Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED HELP WITH PRACTICE WORKSHEET ANSWER ALL ACCORDINGLY PLEASE AND THANK YOU 1. Calculate profit under cash and accrual accounting, based on the following transactions.

NEED HELP WITH PRACTICE WORKSHEET ANSWER ALL ACCORDINGLY PLEASE AND THANK YOU

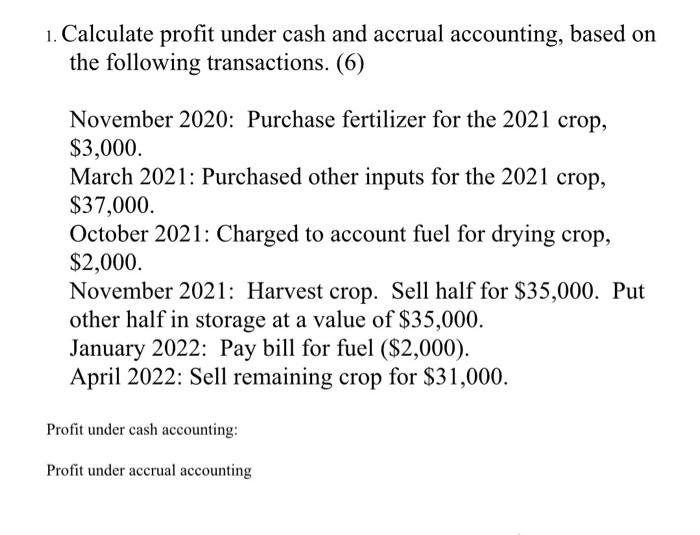

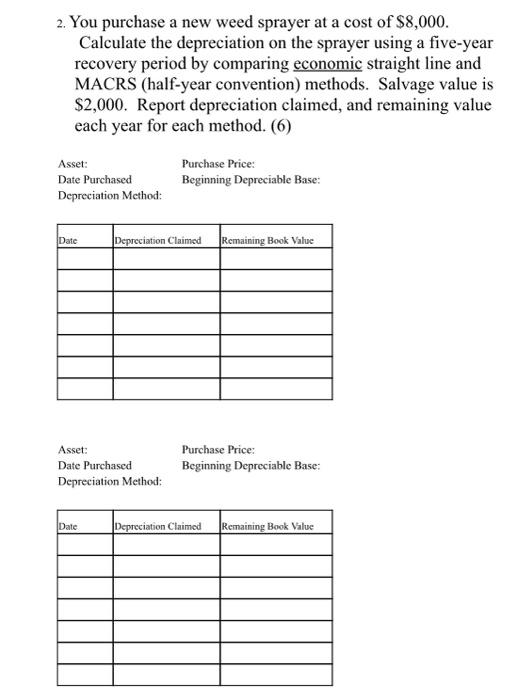

1. Calculate profit under cash and accrual accounting, based on the following transactions. (6) November 2020: Purchase fertilizer for the 2021 crop, $3,000. March 2021: Purchased other inputs for the 2021 crop, $37,000. October 2021: Charged to account fuel for drying crop, $2,000. November 2021: Harvest crop. Sell half for $35,000. Put other half in storage at a value of $35,000. January 2022: Pay bill for fuel ($2,000). April 2022: Sell remaining crop for $31,000. Profit under cash accounting: Profit under accrual accounting 2. You purchase a new weed sprayer at a cost of $8,000. Calculate the depreciation on the sprayer using a five-year recovery period by comparing economic straight line and MACRS (half-year convention) methods. Salvage value is $2,000. Report depreciation claimed, and remaining value each year for each method. (6) Asset: Date Purchased Depreciation Method: Purchase Price: Beginning Depreciable Base: Date Depreciation Claimed Remaining Book Value Asset: Date Purchased Depreciation Method: Purchase Price: Beginning Depreciable Base: Date Depreciation Claimed Remaining Book Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started