Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with incorrect answers that are marked with the red X. The income statement for Delta-tec, Inc., for the year ended December 31, Year

Need help with incorrect answers that are marked with the red X.

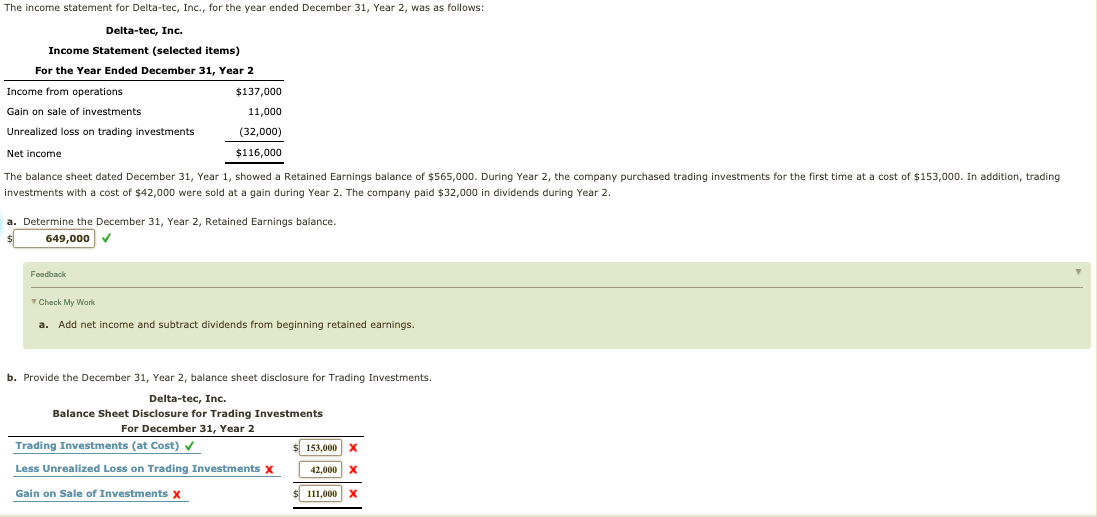

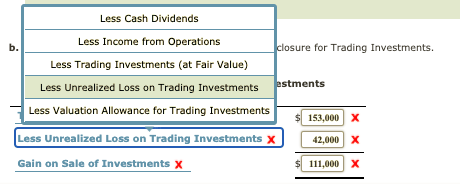

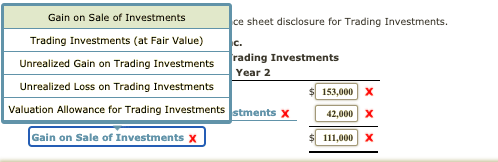

The income statement for Delta-tec, Inc., for the year ended December 31, Year 2, was as follows: Delta-tec, Inc. Income Statement (selected items) For the Year Ended December 31, Year 2 Income from operations $137,000 Gain on sale of investments 11,000 Unrealized loss on trading investments (32,000) $116,000 Net income The balance sheet dated December 31, Year 1, showed a Retained Earnings balance of $565,000. During Year 2, the company purchased trading investments for the first time at a cost of $153,000. In addition, trading investments with a cost of $42,000 were sold at a gain during Year 2. The company paid $32,000 in dividends during Year 2. a. Determine the December 31, Year 2, Retained Earnings balance. 649,000 Feedback Check My World a. Add net income and subtract dividends from beginning retained earnings. b. Provide the December 31, Year 2, balance sheet disclosure for Trading Investments. Delta-tec, Inc. Balance Sheet Disclosure for Trading Investments For December 31, Year 2 Trading Investments (at Cost) 153,000 X Less Unrealized Loss on Trading Investments x 42,000 X Gain on Sale of Investments X 111,000 x Less Cash Dividends Less Income from Operations b. closure for Trading Investments. Less Trading Investments (at Fair Value) Less Unrealized Loss on Trading Investments estments Less Valuation Allowance for Trading Investments 153,000 X Less Unrealized Loss on Trading Investments X 42,000 X Gain on Sale of Investments X 111,000 X c. Gain on Sale of Investments ce sheet disclosure for Trading Investments. Trading Investments (at Fair Value) Unrealized Gain on Trading Investments rading Investments Year 2 Unrealized Loss on Trading Investments 153,000 x Valuation Allowance for Trading Investments Istments X 42,000 X Gain on Sale of Investments x 111,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started