Need help with a Comprehensive Estate Planning probelm. please.

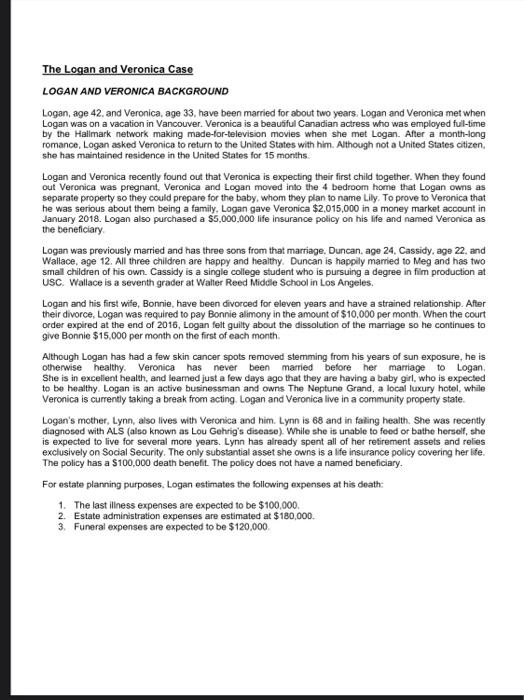

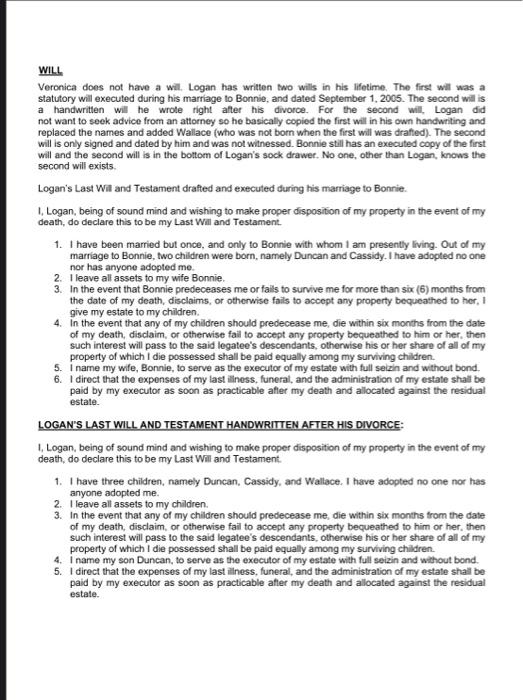

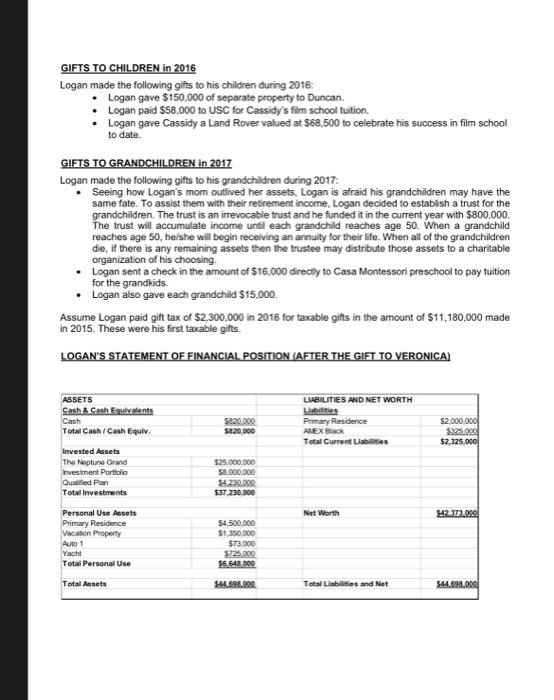

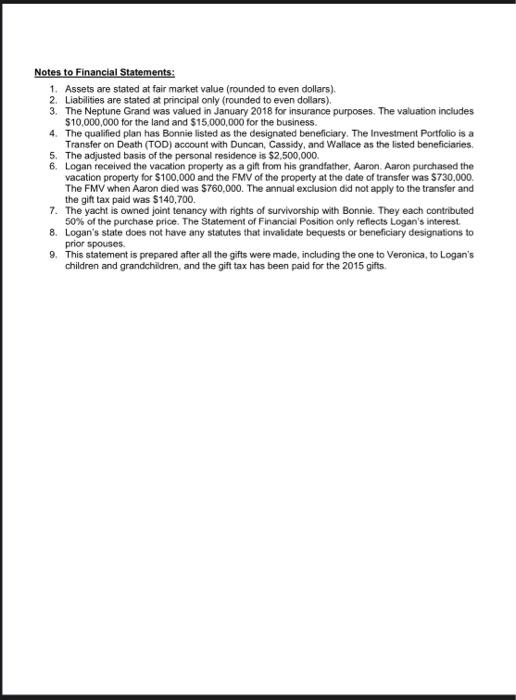

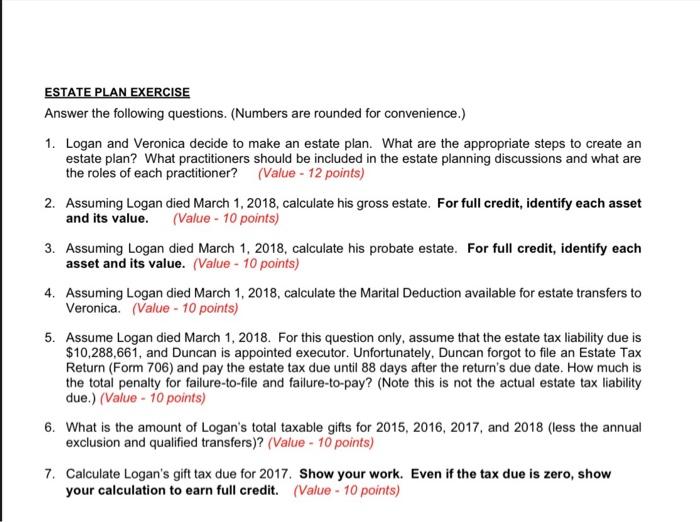

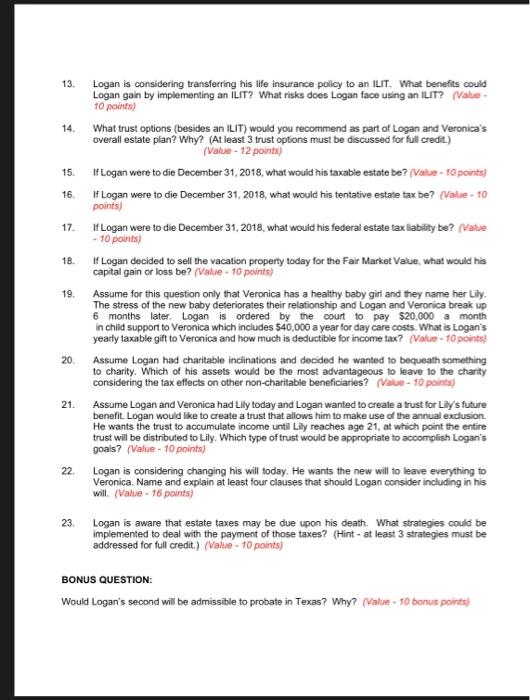

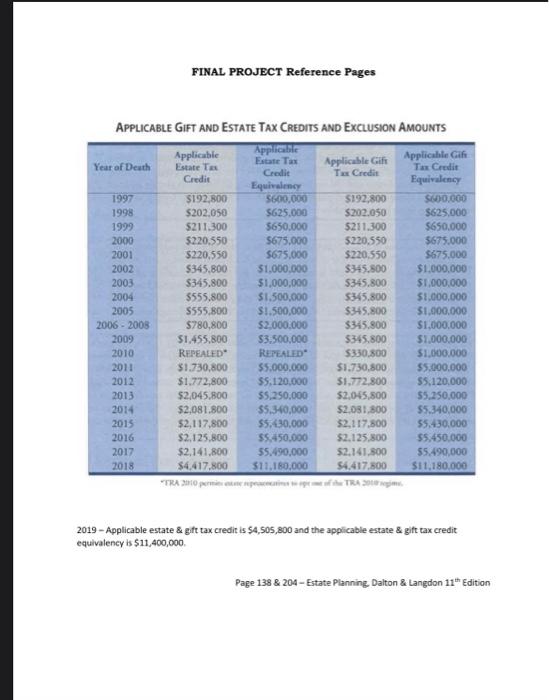

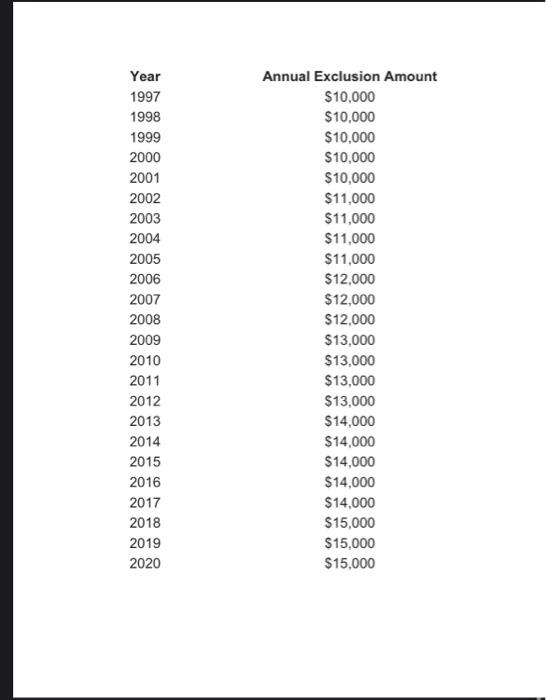

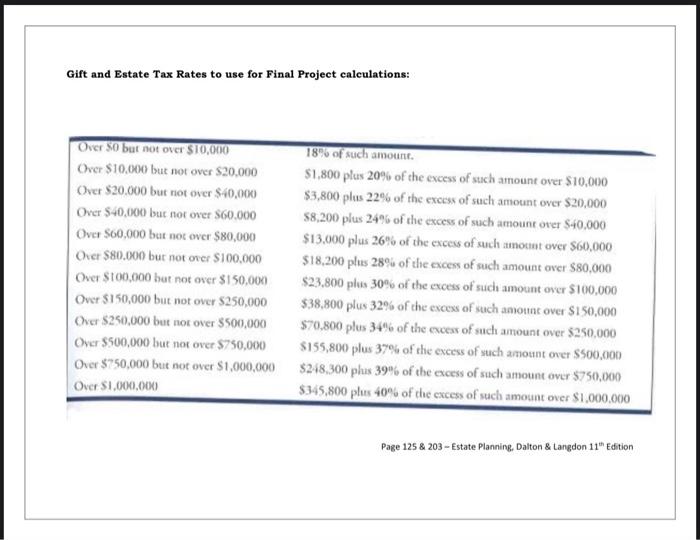

The Logan and Veronica Case LOGAN AND VERONICA BACKGROUND Logan, age 42 and Veronica, age 33, have been married for about two years. Logan and Veronica met when Logan was on a vacation in Vancouver. Veronica is a beautiful Canadian actress who was employed full-time by the Hallmark network making made-for-television movies when she met Logan. After a month-long romance, Logan asked Veronica to return to the United States with him. Although not a United States citizen she has maintained residence in the United States for 15 months Logan and Veronica recently found out that Veronica is expecting their first child together. When they found out Veronica was pregnant. Veronica and Logan moved into the 4 bedroom home that Logan owns as separate property so they could prepare for the baby, whom they plan to name Lily. To prove to Veronica that he was serious about them being a family. Logan gave Veronica $2,015,000 in a money market account in January 2018. Logan also purchased a $5,000,000 life insurance policy on his life and named Veronica as the beneficiary Logan was previously married and has three sons from that marriage. Duncan, age 24. Cassidy, age 22 and Wallace, age 12. All three children are happy and healthy Duncan is happily married to Meg and has two small children of his own. Cassidy is a single college student who is pursuing a degree in film production at USC. Wallace is a seventh grader at Walter Reed Middle School in Los Angeles, Logan and his first wife, Bonnie, have been divorced for eleven years and have a strained relationship. After their divorce, Logan was required to pay Bonnie alimony in the amount of $10,000 per month When the court order expired at the end of 2016, Logan felt guilty about the dissolution of the marriage so he continues to give Bonnie $15,000 per month on the first of each month. Although Logan has had a few skin cancer spots removed stemming from his years of sun exposure, he is otherwise healthy. Veronica has never been married before her marriage to Logan She is in excellent health, and leamed just a few days ago that they are having a baby girl who is expected to be healthy. Logan is an active businessman and owns The Neptune Grand, a local luxury hotel, while Veronica is currently taking a break from acting. Logan and Veronica live in a community property state. Logan's mother, Lynn, also lives with Veronica and him. Lynn is 68 and in failing health. She was recently diagnosed with ALS (also known as Lou Gehrig's disease). While she is unable to feed or bathe herself, she is expected to live for several more years. Lynn has already spent all of her retirement assets and relies exclusively on Social Security. The only substantial asset she owns is a life insurance policy covering her life. The policy has a $100,000 death benefit. The policy does not have a named beneficiary. For estate planning purposes. Logan estimates the following expenses at his death 1. The last illness expenses are expected to be $100,000 2. Estate administration expenses are estimated at $180,000 3. Funeral expenses are expected to be $120,000 WILL Veronica does not have a will, Logan has written two wills in his lifetime. The first will was a statutory will executed during his marriage to Bonnie and dated September 1, 2005. The second will is a handwritten will he wrote right after his divorce. For the second will. Logan did not want to seek advice from an attorney so he basically copied the first wil in his own handwriting and replaced the names and added Wallace (who was not born when the first will was drafted). The second will is only signed and dated by him and was not witnessed. Bonnie still has an executed copy of the first will and the second will is in the bottom of Logan's sock drawer. No one, other than Logan, knows the second will exists. Logan's Last Wil and Testament drafted and executed during his marriage to Bonnie. 1. Logan, being of sound mind and wishing to make proper disposition of my property in the event of my death, do declare this to be my Last Will and Testament. 1. I have been married but once, and only to Bonnie with whom I am presently living. Out of my marriage to Bonnie, two children were born, namely Duncan and Cassidy. I have adopted no one nor has anyone adopted me. 2. I leave all assets to my wife Bonnie 3. In the event that Bonnie predeceases me or fails to survive me for more than six (6) months from the date of my death disclaims, or otherwise fails to accept any property bequeathed to her, I 4. In the event that any of my children should predecease me, die within six months from the date of my death, disclaim, or otherwise fail to accept any property bequeathed to him or her, then such interest will pass to the said legatee's descendants, otherwise his or her share of all of my property of which I die possessed shall be paid equally among my surviving children. 5. i name my wife, Bonnie, to serve as the executor of my estate with full seizin and without bond. 6. I direct that the expenses of my last illness, funeral, and the administration of my estate shall be paid by my executor as soon as practicable after my death and allocated against the residual estate. LOGAN'S LAST WILL AND TESTAMENT HANDWRITTEN AFTER HIS DIVORCE: 1. Logan, being of sound mind and wishing to make proper disposition of my property in the event of my death, do declare this to be my Last Will and Testament 1. I have three children, namely Duncan. Cassidy, and Wallace. I have adopted no one nor has anyone adopted me. 2. I leave all assets to my children. 3. In the event that any of my children should predecease me, die within six months from the date of my death, disclaim, or otherwise fail to accept any property bequeathed to him or her, then such interest will pass to the said legatee's descendants, otherwise his or her share of all of my property of which I die possessed shall be paid equally among my surviving children. 4. I name my son Duncan, to serve as the executor of my estate with full seizin and without bond. 5. I direct that the expenses of my last illness, funeral, and the administration of my estate shall be paid by my executor as soon as practicable after my death and allocated against the residual estate. GIFTS TO CHILDREN in 2016 Logan made the following gifts to his children during 2016: Logan gave $150,000 of separate property to Duncan. Logan paid $58,000 to USC for Cassidy's film school tuition Logan gave Cassidy a Land Rover valued at $68,500 to celebrate his success in film school to date. GIFTS TO GRANDCHILDREN in 2017 Logan made the following gifts to his grandchildren during 2017: Seeing how Logan's mom outlived her assets, Logan is afraid his grandchildren may have the same fate. To assist them with their retirement income, Logan decided to establish a trust for the grandchildren. The trust is an irrevocable trust and he funded it in the current year with $800.000 The trust will accumulate income until each grandchild reaches age 50. When a grandchild reaches age 50, he/she will begin receiving an annuity for their life. When all of the grandchildren die, if there is any remaining assets then the trustee may distribute those assets to a charitable organization of his choosing. Logan sent a check in the amount of $16,000 directly to Casa Montessori preschool to pay tuition for the grandkids Logan also gave each grandchild $15,000. Assume Logan paid gift tax of $2,300,000 in 2016 for taxable gifts in the amount of $11,180,000 made in 2015. These were his first taxable gifts. LOGAN'S STATEMENT OF FINANCIAL POSITION (AFTER THE GIFT TO VERONICA) LIABILITIES AND NET WORTH ASSETS Cash & Cash Equivalents Cash Total Cash/Cash Equiv. $820.000 5820.000 Primary Residence AMEX Back Total Current Liabilities 52.000.000 $325.00 $2.325.000 Invested Assets The Neptune Grand Investment Portfolio Qualified Plan Total Investments $25.000.000 38.000.000 $4230.000 $37.230.000 Net Worth 542.272.00 Personal Use Assets Primary Residence Vacation Property Auto1 Yacht Total Personal Use $4.500.000 $1.350.000 $73.000 $725.000 $6.648.000 Total Assets $44.698.00 Total Liabilities and Net $44.698.000 Notes to Financial Statements: 1. Assets are stated at fair market value (rounded to even dollars). 2. Liabilities are stated at principal only (rounded to even dollars). 3. The Neptune Grand was valued in January 2018 for insurance purposes. The valuation includes $10,000,000 for the land and $15,000,000 for the business. 4. The qualified plan has Bonnie listed as the designated beneficiary. The Investment Portfolio is a Transfer on Death (TOD) account with Duncan, Cassidy, and Wallace as the listed beneficiaries 5. The adjusted basis of the personal residence is $2,500,000 6. Logan received the vacation property as a gift from his grandfather, Aaron Aaron purchased the vacation property for $100.000 and the FMV of the property at the date of transfer was $730,000 The FMV when Aaron died was $760,000. The annual exclusion did not apply to the transfer and the gift tax paid was $140.700. 7. The yacht is owned joint tenancy with rights of survivorship with Bonnie. They each contributed 50% of the purchase price. The Statement of Financial Position only reflects Logan's interest 8. Logan's state does not have any statutes that invalidate bequests or beneficiary designations to prior spouses 9. This statement is prepared after all the gifts were made, including the one to Veronica, to Logan's children and grandchildren, and the gift tax has been paid for the 2015 gifts. ESTATE PLAN EXERCISE Answer the following questions. (Numbers are rounded for convenience.) 1. Logan and Veronica decide to make an estate plan. What are the appropriate steps to create an estate plan? What practitioners should be included in the estate planning discussions and what are the roles of each practitioner? (Value - 12 points) 2. Assuming Logan died March 1, 2018, calculate his gross estate. For full credit, identify each asset and its value. (Value - 10 points) 3. Assuming Logan died March 1, 2018, calculate his probate estate. For full credit, identify each asset and its value. (Value - 10 points) 4. Assuming Logan died March 1, 2018, calculate the Marital Deduction available for estate transfers to Veronica. (Value - 10 points) 5. Assume Logan died March 1, 2018. For this question only, assume that the estate tax liability due is $10,288,661, and Duncan is appointed executor. Unfortunately, Duncan forgot to file an Estate Tax Return (Form 706) and pay the estate tax due until 88 days after the return's due date. How much is the total penalty for failure-to-file and failure-to-pay? (Note this is not the actual estate tax liability due.) (Value - 10 points) 6. What is the amount of Logan's total taxable gifts for 2015, 2016, 2017, and 2018 (less the annual exclusion and qualified transfers)? (Value - 10 points) 7. Calculate Logan's gift tax due for 2017. Show your work. Even if the tax due is zero, show your calculation to earn full credit. (Value - 10 points) 13. 14. 15 16 17 18 19 Logan is considering transferring his life insurance policy to an ILIT. What benefits could Logan gain by implementing an ILIT? What risks does Logan face using an ILIT? Value 10 points) What trust options (besides an ILIT) would you recommend as part of Logan and Veronica's overall estate plan? Why? (At least 3 trust options must be discussed for full credit) (Value - 12 points) If Logan were to die December 31, 2018, what would his taxable estate be? (Value - 10 points) If Logan were to die December 31, 2018, what would his tentative estate tax be? (Value - 10 points) If Logan were to die December 31, 2018, what would his federal estate tax liability be? (Value - 10 points) I Logan decided to sell the vacation property today for the Fair Market Value, what would his capital gain or loss be? (Value - 10 points) Assume for this question only that Veronica has a healthy baby giri and they name her Lily. The stress of the new baby deteriorates their relationship and Logan and Veronica break up 6 months later. Logan is ordered by the court to pay $20,000 a month in child support to Veronica which includes $40,000 a year for day care costs. What is Logan's yearly taxable gift to Veronica and how much is deductible for income tax? (Value - 10 points Assume Logan had charitable inclinations and decided he wanted to bequeath something to charity. Which of his assets would be the most advantageous to leave to the charity considering the tax effects on other non-charitable beneficiaries? Value - 10 points) Assume Logan and Veronica had Lily today and Logan wanted to create a trust for Lay's future benefit. Logan would like to create a trust that allows him to make use of the annual exclusion He wants the trust to accumulate income until Lily reaches age 21, at which point the entire trust will be distributed to Lily. Which type of trust would be appropriate to accomplish Logan's goals? (Value - 10 points) Logan is considering changing his will today. He wants the new will to leave everything to Veronica Name and explain at least four clauses that should Logan consider including in his will. (Value - 16 points) Logan is aware that estate taxes may be due upon his death. What strategies could be implemented to deal with the payment of those taxes? (Hint - at least 3 strategies must be addressed for full credit.) (Value - 10 points) 20 21. 22 23 BONUS QUESTION: Would Logan's second will be admissible to probate in Texas? Why? (Value - 10 bonus points FINAL PROJECT Reference Pages Applicable Gift Applicable Gif APPLICABLE GIFT AND ESTATE TAX CREDITS AND EXCLUSION AMOUNTS Applicable Applicable Estate Tax Year of Death Estate Tax Credit Tax Credit Tax Credit Credit Equivalency Equivalency 1997 $192,800 5600,000 5192,800 S600.000 1998 $202,050 $625.000 $202.050 $625.000 1999 $211.300 $650.000 $211.300 $650.000 2000 $220.550 5675.000 $220.550 5675.000 2001 $220,550 5675.000 $220.550 $675.000 2002 $345.800 $1.000.000 $345.500 $1,000,000 2003 $345.800 $1,000,000 $345.800 $1.000.000 2004 5555.800 $1.500,000 5345.800 $1,000,000 2005 5555.800 $1.500,000 $345.800 $1,000,000 2006 - 2008 S780.800 $2.000.000 $345.800 $1.000.000 2009 $1.455,800 $3.500.000 $345.800 $1,000,000 2010 REPEALED" REPEALED $330.800 $1.000.000 2011 $1.730,800 55.000.000 $1.730,800 55.000.000 2012 $1.772,800 55.120.000 $1.772.800 $5,120,000 2013 $2,045,800 $5.250.000 $2,045,800 55.250.000 2014 $2.081.800 $5.540,000 $2.031.800 $5.340,000 2015 $2,117,800 $5,130,000 $2.117.800 55.430,000 2016 $2.125.800 $5.450.000 $2.125.800 55.450.000 2017 $2.141.800 55.490,000 $2.141.500 55.490,000 2018 $4.417.800 $11.180,000 S4.417.500 $11,180.000 TRA NHI0 giu qu vuwarius Hugo IWA - Nghi 2019 - Applicable estate & gift tax credit is $4,505,800 and the applicable estate & gift tax credit equivalency is $11,400,000 Page 138 & 204 - Estate Planning Dalton & Langdon 11" Edition Year 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Annual Exclusion Amount $10,000 $10,000 $10,000 $10,000 $10,000 $11,000 $11,000 $11,000 $11,000 $12,000 $12,000 $12,000 $13,000 $13,000 $13,000 $13,000 $14,000 $14,000 $14,000 $14,000 $14.000 $15,000 $15,000 $15.000 Gift and Estate Tax Rates to use for Final Project calculations: Over 80 but not over $10,000 18% of such amount Over $10,000 but not over $20.000 $1,800 plus 20% of the excess of such amount over $10,000 Over $20.000 but not over $40,000 $3,800 plus 22% of the excess of such amount over $20,000 Over $40,000 buc nor over $60.000 58.200 plus 24% of the excess of such amount over $40.000 Over $60,000 but noe over $80,000 $13.000 plus 26% of the excess of such mocistever $60,000 Oker $80.000 but not over $100,000 $18.200 plus 28% of the excess of such amount over $80,000 Over $100.000 but not over $150,000 $23.800 plus 30% of the excess of such amount over $100,000 Over $150,000 but not over $250,000 $38,800 plus 32% of the excess of such amount over $150,000 Over $250,000 but not over $500,000 $70,800 plus 34% of the excess of such amount over $250,000 Over $500,000 but not over $750,000 S155,800 plus 37% of the excess of such amount over $500,000 Over $750,000 but not over $1,000,000 $248,300 plus 39% of the excess of such amount over $750,000 Over 1,000,000 $345.800 plus 40% of the excess of such amount over $1.000.000 Page 125 & 203 - Estate Planning, Dalton & Langdon 11" Edition The Logan and Veronica Case LOGAN AND VERONICA BACKGROUND Logan, age 42 and Veronica, age 33, have been married for about two years. Logan and Veronica met when Logan was on a vacation in Vancouver. Veronica is a beautiful Canadian actress who was employed full-time by the Hallmark network making made-for-television movies when she met Logan. After a month-long romance, Logan asked Veronica to return to the United States with him. Although not a United States citizen she has maintained residence in the United States for 15 months Logan and Veronica recently found out that Veronica is expecting their first child together. When they found out Veronica was pregnant. Veronica and Logan moved into the 4 bedroom home that Logan owns as separate property so they could prepare for the baby, whom they plan to name Lily. To prove to Veronica that he was serious about them being a family. Logan gave Veronica $2,015,000 in a money market account in January 2018. Logan also purchased a $5,000,000 life insurance policy on his life and named Veronica as the beneficiary Logan was previously married and has three sons from that marriage. Duncan, age 24. Cassidy, age 22 and Wallace, age 12. All three children are happy and healthy Duncan is happily married to Meg and has two small children of his own. Cassidy is a single college student who is pursuing a degree in film production at USC. Wallace is a seventh grader at Walter Reed Middle School in Los Angeles, Logan and his first wife, Bonnie, have been divorced for eleven years and have a strained relationship. After their divorce, Logan was required to pay Bonnie alimony in the amount of $10,000 per month When the court order expired at the end of 2016, Logan felt guilty about the dissolution of the marriage so he continues to give Bonnie $15,000 per month on the first of each month. Although Logan has had a few skin cancer spots removed stemming from his years of sun exposure, he is otherwise healthy. Veronica has never been married before her marriage to Logan She is in excellent health, and leamed just a few days ago that they are having a baby girl who is expected to be healthy. Logan is an active businessman and owns The Neptune Grand, a local luxury hotel, while Veronica is currently taking a break from acting. Logan and Veronica live in a community property state. Logan's mother, Lynn, also lives with Veronica and him. Lynn is 68 and in failing health. She was recently diagnosed with ALS (also known as Lou Gehrig's disease). While she is unable to feed or bathe herself, she is expected to live for several more years. Lynn has already spent all of her retirement assets and relies exclusively on Social Security. The only substantial asset she owns is a life insurance policy covering her life. The policy has a $100,000 death benefit. The policy does not have a named beneficiary. For estate planning purposes. Logan estimates the following expenses at his death 1. The last illness expenses are expected to be $100,000 2. Estate administration expenses are estimated at $180,000 3. Funeral expenses are expected to be $120,000 WILL Veronica does not have a will, Logan has written two wills in his lifetime. The first will was a statutory will executed during his marriage to Bonnie and dated September 1, 2005. The second will is a handwritten will he wrote right after his divorce. For the second will. Logan did not want to seek advice from an attorney so he basically copied the first wil in his own handwriting and replaced the names and added Wallace (who was not born when the first will was drafted). The second will is only signed and dated by him and was not witnessed. Bonnie still has an executed copy of the first will and the second will is in the bottom of Logan's sock drawer. No one, other than Logan, knows the second will exists. Logan's Last Wil and Testament drafted and executed during his marriage to Bonnie. 1. Logan, being of sound mind and wishing to make proper disposition of my property in the event of my death, do declare this to be my Last Will and Testament. 1. I have been married but once, and only to Bonnie with whom I am presently living. Out of my marriage to Bonnie, two children were born, namely Duncan and Cassidy. I have adopted no one nor has anyone adopted me. 2. I leave all assets to my wife Bonnie 3. In the event that Bonnie predeceases me or fails to survive me for more than six (6) months from the date of my death disclaims, or otherwise fails to accept any property bequeathed to her, I 4. In the event that any of my children should predecease me, die within six months from the date of my death, disclaim, or otherwise fail to accept any property bequeathed to him or her, then such interest will pass to the said legatee's descendants, otherwise his or her share of all of my property of which I die possessed shall be paid equally among my surviving children. 5. i name my wife, Bonnie, to serve as the executor of my estate with full seizin and without bond. 6. I direct that the expenses of my last illness, funeral, and the administration of my estate shall be paid by my executor as soon as practicable after my death and allocated against the residual estate. LOGAN'S LAST WILL AND TESTAMENT HANDWRITTEN AFTER HIS DIVORCE: 1. Logan, being of sound mind and wishing to make proper disposition of my property in the event of my death, do declare this to be my Last Will and Testament 1. I have three children, namely Duncan. Cassidy, and Wallace. I have adopted no one nor has anyone adopted me. 2. I leave all assets to my children. 3. In the event that any of my children should predecease me, die within six months from the date of my death, disclaim, or otherwise fail to accept any property bequeathed to him or her, then such interest will pass to the said legatee's descendants, otherwise his or her share of all of my property of which I die possessed shall be paid equally among my surviving children. 4. I name my son Duncan, to serve as the executor of my estate with full seizin and without bond. 5. I direct that the expenses of my last illness, funeral, and the administration of my estate shall be paid by my executor as soon as practicable after my death and allocated against the residual estate. GIFTS TO CHILDREN in 2016 Logan made the following gifts to his children during 2016: Logan gave $150,000 of separate property to Duncan. Logan paid $58,000 to USC for Cassidy's film school tuition Logan gave Cassidy a Land Rover valued at $68,500 to celebrate his success in film school to date. GIFTS TO GRANDCHILDREN in 2017 Logan made the following gifts to his grandchildren during 2017: Seeing how Logan's mom outlived her assets, Logan is afraid his grandchildren may have the same fate. To assist them with their retirement income, Logan decided to establish a trust for the grandchildren. The trust is an irrevocable trust and he funded it in the current year with $800.000 The trust will accumulate income until each grandchild reaches age 50. When a grandchild reaches age 50, he/she will begin receiving an annuity for their life. When all of the grandchildren die, if there is any remaining assets then the trustee may distribute those assets to a charitable organization of his choosing. Logan sent a check in the amount of $16,000 directly to Casa Montessori preschool to pay tuition for the grandkids Logan also gave each grandchild $15,000. Assume Logan paid gift tax of $2,300,000 in 2016 for taxable gifts in the amount of $11,180,000 made in 2015. These were his first taxable gifts. LOGAN'S STATEMENT OF FINANCIAL POSITION (AFTER THE GIFT TO VERONICA) LIABILITIES AND NET WORTH ASSETS Cash & Cash Equivalents Cash Total Cash/Cash Equiv. $820.000 5820.000 Primary Residence AMEX Back Total Current Liabilities 52.000.000 $325.00 $2.325.000 Invested Assets The Neptune Grand Investment Portfolio Qualified Plan Total Investments $25.000.000 38.000.000 $4230.000 $37.230.000 Net Worth 542.272.00 Personal Use Assets Primary Residence Vacation Property Auto1 Yacht Total Personal Use $4.500.000 $1.350.000 $73.000 $725.000 $6.648.000 Total Assets $44.698.00 Total Liabilities and Net $44.698.000 Notes to Financial Statements: 1. Assets are stated at fair market value (rounded to even dollars). 2. Liabilities are stated at principal only (rounded to even dollars). 3. The Neptune Grand was valued in January 2018 for insurance purposes. The valuation includes $10,000,000 for the land and $15,000,000 for the business. 4. The qualified plan has Bonnie listed as the designated beneficiary. The Investment Portfolio is a Transfer on Death (TOD) account with Duncan, Cassidy, and Wallace as the listed beneficiaries 5. The adjusted basis of the personal residence is $2,500,000 6. Logan received the vacation property as a gift from his grandfather, Aaron Aaron purchased the vacation property for $100.000 and the FMV of the property at the date of transfer was $730,000 The FMV when Aaron died was $760,000. The annual exclusion did not apply to the transfer and the gift tax paid was $140.700. 7. The yacht is owned joint tenancy with rights of survivorship with Bonnie. They each contributed 50% of the purchase price. The Statement of Financial Position only reflects Logan's interest 8. Logan's state does not have any statutes that invalidate bequests or beneficiary designations to prior spouses 9. This statement is prepared after all the gifts were made, including the one to Veronica, to Logan's children and grandchildren, and the gift tax has been paid for the 2015 gifts. ESTATE PLAN EXERCISE Answer the following questions. (Numbers are rounded for convenience.) 1. Logan and Veronica decide to make an estate plan. What are the appropriate steps to create an estate plan? What practitioners should be included in the estate planning discussions and what are the roles of each practitioner? (Value - 12 points) 2. Assuming Logan died March 1, 2018, calculate his gross estate. For full credit, identify each asset and its value. (Value - 10 points) 3. Assuming Logan died March 1, 2018, calculate his probate estate. For full credit, identify each asset and its value. (Value - 10 points) 4. Assuming Logan died March 1, 2018, calculate the Marital Deduction available for estate transfers to Veronica. (Value - 10 points) 5. Assume Logan died March 1, 2018. For this question only, assume that the estate tax liability due is $10,288,661, and Duncan is appointed executor. Unfortunately, Duncan forgot to file an Estate Tax Return (Form 706) and pay the estate tax due until 88 days after the return's due date. How much is the total penalty for failure-to-file and failure-to-pay? (Note this is not the actual estate tax liability due.) (Value - 10 points) 6. What is the amount of Logan's total taxable gifts for 2015, 2016, 2017, and 2018 (less the annual exclusion and qualified transfers)? (Value - 10 points) 7. Calculate Logan's gift tax due for 2017. Show your work. Even if the tax due is zero, show your calculation to earn full credit. (Value - 10 points) 13. 14. 15 16 17 18 19 Logan is considering transferring his life insurance policy to an ILIT. What benefits could Logan gain by implementing an ILIT? What risks does Logan face using an ILIT? Value 10 points) What trust options (besides an ILIT) would you recommend as part of Logan and Veronica's overall estate plan? Why? (At least 3 trust options must be discussed for full credit) (Value - 12 points) If Logan were to die December 31, 2018, what would his taxable estate be? (Value - 10 points) If Logan were to die December 31, 2018, what would his tentative estate tax be? (Value - 10 points) If Logan were to die December 31, 2018, what would his federal estate tax liability be? (Value - 10 points) I Logan decided to sell the vacation property today for the Fair Market Value, what would his capital gain or loss be? (Value - 10 points) Assume for this question only that Veronica has a healthy baby giri and they name her Lily. The stress of the new baby deteriorates their relationship and Logan and Veronica break up 6 months later. Logan is ordered by the court to pay $20,000 a month in child support to Veronica which includes $40,000 a year for day care costs. What is Logan's yearly taxable gift to Veronica and how much is deductible for income tax? (Value - 10 points Assume Logan had charitable inclinations and decided he wanted to bequeath something to charity. Which of his assets would be the most advantageous to leave to the charity considering the tax effects on other non-charitable beneficiaries? Value - 10 points) Assume Logan and Veronica had Lily today and Logan wanted to create a trust for Lay's future benefit. Logan would like to create a trust that allows him to make use of the annual exclusion He wants the trust to accumulate income until Lily reaches age 21, at which point the entire trust will be distributed to Lily. Which type of trust would be appropriate to accomplish Logan's goals? (Value - 10 points) Logan is considering changing his will today. He wants the new will to leave everything to Veronica Name and explain at least four clauses that should Logan consider including in his will. (Value - 16 points) Logan is aware that estate taxes may be due upon his death. What strategies could be implemented to deal with the payment of those taxes? (Hint - at least 3 strategies must be addressed for full credit.) (Value - 10 points) 20 21. 22 23 BONUS QUESTION: Would Logan's second will be admissible to probate in Texas? Why? (Value - 10 bonus points FINAL PROJECT Reference Pages Applicable Gift Applicable Gif APPLICABLE GIFT AND ESTATE TAX CREDITS AND EXCLUSION AMOUNTS Applicable Applicable Estate Tax Year of Death Estate Tax Credit Tax Credit Tax Credit Credit Equivalency Equivalency 1997 $192,800 5600,000 5192,800 S600.000 1998 $202,050 $625.000 $202.050 $625.000 1999 $211.300 $650.000 $211.300 $650.000 2000 $220.550 5675.000 $220.550 5675.000 2001 $220,550 5675.000 $220.550 $675.000 2002 $345.800 $1.000.000 $345.500 $1,000,000 2003 $345.800 $1,000,000 $345.800 $1.000.000 2004 5555.800 $1.500,000 5345.800 $1,000,000 2005 5555.800 $1.500,000 $345.800 $1,000,000 2006 - 2008 S780.800 $2.000.000 $345.800 $1.000.000 2009 $1.455,800 $3.500.000 $345.800 $1,000,000 2010 REPEALED" REPEALED $330.800 $1.000.000 2011 $1.730,800 55.000.000 $1.730,800 55.000.000 2012 $1.772,800 55.120.000 $1.772.800 $5,120,000 2013 $2,045,800 $5.250.000 $2,045,800 55.250.000 2014 $2.081.800 $5.540,000 $2.031.800 $5.340,000 2015 $2,117,800 $5,130,000 $2.117.800 55.430,000 2016 $2.125.800 $5.450.000 $2.125.800 55.450.000 2017 $2.141.800 55.490,000 $2.141.500 55.490,000 2018 $4.417.800 $11.180,000 S4.417.500 $11,180.000 TRA NHI0 giu qu vuwarius Hugo IWA - Nghi 2019 - Applicable estate & gift tax credit is $4,505,800 and the applicable estate & gift tax credit equivalency is $11,400,000 Page 138 & 204 - Estate Planning Dalton & Langdon 11" Edition Year 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Annual Exclusion Amount $10,000 $10,000 $10,000 $10,000 $10,000 $11,000 $11,000 $11,000 $11,000 $12,000 $12,000 $12,000 $13,000 $13,000 $13,000 $13,000 $14,000 $14,000 $14,000 $14,000 $14.000 $15,000 $15,000 $15.000 Gift and Estate Tax Rates to use for Final Project calculations: Over 80 but not over $10,000 18% of such amount Over $10,000 but not over $20.000 $1,800 plus 20% of the excess of such amount over $10,000 Over $20.000 but not over $40,000 $3,800 plus 22% of the excess of such amount over $20,000 Over $40,000 buc nor over $60.000 58.200 plus 24% of the excess of such amount over $40.000 Over $60,000 but noe over $80,000 $13.000 plus 26% of the excess of such mocistever $60,000 Oker $80.000 but not over $100,000 $18.200 plus 28% of the excess of such amount over $80,000 Over $100.000 but not over $150,000 $23.800 plus 30% of the excess of such amount over $100,000 Over $150,000 but not over $250,000 $38,800 plus 32% of the excess of such amount over $150,000 Over $250,000 but not over $500,000 $70,800 plus 34% of the excess of such amount over $250,000 Over $500,000 but not over $750,000 S155,800 plus 37% of the excess of such amount over $500,000 Over $750,000 but not over $1,000,000 $248,300 plus 39% of the excess of such amount over $750,000 Over 1,000,000 $345.800 plus 40% of the excess of such amount over $1.000.000 Page 125 & 203 - Estate Planning, Dalton & Langdon 11" Edition