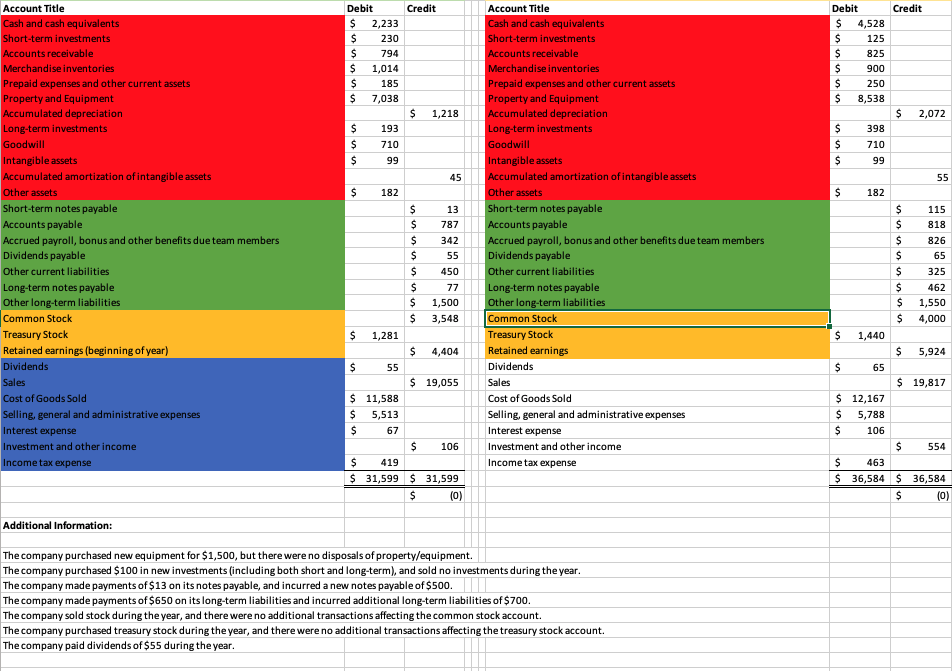

need help with creating an income statement

Account Title Debit Credit Account Title Debit Credit Cash and cash equivalents $ 2,233 Cash and cash equivalents 4,528 Short-term investments 230 Short-term investments 125 Accounts receivable 794 Accounts receivable 825 Merchandise inventories 1,014 Merchandise inventories 900 Prepaid expenses and other current assets 185 Prepaid expenses and other current assets 250 Property and Equipment 7,038 Property and Equipment 8,538 Accumulated depreciation $ 1,218 Accumulated depreciation $ 2,072 Long-term investments $ 193 Long-term investments 398 Goodwill 710 Goodwill 710 Intangible assets 99 Intangible assets 99 Accumulated amortization of intangible assets 45 Accumulated amortization of intangible assets 55 Other assets S 182 Other assets $ 182 Short-term notes payable $ ET Short-term notes payable 115 Accounts payable $ 787 Accounts payable 818 Accrued payroll, bonus and other benefits due team members S 342 Accrued payroll, bonus and other benefits due team members 826 Dividends payable S 55 Dividends payable 65 Other current liabilities 450 Other current liabilities S 325 Long-term notes payable 77 Long-term notes payable 462 Other long-term liabilities S 1,500 Other long-term liabilities 1,550 Common Stock S 3,548 Common Stock 4,000 Treasury Stock S 1,281 Treasury Stock S 1,440 Retained earnings (beginning of year) 4,404 Retained earnings S 5,924 Dividends S 55 Dividends S 65 Sales $ 19,055 Sales $ 19,817 Cost of Goods Sold S 11,588 Cost of Goods Sold $ 12,167 Selling, general and administrative expenses 5,513 Selling, general and administrative expenses 5,788 Interest expense 67 Interest expense 106 Investment and other income S 106 Investment and other income S 554 Income tax expense S 419 Income tax expense S 463 31,599 $ 31,599 $ 36,584 $ 36,584 (0) S Additional Information: The company purchased new equipment for $1,500, but there were no disposals of property/equipment. The company purchased $100 in new investments (including both short and long-term), and sold no investments during the year. The company made payments of $13 on its notes payable, and incurred a new notes payable of $500. The company made payments of $650 on its long-term liabilities and incurred additional long-term liabilities of $700. The company sold stock during the year, and there were no additional transactions affecting the common stock account. The company purchased treasury stock during the year, and there were no additional transactions affecting the treasury stock account. The company paid dividends of $55 during the year