Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with full chart Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1. for $2,100,000.

Need help with full chart

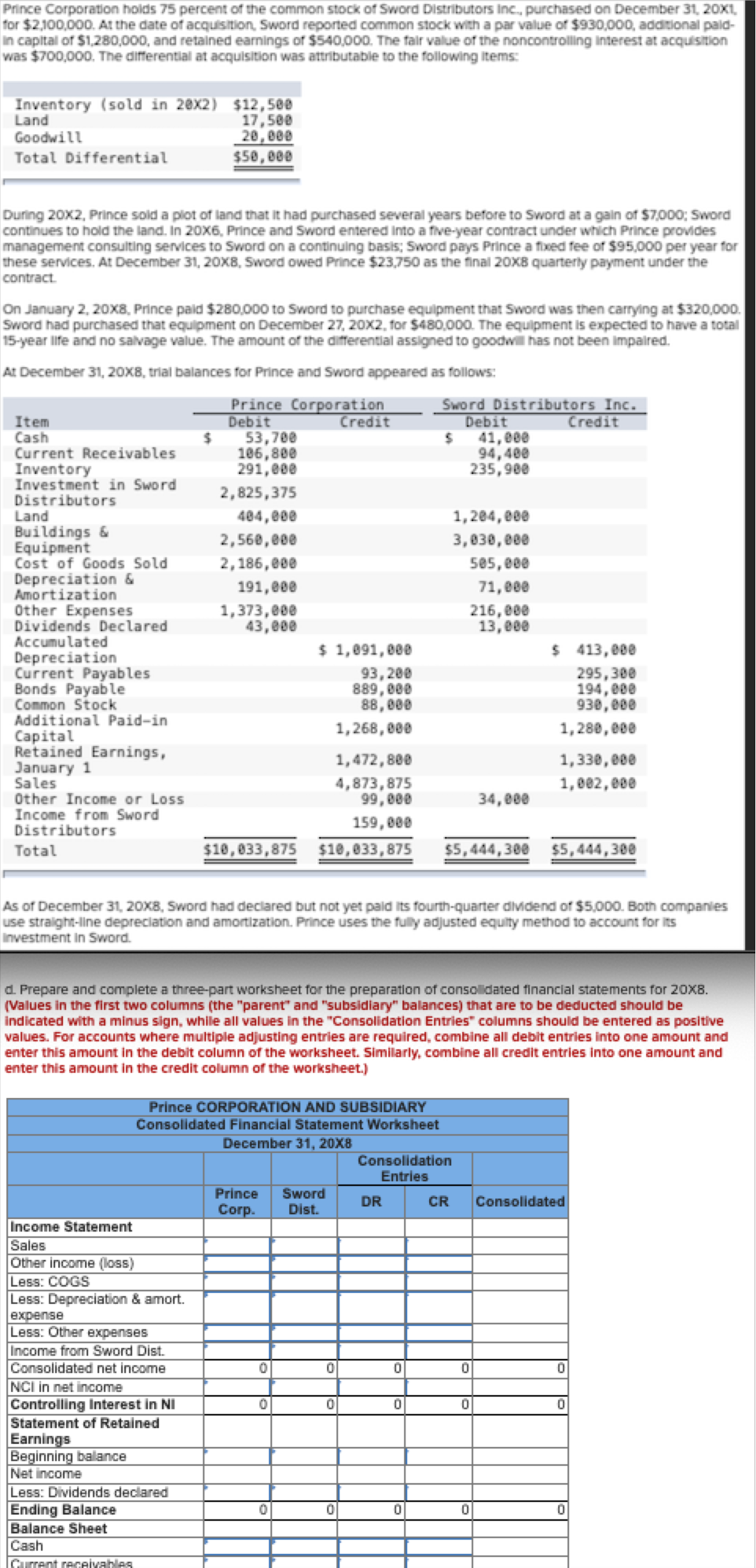

Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1. for $2,100,000. At the date of acquisition Sword reported common stock with a par value of $930,000, additional paid- in capital of $1.280,000, and retained earnings of $540,000. The fair value of the noncontrolling interest at acquisition was $700,000. The differential at acquisition was attributable to the following items: Inventory (sold in 20x2) $12,500 Land 17,500 Goodwill 20,000 Total Differential $50,000 During 20X2, Prince sold a plot of land that it had purchased several years before to Sword at a gain of $7,000: Sword continues to hold the land. In 20X6, Prince and Sword entered into a five-year contract under which Prince provides management consulting services to Sword on a continuing basis: Sword pays Prince a fixed fee of $95,000 per year for these services. At December 31, 20X8, Sword owed Prince $23.750 as the final 20X8 quarterly payment under the contract On January 2, 20X8. Prince paid $280,000 to Sword to purchase equipment that Sword was then carrying at $320,000. Sword had purchased that equipment on December 27, 20x2.for $480,000. The equipment is expected to have a total 15-year life and no salvage value. The amount of the differential assigned to goodwill has not been impaired. At December 31, 20X8, trial balances for Prince and Sword appeared as follows: Sword Distributors Inc. Debit Credit 41,000 94,400 235,900 Item Cash Current Receivables Inventory Investment in Sword Distributors Land Buildings & Equipment Cost of Goods Sold Depreciation & Amortization Other Expenses Dividends Declared Accumulated Depreciation Current Payables Bonds Payable Common Stock Additional Paid-in Capital Retained Earnings, January 1 Sales Other Income or Loss Income from Sword Distributors Total Prince Corporation Debit Credit 53,700 106,800 291,000 2,825,375 484,000 2,560,000 2,186,000 191,000 1,373,000 43,000 $ 1,091,000 93,200 889,000 88,000 1,268,000 1,204,000 3,030,000 505,000 71,000 216,000 13,000 $ 413,000 295, 300 194,000 930,000 1,280,000 1,330,000 1,002,200 1,472,800 4,873,875 99,000 159,000 $10,033,875 34,000 $10,033,875 $5,444,300 $5,444,300 As of December 31, 20XB, Sword had declared but not yet paid its fourth-quarter dividend of $5.000. Both companies use straight-line depreciation and amortization. Prince uses the fully adjusted equilty method to account for its Investment in Sword. d. Prepare and complete a three-part worksheet for the preparation of consolidated financial statements for 20x8. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Consolidated Prince CORPORATION AND SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 20X8 Consolidation Entries Prince Sword DR CR Corp Dist. Income Statement Sales Other income (loss) Less: COGS Less: Depreciation & amort. expense Less: Other expenses Income from Sword Dist. Consolidated net income 0 0 0 NCI in net income Controlling Interest in NI 0 0 0 Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance 0 0 0 Balance Sheet Cash Current receivables 0 0 0 0 0 0 Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1. for $2,100,000. At the date of acquisition Sword reported common stock with a par value of $930,000, additional paid- in capital of $1.280,000, and retained earnings of $540,000. The fair value of the noncontrolling interest at acquisition was $700,000. The differential at acquisition was attributable to the following items: Inventory (sold in 20x2) $12,500 Land 17,500 Goodwill 20,000 Total Differential $50,000 During 20X2, Prince sold a plot of land that it had purchased several years before to Sword at a gain of $7,000: Sword continues to hold the land. In 20X6, Prince and Sword entered into a five-year contract under which Prince provides management consulting services to Sword on a continuing basis: Sword pays Prince a fixed fee of $95,000 per year for these services. At December 31, 20X8, Sword owed Prince $23.750 as the final 20X8 quarterly payment under the contract On January 2, 20X8. Prince paid $280,000 to Sword to purchase equipment that Sword was then carrying at $320,000. Sword had purchased that equipment on December 27, 20x2.for $480,000. The equipment is expected to have a total 15-year life and no salvage value. The amount of the differential assigned to goodwill has not been impaired. At December 31, 20X8, trial balances for Prince and Sword appeared as follows: Sword Distributors Inc. Debit Credit 41,000 94,400 235,900 Item Cash Current Receivables Inventory Investment in Sword Distributors Land Buildings & Equipment Cost of Goods Sold Depreciation & Amortization Other Expenses Dividends Declared Accumulated Depreciation Current Payables Bonds Payable Common Stock Additional Paid-in Capital Retained Earnings, January 1 Sales Other Income or Loss Income from Sword Distributors Total Prince Corporation Debit Credit 53,700 106,800 291,000 2,825,375 484,000 2,560,000 2,186,000 191,000 1,373,000 43,000 $ 1,091,000 93,200 889,000 88,000 1,268,000 1,204,000 3,030,000 505,000 71,000 216,000 13,000 $ 413,000 295, 300 194,000 930,000 1,280,000 1,330,000 1,002,200 1,472,800 4,873,875 99,000 159,000 $10,033,875 34,000 $10,033,875 $5,444,300 $5,444,300 As of December 31, 20XB, Sword had declared but not yet paid its fourth-quarter dividend of $5.000. Both companies use straight-line depreciation and amortization. Prince uses the fully adjusted equilty method to account for its Investment in Sword. d. Prepare and complete a three-part worksheet for the preparation of consolidated financial statements for 20x8. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Consolidated Prince CORPORATION AND SUBSIDIARY Consolidated Financial Statement Worksheet December 31, 20X8 Consolidation Entries Prince Sword DR CR Corp Dist. Income Statement Sales Other income (loss) Less: COGS Less: Depreciation & amort. expense Less: Other expenses Income from Sword Dist. Consolidated net income 0 0 0 NCI in net income Controlling Interest in NI 0 0 0 Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance 0 0 0 Balance Sheet Cash Current receivables 0 0 0 0 0 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started