Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with adjusting entry 1-8. Adjusting Entry 5, Depreciation on Truck. The delivery truck was purchased on January 1, 2015. The truck is depreciated

Need help with adjusting entry 1-8.

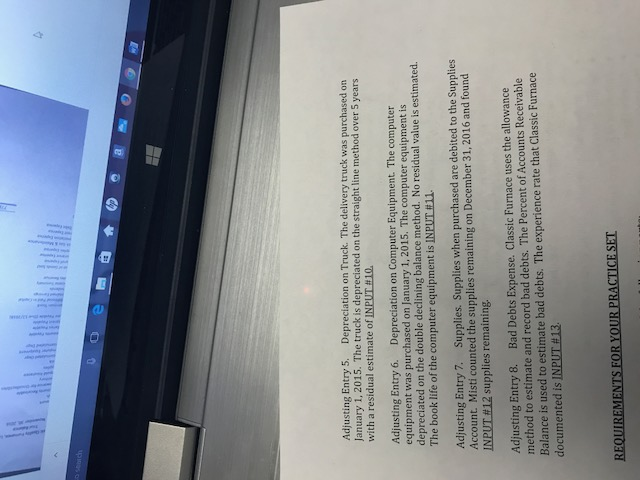

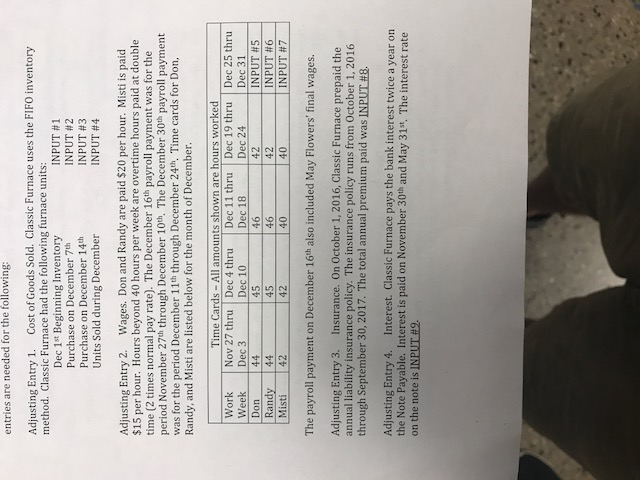

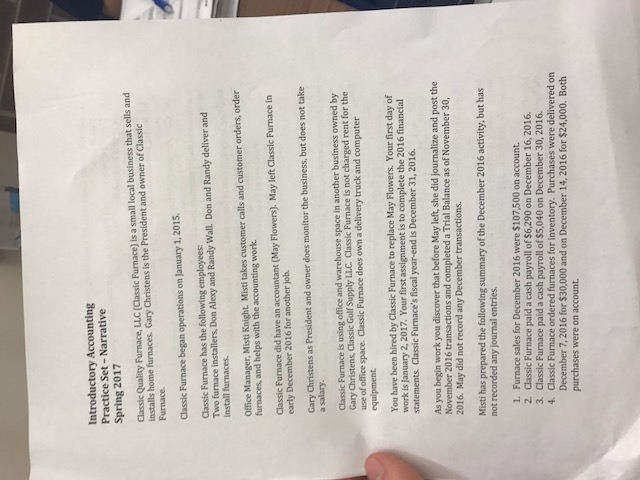

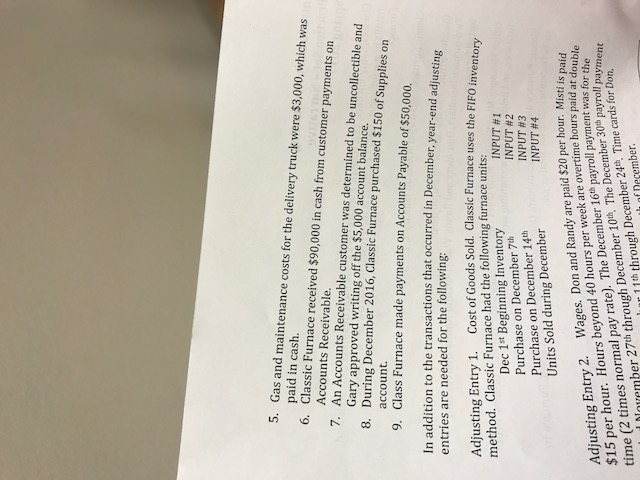

Adjusting Entry 5, Depreciation on Truck. The delivery truck was purchased on January 1, 2015. The truck is depreciated on the straight line method over 5 years with a residual estimate of INPUT 10. Adjusting Entry 6. Depreciation on Computer Equipment. The computer equipment was purchased on January 1, 2015. The computer equipment is on the double declining balance method. No residual value is estimated. The book life of the computer equipment is INPUL fill. Adjusting Entry 7. Supplies. Supplies when purchased are debited to the supplies Account. Misti counted the supplies remaining on December 31, 2016 and found INPUT 12 supplies remaining. Adjusting Entry Bad Debts Expense. Classic Furnace uses the allowance method to 8 The Percent of Accounts Receivable estimate and record bad debts. Balance is used to estimate bad debts. The experience rate that Classic Furnace documented is INPUT ft 13. REQUIREMENTS EOR YOUR PRACTICE SET Adjusting Entry 5, Depreciation on Truck. The delivery truck was purchased on January 1, 2015. The truck is depreciated on the straight line method over 5 years with a residual estimate of INPUT 10. Adjusting Entry 6. Depreciation on Computer Equipment. The computer equipment was purchased on January 1, 2015. The computer equipment is on the double declining balance method. No residual value is estimated. The book life of the computer equipment is INPUL fill. Adjusting Entry 7. Supplies. Supplies when purchased are debited to the supplies Account. Misti counted the supplies remaining on December 31, 2016 and found INPUT 12 supplies remaining. Adjusting Entry Bad Debts Expense. Classic Furnace uses the allowance method to 8 The Percent of Accounts Receivable estimate and record bad debts. Balance is used to estimate bad debts. The experience rate that Classic Furnace documented is INPUT ft 13. REQUIREMENTS EOR YOUR PRACTICE SETStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started