interest and penalties of $1,200 were accrued, of which $120 was estimated to be uncollectible. Required: Record this transaction in both the debt service fund and governmental activities journals. In the debt service fund net receivables and interest and penalties should be also be recorded as deferred inflows of resources, rather than revenues. 13. [Para. 6b-13] At December 31, 2020, accrued interest expense on the two outstanding bond issues was recorded in the governmental activities general journal. Amortization of the premium on the 3% bonds sold was also recorded in the amount of $3,125. Required: Record the accrual in the governmental activities journal. 14. Verify the accuracy of all your preceding journal entries in the debt service fund and governmental activities general journals, then click [Post entries] of each entity to post the entries to the respective general ledgers. For the debt service fund only, make the entries needed to close the budgetary and operating statement accounts at the end of fiscal year 2020 and post them to the fund's general ledger. (Note: You must click on the box for [Closing Entry] to check mark it; "Closing Entry" checkbox appears next to the [Add credit] field for the account being closed. Be sure the checkmark is present for each account being closed.) Click [Post entries] to post the closing entry. Closing entries will be made in the governmental activities general journal in Chapter 9 of this cumulative problem. Ignore those entries for now. Export the post-closing trial balance for year 2020 to an Excel worksheet and use Excel to prepare a balance sheet for the debt service fund as of December 31, 2020. (See Illustration 4-4 in the textbook for an example of an appropriate format of a governmental fund balance sheet.). In addition, print the post-closing trial balance from the [Reports] drop-down menu