Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with number 1 and all the info is posted below as well as the T account, im not sure if the T account

need help with number 1 and all the info is posted below as well as the T account, im not sure if the T account is correct could you verify that also?

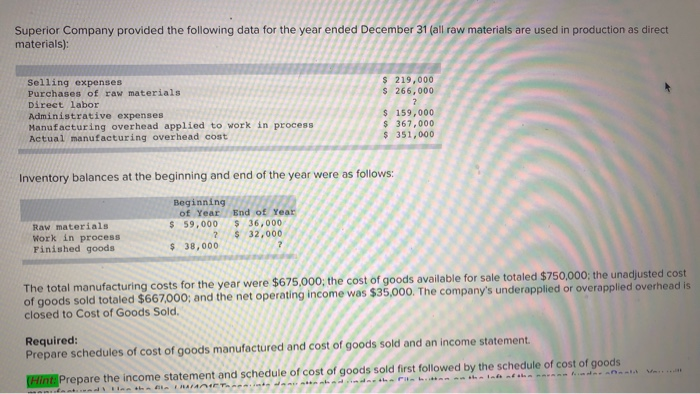

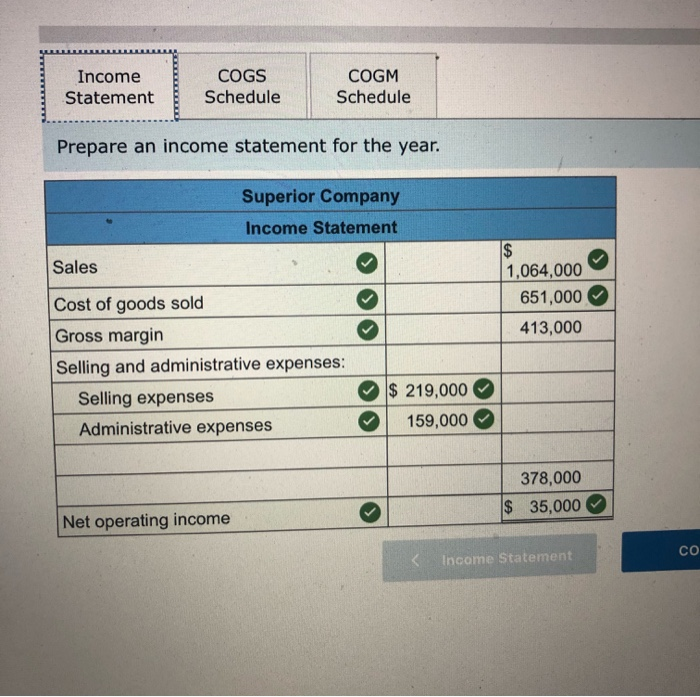

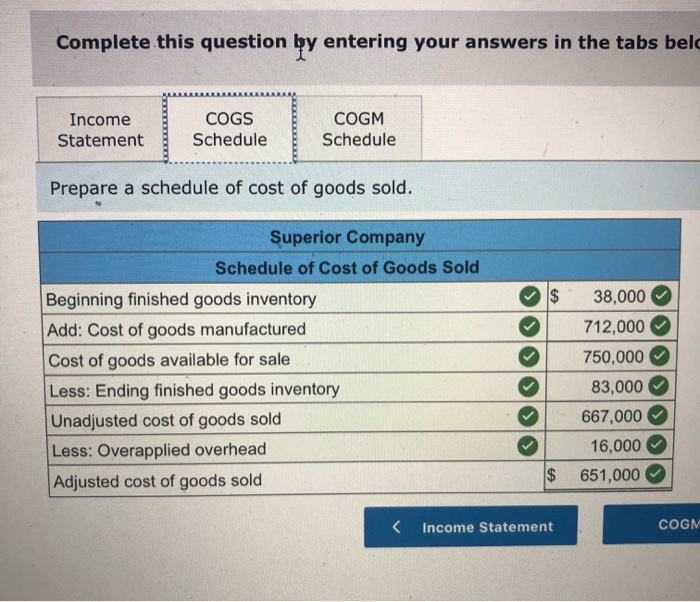

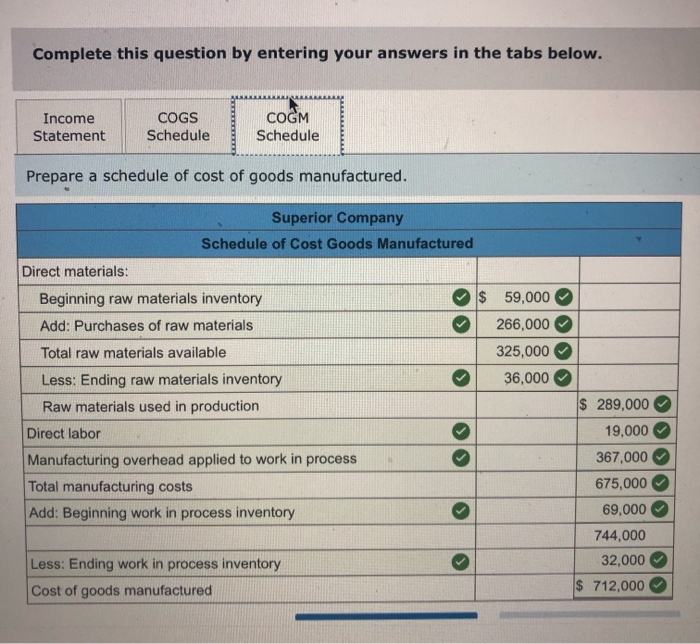

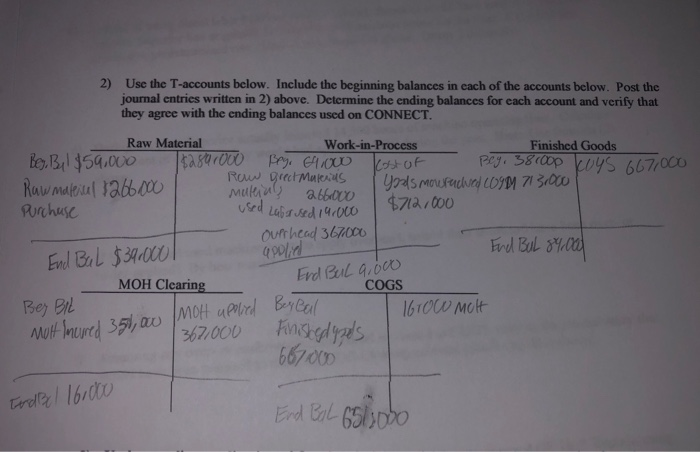

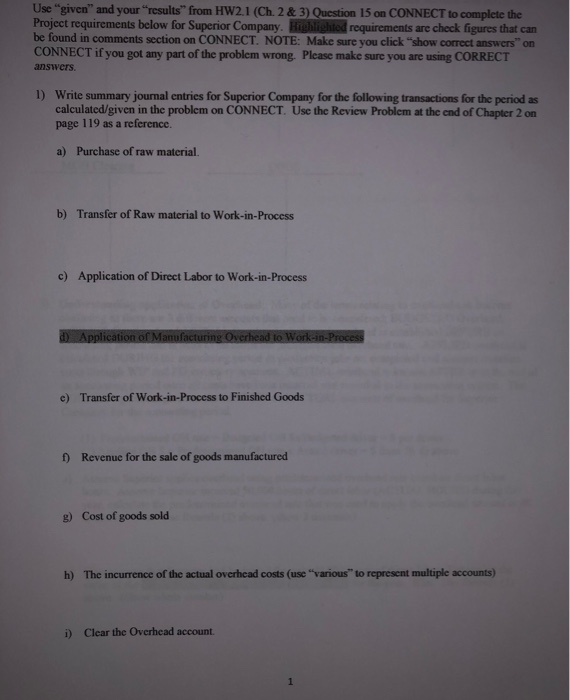

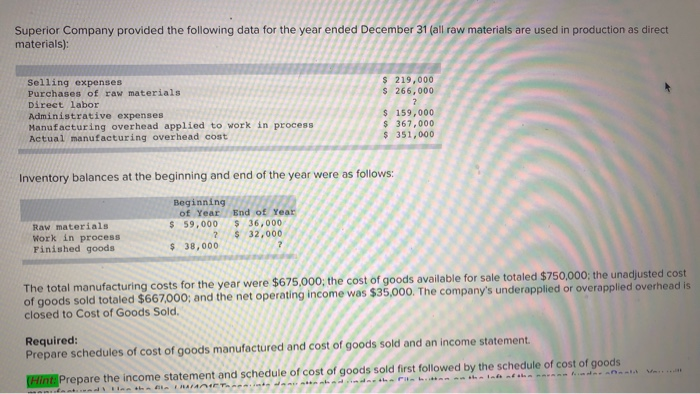

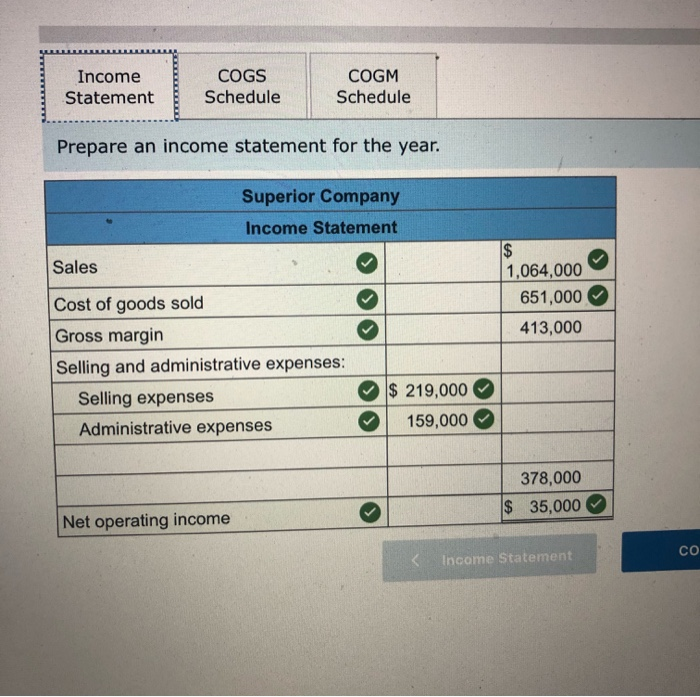

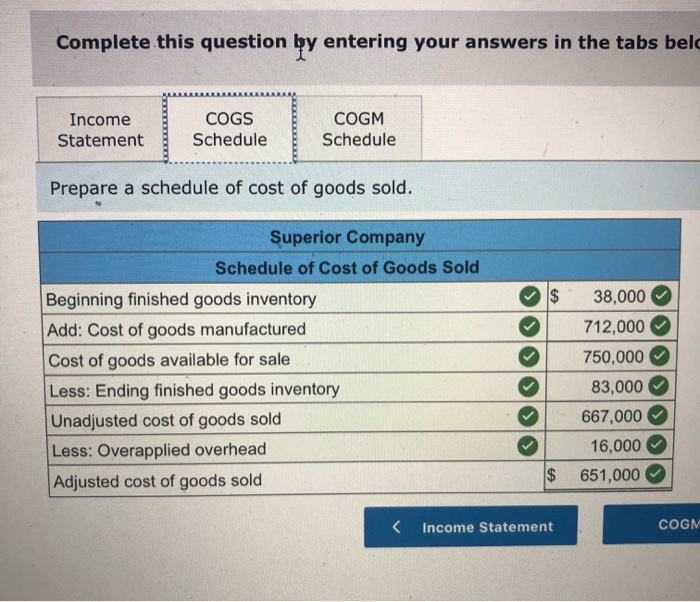

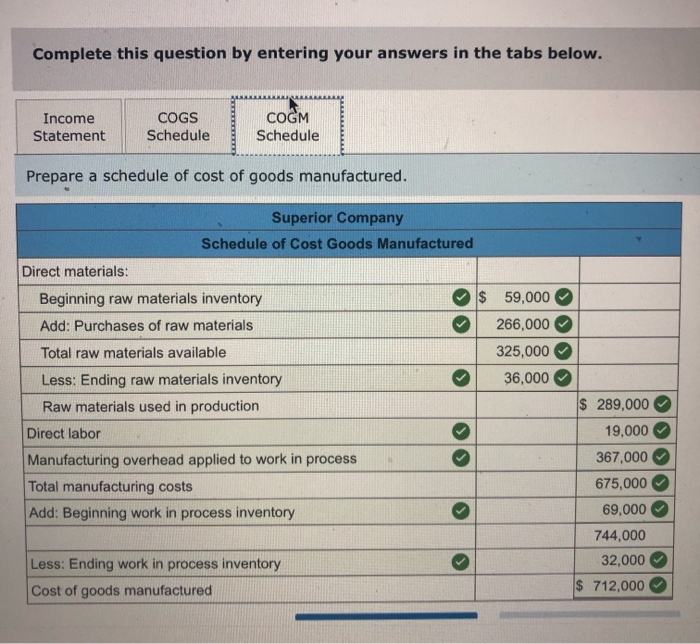

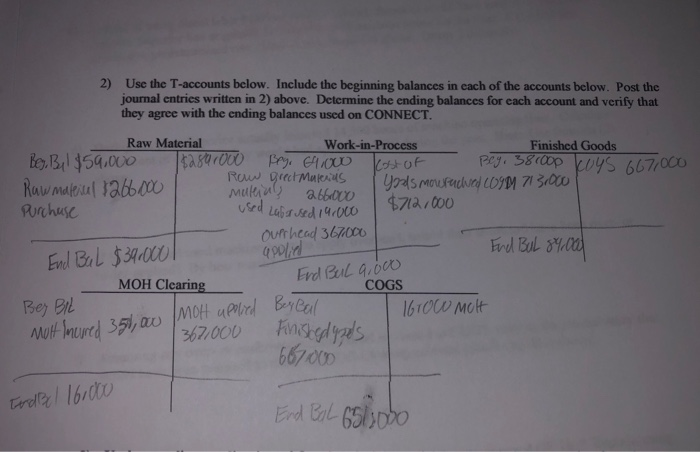

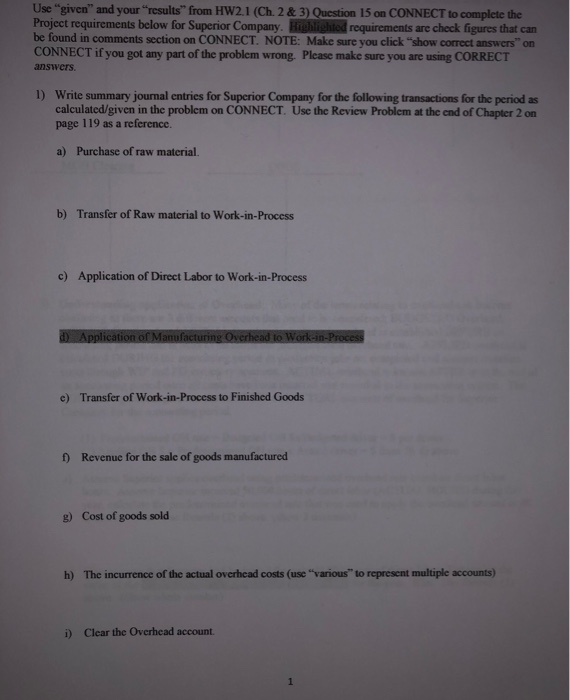

Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials): Selling expenses Purchases of raw materials Direct labor Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead cost $ 219,000 $ 266,000 2 $ 159,000 $ 367,000 $ 351,000 Inventory balances at the beginning and end of the year were as follows: Raw materials Work in process Finished goods Beginning of Year $ 59,000 2 $ 38,000 End of Year $ 36,000 $ 32,000 The total manufacturing costs for the year were $675,000; the cost of goods available for sale totaled $750,000; the unadjusted cost of goods sold totaled $667.000; and the net operating income was $35,000. The company's underapplied or overapplied overhead is closed to Cost of Goods Sold, Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods Income Statement COGS Schedule COGM Schedule Prepare an income statement for the year. Superior Company Income Statement Sales $ 1,064,000 651,000 413,000 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses $ 219,000 159,000 378,000 $ 35,000 Net operating income Income Statement Complete this question by entering your answers in the tabs bel Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods sold. $ Superior Company Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Unadjusted cost of goods sold Less: Overapplied overhead Adjusted cost of goods sold 38,000 712,000 750,000 83,000 667,000 16,000 651,000 $ Income Statement COGN Complete this question by entering your answers in the tabs below. Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods manufactured. Superior Company Schedule of Cost Goods Manufactured > $ 59,000 266,000 325,000 36,000 Direct materials: Beginning raw materials inventory Add: Purchases of raw materials Total raw materials available Less: Ending raw materials inventory Raw materials used in production Direct labor Manufacturing overhead applied to work in process Total manufacturing costs Add: Beginning work in process inventory $ 289,000 19,000 367,000 675,000 69,000 744,000 32,000 $ 712,000 > Less: Ending work in process inventory Cost of goods manufactured Kost of Mult moured 351, au Mot upplied Bereal 2) Use the T-accounts below. Include the beginning balances in each of the accounts below. Post the journal entries written in 2) above. Determine the ending balances for each account and verify that they agree with the ending balances used on CONNECT. Raw Material Work-in-Process Finished Goods Beg. Byl $59.000 52801000 Pege n00D Poji 38000p Woys 667,000 Row grec Maleis Raw material 1266000 material, Yous mourudised CD9M 713.000 a66.000 Purchase used Lula sed 19.000 $712,000 overhead 367000 applied End BuL 89.000 MOH Clearing COGS Grow MCH 367,000 Finishedyals 667.000 End Bal $39.000 End Bul 9.000 Bey Bit Ted Bel 16.000 End Bol 6511000 Use "given" and your "results" from HW2.1 (Ch. 2 & 3) Question 15 on CONNECT to complete the Project requirements below for Superior Company. Highlighted requirements are check figures that can be found in comments section on CONNECT. NOTE: Make sure you click "show correct answers on CONNECT if you got any part of the problem wrong. Please make sure you are using CORRECT answers 1) Write summary journal entries for Superior Company for the following transactions for the period as calculated/given in the problem on CONNECT. Use the Review Problem at the end of Chapter 2 on page 119 as a reference. a) Purchase of raw material. b) Transfer of Raw material to Work-in-Process c) Application of Direct Labor to Work-in-Process d) Application of Manufacturing Overhead to Work-in-Process e) Transfer of Work-in-Process to Finished Goods f) Revenue for the sale of goods manufactured g) Cost of goods sold h) The incurrence of the actual overhead costs (use" various to represent multiple accounts) i) Clear the Overhead account

this is the question number 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started