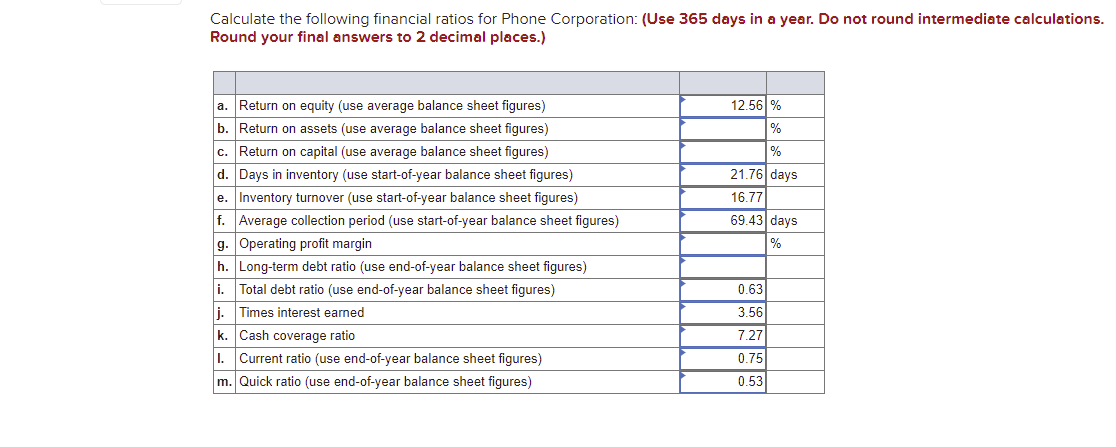

Need help with b, c, g, and h

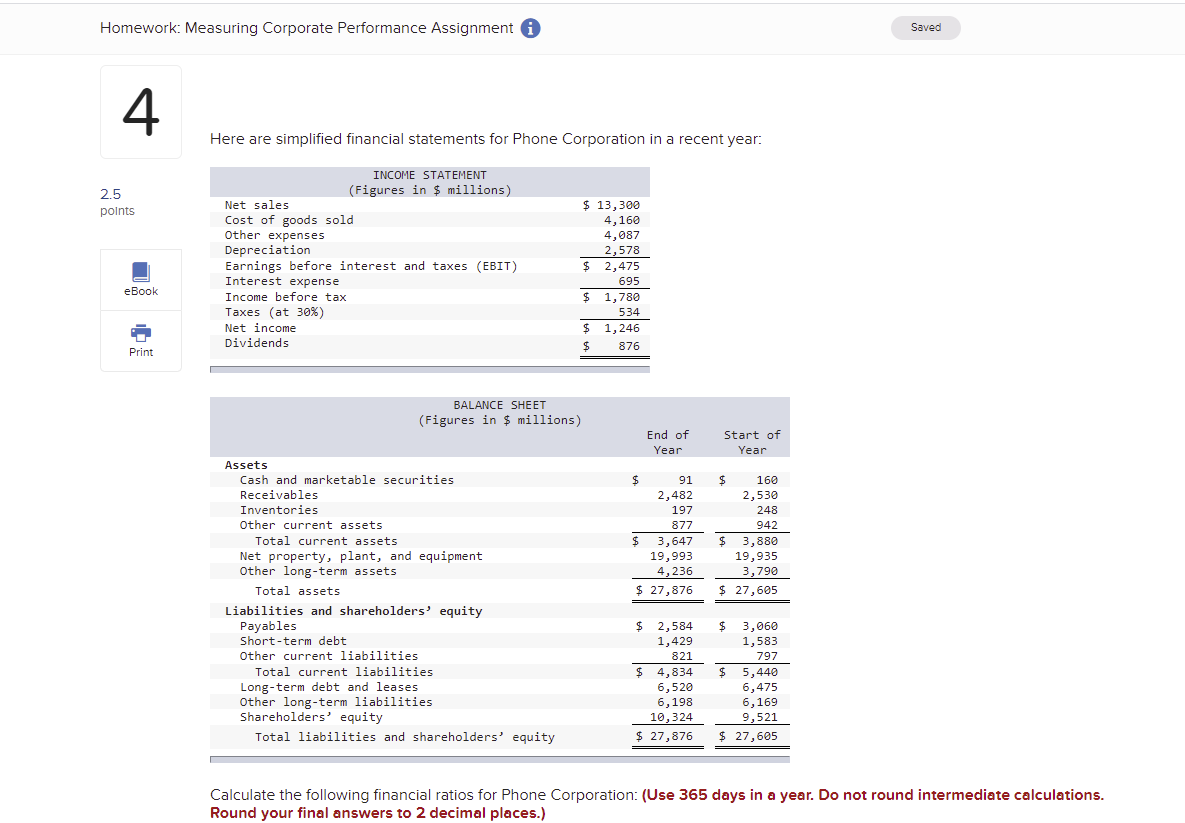

Homework: Measuring Corporate Performance Assignment 0 Saved Here are simplified nancial statements for Phone Corporation in a recent year: INCOME STATEMENT 2-5 (Figures in $ millions) Net sales 5 13,300 points Cost of goods sold 4,160 Other expenses 4,887 Depreciation 2, 578 El Earnings before interest and taxes (EBIT) 5 2,475 Interest expense 695 eBook Income before tax 5 1,780 Taxes (at 38%] 534 6 Net income 5 1,246 _ Dividends 5 375 Print | BALANCE SHEET (Figures in $ millions) End of Start of Year Year Assets Cash and marketable securities $ 91 5 160 Receivables 2, 482 2, 530 Inventories 197 248 Other current assets 377 942 Total current assets $ 3,647 5 3,380 Net property, plant, and equipment 19,993 19,935 Other longterm assets 4,236 3,790 Total assets 5 27,376 5 27,605 Liabilities and shareholders' equity Payables 5 2,584 5 3,860 Shortterm debt 1,429 1,583 Other current liabilities 321 797 Total current liabilities 5 4,334 5 5,440 Longterm debt and leases 6,520 6,475 Other longterm liabilities 6,198 6,169 Shareholders' equity 18,324 9,521 Total liabilities and shareholders' equity 5 27,376 5 27,605 Calculate thefollowing nancial ratios for Phone Corporation: {Use 365 days in a year. Do not round intermediate calculations. Round your nal answers to 2 decimal places.) Calculate the following financial ratios for Phone Corporation: (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.) a. Return on equity (use average balance sheet figures) 12.56 % b. Return on assets (use average balance sheet figures) % C. Return on capital (use average balance sheet figures) % d. Days in inventory (use start-of-year balance sheet figures) 21.76 days e. Inventory turnover (use start-of-year balance sheet figures) 16.77 F. Average collection period (use start-of-year balance sheet figures) 69.43 days g. Operating profit margin % h . Long-term debt ratio (use end-of-year balance sheet figures) i. Total debt ratio (use end-of-year balance sheet figures) 0.63 j. Times interest earned 3.56 k. Cash coverage ratio 7.27 1. Current ratio (use end-of-year balance sheet figures) 0.75 m. Quick ratio (use end-of-year balance sheet figures) 0.53