need help with C-1 and C-2

im needing help with C-1 & C-2

ive posted my answers for Part A and B they are correct.

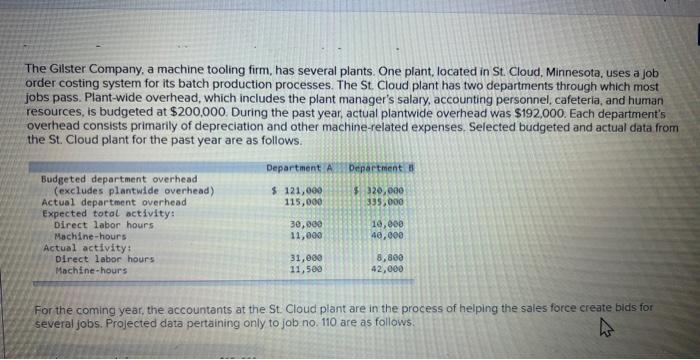

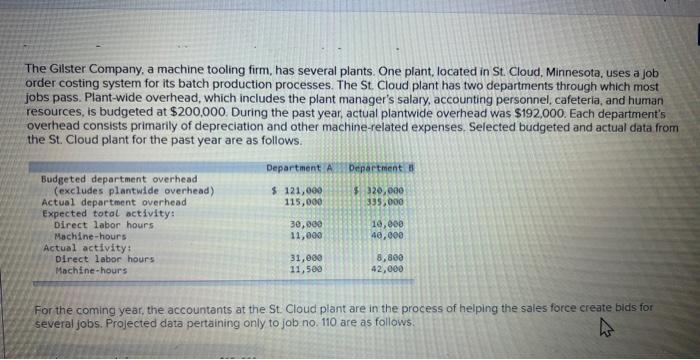

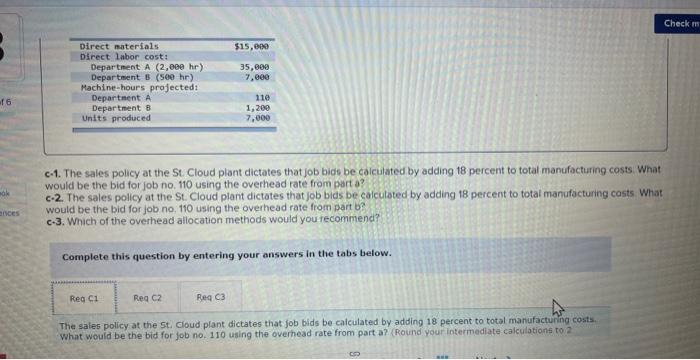

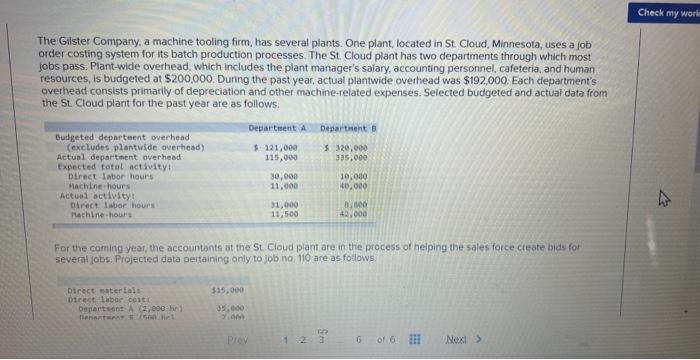

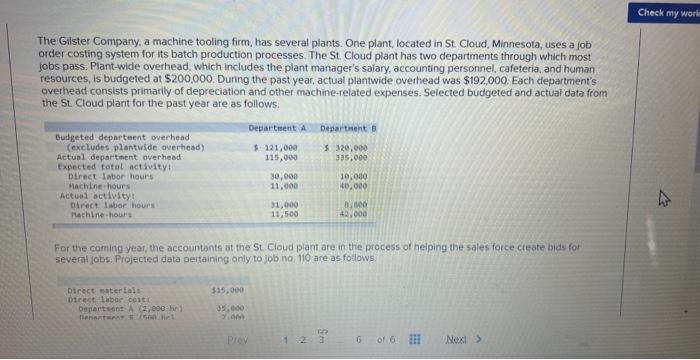

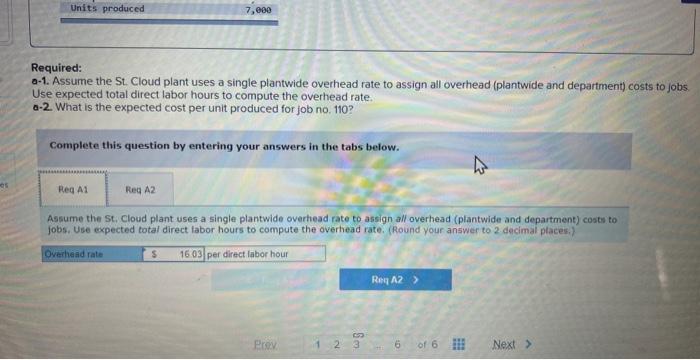

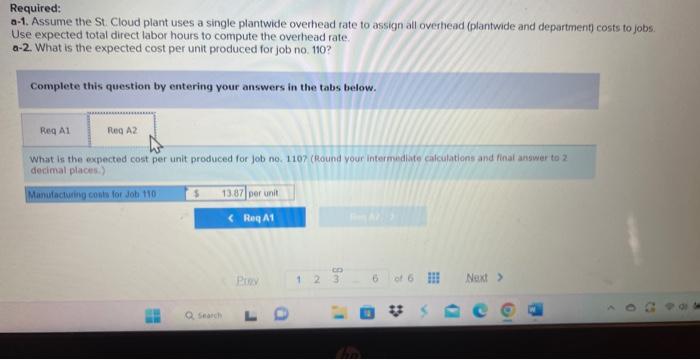

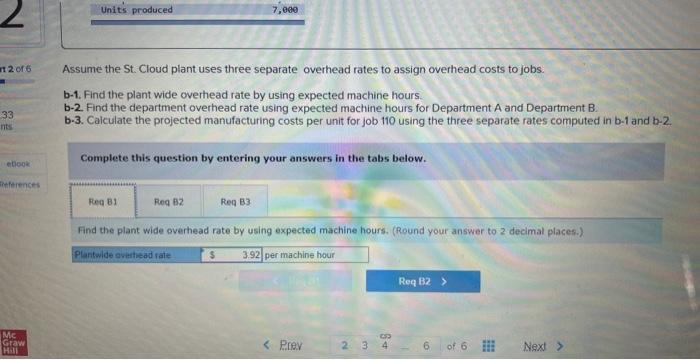

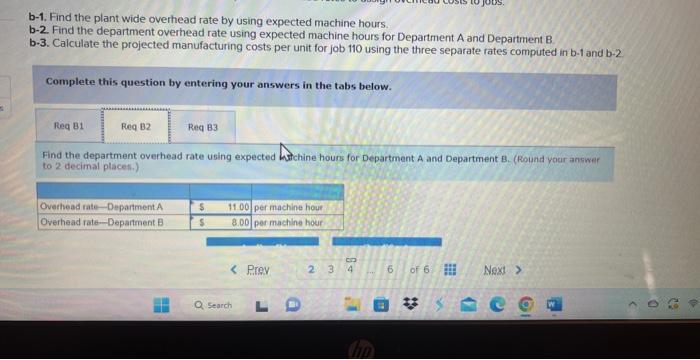

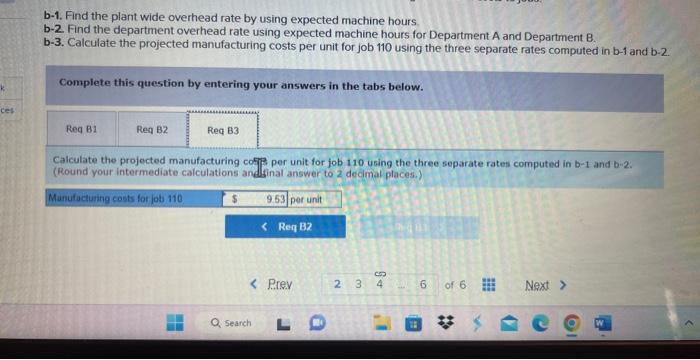

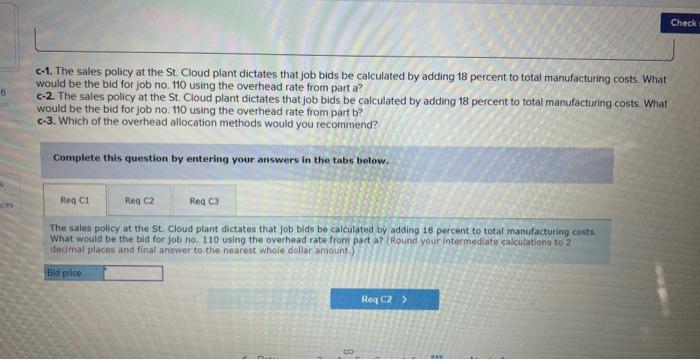

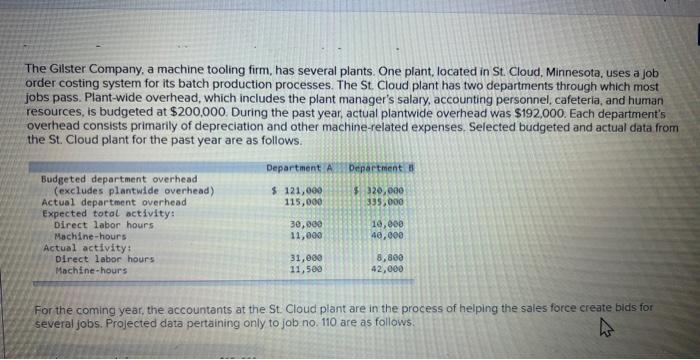

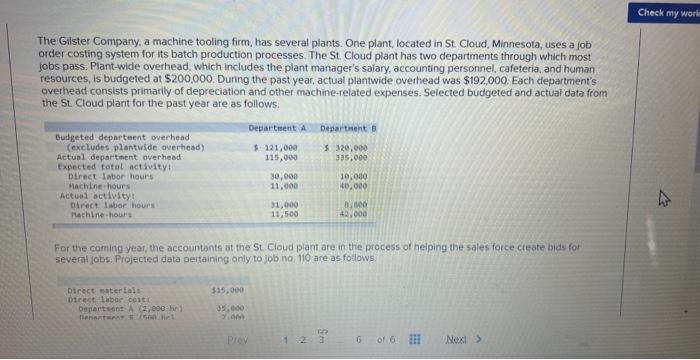

The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $192,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. For the coming year, the accountants at the St. Cloud plant are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows. c-1. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 18 percent to total manufacturing costs What would be the bid for job no. 110 using the overhead rate from part a? c-2. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 18 percent to total manufacturing casts What would be the bid for job no, 110 using the overhead rate from part b? c-3. Which of the overhead allocation methods would yourecommend? Complete this question by entering your answers in the tabs below. The sales policy at the st. cioud plant dictates that job bids be calculated by adding 18 percent to total manufacturng costs. What would be the bid for job no. 110 using the overhead rate from part a? (Round your intermediate calculations to 2 The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $192,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. For the coming year, the accountants at the St. Cioud plant are in the process of helping the sales force cleate bids for several jobs: Projected data pertaining only to job no, 110 are as follows. Required: a-1. Assume the St. Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs Use expected total direct labor hours to compute the overhead rate. a-2. What is the expected cost per unit produced for job no. 110 ? Complete this question by entering your answers in the tabs below. Assume the St, Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to Jobs. Use expected total direct labor hours to compute the overhead rate. (Round your answer to 2 decimal places.) Required: a-1. Assume the St. Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs. Use expected total direct labor hours to compute the overhead rate a-2. What is the expected cost per unit produced for job no. 110 ? Complete this question by entering your answers in the tabs below. What is the expected cost per unit produced for job no. 110 ? (Round your intermedlate calculations and final angwer to 2 decimal places? Assume the St. Cloud plant uses three separate overhead rates to assign overhead costs to jobs. b-1. Find the plant wide overhead rate by using expected machine hours. b-2. Find the department overhead rate using expected machine hours for Department A and Department B. b-3. Calculate the projected manufacturing costs per unit for job 110 using the three separate rates computed in b-1 and b-2. Complete this question by entering your answers in the tabs below. Find the plant wide overhead rate by using expected machine hours. (Round your answer to 2 decimal places.) b-1. Find the plant wide overhead rate by using expected machine hours. b-2. Find the department overhead rate using expected machine hours for Department A and Department B b-3. Calculate the projected manufacturing costs per unit for job 110 using the three separate rates computed in b-1 and b-2 Complete this question by entering your answers in the tabs below. Find the department overhead rate using expected hitchine hours for Department A and Department B. (Round your answer to 2 decimal placen.) b-1. Find the plant wide overhead rate by using expected machine hours b-2. Find the department overhead rate using expected machine hours for Department A and Department B. b-3. Calculate the projected manufacturing costs per unit for job 110 using the three separate rates computed in b-1 and b-2. Complete this question by entering your answers in the tabs below. Calculate the projected manufacturing cofp per unit for fob 110 using the three separate rates computed in b-1 and b-2. (Round your intermediate calculations andinal answer to 2 decimal places.) c-1. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 18 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part a? c-2. The sales policy at the St. Cloud plant dictates that job bids be caiculated by adding 18 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part b? c-3. Which of the overhead allocation methods would you recommend? Complete this question by entering your answers in the tabs below. The sales policy at the St. Cloud plant dictates that job blds be calculated by adding 18 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part a? (Round your intermediato calculations to ? dedimal places and final answer to the nearest whole dolar amount.) The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $192,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. For the coming year, the accountants at the St. Cloud plant are in the process of helping the sales force create bids for several jobs. Projected data pertaining only to job no. 110 are as follows. c-1. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 18 percent to total manufacturing costs What would be the bid for job no. 110 using the overhead rate from part a? c-2. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 18 percent to total manufacturing casts What would be the bid for job no, 110 using the overhead rate from part b? c-3. Which of the overhead allocation methods would yourecommend? Complete this question by entering your answers in the tabs below. The sales policy at the st. cioud plant dictates that job bids be calculated by adding 18 percent to total manufacturng costs. What would be the bid for job no. 110 using the overhead rate from part a? (Round your intermediate calculations to 2 The Gilster Company, a machine tooling firm, has several plants. One plant, located in St. Cloud, Minnesota, uses a job order costing system for its batch production processes. The St. Cloud plant has two departments through which most jobs pass. Plant-wide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $200,000. During the past year, actual plantwide overhead was $192,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the St. Cloud plant for the past year are as follows. For the coming year, the accountants at the St. Cioud plant are in the process of helping the sales force cleate bids for several jobs: Projected data pertaining only to job no, 110 are as follows. Required: a-1. Assume the St. Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs Use expected total direct labor hours to compute the overhead rate. a-2. What is the expected cost per unit produced for job no. 110 ? Complete this question by entering your answers in the tabs below. Assume the St, Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to Jobs. Use expected total direct labor hours to compute the overhead rate. (Round your answer to 2 decimal places.) Required: a-1. Assume the St. Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs. Use expected total direct labor hours to compute the overhead rate a-2. What is the expected cost per unit produced for job no. 110 ? Complete this question by entering your answers in the tabs below. What is the expected cost per unit produced for job no. 110 ? (Round your intermedlate calculations and final angwer to 2 decimal places? Assume the St. Cloud plant uses three separate overhead rates to assign overhead costs to jobs. b-1. Find the plant wide overhead rate by using expected machine hours. b-2. Find the department overhead rate using expected machine hours for Department A and Department B. b-3. Calculate the projected manufacturing costs per unit for job 110 using the three separate rates computed in b-1 and b-2. Complete this question by entering your answers in the tabs below. Find the plant wide overhead rate by using expected machine hours. (Round your answer to 2 decimal places.) b-1. Find the plant wide overhead rate by using expected machine hours. b-2. Find the department overhead rate using expected machine hours for Department A and Department B b-3. Calculate the projected manufacturing costs per unit for job 110 using the three separate rates computed in b-1 and b-2 Complete this question by entering your answers in the tabs below. Find the department overhead rate using expected hitchine hours for Department A and Department B. (Round your answer to 2 decimal placen.) b-1. Find the plant wide overhead rate by using expected machine hours b-2. Find the department overhead rate using expected machine hours for Department A and Department B. b-3. Calculate the projected manufacturing costs per unit for job 110 using the three separate rates computed in b-1 and b-2. Complete this question by entering your answers in the tabs below. Calculate the projected manufacturing cofp per unit for fob 110 using the three separate rates computed in b-1 and b-2. (Round your intermediate calculations andinal answer to 2 decimal places.) c-1. The sales policy at the St. Cloud plant dictates that job bids be calculated by adding 18 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part a? c-2. The sales policy at the St. Cloud plant dictates that job bids be caiculated by adding 18 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part b? c-3. Which of the overhead allocation methods would you recommend? Complete this question by entering your answers in the tabs below. The sales policy at the St. Cloud plant dictates that job blds be calculated by adding 18 percent to total manufacturing costs. What would be the bid for job no. 110 using the overhead rate from part a? (Round your intermediato calculations to ? dedimal places and final answer to the nearest whole dolar amount.)