Need help with part A and B with explanation. Thank you!

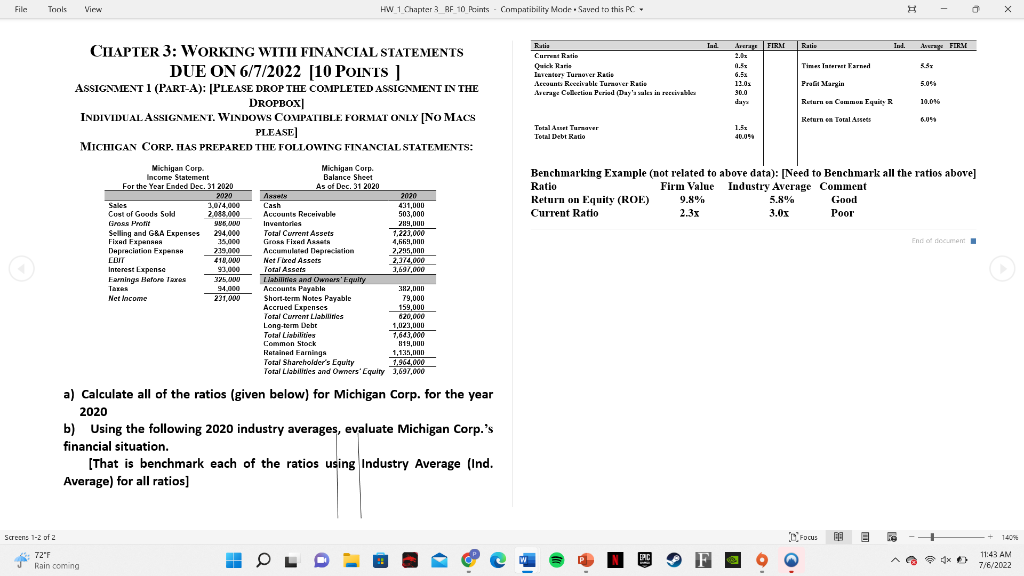

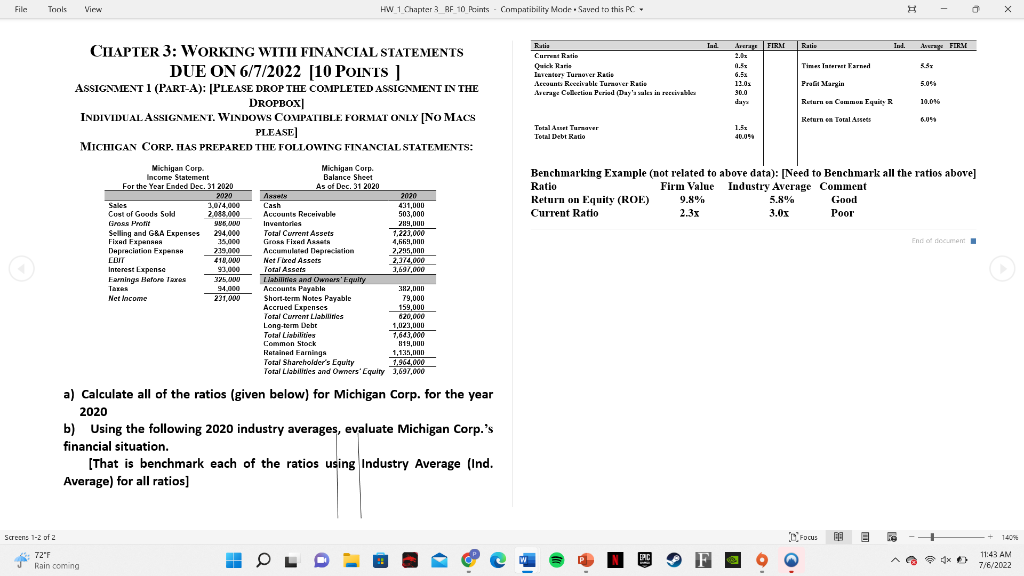

File Tools View CHAPTER 3: WORKING WITII FINANCIAL DUE ON 6/7/2022 [10 POINTS ] ASSIGNMENT 1 (PART-A): [PLEASE DROP THE COMPLETED ASSIGNMENT IN THE DROPBOX INDIVIDUAL ASSIGNMENT. WINDOWS COMPATIBLE FORMAT ONLY [NO MACS PLEASE] MICHIGAN CORP. HAS PREPARED THE FOLLOWING FINANCIAL STATEMENTS: Michigan Corp. Income Statement For the Year Ended Dec. 31 2020 Screens 1-2 of 2 72"F in Rain coming Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expense Depreciation Expense EDIT Interest Expense Earnings Before Taxes Taxes Net Income 2020 3.0/4.000 2,088,000 986.04000 294,000 35,000 239,000 410,000 93,000 325,000 94,000 231,000 Assets Cash Michigan Corp. Balance Sheet As of Dec. 31 2020 Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Accumulated Depreciation Net Fred Assets Total Assets HW 1 Chapter 3 RF_10_Points - Compatibility Mode Saved to this PC HOL STATEMENTS Liabilities and Owners' Equity Accounts Payable Short-term Notes Payable Accrued Expenses Total Current Liabilities Long-term Debt Total Liabilities 1,643,000 Common Stock 819,000 Retained Earnings 1,135,000 Total Shareholder's Equity 1,964,000 Total Liabilities and Owners' Equity 3,697,000 a) Calculate all of the ratios (given below) for Michigan Corp. for the year 2020 b) Using the following 2020 industry averages, evaluate Michigan Corp.'s financial situation. U 2020 431,000 503,000 289,000 1,223,000 4,669,000 2,295,000 2,374,000 3,697,000 [That is benchmark each of the ratios using Industry Average (Ind. Average) for all ratios] 382,000 79,000 159,000 620,000 1,023,000 Fartin Current Ratio Quick Rario Inveatery Turnover Ratio Accounts Receivable Turnover Rasio Average Collection Period (Day's sales in receivables Total Asset Turnaver Total Debt Ratio Ratio Return on Equity (ROE) Current Ratio Ind. EPIC Average FIRM Ratis 0.5x 6.5x 11.0x 30.0 days 1.5 40.0% Times Interest Earned 5.8% 3.0x Frafit Margin Return on Common Equity R Return on Total Assets Ind. Focus EE 8 A FIRM Benchmarking Example (not related to above data): [Need to Benchmark all the ratios above] Firm Value Industry Average Comment 9.8% Good Poor 2.3x 5.5x ^ G 5.0% 10.01 6.05 End of document 140% 11:43 AM 7/6/2022