Need help with accounting project HELP Pleas, Need to calculate answers for all the questions on Page 1

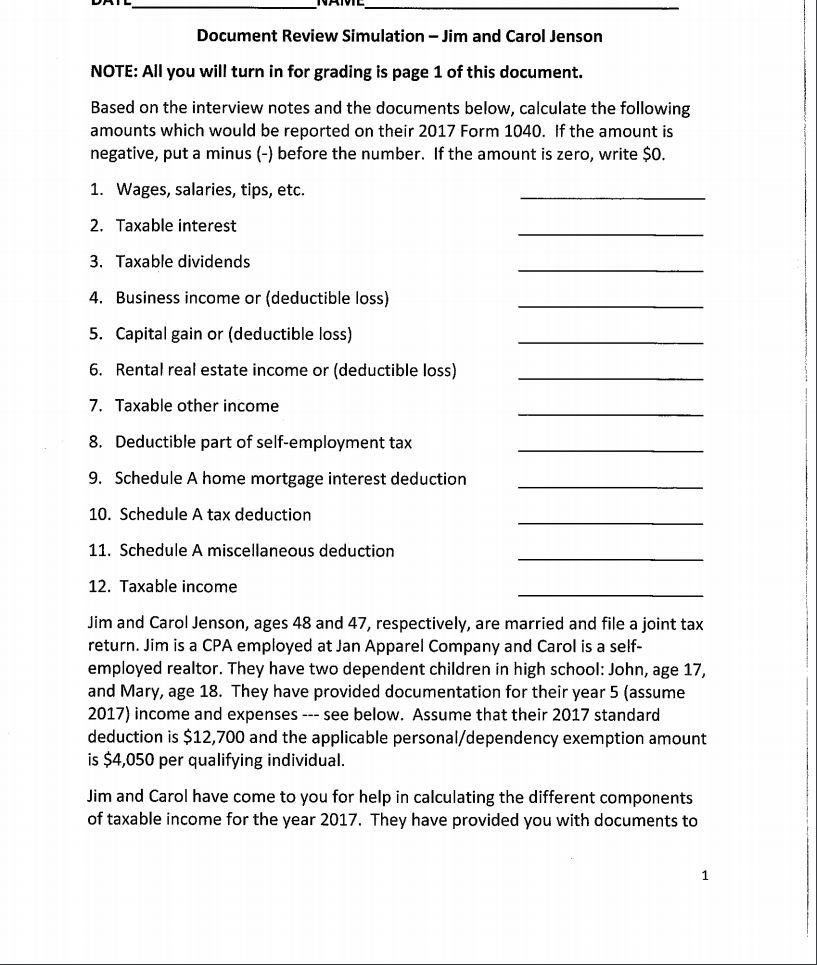

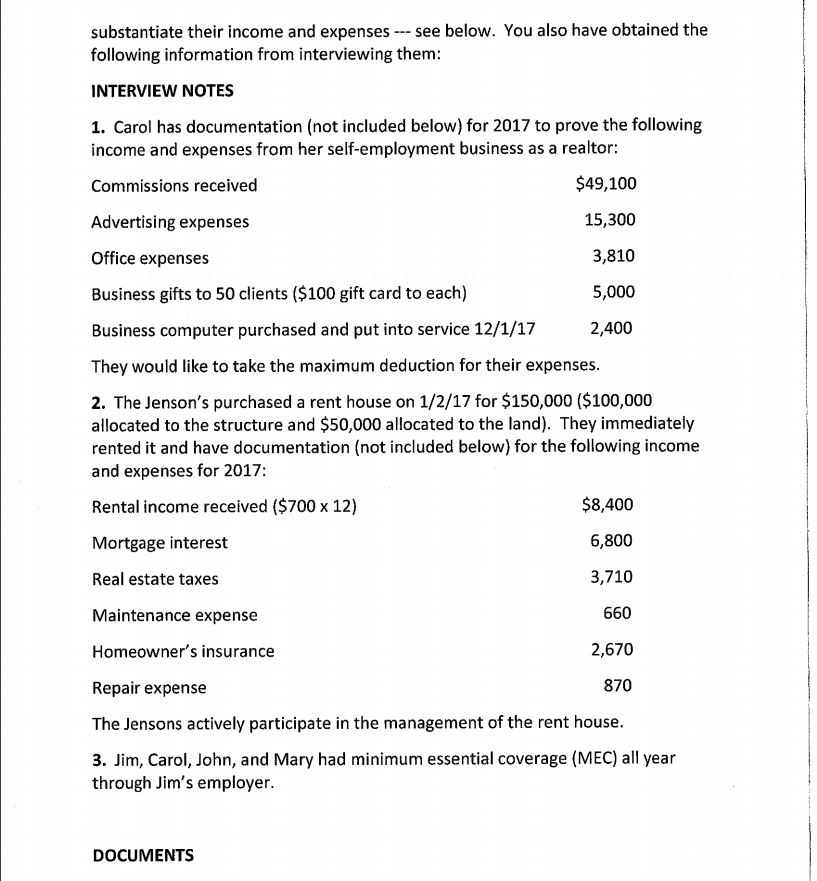

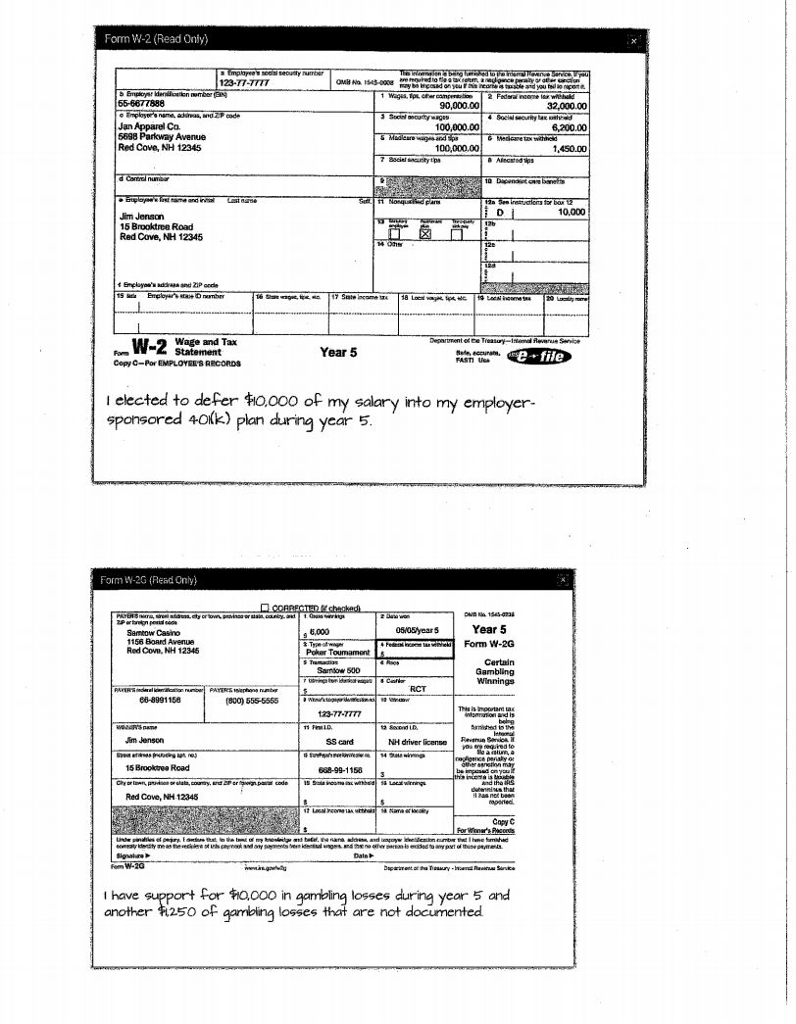

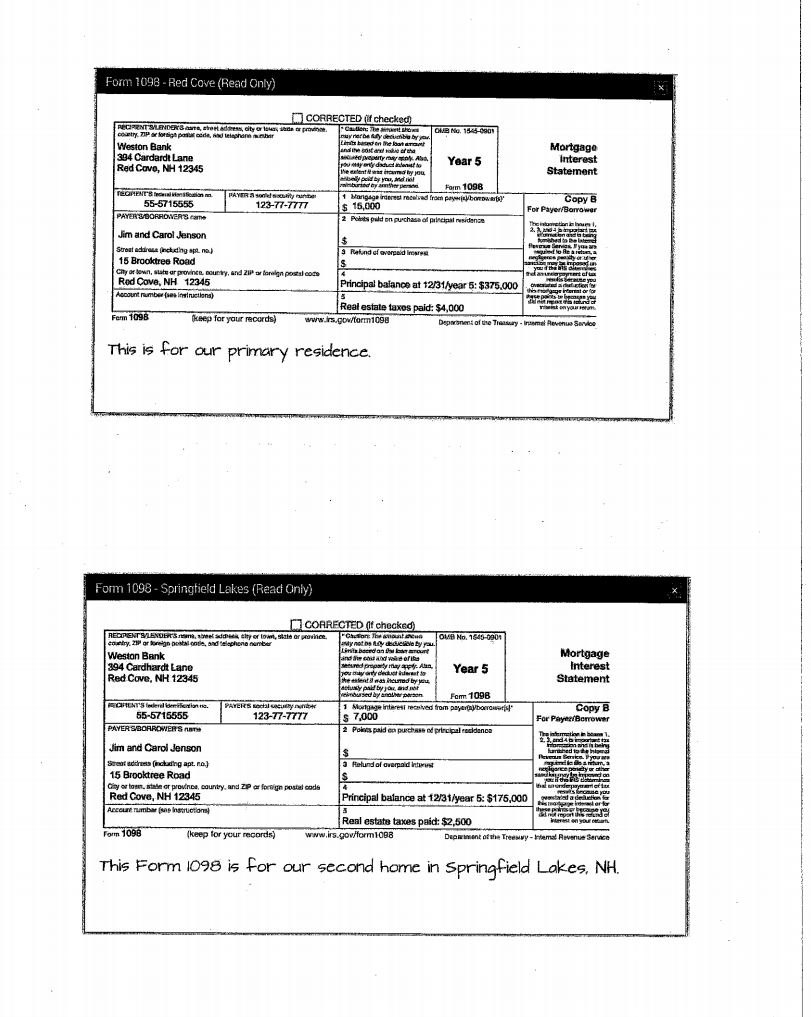

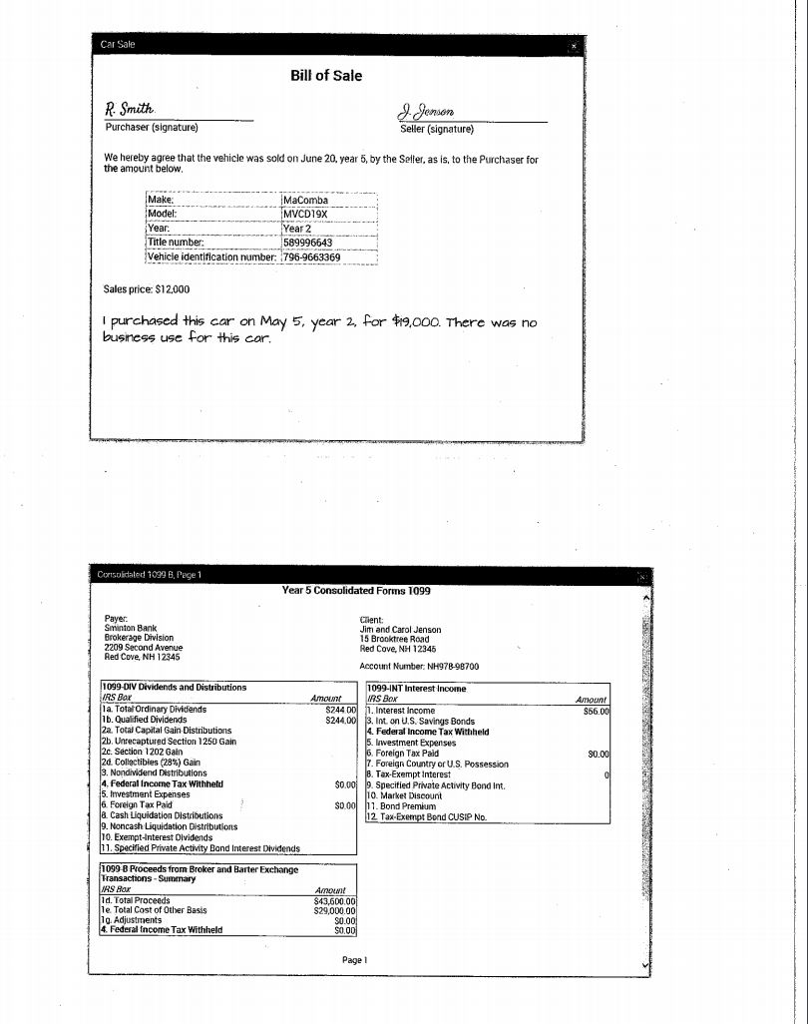

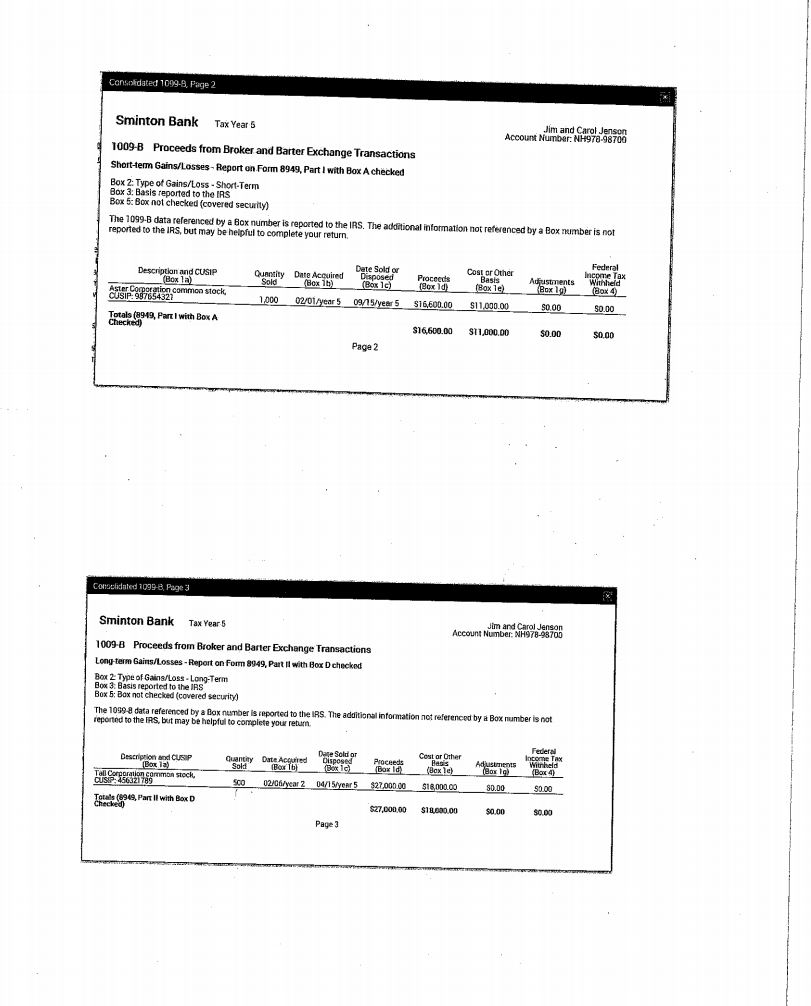

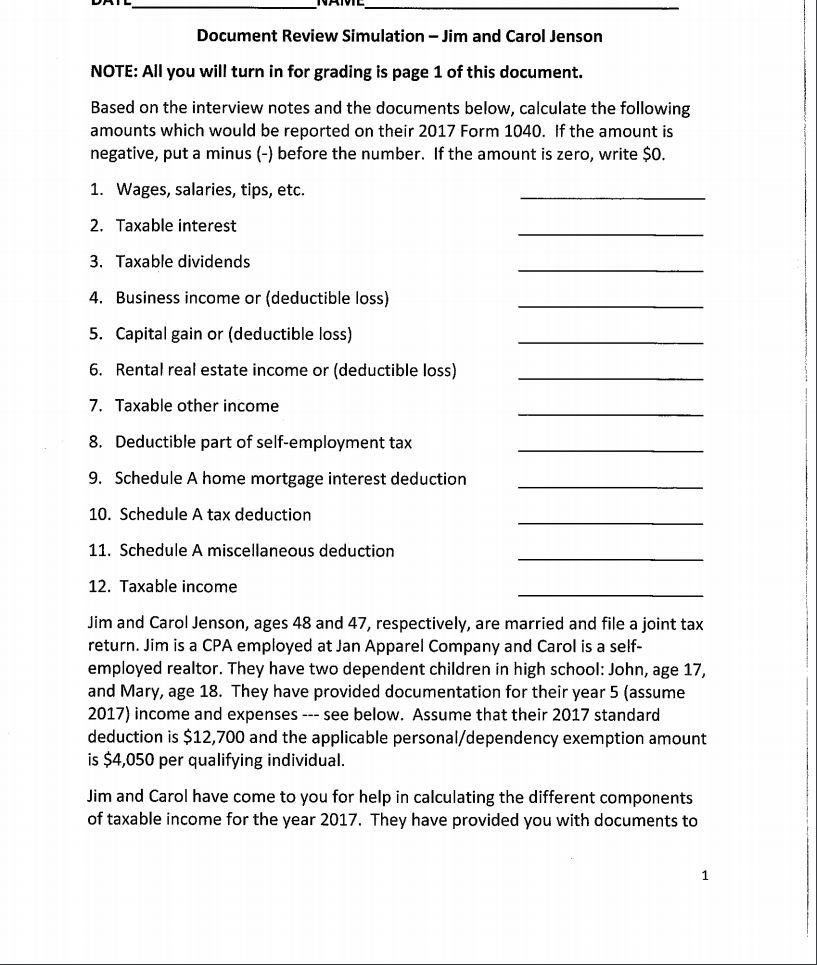

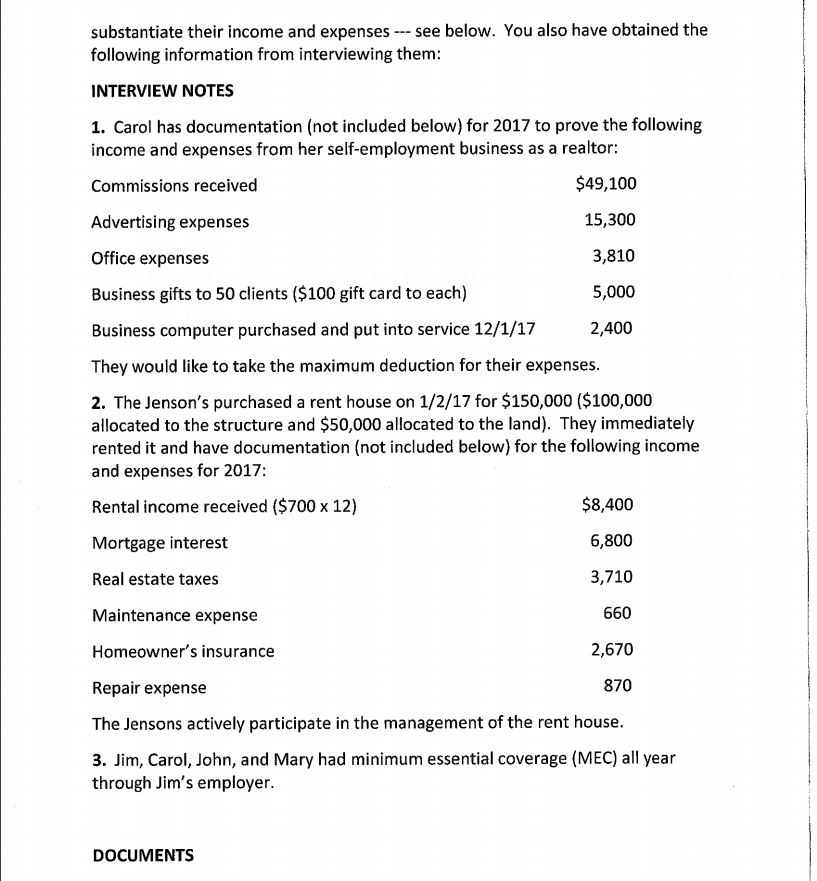

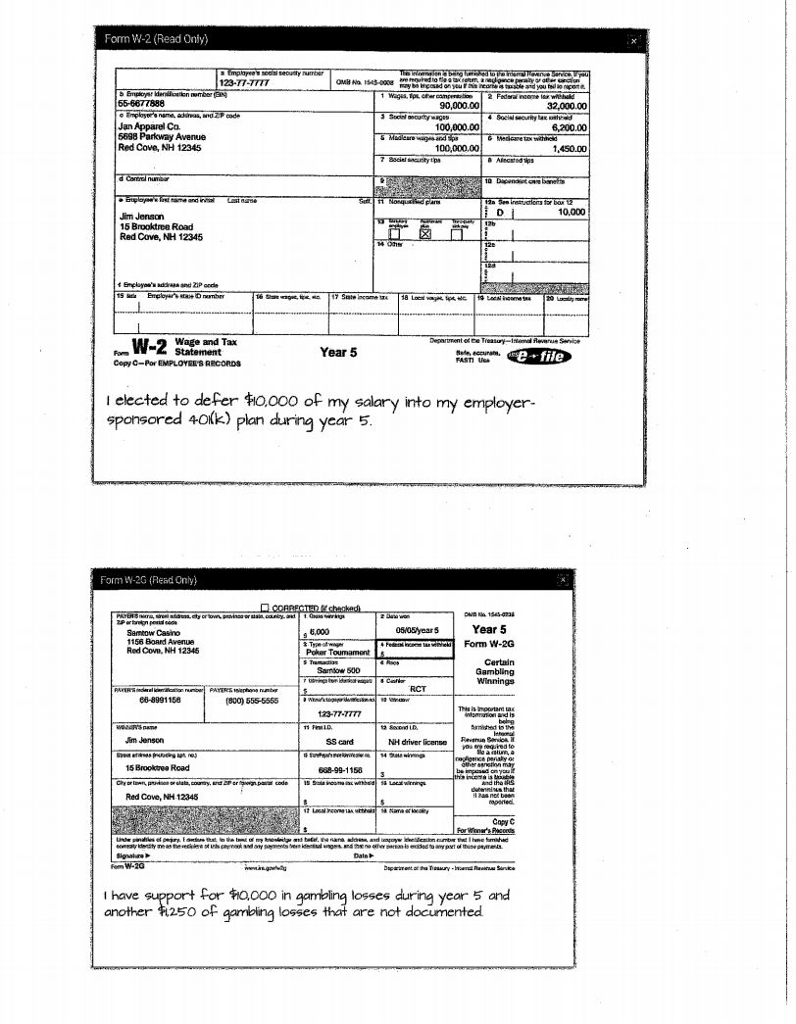

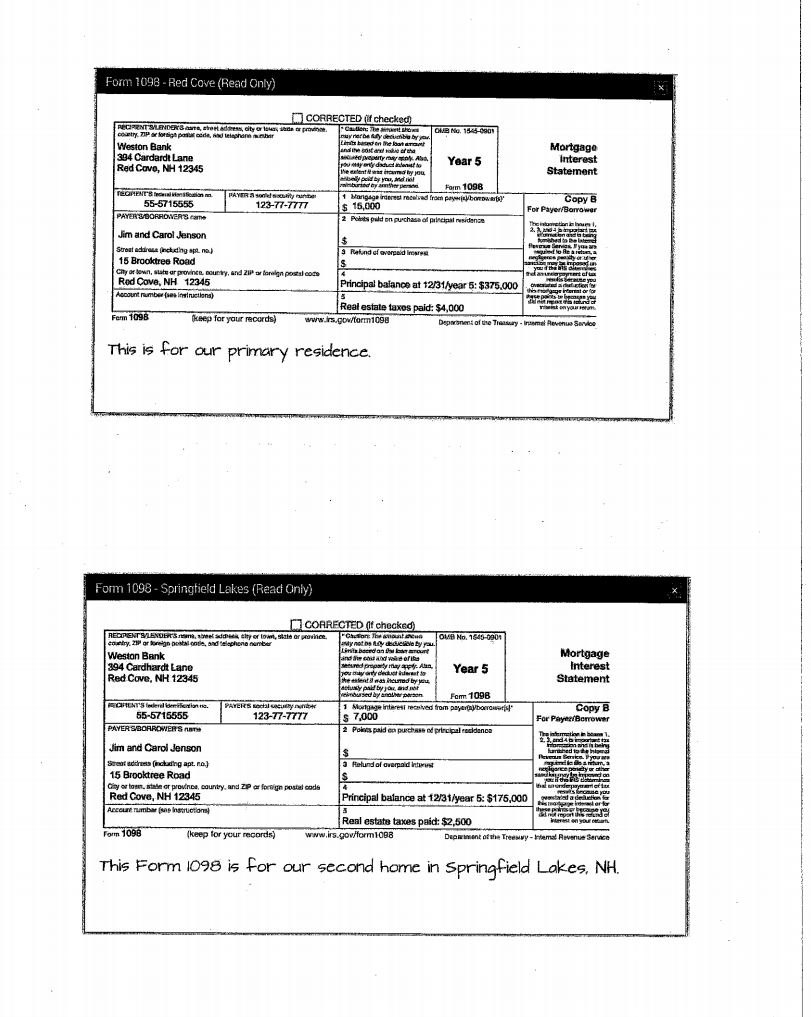

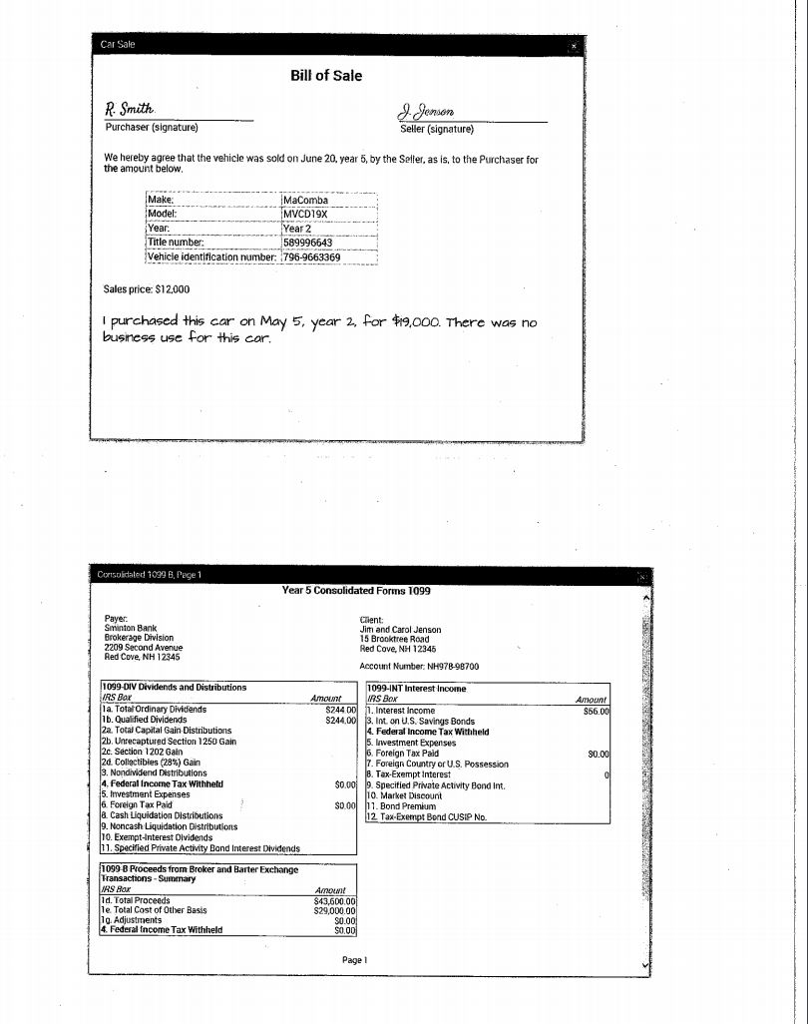

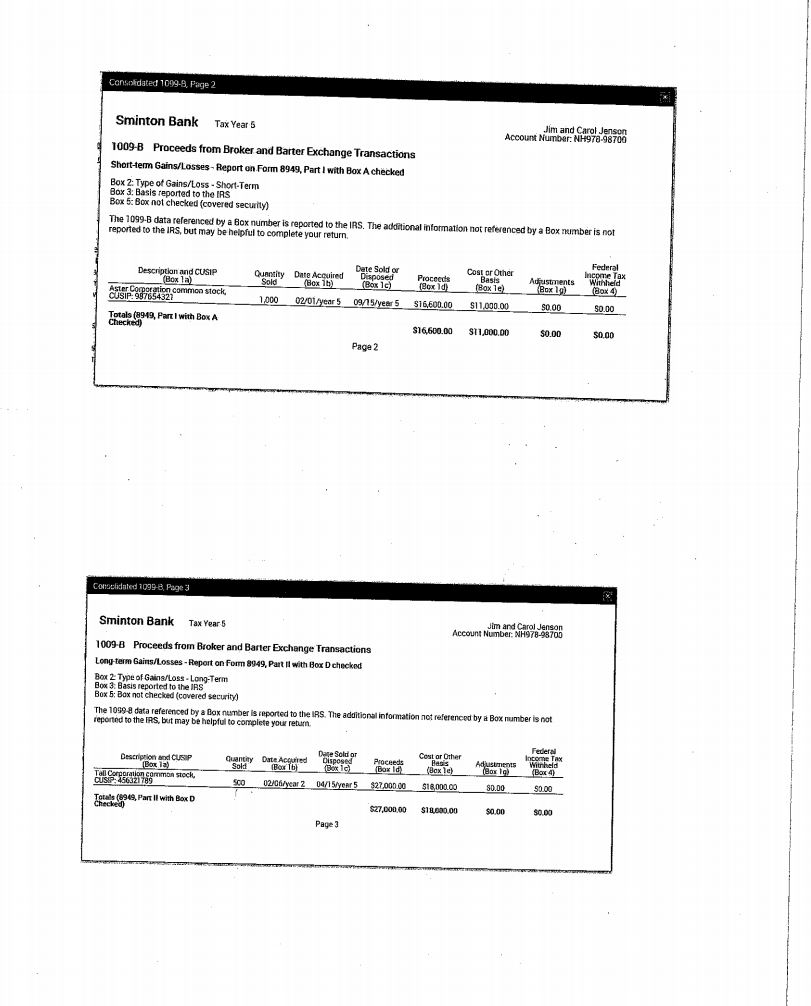

Document Review Simulation Jim and Carol Jenson NOTE: All you will turn in for grading is page 1 of this document. Based on the interview notes and the documents below, calculate the following amounts which would be reported on their 2017 Form 1040. If the amount is negative, put a minus ) before the number. If the amount is zero, write $0. 1. Wages, salaries, tips, etc. 2. Taxable interest 3. Taxable dividends Business income or (deductible loss) 5. Capital gain or (deductible loss) 6. 4. Rental real estate income or (deductible loss) 7. Taxable other income 8. Deductible part of self-employment tax 9. Schedule A home mortgage interest deduction 10. Schedule A tax deduction 11. Schedule A miscellaneous deduction 12. Taxable income Jim and Carol Jenson, ages 48 and 47, respectively, are married and file a joint tax return. Jim is a CPA employed at Jan Apparel Company and Carol is a self- employed realtor. They have two dependent children in high school: John, age 17, and Mary, age 18. They have provided documentation for their year 5 (assume 2017) income and expenses see below. Assume that their 2017 standard deduction is $12,700 and the applicable personal/dependency exemption amount is $4,050 per qualifying individual. Jim and Carol have come to you for help in calculating the different components of taxable income for the year 2017. They have provided you with documents to Document Review Simulation Jim and Carol Jenson NOTE: All you will turn in for grading is page 1 of this document. Based on the interview notes and the documents below, calculate the following amounts which would be reported on their 2017 Form 1040. If the amount is negative, put a minus ) before the number. If the amount is zero, write $0. 1. Wages, salaries, tips, etc. 2. Taxable interest 3. Taxable dividends Business income or (deductible loss) 5. Capital gain or (deductible loss) 6. 4. Rental real estate income or (deductible loss) 7. Taxable other income 8. Deductible part of self-employment tax 9. Schedule A home mortgage interest deduction 10. Schedule A tax deduction 11. Schedule A miscellaneous deduction 12. Taxable income Jim and Carol Jenson, ages 48 and 47, respectively, are married and file a joint tax return. Jim is a CPA employed at Jan Apparel Company and Carol is a self- employed realtor. They have two dependent children in high school: John, age 17, and Mary, age 18. They have provided documentation for their year 5 (assume 2017) income and expenses see below. Assume that their 2017 standard deduction is $12,700 and the applicable personal/dependency exemption amount is $4,050 per qualifying individual. Jim and Carol have come to you for help in calculating the different components of taxable income for the year 2017. They have provided you with documents to