Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with Finance Question, read it carefully and check your answer please. Thank you. The following are two projects a firm is considering: Assuming

Need help with Finance Question, read it carefully and check your answer please. Thank you.

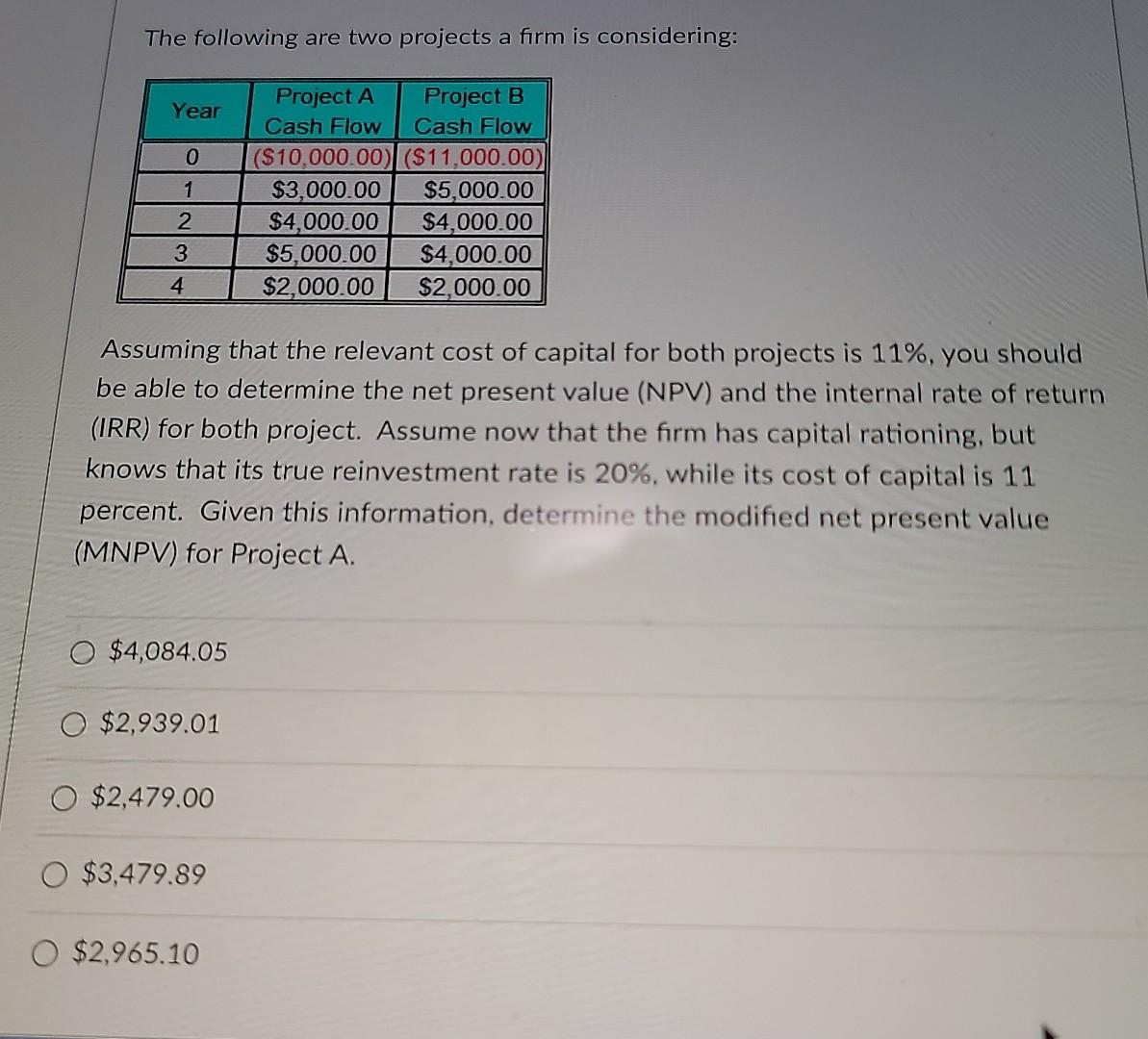

The following are two projects a firm is considering: Assuming that the relevant cost of capital for both projects is 11%, you should be able to determine the net present value (NPV) and the internal rate of return (IRR) for both project. Assume now that the firm has capital rationing, but knows that its true reinvestment rate is 20%, while its cost of capital is 11 percent. Given this information, determine the modified net present value (MNPV) for Project A. $4,084.05 $2,939.01 $2,479.00 $3,479.89 $2,965.10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started