Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with answering 1 &2 of problem 14-3B The following year-end information is taken from the December 31 adjusted trial balance and other records

need help with answering 1 &2 of problem 14-3B

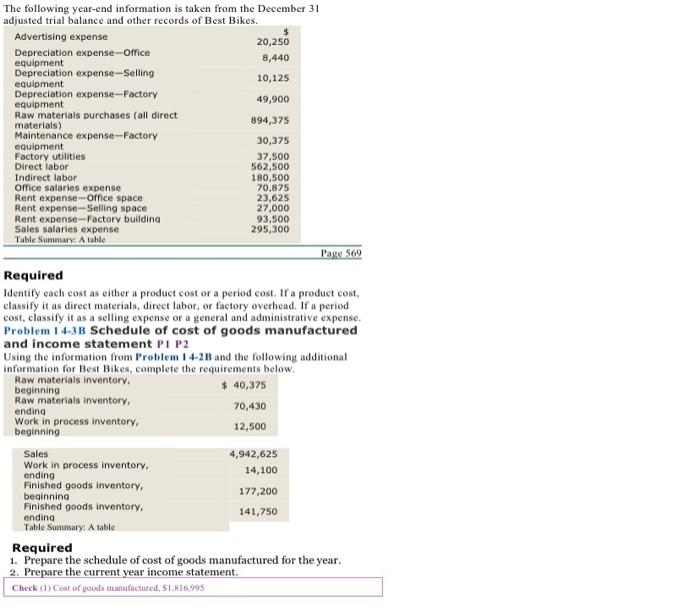

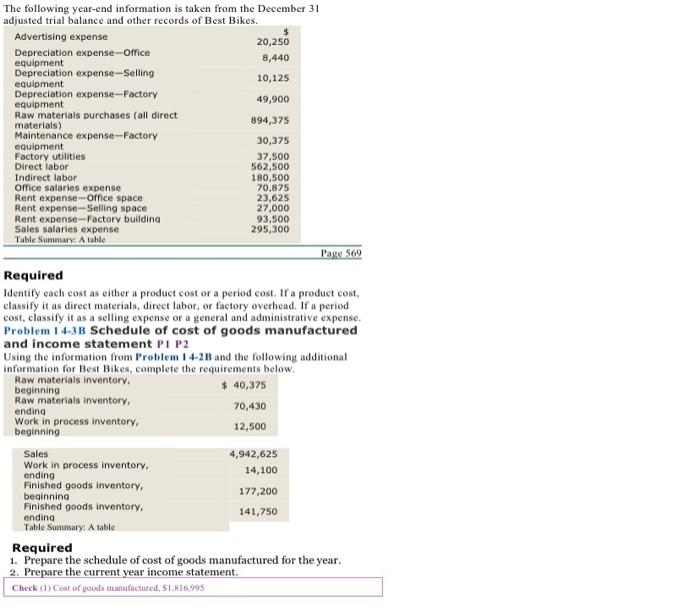

The following year-end information is taken from the December 31 adjusted trial balance and other records of Best Bikes. Advertising expense 20,250 Depreciation expense-Office equipment 8,440 Depreciation expense-Selling 10,125 equipment Depreciation expense-Factory equipment 49,900 Raw materials purchases (all direct materials) 894,375 Maintenance expense-Factory 30,375 equipment Factory utilities 37,500 Direct labor 562,500 Indirect labor 180,500 Office salaries expense 70.875 Rent expense-Office space 23,625 Rent expense-Selling space 27,000 Rent expense-Factory building 93.500 Sales salaries expense 295,300 Table Summary: A table Page 560 Required Identity each cost as either a product cost or a period cost. If a product cost, classify it as direct materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense. Problem 14-3B Schedule of cost of goods manufactured and income statement P1 P2 Using the information from Problem 14-2B and the following additional information for Best Bikes, complete the requirements below. Raw materials inventory. beginning $ 40,375 Raw materials inventory 70,430 ending Work in process inventory 12,500 beginning Sales 4,942,625 Work in process inventory 14,100 ending Finished goods inventory, beginning 177,200 Finished goods inventory. ending 141,750 Table Summary: A table Required 1. Prepare the schedule of cost of goods manufactured for the year. 2. Prepare the current year income statement Check nCost of goods manufactured $1.816995

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started