Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with G, I-2, and J Complete this question by entering your answers in the tabs below. Construct a mortgage amortization. Note: Do not

Need help with G, I-2, and J

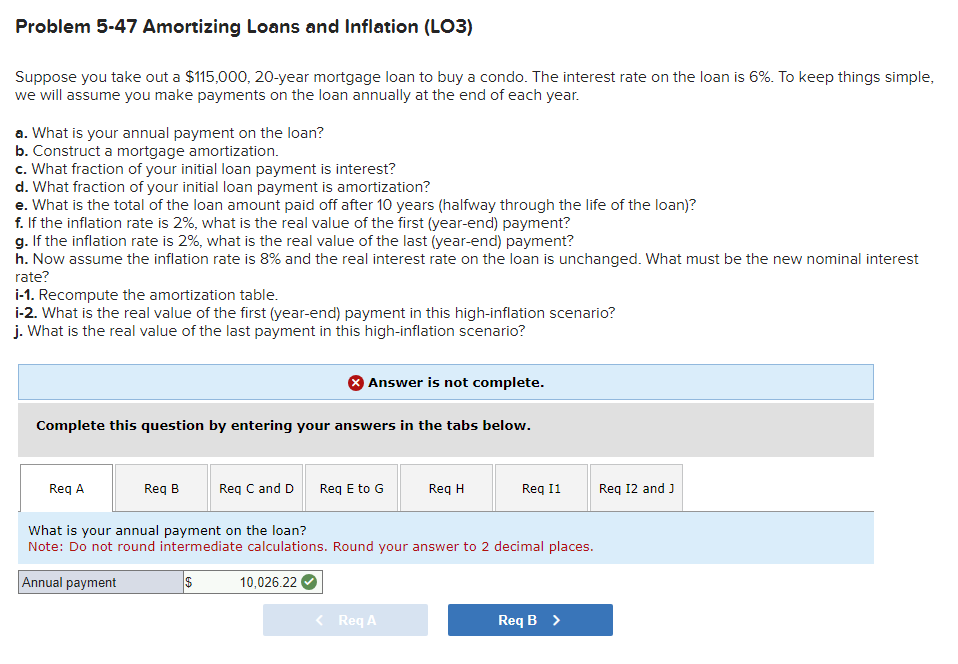

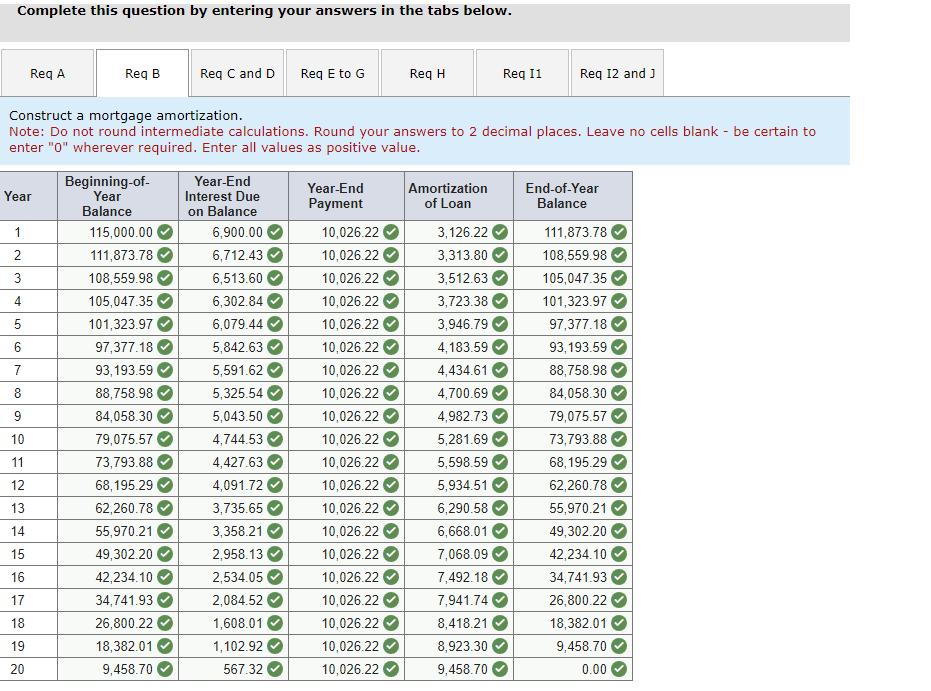

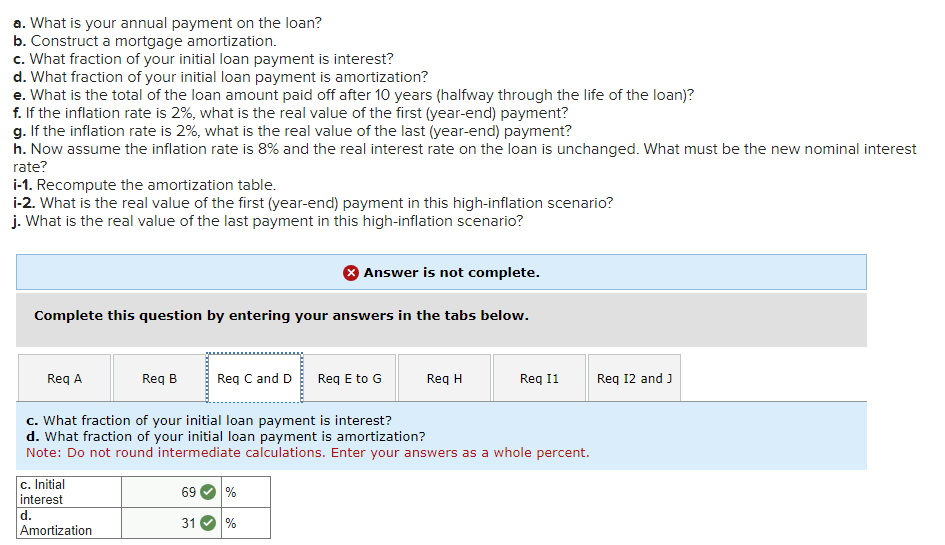

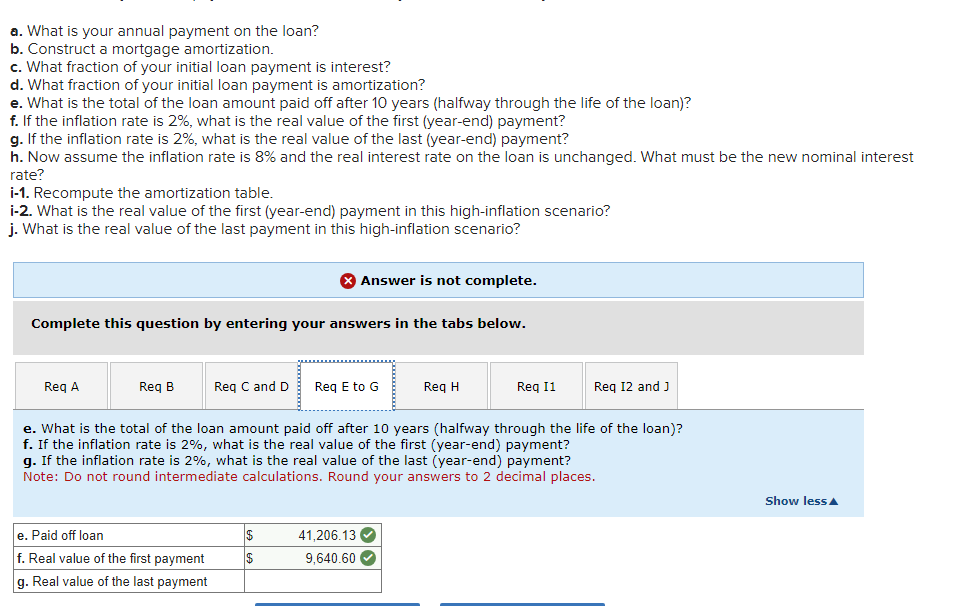

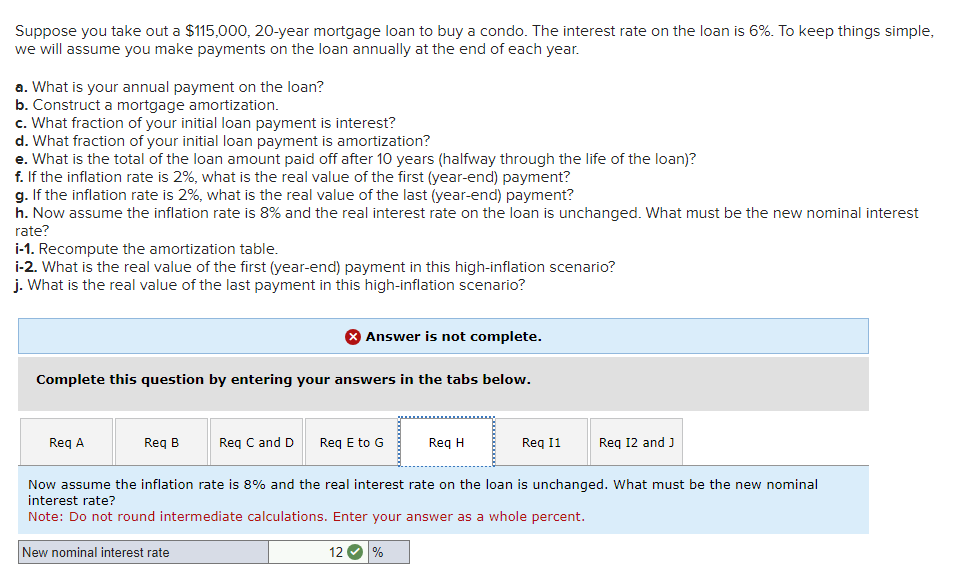

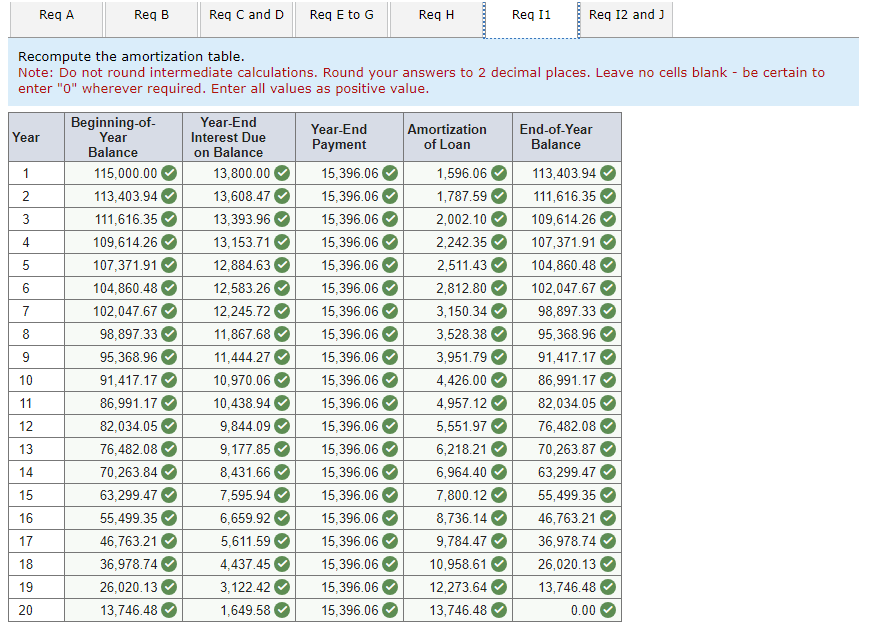

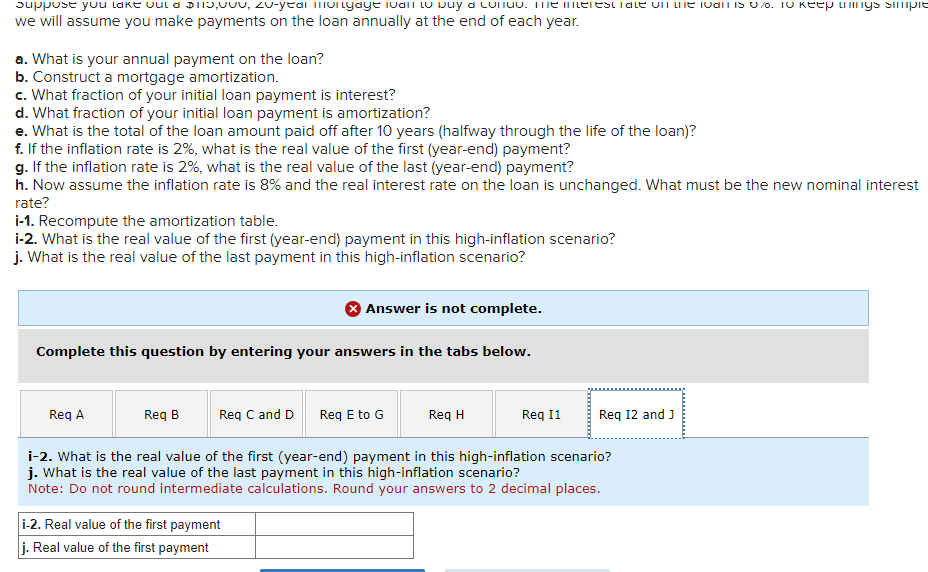

Complete this question by entering your answers in the tabs below. Construct a mortgage amortization. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter " 0 " wherever required. Enter all values as positive value. Suppose you take out a $115,000,20-year mortgage loan to buy a condo. The interest rate on the loan is 6%. To keep things simple, we will assume you make payments on the loan annually at the end of each year. a. What is your annual payment on the loan? b. Construct a mortgage amortization. c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 2%, what is the real value of the first (year-end) payment? g. If the inflation rate is 2%, what is the real value of the last (year-end) payment? h. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? i-1. Recompute the amortization table. i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Answer is not complete. Complete this question by entering your answers in the tabs below. What is your annual payment on the loan? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. we will assume you make payments on the loan annually at the end of each year. a. What is your annual payment on the loan? b. Construct a mortgage amortization. c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 2%, what is the real value of the first (year-end) payment? g. If the inflation rate is 2%, what is the real value of the last (year-end) payment? h. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? i-1. Recompute the amortization table. i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Answer is not complete. Complete this question by entering your answers in the tabs below. i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Suppose you take out a $115,000,20-year mortgage loan to buy a condo. The interest rate on the loan is 6%. To keep things simple, we will assume you make payments on the loan annually at the end of each year. a. What is your annual payment on the loan? b. Construct a mortgage amortization. c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 2%, what is the real value of the first (year-end) payment? g. If the inflation rate is 2%, what is the real value of the last (year-end) payment? h. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? i-1. Recompute the amortization table. i - 2 . What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Complete this question by entering your answers in the tabs below. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? Note: Do not round intermediate calculations. Enter your answer as a whole percent. a. What is your annual payment on the loan? b. Construct a mortgage amortization. c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 2%, what is the real value of the first (year-end) payment? g. If the inflation rate is 2%, what is the real value of the last (year-end) payment? h. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? i-1. Recompute the amortization table. i - 2 . What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Answer is not complete. Complete this question by entering your answers in the tabs below. e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 2%, what is the real value of the first (year-end) payment? g. If the inflation rate is 2%, what is the real value of the last (year-end) payment? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Recompute the amortization table. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter " 0 " wherever required. Enter all values as positive value. a. What is your annual payment on the loan? b. Construct a mortgage amortization. c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? e. What is the total of the loan amount paid off after 10 years (halfway through the life of the loan)? f. If the inflation rate is 2%, what is the real value of the first (year-end) payment? g. If the inflation rate is 2%, what is the real value of the last (year-end) payment? h. Now assume the inflation rate is 8% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? i-1. Recompute the amortization table. i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Answer is not complete. Complete this question by entering your answers in the tabs below. c. What fraction of your initial loan payment is interest? d. What fraction of your initial loan payment is amortization? Note: Do not round intermediate calculations. Enter your answers as a whole percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started