Answered step by step

Verified Expert Solution

Question

1 Approved Answer

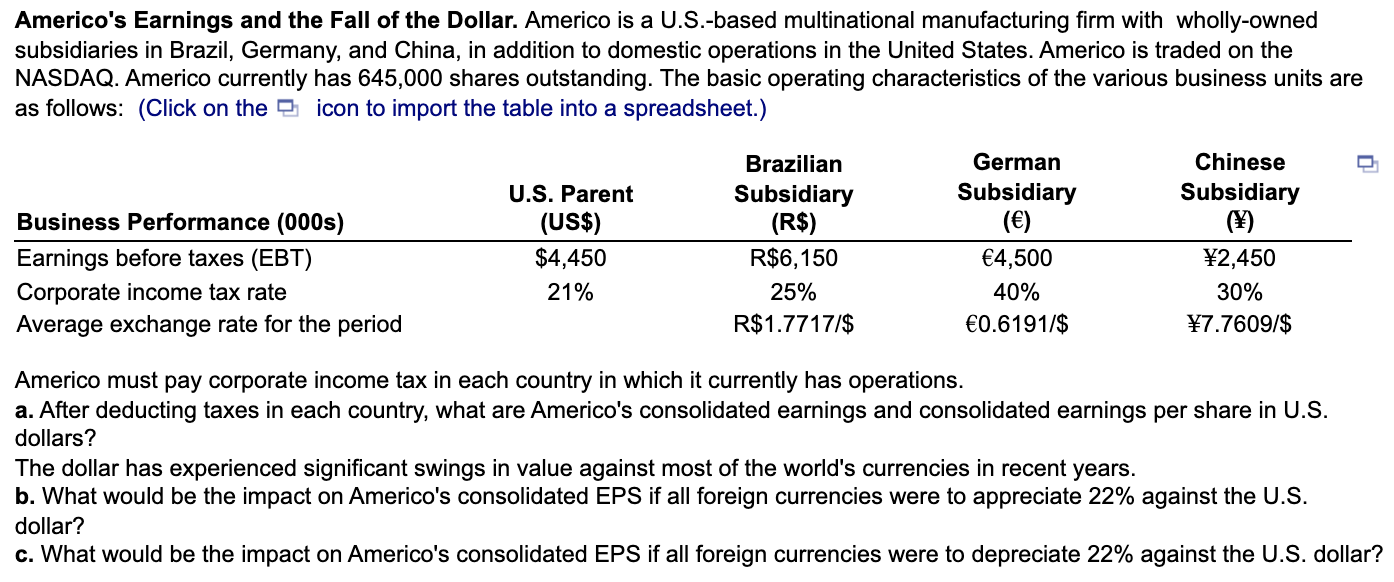

Need help with parts b and c Americo's Earnings and the Fall of the Dollar. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries

Need help with parts b and c

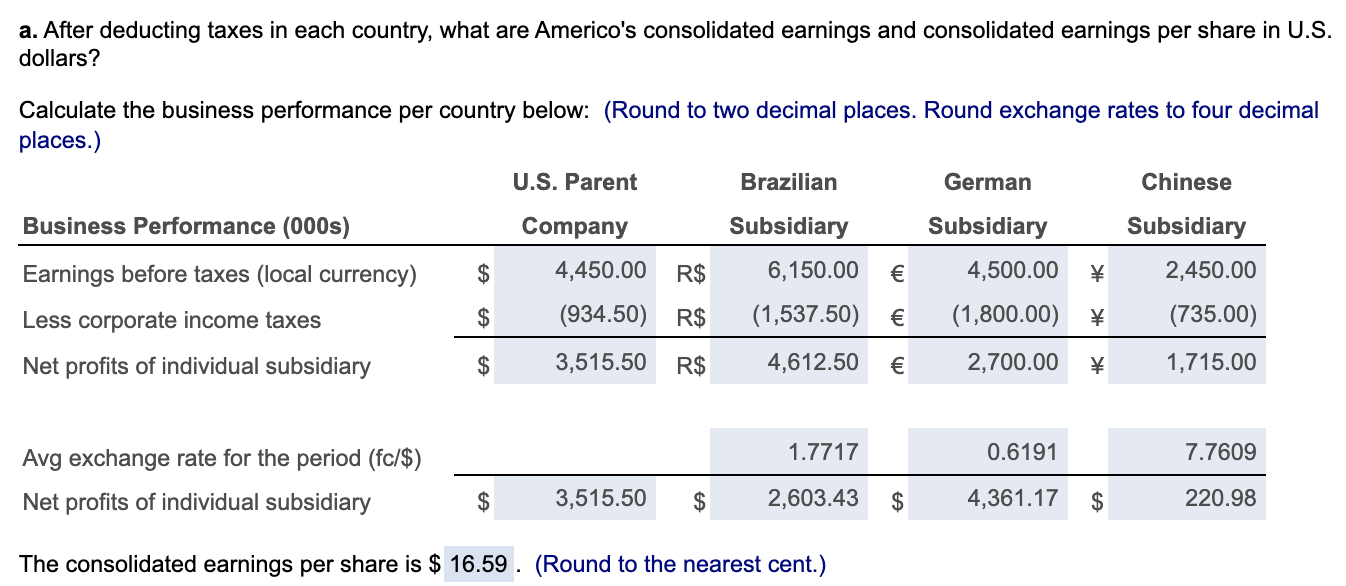

Americo's Earnings and the Fall of the Dollar. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has 645,000 shares outstanding. The basic operating characteristics of the various business units are as follows: (Click on the icon to import the table into a spreadsheet.) Brazilian Subsidiary (R$) Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (US$) $4,450 21% German Subsidiary () 4,500 40% 0.6191/$ Chinese Subsidiary () 2,450 30% 7.7609/$ R$6,150 25% R$ 1.7717/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? The dollar has experienced significant swings in value against most of the world's currencies in recent years. b. What would be the impact on Americo's consolidated EPS if all foreign currencies were to appreciate 22% against the U.S. dollar? c. What would be the impact on Americo's consolidated EPS if all foreign currencies were to depreciate 22% against the U.S. dollar? a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? Calculate the business performance per country below: (Round to two decimal places. Round exchange rates to four decimal places.) U.S. Parent Brazilian German Chinese Business Performance (000s) Company Subsidiary Earnings before taxes (local currency) $ 4,450.00 R$ Subsidiary 6,150.00 (1,537.50) 4,500.00 Subsidiary 2,450.00 (735.00) Less corporate income taxes $ (934.50) R$ (1,800.00) Net profits of individual subsidiary $ 3,515.50 R$ 4,612.50 2,700.00 1,715.00 1.7717 0.6191 7.7609 Avg exchange rate for the period (fc/$) Net profits of individual subsidiary $ 3,515.50 $ 2,603.43 4,361.17 $ 220.98 The consolidated earnings per share is $ 16.59. (Round to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started