need help with a and d

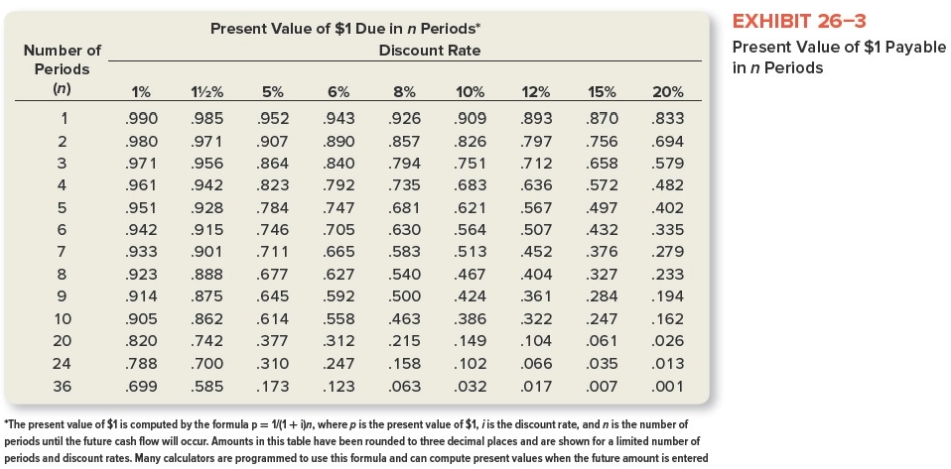

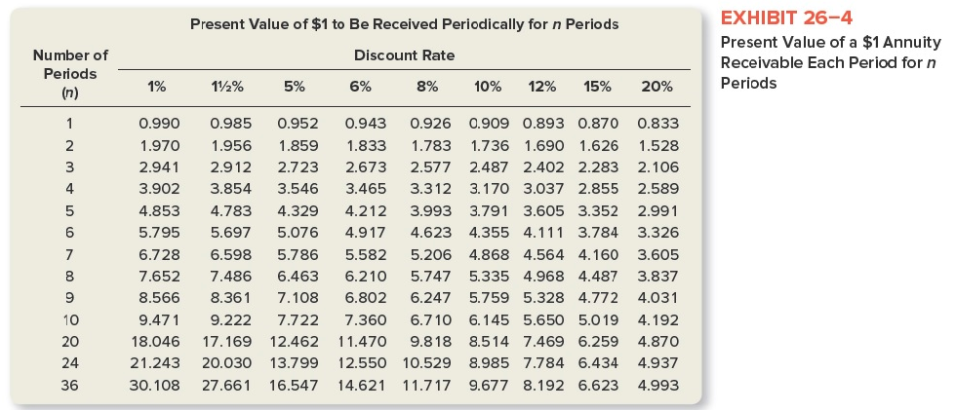

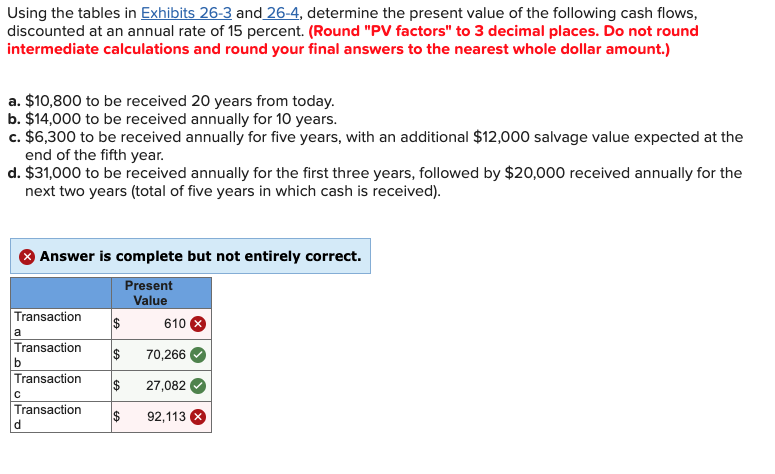

Present Value of $1 Due in n Periods* EXHIBIT 26-3 Number of Discount Rate Present Value of $1 Payable Periods in n Periods (n) 1% 11/2% 5% 6% 8% 10% 12% 15% 20% DO YOU A WN - 990 985 952 943 .926 909 893 .870 .833 980 .971 .907 .890 .857 .826 .797 .756 .694 .971 .956 864 .840 .794 .751 712 .658 .579 .961 .942 823 .792 .735 .683 .636 .572 .482 951 .928 .784 .747 681 .621 567 497 .402 942 .915 746 .705 630 .564 507 432 .335 933 .901 .711 .665 .583 513 452 376 279 923 .888 677 627 .540 .467 .404 .327 233 .914 .875 .645 592 .500 .424 .361 .284 .194 10 .905 .862 614 558 .463 .386 .322 247 . 162 20 820 .742 .377 .312 .215 . 149 .104 061 026 24 788 700 310 247 . 158 . 102 066 .035 013 36 699 .585 . 173 .123 063 .032 .017 007 .00 1 "The present value of $1 is computed by the formula p = 1/(1 + ijn, where p is the present value of $1, / is the discount rate, and n is the number of periods until the future cash flow will occur. Amounts in this table have been rounded to three decimal places and are shown for a limited number of periods and discount rates. Many calculators are programmed to use this formula and can compute present values when the future amount is enteredPresent Value of $1 to Be Received Periodically for n Periods EXHIBIT 26-4 Number of Discount Rate Present Value of a $1 Annuity Periods Receivable Each Period for n (n) 1% 11/2% 5% 6% 8% 10% 12% 15% 20% Periods DO YOU AWN - 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 1.970 1.956 1.859 1.833 1.783 1.736 1.690 1.626 1.528 2.941 2.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855 2.589 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 5.795 5.697 5.076 4.917 4.623 4.355 4.111 3.784 3.326 6.728 6.598 5.786 5.582 5.206 4.868 4.564 4.160 3.605 7.652 7.486 6.463 6.210 5.747 5.335 4.968 4.487 3.837 8.566 8.361 7.108 6.802 6.247 5.759 5.328 4.772 4.031 10 9.471 9.222 7.722 7.360 6.710 6.145 5.650 5.019 4.192 20 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.870 24 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 36 30. 108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993Using the tables in Exhibits 26-3 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. (Round "PV factors" to 3 decimal places. Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) a. $10,800 to be received 20 years from today. b. $14,000 to be received annually for 10 years. c. $6,300 to be received annually for five years, with an additional $12,000 salvage value expected at the end of the fifth year. d. $31,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received). X Answer is complete but not entirely correct. Present Value Transaction a 610 X Transaction b $ 70,266 Transaction $ C 27,082 Transaction $ 92,113