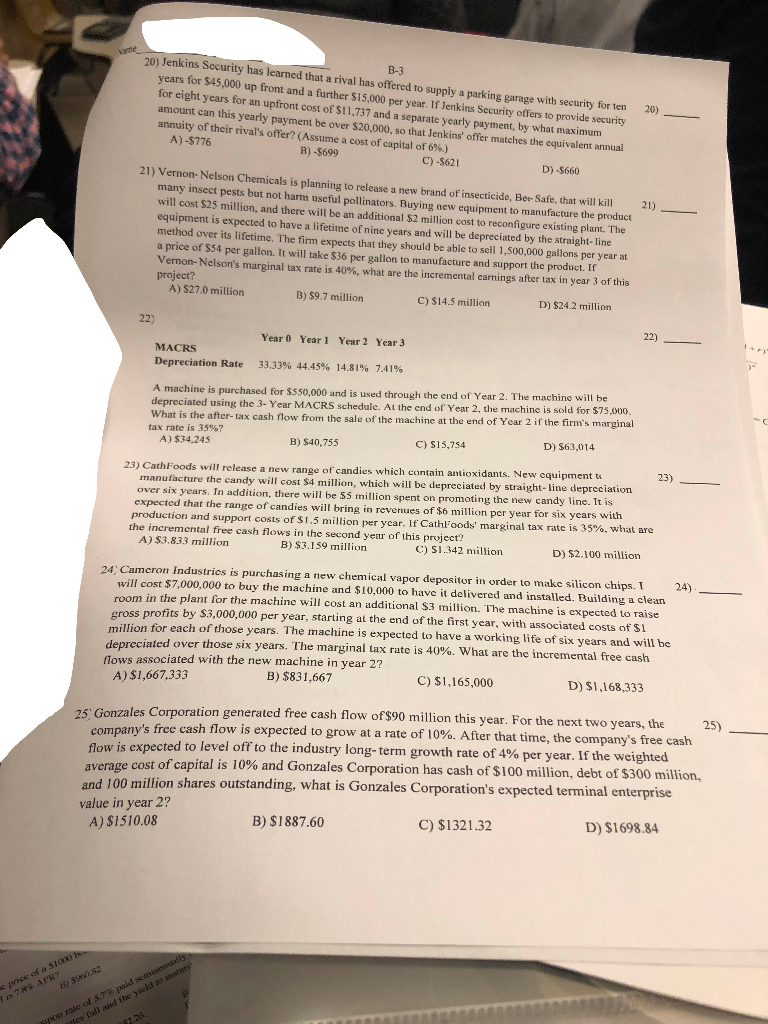

Need help with question #24

ame B-3 20) Jenkins Security has learned that a rival has offered to supply a parking garage with security for ten years for $45,000 up front and a further $15,000 per year. If Jenkins Security offers to provide security for eight years for an upfront cost of $11.737 and a separate yearly payment, by what maximum amount can this yearly payment be over $20,000, so that Jenkins' offer matches the equivalent annual annuity of their rival's offer? (Assume a cost of capital of 6%.) B) -3699 C) -5621 D) -5660 20) A)-$776 21). 21) Vernon Nelson Chemicals is planning to release a new brand of insecticide, Ber Safe, that will kill many insect pests but not harm useful pollinators. Buying new equipment to manufacture the product will cost $25 million, and there will be an additional $2 million cost to reconfigure existing plant. The equipment is expected to have a lifetime of nine years and will be depreciated by the straight-line method over its lifetime. The firm expects that they should be able to sell 1,500,000 gallons per year at a price of $54 per gallon. It will take 536 per gallon to manufacture and support the product. If Vernon- Nelson's marginal tax rate is 40%, what are the incremental carnings after tax in year 3 of this project? A) $27.0 million B) $9.7 million C) $14.5 million D) $24.2 million 22) Year 0 Year 1 Year 2 Year 3 MACRS Depreciation Rate 33,33% 44.45% 14.81% 7.41% A machine is purchased for $S50,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%? A) $34,245 B) $40,755 C) S15,754 D) $63,014 23) 23) CathFoods will release a new range of candies which contain antioxidants. New equipmentti manufacture the candy will cost $4 million, which will be depreciated by straight-line depreciation over six years. In addition, there will be $5 million spent on promoting the new candy line. It is expected that the range of candies will bring in revenues of $6 million per year for six years with production and support costs of $1.5 million per year. If Cathfoods' marginal tax rate is 35%, what are the incremental free cash flows in the second year of this project? A) $3.833 million B) $3.159 million C) SI 342 million D) $2.100 million 24. Cameron Industries is purchasing a new chemical vapor depositor in order to make silicon chips. I 24) - will cost $7,000,000 to buy the machine and $10,000 to have it delivered and installed. Building a clean room in the plant for the machine will cost an additional S3 million. The machine is expected to raise cross profits by $3,000,000 per year, starting at the end of the first year, with associated costs of si million for each of those years. The machine is expected to have a working life of six years and will be depreciated over those six years. The marginal tax rate is 40%. What are the incremental free cash flows associated with the new machine in year 2? A) $1,667,333 B) $831,667 C) $1,165,000 D) $1,168,333 Gonzales Corporation generated free cash flow of$90 million this year. For the next two years, the 25) company's free cash flow is expected to grow at a rate of 10%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 4% per year. If the weighted average cost of capital is 10% and Gonzales Corporation has cash of $100 million, debt of $300 million, and 100 million shares outstanding, what is Gonzales Corporation's expected terminal enterprise value in year 2? A) $1510.08 B) $1887.60 C) $1321.32 D) $1698.84 price of a $10 is 785 APR? 8) 3082 pop role of 5 paid canal yes fall and the yield son