Question

*NEED HELP WITH PART C - JOURNAL ENTRIES ONLY* Stellar Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases

*NEED HELP WITH PART C - JOURNAL ENTRIES ONLY*

Stellar Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $288,269, and its unguaranteed residual value at the end of the lease term is estimated to be $18,400. National will pay annual payments of $41,600 at the beginning of each year and all maintenance, insurance, and taxes. Stellar incurred costs of $171,900 in manufacturing the equipment and $4,200 in negotiating and closing the lease. Stellar has determined that the collectibility of the lease payments is reasonably predictable, that no additional costs will be incurred, and that the implicit interest rate is 10%.

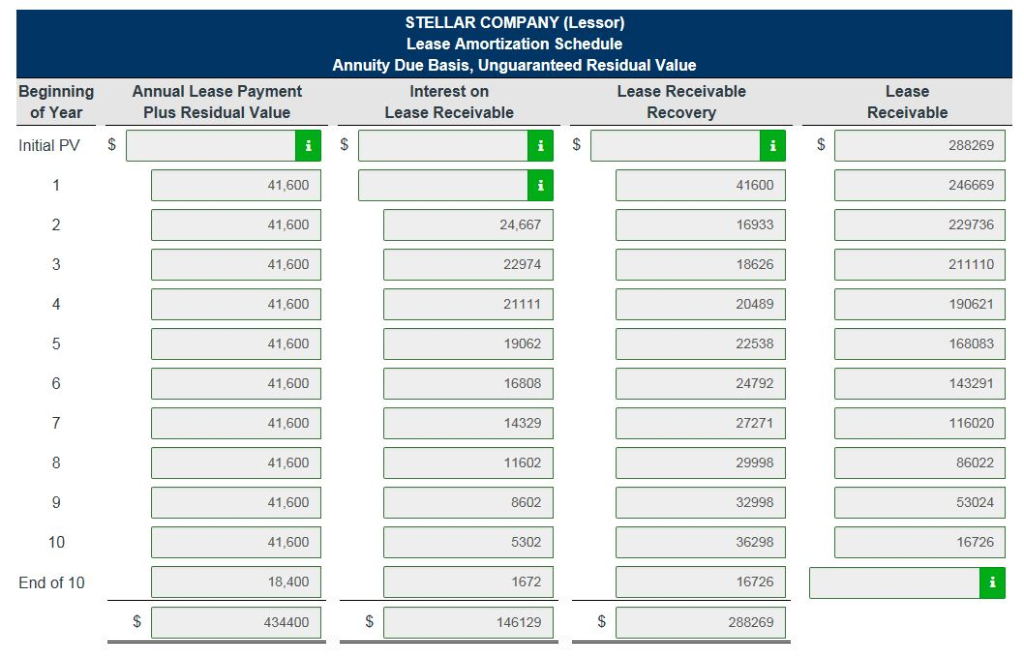

Prepare a 10-year lease amortization schedule. (Round answers to 0 decimal places e.g. 58,971.)

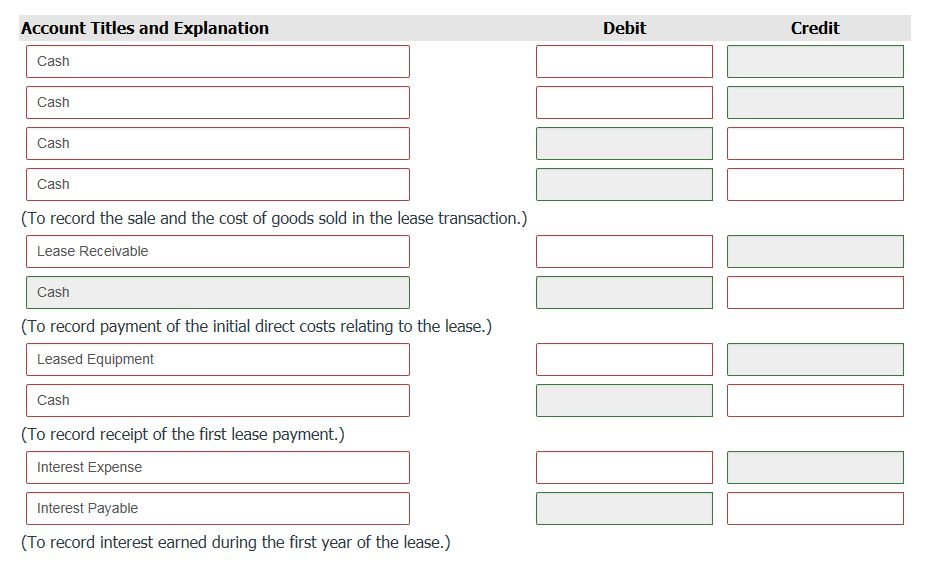

Prepare all of the lessors journal entries for the first year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places e.g. 58,971.)

List of Accounts

- Accounts Payable

- Accumulated DepreciationBuilding

- Accumulated DepreciationCapital Leases

- Accumulated DepreciationEquipment

- Airplanes

- Buildings

- Cash

- Cost of Goods Sold

- Depreciation Expense

- Equipment

- Executory Costs

- Executory Costs Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Leased Buildings

- Leased Equipment

- Leased Land

- Lease Liability

- Lease Receivable

- Loss on Capital Lease

- Machinery

- Maintenance and Repairs Expense

- No Entry

- Prepaid Lease Executory Costs

- Property Tax Expense

- Property Tax Payable

- Rent Expense

- Rent Payable

- Rent Receivable

- Rent Revenue

- Revenue from Sale-Leaseback

- Salaries and Wages Expense

- Sales Revenue

- Selling Expenses

- Trucks

- Unearned Profit on Sale-Leaseback

- Unearned Service Revenue

PLEASE DO THE JOURNAL ENTRIES

USE ONLY THE ACCOUNT TITLES ABOVE

SHOW WORK

THANK YOU

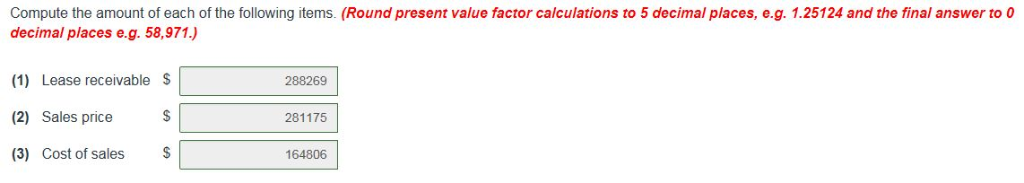

Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) (1) Lease receivable S 288269 2 Sales price 201175 281175 (3) Cost of sales S 164806 STELLAR COMPANY (Lessor) Lease Amortization Schedule Annuity Due Basis, Unguaranteed Residual Value Beginning Annual Lease Payment Plus Residual Value Interest on Lease Receivable Lease Receivable Recovery Lease Receivable of Year Initial PV $ 288269 41,600 41,600 41,600 41600 246669 2 24,667 16933 229736 22974 18626 211110 4 41,600 20489 190621 41,600 19062 22538 168083 6 41,600 16808 24792 143291 41,600 14329 27271 116020 41,600 11602 29998 86022 41,600 8602 32998 53024 10 41,600 36298 16726 End of 10 18,400 1672 16726 434400 146129 288269 Account Titles and Explanation Debit Credit Cash Cash Cash Cash (To record the sale and the cost of goods sold in the lease transaction.) Lease Receivable Cash (To record payment of the initial direct costs relating to the lease.) Leased Equipment Cash (To record receipt of the first lease payment.) Interest Expense Interest Payable (To record interest earned during the first year of the lease.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started