Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with part B and C show steps thank you 8. Blundell Biotech. Blundell Biotech is a US-based biotechnology company with operations and earnings

need help with part B and C

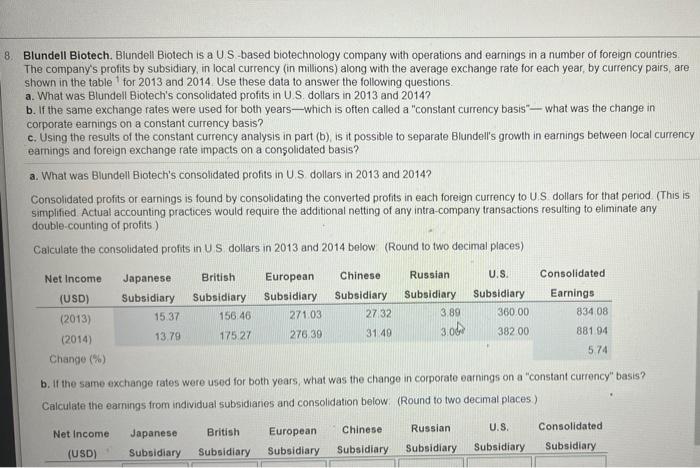

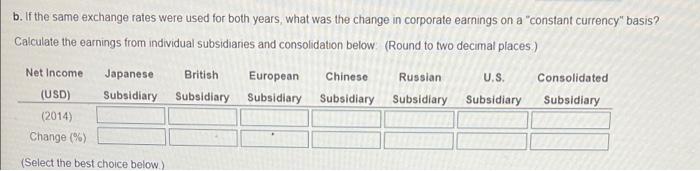

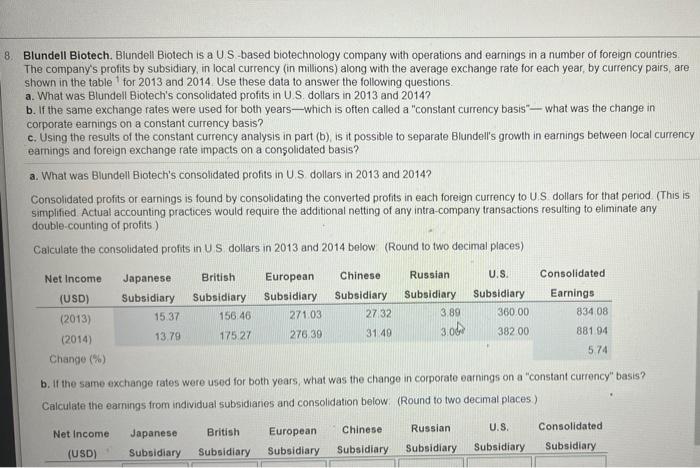

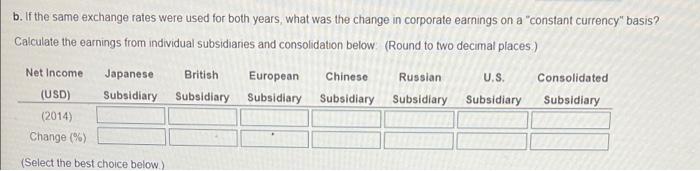

8. Blundell Biotech. Blundell Biotech is a US-based biotechnology company with operations and earnings in a number of foreign countries The company's profits by subsidiary, in local currency (in millions) along with the average exchange rate for each year, by currency pairs, are shown in the table for 2013 and 2014 Use these data to answer the following questions. a. What was Blundell Biotech's consolidated profits in US dollars in 2013 and 2014? b. If the same exchange rates were used for both yearswhich is often called a "constant currency basis" what was the change in corporate earnings on a constant currency basis? c. Using the results of the constant currency analysis in part (b), is it possible to separate Blundell's growth in earnings between local currency earnings and foreign exchange rate impacts on a consolidated basis? a. What was Blundell Biotech's consolidated profits in US dollars in 2013 and 2014? Consolidated profits or earnings is found by consolidating the converted profits in each foreign currency to US dollars for that period (This is simplified Actual accounting practices would require the additional netting of any intra-company transactions resulting to eliminate any double-counting of profits.) Calculate the consolidated profits in US dollars in 2013 and 2014 below (Round to two decimal places) 304 Net Income Japanese British European Chinese Russian U.S. Consolidated (USD) Subsidiary Subsidiary Subsidiary Subsidiary Subsidiary Subsidiary Earnings (2013) 15.37 156 46 271.03 2732 3.89 360.00 834 08 13.79 (2014) 175.27 276.39 3149 382 00 881 94 5.74 Change (%) b. If the same exchange rates were used for both years, what was the change in corporate earnings on a "constant currency" basis? Calculate the earnings from individual subsidiaries and consolidation below (Round to two decimal places) Chinese U.S. Consolidated Net Income British Japanese European Subsidiary Russian Subsidiary (USD) Subsidiary Subsidiary Subsidiary Subsidiary Subsidiary b. If the same exchange rates were used for both years, what was the change in corporate earnings on a "constant currency" basis? Calculate the earnings from individual subsidiaries and consolidation below (Round to two decimal places) Net Income Consolidated Japanese British European Subsidiary Subsidiary Subsidiary Chinese Russian U.S. Subsidiary Subsidiary Subsidiary Subsidiary (USD) (2014) Change (%) (Select the best choice below) (a) Net Income 2013 2014 Japanese Subsidiary JPY 1,500 1.460 British Subsidiary GBP 100.00 106 40 European Subsidiary EUR 204 00 20800 Chinese Subsidiary CNY 168.00 194.00 Russian Subsidiary RUB 124.00 116.00 United States Subsidiary USD 360.00 382.00 USD (b) Exchange Rate 2013 2014 JPY = 1 USD 97 57 105 88 USD = 1 GBP 1.5646 1 6473 USD - 1 EUR 1.3286 1 3288 CNY 1 USD 6.1484 6.1612 RUB - 1 USD 31 86 38.62 show steps

thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started