Answered step by step

Verified Expert Solution

Question

1 Approved Answer

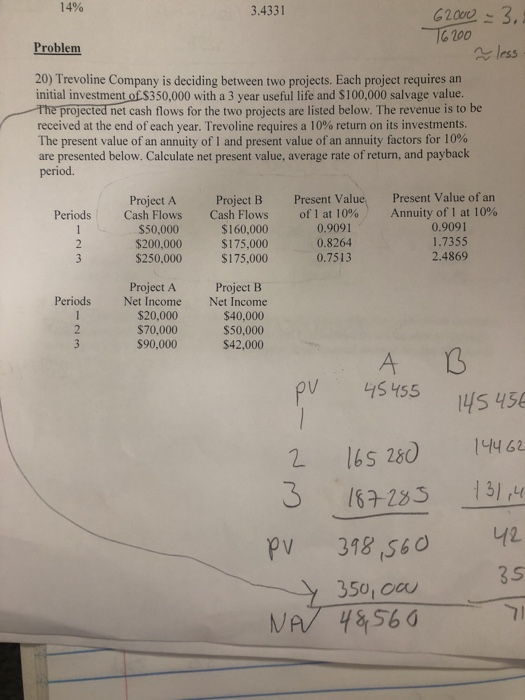

need help with how to get average rate of return 14% 3.4331 62000- 3, T6 200 less %31 Problem 20) Trevoline Company is deciding between

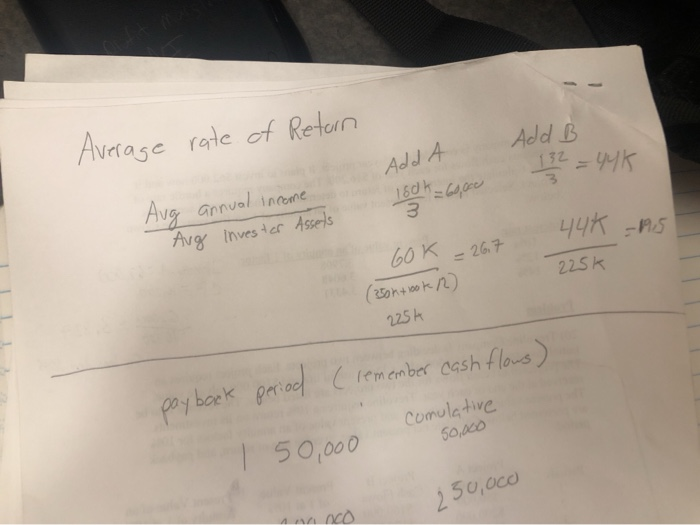

need help with how to get average rate of return

14% 3.4331 62000- 3, T6 200 less %31 Problem 20) Trevoline Company is deciding between two projects. Each project requires an initial investment of $350,000 with a 3 year useful life and $100,000 salvage value. The projected net cash flows for the two projects are listed below. The revenue is to be received at the end of each year. Trevoline reguires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below. Calculate net present value, average rate of return, and payback period. Project B Cash Flows $160,000 $175,000 $175,000 Present Value of an Project A Cash Flows $50,000 $200,000 $250,000 Present Value Annuity of 1 at 10% 0.9091 1.7355 2.4869 of 1 at 10% 0.9091 Periods 0.8264 0.7513 Project B Net Income Project A Net Income $20,000 $70,000 $90,000 Periods $40,000 $50,000 $42,000 pv 45455 145 45E 14462 165 280 131,4 187285 42 398,560 35 350, cau NAY 48560 Average rate of Retern Add B Add A 160 k-60 Avg annual income 132 Avg inves ter Assels 44K n5 60 K = 26.7 225K 225h poy back pariael ( lemember cash flous) Comulative 50,000 1 50,000 250,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started