need help with question 3 please....

need help with question 3 please....

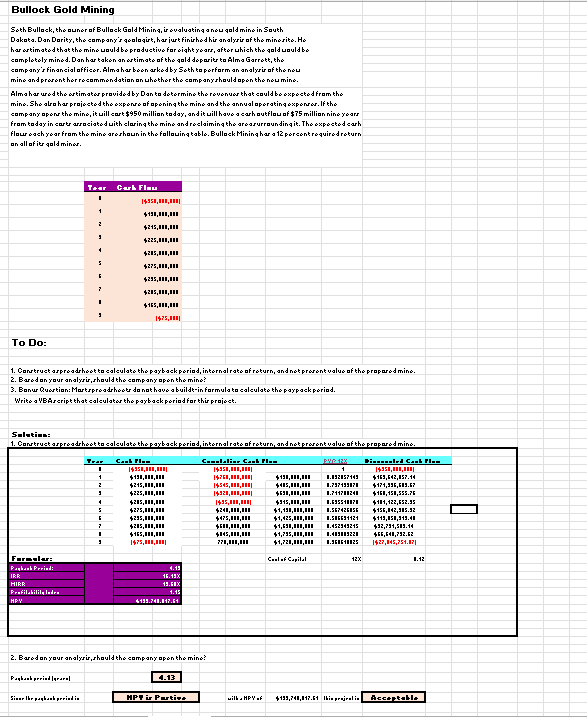

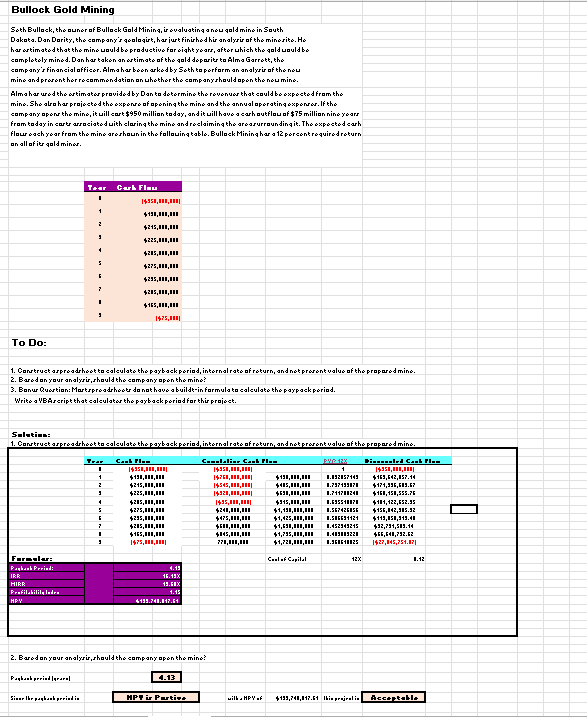

Bullock Gold Mining Seth Bullock, the auner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company's goologist, har just finished his analysis of the minorite. Ho har artimated that the mine uould be productive for eight years, after which the gold could be completely mind. Dan hartakon an artimate of the gold doparitr to Alma Garrott, the company's financial officer. Almahar been arked by Soth toporform an analysis of the new mino and preronthorrecommendation on whether the companyshould open the nou mine. Almaharwed the artimator provided by Danto determine the rovonuar that could be expected from the mino. She also har projected the expone of opening the mine and the annual operating exponer.If the company open the mine, it will cart $950 million today, and it will have a carh outflow of $75 million nine years from today in cartr wrociated with claring the mine andreclaiming the arearurrounding it. The expected cash flour ach year from the mine are shown in the following table. Bullock Mining har a 12 percent required return on all of it gold minor. Teer Crk FIEM 14351,111,1101 $191,111,111 $215,111,111 4225,111,111 4215,111,111 $275,111,111 4295,011, 001 $215,111,111 $165,111,111 1475,111 To Do: 1. Construct aspreadsheetto calculate the payback poriod, internal rate of return, and not provont value of the propored mine. 2. Bared on your analyrir, should the company open the mine? 3. Bonur Quartion: Martspreadsheet do not have a buildt-in formulato calculate the paypaskporiod. Writo a VBArcript that calculator the payback period for thir project. Salaties: 1. Construct aspreadsheetto calculate the payback period internal rate of return, and netprorent value of the properedmine. T.as 2 3 + 5 CALFI 14951,111,1111 131,111,111 4115.100,00 $225,111,111 4215,111,011 $275,111,111 *295,111,111 $215,111,111 $165,111,111 1475,111,1111 Collier Cell 19951,111,1111 14761,111,000 131,011, 011 19545,111, 115,111,111 14921,111,11 $191,041,01 ...! 1495,111,000 115,111, 011 $241,011, 011 $1,131,000,000 475,011, 001 1,425,000.00 4611,011, 001 1,511,000.00 $145,011, 011 $1,715,011, 011 271,011,011 $1,721,111,111 PHOEN 4 1.192057143 1.797111171 1.711701240 1.695511171 1.56742LISE L.STEE31121 1.452349215 1.413111221 1.36111125 PizzzCall 14951,111,1111 $169,642,157.14 171,936,601.7 4161,151,555.76 111, 122,652.35 $156,142,315.12 $119,151,319.41 $32,751,519.10 465,541,732.62 1427,145,751.121 7 1 1 Forsalar Carlo Capital 12% 1.12 Feed1 IRR HIRR Profilbili, I. HPY 4.13 16.19% 19.ELX 1.13 4199.741.117.61 2. Bared on your analysis, should the company open the mine? Pagbab prigrarol 4.13 Sir Ibrugbaab pprindi HPT i Putive will. HPV. $199,741,117.61 lbi prejeli Accentable Bullock Gold Mining Seth Bullock, the auner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company's goologist, har just finished his analysis of the minorite. Ho har artimated that the mine uould be productive for eight years, after which the gold could be completely mind. Dan hartakon an artimate of the gold doparitr to Alma Garrott, the company's financial officer. Almahar been arked by Soth toporform an analysis of the new mino and preronthorrecommendation on whether the companyshould open the nou mine. Almaharwed the artimator provided by Danto determine the rovonuar that could be expected from the mino. She also har projected the expone of opening the mine and the annual operating exponer.If the company open the mine, it will cart $950 million today, and it will have a carh outflow of $75 million nine years from today in cartr wrociated with claring the mine andreclaiming the arearurrounding it. The expected cash flour ach year from the mine are shown in the following table. Bullock Mining har a 12 percent required return on all of it gold minor. Teer Crk FIEM 14351,111,1101 $191,111,111 $215,111,111 4225,111,111 4215,111,111 $275,111,111 4295,011, 001 $215,111,111 $165,111,111 1475,111 To Do: 1. Construct aspreadsheetto calculate the payback poriod, internal rate of return, and not provont value of the propored mine. 2. Bared on your analyrir, should the company open the mine? 3. Bonur Quartion: Martspreadsheet do not have a buildt-in formulato calculate the paypaskporiod. Writo a VBArcript that calculator the payback period for thir project. Salaties: 1. Construct aspreadsheetto calculate the payback period internal rate of return, and netprorent value of the properedmine. T.as 2 3 + 5 CALFI 14951,111,1111 131,111,111 4115.100,00 $225,111,111 4215,111,011 $275,111,111 *295,111,111 $215,111,111 $165,111,111 1475,111,1111 Collier Cell 19951,111,1111 14761,111,000 131,011, 011 19545,111, 115,111,111 14921,111,11 $191,041,01 ...! 1495,111,000 115,111, 011 $241,011, 011 $1,131,000,000 475,011, 001 1,425,000.00 4611,011, 001 1,511,000.00 $145,011, 011 $1,715,011, 011 271,011,011 $1,721,111,111 PHOEN 4 1.192057143 1.797111171 1.711701240 1.695511171 1.56742LISE L.STEE31121 1.452349215 1.413111221 1.36111125 PizzzCall 14951,111,1111 $169,642,157.14 171,936,601.7 4161,151,555.76 111, 122,652.35 $156,142,315.12 $119,151,319.41 $32,751,519.10 465,541,732.62 1427,145,751.121 7 1 1 Forsalar Carlo Capital 12% 1.12 Feed1 IRR HIRR Profilbili, I. HPY 4.13 16.19% 19.ELX 1.13 4199.741.117.61 2. Bared on your analysis, should the company open the mine? Pagbab prigrarol 4.13 Sir Ibrugbaab pprindi HPT i Putive will. HPV. $199,741,117.61 lbi prejeli Accentable

need help with question 3 please....

need help with question 3 please....