Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with a parts of this question thank you!! Comparing/evaluating two contracts (LN-2 material - Part II). A jury just had awarded you $500,000.

need help with a parts of this question

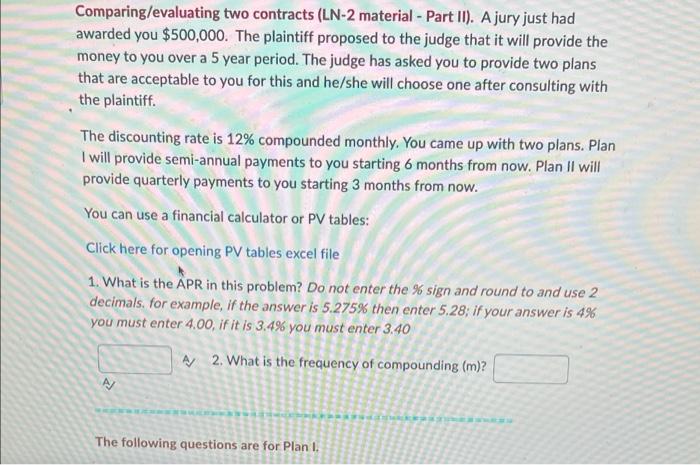

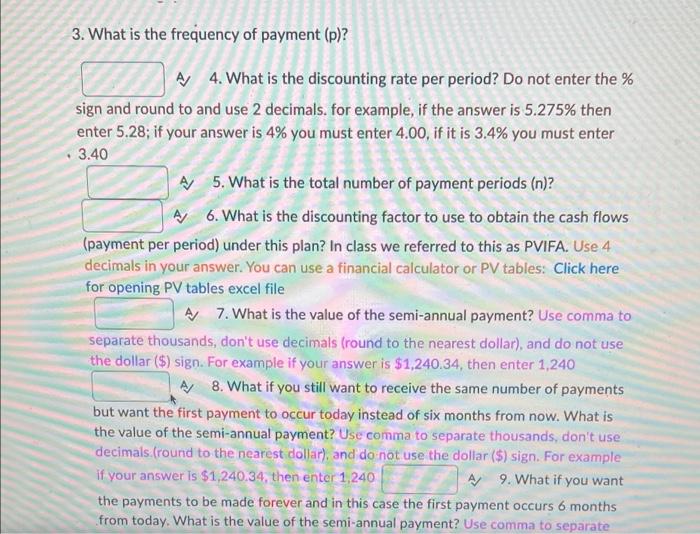

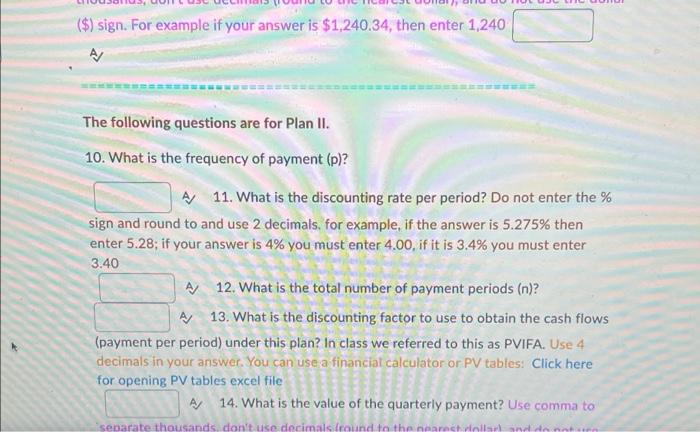

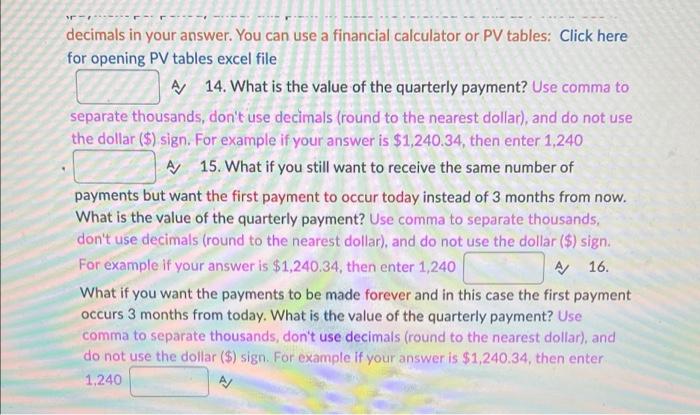

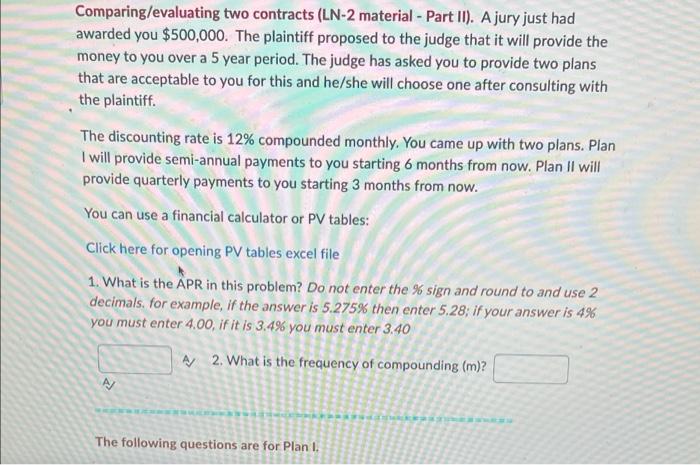

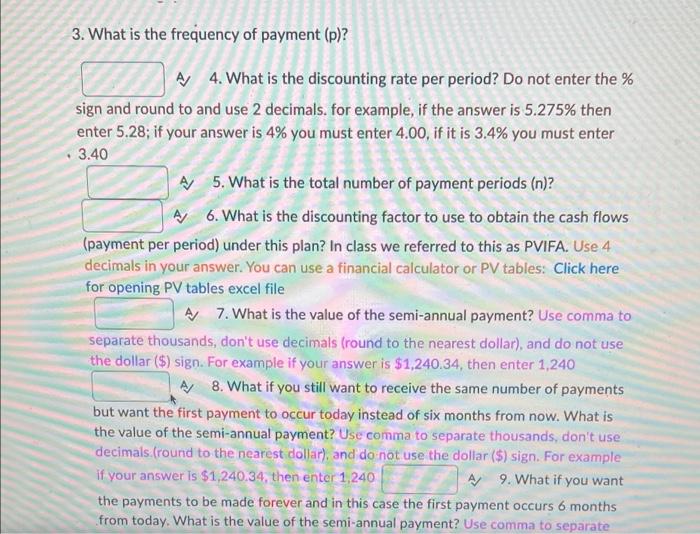

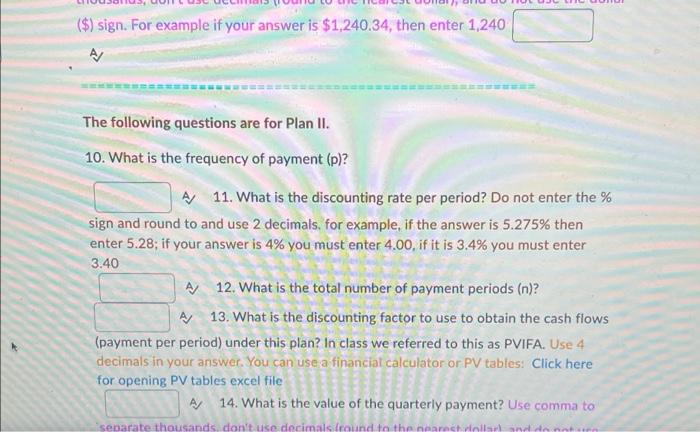

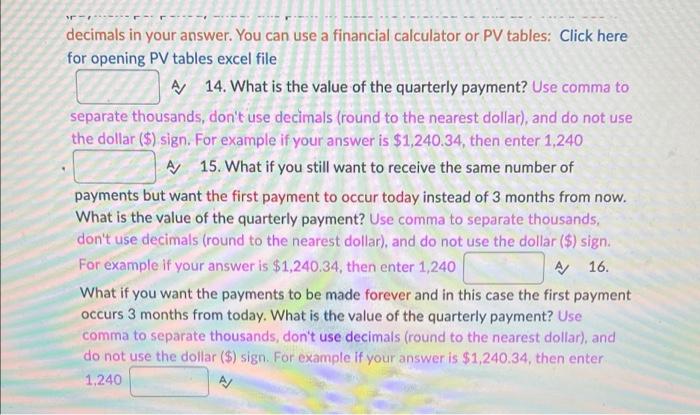

Comparing/evaluating two contracts (LN-2 material - Part II). A jury just had awarded you $500,000. The plaintiff proposed to the judge that it will provide the money to you over a 5 year period. The judge has asked you to provide two plans that are acceptable to you for this and he/she will choose one after consulting with the plaintiff. The discounting rate is 12% compounded monthly. You came up with two plans. Plan I will provide semi-annual payments to you starting 6 months from now. Plan II will provide quarterly payments to you starting 3 months from now. You can use a financial calculator or PV tables: Click here for opening PV tables excel file 1. What is the APR in this problem? Do not enter the % sign and round to and use 2 decimals, for example, if the answer is 5.275% then enter 5.28; if your answer is 4% you must enter 4.00, if it is 3.4% you must enter 3.40 A 2. What is the frequency of compounding (m)? N The following questions are for Plan I. 3. What is the frequency of payment (p)? A 4. What is the discounting rate per period? Do not enter the % sign and round to and use 2 decimals. for example, if the answer is 5.275% then enter 5.28; if your answer is 4% you must enter 4.00, if it is 3.4% you must enter 3.40 A 5. What is the total number of payment periods (n)? A 6. What is the discounting factor to use to obtain the cash flows (payment per period) under this plan? In class we referred to this as PVIFA. Use 4 decimals in your answer. You can use a financial calculator or PV tables: Click here for opening PV tables excel file A 7. What is the value of the semi-annual payment? Use comma to separate thousands, don't use decimals (round to the nearest dollar), and do not use the dollar ($) sign. For example if your answer is $1,240.34, then enter 1,240 A 8. What if you still want to receive the same number of payments but want the first payment to occur today instead of six months from now. What is the value of the semi-annual payment? Use comma to separate thousands, don't use decimals (round to the nearest dollar), and do not use the dollar ($) sign. For example if your answer is $1,240.34, then enter 1,240 A 9. What if you want the payments to be made forever and in this case the first payment occurs 6 months from today. What is the value of the semi-annual payment? Use comma to separate * ($) sign. For example if your answer is $1,240.34, then enter 1,240 A/ The following questions are for Plan II. 10. What is the frequency of payment (p)? A 11. What is the discounting rate per period? Do not enter the % sign and round to and use 2 decimals, for example, if the answer is 5.275% then enter 5.28; if your answer is 4% you must enter 4.00, if it is 3.4% you must enter 3.40 A 12. What is the total number of payment periods (n)? A 13. What is the discounting factor to use to obtain the cash flows (payment per period) under this plan? In class we referred to this as PVIFA. Use 4 decimals in your answer. You can use a financial calculator or PV tables: Click here for opening PV tables excel file A 14. What is the value of the quarterly payment? Use comma to separate thousands, don't use decimals (roun to the nearest riellark and do not decimals in your answer. You can use a financial calculator or PV tables: Click here for opening PV tables excel file A 14. What is the value of the quarterly payment? Use comma to separate thousands, don't use decimals (round to the nearest dollar), and do not use the dollar ($) sign. For example if your answer is $1,240.34, then enter 1,240 A 15. What if you still want to receive the same number of payments but want the first payment to occur today instead of 3 months from now. What is the value of the quarterly payment? Use comma to separate thousands, don't use decimals (round to the nearest dollar), and do not use the dollar ($) sign. For example if your answer is $1,240.34, then enter 1,240 A 16. What if you want the payments to be made forever and in this case the first payment occurs 3 months from today. What is the value of the quarterly payment? Use comma to separate thousands, don't use decimals (round to the nearest dollar), and do not use the dollar ($) sign. For example if your answer is $1,240.34, then enter. 1,240 A/ thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started