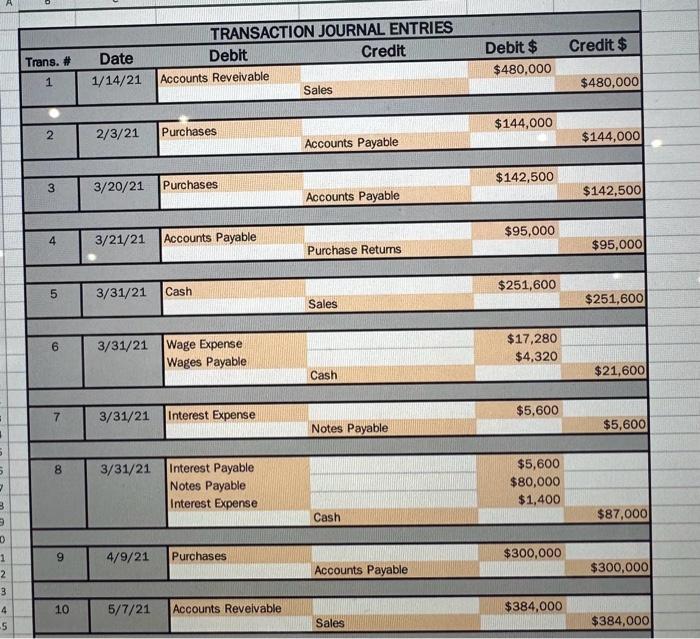

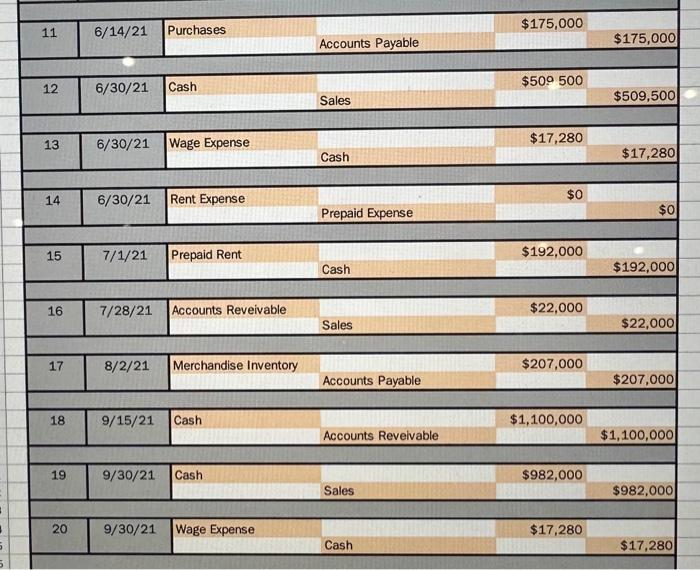

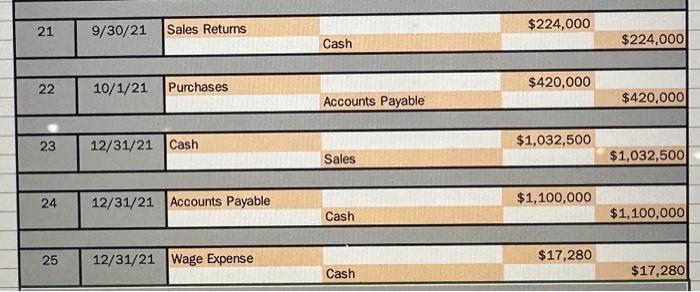

need help with all orange boxes

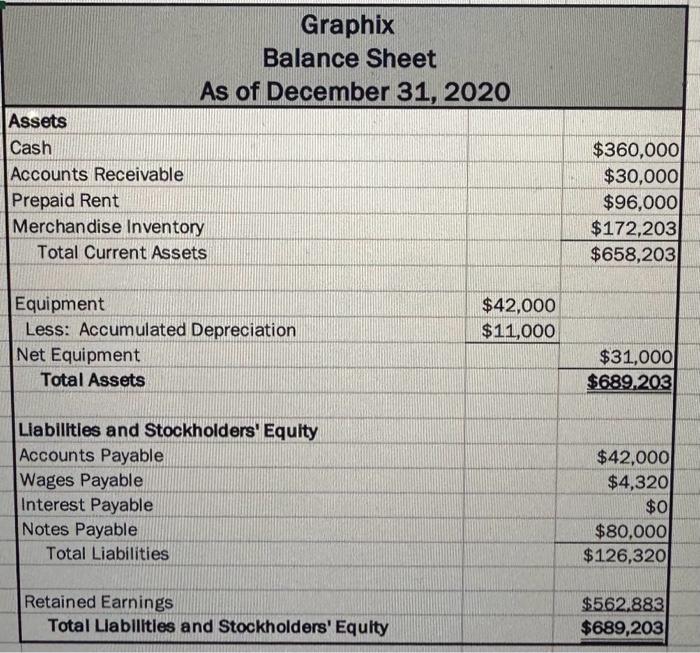

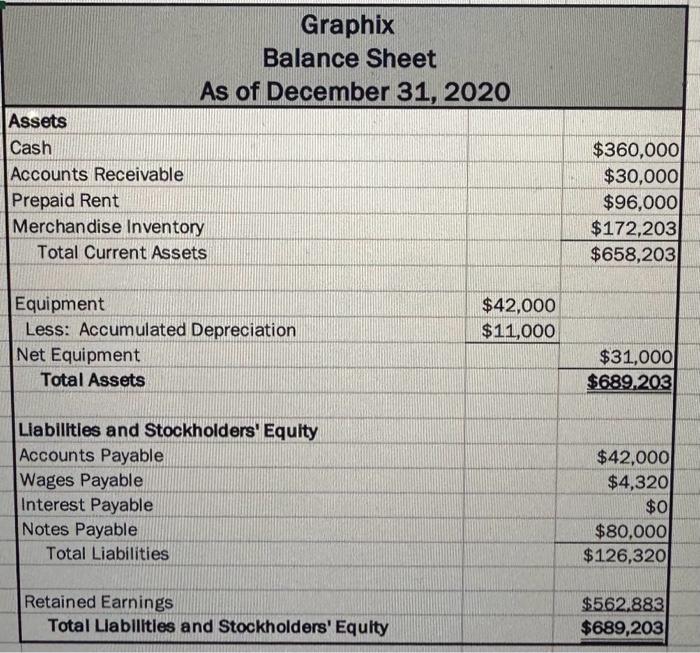

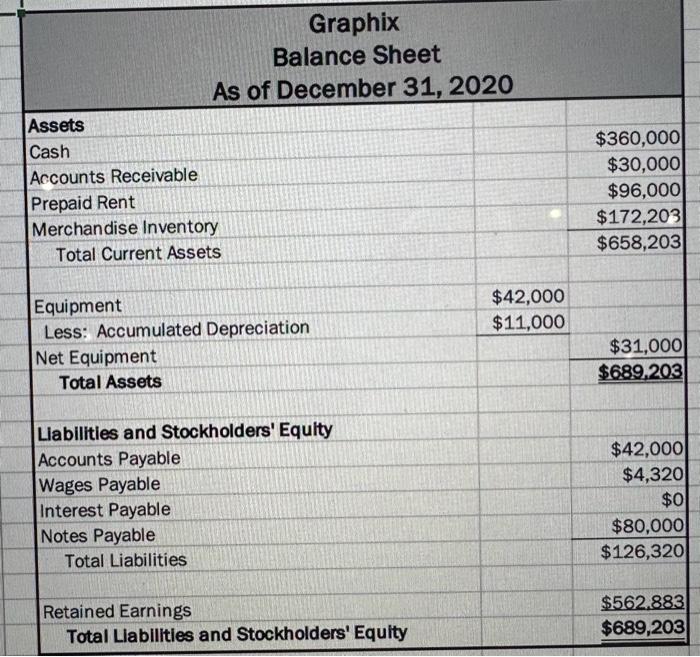

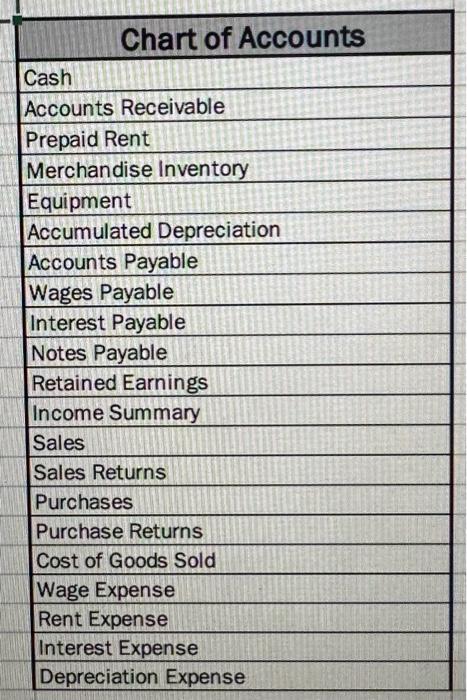

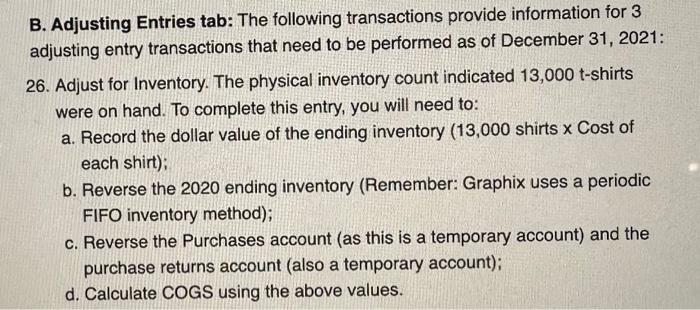

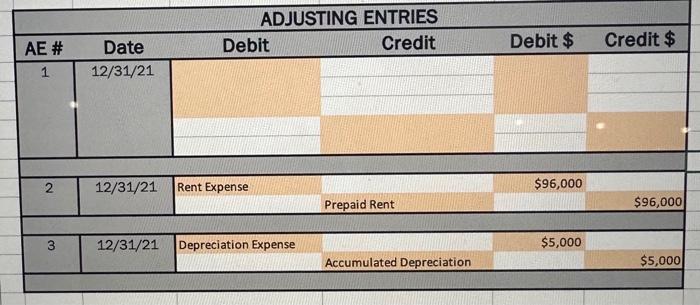

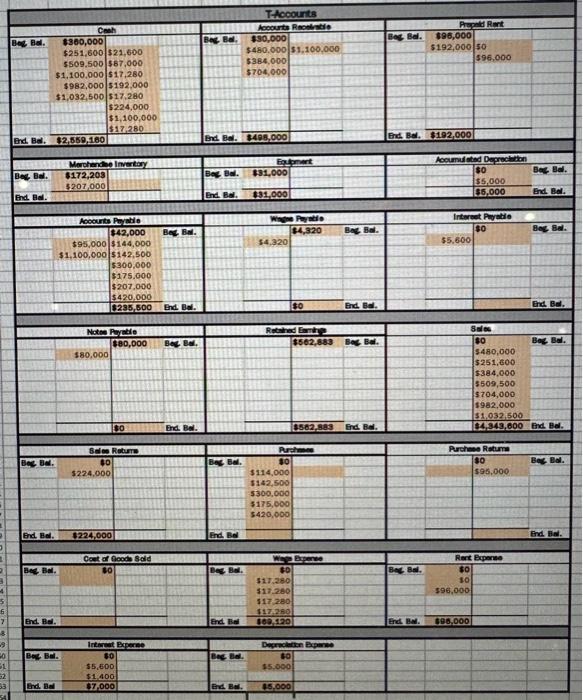

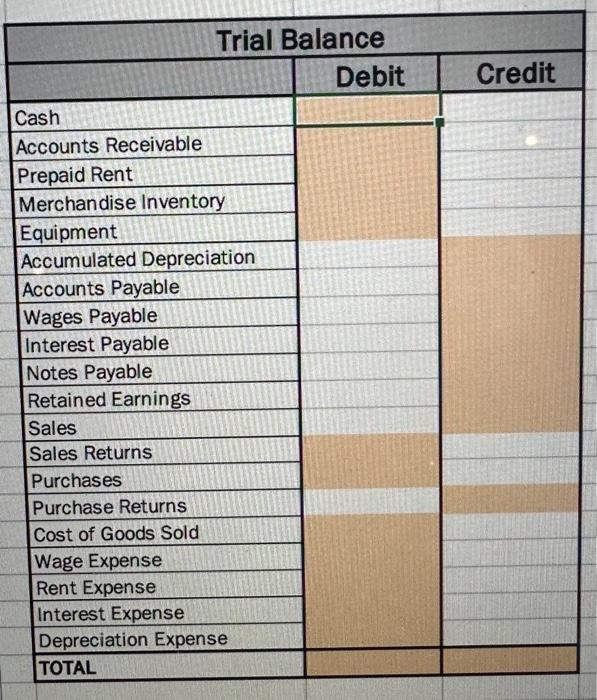

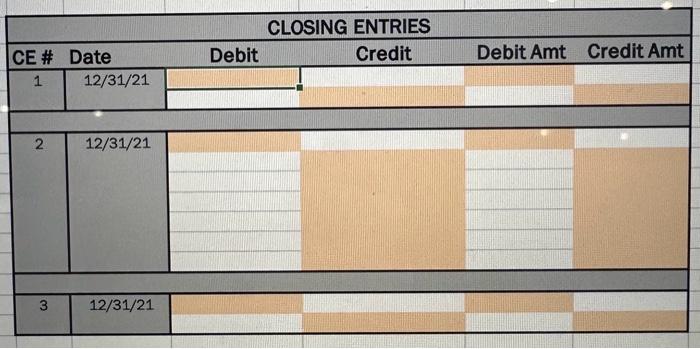

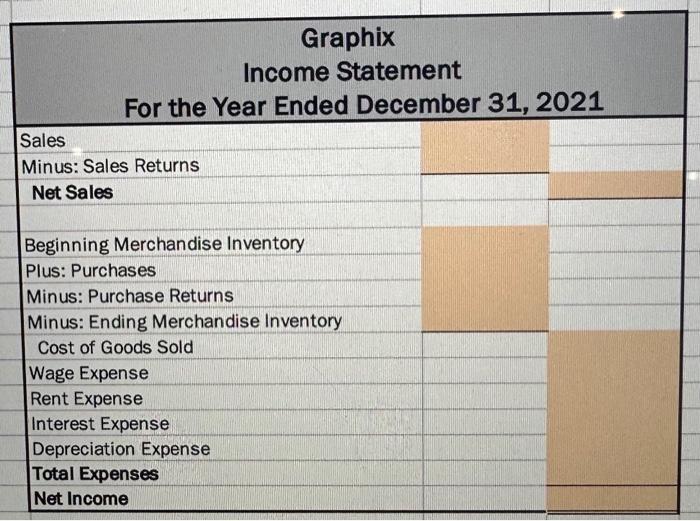

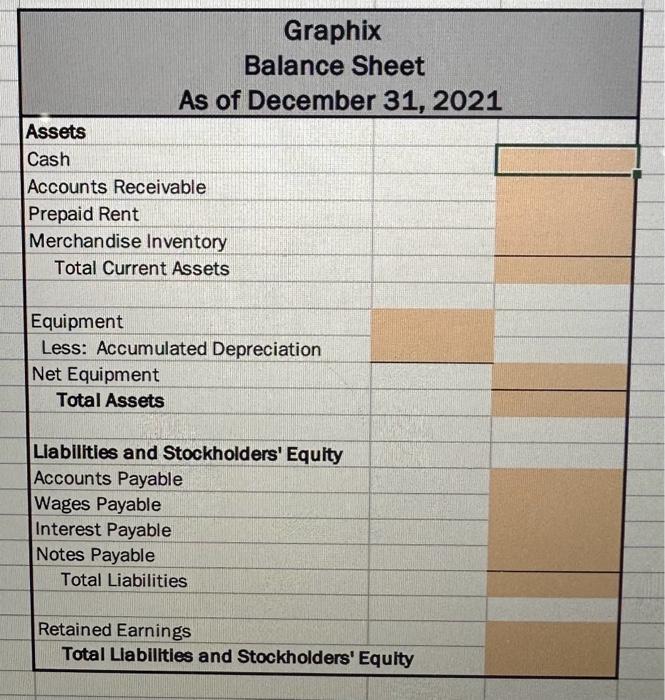

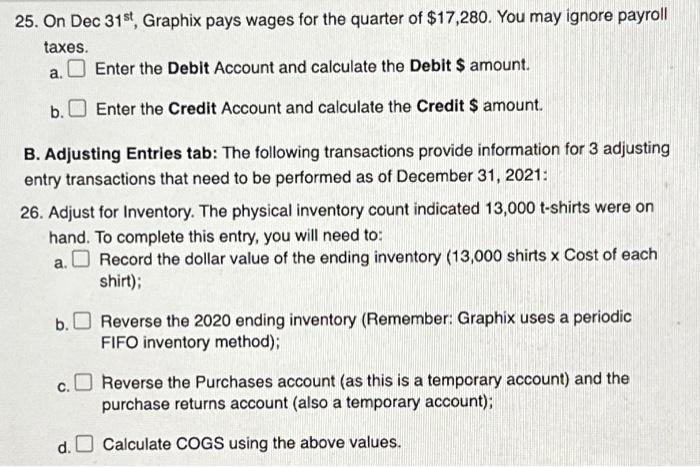

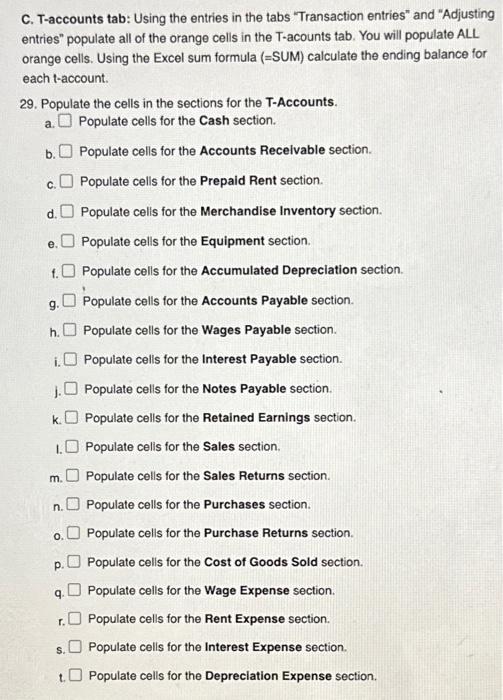

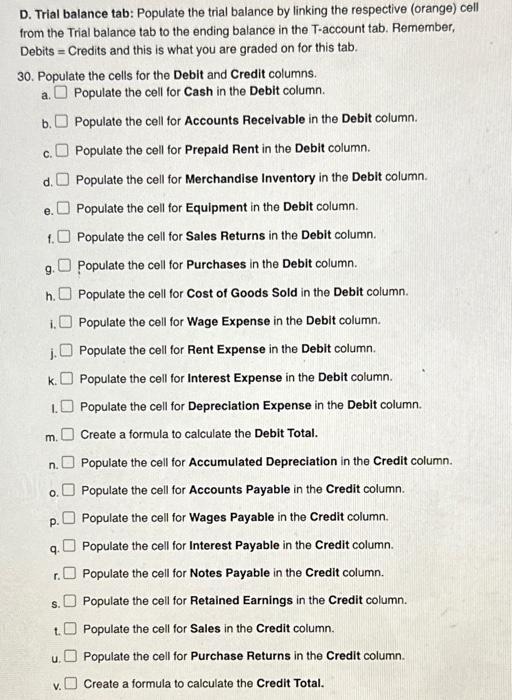

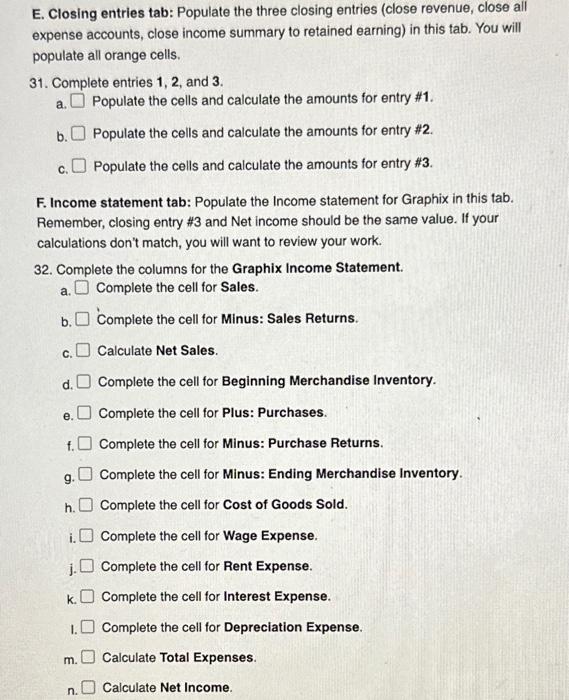

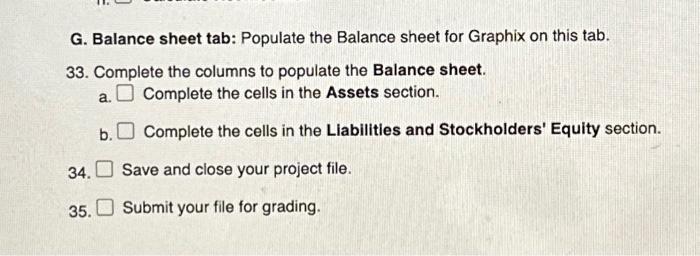

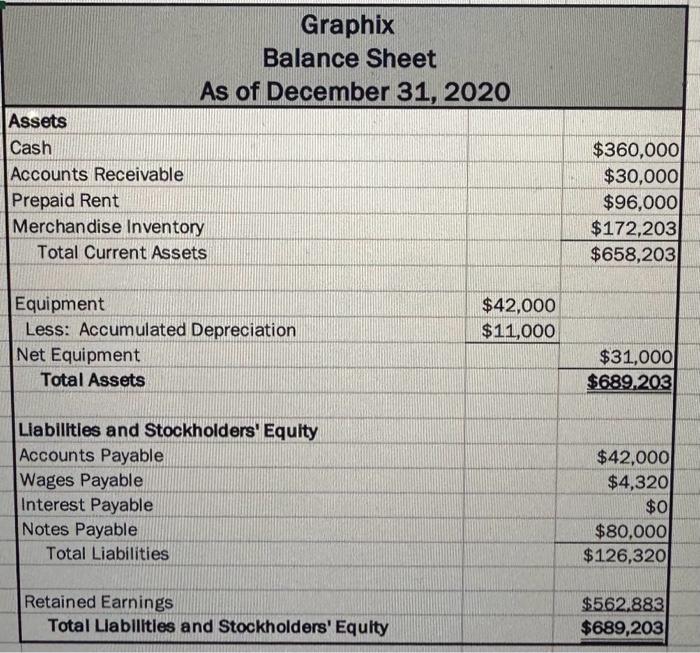

Graphix Balance Sheet As of December 31, 2020 \begin{tabular}{|lrr|} \hline Assets & \\ \hline Cash & $360,000 \\ \hline Accounts Receivable & $30,000 \\ \hline Prepaid Rent & $96,000 \\ \hline Merchandise Inventory & $172,203 \\ \hline Total Current Assets & $658,203 \\ \hline Equipment & $42,000 & \\ \hline Less: Accumulated Depreciation & $11,000 & \\ \hline Net Equipment & & $31,000 \\ \hline Total Assets & $689,203 \\ \hline & \\ \hline Llabillties and Stockholders' Equity & \\ \hline Accounts Payable & $42,000 \\ Wages Payable & $4,320 \\ \hline Interest Payable & $0 \\ \hline Notes Payable & $126,000 \\ \hline Total Liabilities & & \\ \hline & Retained Earnings & $682,883 \\ \hline Total Llablilties and Stockholders' Equlty & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \multicolumn{1}{|c|}{ Chart of Accounts } \\ \hline Cash \\ \hline Accounts Receivable \\ \hline Prepaid Rent \\ \hline Merchandise Inventory \\ \hline Equipment \\ \hline Accumulated Depreciation \\ \hline Accounts Payable \\ \hline Wages Payable \\ \hline Interest Payable \\ \hline Notes Payable \\ \hline Retained Earnings \\ \hline Income Summary \\ \hline Sales \\ \hline Sales Returns \\ \hline Purchases \\ \hline Purchase Returns \\ \hline Cost of Goods Sold \\ \hline Wage Expense \\ \hline Rent Expense \\ \hline Interest Expense \\ \hline Depreciation Expense \\ \hline \end{tabular} B. Adjusting Entries tab: The following transactions provide information for 3 adjusting entry transactions that need to be performed as of December 31,2021 : 26. Adjust for Inventory. The physical inventory count indicated 13,000 t-shirts were on hand. To complete this entry, you will need to: a. Record the dollar value of the ending inventory (13,000 shirts Cost of each shirt); b. Reverse the 2020 ending inventory (Remember: Graphix uses a periodic FIFO inventory method); c. Reverse the Purchases account (as this is a temporary account) and the purchase returns account (also a temporary account); d. Calculate COGS using the above values. \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ Trial Balance } \\ \hline & Debit & Credit \\ \hline Cash & \\ \hline Accounts Receivable \\ \hline Prepaid Rent \\ \hline Merchandise Inventory \\ \hline Equipment \\ \hline Accumulated Depreciation & \\ \hline Accounts Payable \\ \hline Wages Payable \\ \hline Interest Payable \\ \hline Notes Payable \\ \hline Retained Earnings \\ \hline Sales \\ \hline Sales Returns \\ \hline Purchases \\ \hline Purchase Returns \\ \hline Cost of Goods Sold \\ \hline Wage Expense & \\ \hline Rent Expense & \\ \hline Interest Expense & \\ \hline Depreciation Expense \\ \hline TOTAL \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ CLOSING ENTRIES } \\ \hline \multicolumn{2}{|c|}{ CE \# Date Credit } & \\ \hline 1 & 12/31/21 & & \\ \hline 2 & 12/31/21 & & \\ \hline \multicolumn{2}{|c|}{ Debit Amt Credit Amt } \\ \hline & & \\ \hline 3 & 12/31/21 & \\ \hline \end{tabular} Graphix Income Statement For the Year Ended December 31, 2021 Sales Minus: Sales Returns Net Sales Beginning Merchandise Inventory Plus: Purchases Minus: Purchase Returns Minus: Ending Merchandise Inventory Cost of Goods Sold Wage Expense Rent Expense Interest Expense Depreciation Expense Total Expenses Net Income Graphix Balance Sheet As of December 31, 2021 Assets Cash Accounts Receivable Prepaid Rent Merchandise Inventory Total Current Assets Equipment Less: Accumulated Depreciation Net Equipment Total Assets Llabilities and Stockholders' Equity Accounts Payable Wages Payable Interest Payable Notes Payable Total Liabilities Retained Earnings Total Llabilities and Stockholders' Equity 25. On Dec 31st, Graphix pays wages for the quarter of $17,280. You may ignore payroll taxes. a. Enter the Debit Account and calculate the Debit $ amount. b. Enter the Credit Account and calculate the Credit $ amount. B. Adjusting Entries tab: The following transactions provide information for 3 adjusting entry transactions that need to be performed as of December 31,2021 : 26. Adjust for Inventory. The physical inventory count indicated 13,000t-shirts were on hand. To complete this entry, you will need to: a. Record the dollar value of the ending inventory (13,000 shirts Cost of each shirt); b. Reverse the 2020 ending inventory (Remember: Graphix uses a periodic FIFO inventory method); c. Reverse the Purchases account (as this is a temporary account) and the purchase returns account (also a temporary account); d. Calculate COGS using the above values. C. T-accounts tab: Using the entries in the tabs "Transaction entries" and "Adjusting entries" populate all of the orange cells in the T-acounts tab. You will populate ALL orange cells. Using the Excel sum formula (=SUM) calculate the ending balance for each t-account. 29. Populate the cells in the sections for the T-Accounts. a. Populate cells for the Cash section. b. Populate cells for the Accounts Recelvable section. c. Populate cells for the Prepaid Rent section. d. Populate cells for the Merchandise Inventory section. e. Populate cells for the Equipment section. f. Populate cells for the Accumulated Depreciation section. g. Populate cells for the Accounts Payable section. h. Populate cells for the Wages Payable section. i. Populate cells for the Interest Payable section. j. Populate cells for the Notes Payable section. k. Populate cells for the Retained Earnings section. 1. Populate celis for the Sales section. m. Populate cells for the Sales Returns section. n. Populate cells for the Purchases section. o. Populate cells for the Purchase Returns section. p. Populate cells for the Cost of Goods Sold section. q. Populate cells for the Wage Expense section. r. Populate cells for the Rent Expense section. s. Populate cells for the Interest Expense section. t. Populate cells for the Depreclation Expense section. D. Trial balance tab: Populate the trial balance by linking the respective (orange) cell from the Trial balance tab to the ending balance in the T-account tab. Remember, Debits = Credits and this is what you are graded on for this tab. 30. Populate the cells for the Debit and Credit columns. a. Populate the cell for Cash in the Debit column. b. Populate the cell for Accounts Recelvable in the Debit column. c. Populate the cell for Prepaid Rent in the Debit column. d. Populate the cell for Merchandise Inventory in the Debit column. e. Populate the cell for Equipment in the Debit column. 1. Populate the cell for Sales Returns in the Debit column. g. Populate the cell for Purchases in the Debit column. h. Populate the cell for Cost of Goods Sold in the Debit column. i. Populate the cell for Wage Expense in the Debit column. j. Populate the cell for Rent Expense in the Debit column. k. Populate the cell for Interest Expense in the Debit column. 1. Populate the cell for Depreciation Expense in the Debit column. m. Create a formula to calculate the Debit Total. n. Populate the cell for Accumulated Depreciation in the Credit column. o. Populate the cell for Accounts Payable in the Credit column. p. Populate the cell for Wages Payable in the Credit column. q. Populate the cell for Interest Payable in the Credit column. r. Populate the cell for Notes Payable in the Credit column. s. Populate the cell for Retained Earnings in the Credit column. t. Populate the cell for Sales in the Credit column. u. Populate the cell for Purchase Returns in the Credit column. v. Create a formula to calculate the Credit Total. E. Closing entries tab: Populate the three closing entries (close revenue, close all expense accounts, close income summary to retained earning) in this tab. You will populate all orange cells. 31. Complete entries 1,2 , and 3. a. Populate the cells and calculate the amounts for entry \#1. b. Populate the cells and calculate the amounts for entry \#2. c. Populate the cells and calculate the amounts for entry \#3. F. Income statement tab: Populate the Income statement for Graphix in this tab. Remember, closing entry #3 and Net income should be the same value. If your calculations don't match, you will want to review your work. 32. Complete the columns for the Graphix Income Statement. a. Complete the cell for Sales. b. Complete the cell for Minus: Sales Returns. c. Calculate Net Sales. d. Complete the cell for Beginning Merchandise Inventory. e. Complete the cell for Plus: Purchases. f. Complete the cell for Minus: Purchase Returns. g. Complete the cell for Minus: Ending Merchandise Inventory. h. Complete the cell for Cost of Goods Sold. i. Complete the cell for Wage Expense. j. Complete the cell for Rent Expense. k. Complete the cell for Interest Expense. 1. Complete the cell for Depreciation Expense. m. Calculate Total Expenses. n. Calculate Net Income. G. Balance sheet tab: Populate the Balance sheet for Graphix on this tab. 33. Complete the columns to populate the Balance sheet. a. Complete the cells in the Assets section. b. Complete the cells in the Llabilities and Stockholders' Equity section. 34. Save and close your project file. 35. Submit your file for grading. Graphix Balance Sheet As of December 31, 2020 \begin{tabular}{|lrr|} \hline Assets & \\ \hline Cash & $360,000 \\ \hline Accounts Receivable & $30,000 \\ \hline Prepaid Rent & $96,000 \\ \hline Merchandise Inventory & $172,203 \\ \hline Total Current Assets & $658,203 \\ \hline Equipment & $42,000 & \\ \hline Less: Accumulated Depreciation & $11,000 & \\ \hline Net Equipment & & $31,000 \\ \hline Total Assets & $689,203 \\ \hline & \\ \hline Llabillties and Stockholders' Equity & \\ \hline Accounts Payable & $42,000 \\ Wages Payable & $4,320 \\ \hline Interest Payable & $0 \\ \hline Notes Payable & $126,000 \\ \hline Total Liabilities & & \\ \hline & Retained Earnings & $682,883 \\ \hline Total Llablilties and Stockholders' Equlty & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \multicolumn{1}{|c|}{ Chart of Accounts } \\ \hline Cash \\ \hline Accounts Receivable \\ \hline Prepaid Rent \\ \hline Merchandise Inventory \\ \hline Equipment \\ \hline Accumulated Depreciation \\ \hline Accounts Payable \\ \hline Wages Payable \\ \hline Interest Payable \\ \hline Notes Payable \\ \hline Retained Earnings \\ \hline Income Summary \\ \hline Sales \\ \hline Sales Returns \\ \hline Purchases \\ \hline Purchase Returns \\ \hline Cost of Goods Sold \\ \hline Wage Expense \\ \hline Rent Expense \\ \hline Interest Expense \\ \hline Depreciation Expense \\ \hline \end{tabular} B. Adjusting Entries tab: The following transactions provide information for 3 adjusting entry transactions that need to be performed as of December 31,2021 : 26. Adjust for Inventory. The physical inventory count indicated 13,000 t-shirts were on hand. To complete this entry, you will need to: a. Record the dollar value of the ending inventory (13,000 shirts Cost of each shirt); b. Reverse the 2020 ending inventory (Remember: Graphix uses a periodic FIFO inventory method); c. Reverse the Purchases account (as this is a temporary account) and the purchase returns account (also a temporary account); d. Calculate COGS using the above values. \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ Trial Balance } \\ \hline & Debit & Credit \\ \hline Cash & \\ \hline Accounts Receivable \\ \hline Prepaid Rent \\ \hline Merchandise Inventory \\ \hline Equipment \\ \hline Accumulated Depreciation & \\ \hline Accounts Payable \\ \hline Wages Payable \\ \hline Interest Payable \\ \hline Notes Payable \\ \hline Retained Earnings \\ \hline Sales \\ \hline Sales Returns \\ \hline Purchases \\ \hline Purchase Returns \\ \hline Cost of Goods Sold \\ \hline Wage Expense & \\ \hline Rent Expense & \\ \hline Interest Expense & \\ \hline Depreciation Expense \\ \hline TOTAL \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ CLOSING ENTRIES } \\ \hline \multicolumn{2}{|c|}{ CE \# Date Credit } & \\ \hline 1 & 12/31/21 & & \\ \hline 2 & 12/31/21 & & \\ \hline \multicolumn{2}{|c|}{ Debit Amt Credit Amt } \\ \hline & & \\ \hline 3 & 12/31/21 & \\ \hline \end{tabular} Graphix Income Statement For the Year Ended December 31, 2021 Sales Minus: Sales Returns Net Sales Beginning Merchandise Inventory Plus: Purchases Minus: Purchase Returns Minus: Ending Merchandise Inventory Cost of Goods Sold Wage Expense Rent Expense Interest Expense Depreciation Expense Total Expenses Net Income Graphix Balance Sheet As of December 31, 2021 Assets Cash Accounts Receivable Prepaid Rent Merchandise Inventory Total Current Assets Equipment Less: Accumulated Depreciation Net Equipment Total Assets Llabilities and Stockholders' Equity Accounts Payable Wages Payable Interest Payable Notes Payable Total Liabilities Retained Earnings Total Llabilities and Stockholders' Equity 25. On Dec 31st, Graphix pays wages for the quarter of $17,280. You may ignore payroll taxes. a. Enter the Debit Account and calculate the Debit $ amount. b. Enter the Credit Account and calculate the Credit $ amount. B. Adjusting Entries tab: The following transactions provide information for 3 adjusting entry transactions that need to be performed as of December 31,2021 : 26. Adjust for Inventory. The physical inventory count indicated 13,000t-shirts were on hand. To complete this entry, you will need to: a. Record the dollar value of the ending inventory (13,000 shirts Cost of each shirt); b. Reverse the 2020 ending inventory (Remember: Graphix uses a periodic FIFO inventory method); c. Reverse the Purchases account (as this is a temporary account) and the purchase returns account (also a temporary account); d. Calculate COGS using the above values. C. T-accounts tab: Using the entries in the tabs "Transaction entries" and "Adjusting entries" populate all of the orange cells in the T-acounts tab. You will populate ALL orange cells. Using the Excel sum formula (=SUM) calculate the ending balance for each t-account. 29. Populate the cells in the sections for the T-Accounts. a. Populate cells for the Cash section. b. Populate cells for the Accounts Recelvable section. c. Populate cells for the Prepaid Rent section. d. Populate cells for the Merchandise Inventory section. e. Populate cells for the Equipment section. f. Populate cells for the Accumulated Depreciation section. g. Populate cells for the Accounts Payable section. h. Populate cells for the Wages Payable section. i. Populate cells for the Interest Payable section. j. Populate cells for the Notes Payable section. k. Populate cells for the Retained Earnings section. 1. Populate celis for the Sales section. m. Populate cells for the Sales Returns section. n. Populate cells for the Purchases section. o. Populate cells for the Purchase Returns section. p. Populate cells for the Cost of Goods Sold section. q. Populate cells for the Wage Expense section. r. Populate cells for the Rent Expense section. s. Populate cells for the Interest Expense section. t. Populate cells for the Depreclation Expense section. D. Trial balance tab: Populate the trial balance by linking the respective (orange) cell from the Trial balance tab to the ending balance in the T-account tab. Remember, Debits = Credits and this is what you are graded on for this tab. 30. Populate the cells for the Debit and Credit columns. a. Populate the cell for Cash in the Debit column. b. Populate the cell for Accounts Recelvable in the Debit column. c. Populate the cell for Prepaid Rent in the Debit column. d. Populate the cell for Merchandise Inventory in the Debit column. e. Populate the cell for Equipment in the Debit column. 1. Populate the cell for Sales Returns in the Debit column. g. Populate the cell for Purchases in the Debit column. h. Populate the cell for Cost of Goods Sold in the Debit column. i. Populate the cell for Wage Expense in the Debit column. j. Populate the cell for Rent Expense in the Debit column. k. Populate the cell for Interest Expense in the Debit column. 1. Populate the cell for Depreciation Expense in the Debit column. m. Create a formula to calculate the Debit Total. n. Populate the cell for Accumulated Depreciation in the Credit column. o. Populate the cell for Accounts Payable in the Credit column. p. Populate the cell for Wages Payable in the Credit column. q. Populate the cell for Interest Payable in the Credit column. r. Populate the cell for Notes Payable in the Credit column. s. Populate the cell for Retained Earnings in the Credit column. t. Populate the cell for Sales in the Credit column. u. Populate the cell for Purchase Returns in the Credit column. v. Create a formula to calculate the Credit Total. E. Closing entries tab: Populate the three closing entries (close revenue, close all expense accounts, close income summary to retained earning) in this tab. You will populate all orange cells. 31. Complete entries 1,2 , and 3. a. Populate the cells and calculate the amounts for entry \#1. b. Populate the cells and calculate the amounts for entry \#2. c. Populate the cells and calculate the amounts for entry \#3. F. Income statement tab: Populate the Income statement for Graphix in this tab. Remember, closing entry #3 and Net income should be the same value. If your calculations don't match, you will want to review your work. 32. Complete the columns for the Graphix Income Statement. a. Complete the cell for Sales. b. Complete the cell for Minus: Sales Returns. c. Calculate Net Sales. d. Complete the cell for Beginning Merchandise Inventory. e. Complete the cell for Plus: Purchases. f. Complete the cell for Minus: Purchase Returns. g. Complete the cell for Minus: Ending Merchandise Inventory. h. Complete the cell for Cost of Goods Sold. i. Complete the cell for Wage Expense. j. Complete the cell for Rent Expense. k. Complete the cell for Interest Expense. 1. Complete the cell for Depreciation Expense. m. Calculate Total Expenses. n. Calculate Net Income. G. Balance sheet tab: Populate the Balance sheet for Graphix on this tab. 33. Complete the columns to populate the Balance sheet. a. Complete the cells in the Assets section. b. Complete the cells in the Llabilities and Stockholders' Equity section. 34. Save and close your project file. 35. Submit your file for grading