Answered step by step

Verified Expert Solution

Question

1 Approved Answer

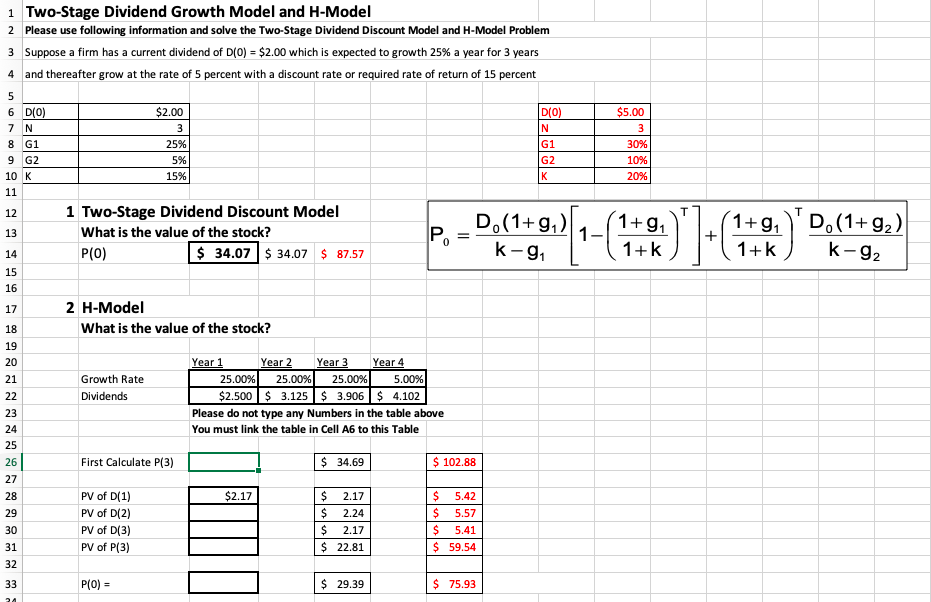

Need help with formulas in the empty boxes. Correct answers are shown to the right in black (ignore the red numbers, they are irrelevant) Please

Need help with formulas in the empty boxes. Correct answers are shown to the right in black (ignore the red numbers, they are irrelevant) Please and thank you!!

1 Two-Stage Dividend Growth Model and H-Model 2 Please use following information and solve the Two-Stage Dividend Discount Model and H-Model Problem 3 Suppose a firm has a current dividend of D(0) = $2.00 which is expected to growth 25% a year for 3 years 4 and thereafter grow at the rate of 5 percent with a discount rate or required rate of return of 15 percent 5 6 D(0) $2.00 D(0) 7 N 3 8 G1 25% 9 G2 5% 10 K 15% 11 1 Two-Stage Dividend Discount Model D.(1+,) What is the value of the stock? P. 14 PO) $ 34.07 $ 34.07 $ 87.57 K-9 N G1 G2 K $5.00 3 30% 10% 20% 12 T 1+91 1+91 D. (1+92) 13 = 1- + 1+k 1+k K-92 15 16 17 2 H-Model What is the value of the stock? Growth Rate Dividends Year 1 Year 2 Year 3 Year 4 25.00% 25.00% 25.00% 5.00% $2.500 $ 3.125 $ 3.906 $ 4.102 Please do not type any Numbers in the table above You must link the table in Cell A6 to this Table 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 First Calculate P(3) $ 34.69 $ 102.88 $2.17 PV of D(1) PV of D(2) PV of D(3) PV of P(3) $ 2.17 $ 2.24 $ 2.17 $ 22.81 $ 5.42 $ 5.57 $ 5.41 $ 59.54 33 PO) = $ 29.39 $ 75.93 24 1 Two-Stage Dividend Growth Model and H-Model 2 Please use following information and solve the Two-Stage Dividend Discount Model and H-Model Problem 3 Suppose a firm has a current dividend of D(0) = $2.00 which is expected to growth 25% a year for 3 years 4 and thereafter grow at the rate of 5 percent with a discount rate or required rate of return of 15 percent 5 6 D(0) $2.00 D(0) 7 N 3 8 G1 25% 9 G2 5% 10 K 15% 11 1 Two-Stage Dividend Discount Model D.(1+,) What is the value of the stock? P. 14 PO) $ 34.07 $ 34.07 $ 87.57 K-9 N G1 G2 K $5.00 3 30% 10% 20% 12 T 1+91 1+91 D. (1+92) 13 = 1- + 1+k 1+k K-92 15 16 17 2 H-Model What is the value of the stock? Growth Rate Dividends Year 1 Year 2 Year 3 Year 4 25.00% 25.00% 25.00% 5.00% $2.500 $ 3.125 $ 3.906 $ 4.102 Please do not type any Numbers in the table above You must link the table in Cell A6 to this Table 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 First Calculate P(3) $ 34.69 $ 102.88 $2.17 PV of D(1) PV of D(2) PV of D(3) PV of P(3) $ 2.17 $ 2.24 $ 2.17 $ 22.81 $ 5.42 $ 5.57 $ 5.41 $ 59.54 33 PO) = $ 29.39 $ 75.93 24Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started