need help with D answer is wrong

no issues with a b c

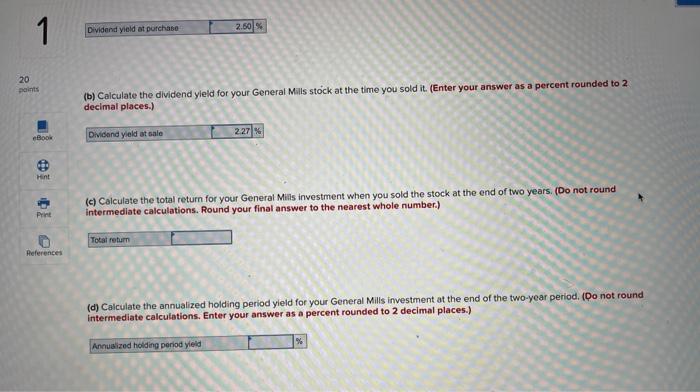

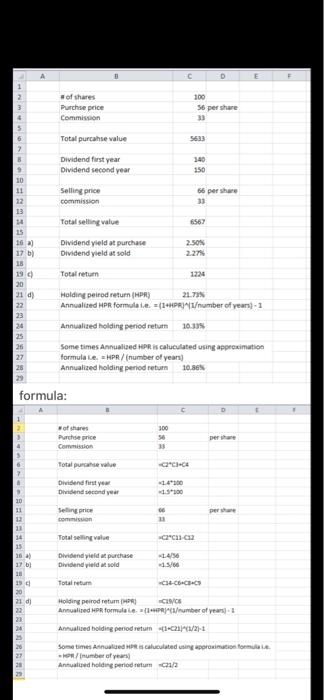

1 1 Dividend yield at purchase 2.50 20 points (b) Calculate the dividend yield for your General Mills stock at the time you sold it (Enter your answer as a percent rounded to 2 decimal places.) Book Dividend yield at sale Hint (c) Calculate the total return for your General Mills investment when you sold the stock at the end of two years. (Do not round intermediate calculations. Round your final answer to the nearest whole number.) Print Total return References (d) Calculate the annualized holding period yield for your General Mills investment at the end of the two-year period. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) % Annualized holding period yield D E of shares Purchse price Commission 300 56 per share 33 Total purchse value 5633 7 8 9 Dividend first year Dividend second year 340 150 11 Selling price commission 66 per share 33 Total selling value 6567 13 14 LS 16 a) 17 b) 15 13 0 20 21 ) Dividend yield at purchase Dividend yield at sold 2.50N 2.27 Total return 1224 23 24 Holding perod return (PR) 21.73 Annualized HPR formulaire. = (1+PRILumber of years) - 1 Annualized holding period return 10.339 Sometimes Annual HPR is calculated using approximation formula HPRumber of years) Annualized holding period return 10.86 25 formula: 300 of shares Purchase price Commission pere 33 -2C Total pura se value Dividend first yea Dividend second year 2.500 66 pers Selling price min Total selling value cu ca 14/50 11 12 1 14 25 26 17 ) 18 15 30 21 di 22 22 Dividend yield at purchase Dividend yield told Total retum CB- CCC Holding perodretum MRI CECS Annuaired HPR formulate number of years)-1 Annuaired holding period return 21/2) Sometimes Annual cated in Profile -number of years Antuated holding period tutum 1/2 1 1 Dividend yield at purchase 2.50 20 points (b) Calculate the dividend yield for your General Mills stock at the time you sold it (Enter your answer as a percent rounded to 2 decimal places.) Book Dividend yield at sale Hint (c) Calculate the total return for your General Mills investment when you sold the stock at the end of two years. (Do not round intermediate calculations. Round your final answer to the nearest whole number.) Print Total return References (d) Calculate the annualized holding period yield for your General Mills investment at the end of the two-year period. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) % Annualized holding period yield D E of shares Purchse price Commission 300 56 per share 33 Total purchse value 5633 7 8 9 Dividend first year Dividend second year 340 150 11 Selling price commission 66 per share 33 Total selling value 6567 13 14 LS 16 a) 17 b) 15 13 0 20 21 ) Dividend yield at purchase Dividend yield at sold 2.50N 2.27 Total return 1224 23 24 Holding perod return (PR) 21.73 Annualized HPR formulaire. = (1+PRILumber of years) - 1 Annualized holding period return 10.339 Sometimes Annual HPR is calculated using approximation formula HPRumber of years) Annualized holding period return 10.86 25 formula: 300 of shares Purchase price Commission pere 33 -2C Total pura se value Dividend first yea Dividend second year 2.500 66 pers Selling price min Total selling value cu ca 14/50 11 12 1 14 25 26 17 ) 18 15 30 21 di 22 22 Dividend yield at purchase Dividend yield told Total retum CB- CCC Holding perodretum MRI CECS Annuaired HPR formulate number of years)-1 Annuaired holding period return 21/2) Sometimes Annual cated in Profile -number of years Antuated holding period tutum 1/2