Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with an old test question. Thanks Question 2: Swaps for Risk Management 30 Points Step One: Bond at P(mkt) Asset Swap Seller Asset

Need help with an old test question. Thanks

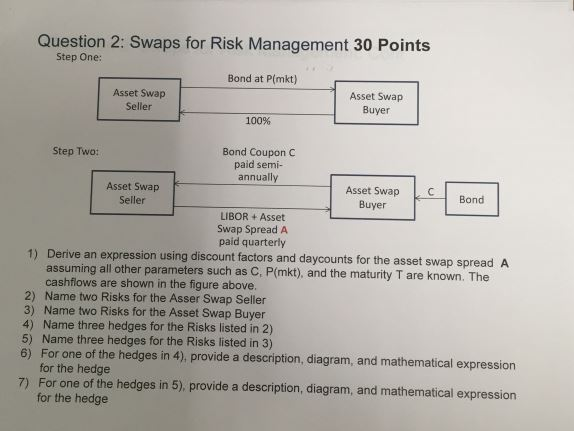

Question 2: Swaps for Risk Management 30 Points Step One: Bond at P(mkt) Asset Swap Seller Asset Swap Buyer 100% Step Two: Bond Coupon C paid semi- annually Asset Swap Seller Asset Swap C Bond Buyer LIBOR +Asset Swap Spread A paid quarterly Derive an expression using discount factors and daycounts for the asset swap spread A assuming all other parameters such as C, P(mkt), and the maturity T are known. The 1) cashflows are shown in the figure above. 2) Name two Risks for the Asser Swap Seller 3) Name two Risks for the Asset Swap Buyer 4) Name three hedges for the Risks listed in 2) 5) Name three hedges for the Risks listed in 3) 6) For one of the hedges in 4), provide a description, diagram, and mathematical expression for the hedge For one of the hedges in 5), provide a description, diagram, and mathematical expression for the hedge 7) Question 2: Swaps for Risk Management 30 Points Step One: Bond at P(mkt) Asset Swap Seller Asset Swap Buyer 100% Step Two: Bond Coupon C paid semi- annually Asset Swap Seller Asset Swap C Bond Buyer LIBOR +Asset Swap Spread A paid quarterly Derive an expression using discount factors and daycounts for the asset swap spread A assuming all other parameters such as C, P(mkt), and the maturity T are known. The 1) cashflows are shown in the figure above. 2) Name two Risks for the Asser Swap Seller 3) Name two Risks for the Asset Swap Buyer 4) Name three hedges for the Risks listed in 2) 5) Name three hedges for the Risks listed in 3) 6) For one of the hedges in 4), provide a description, diagram, and mathematical expression for the hedge For one of the hedges in 5), provide a description, diagram, and mathematical expression for the hedge 7)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started