Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with question 4 Attached please find Income Statement, Balance Sheet, and footnote 5 on LIFO inventories from General Electric's 2014 Annual Report. Answer

Need help with question 4

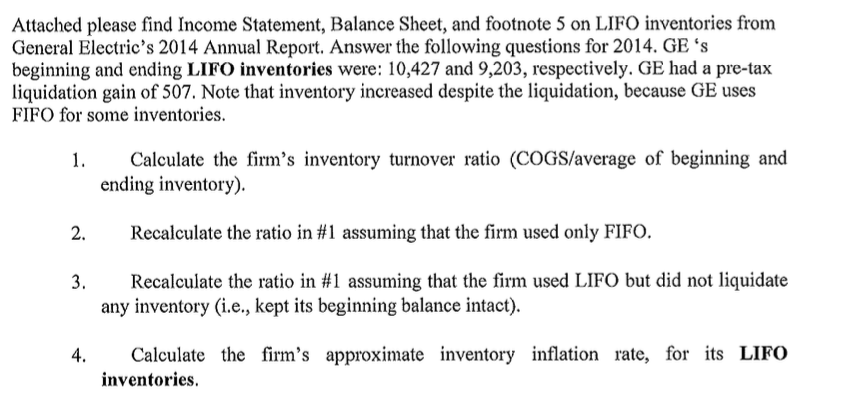

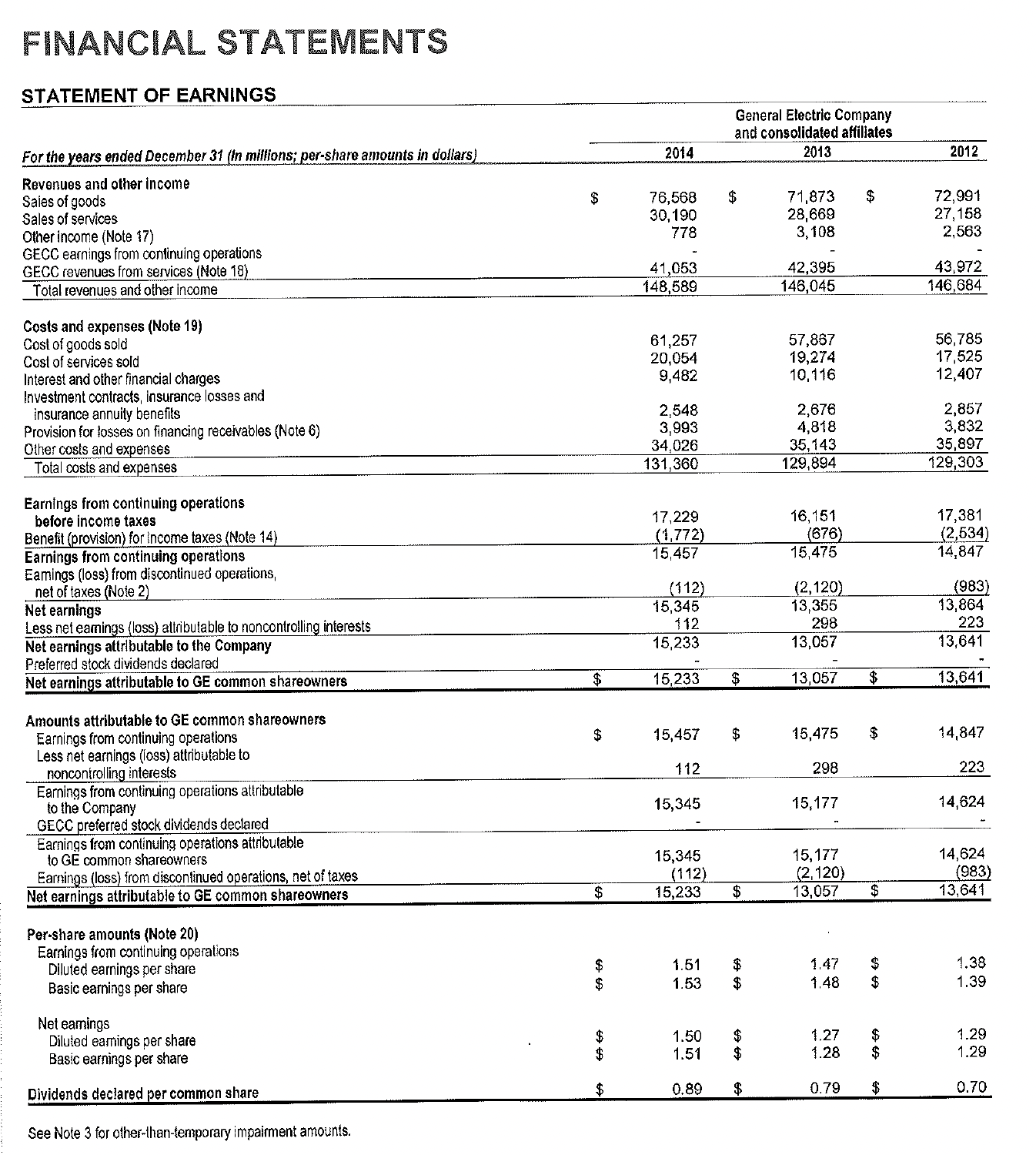

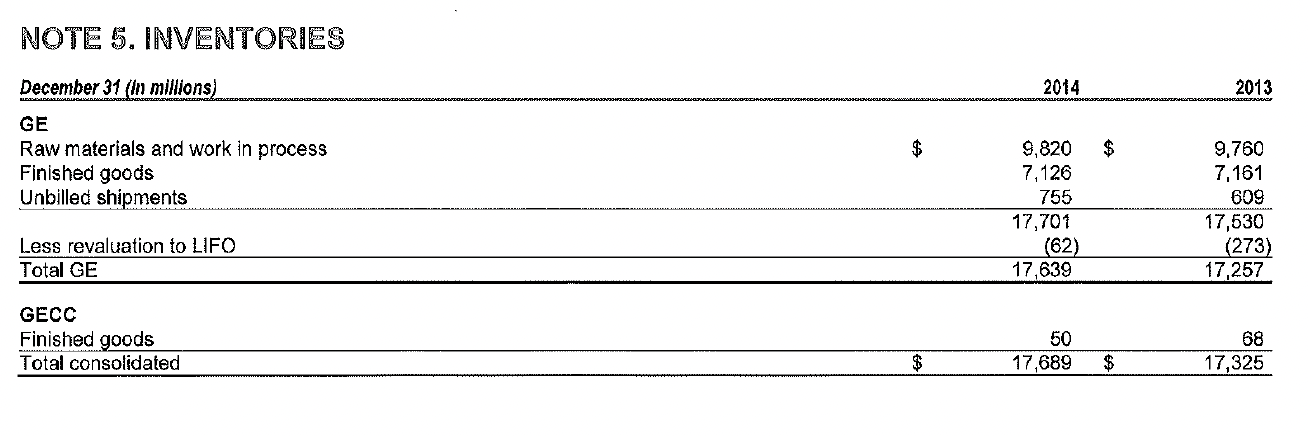

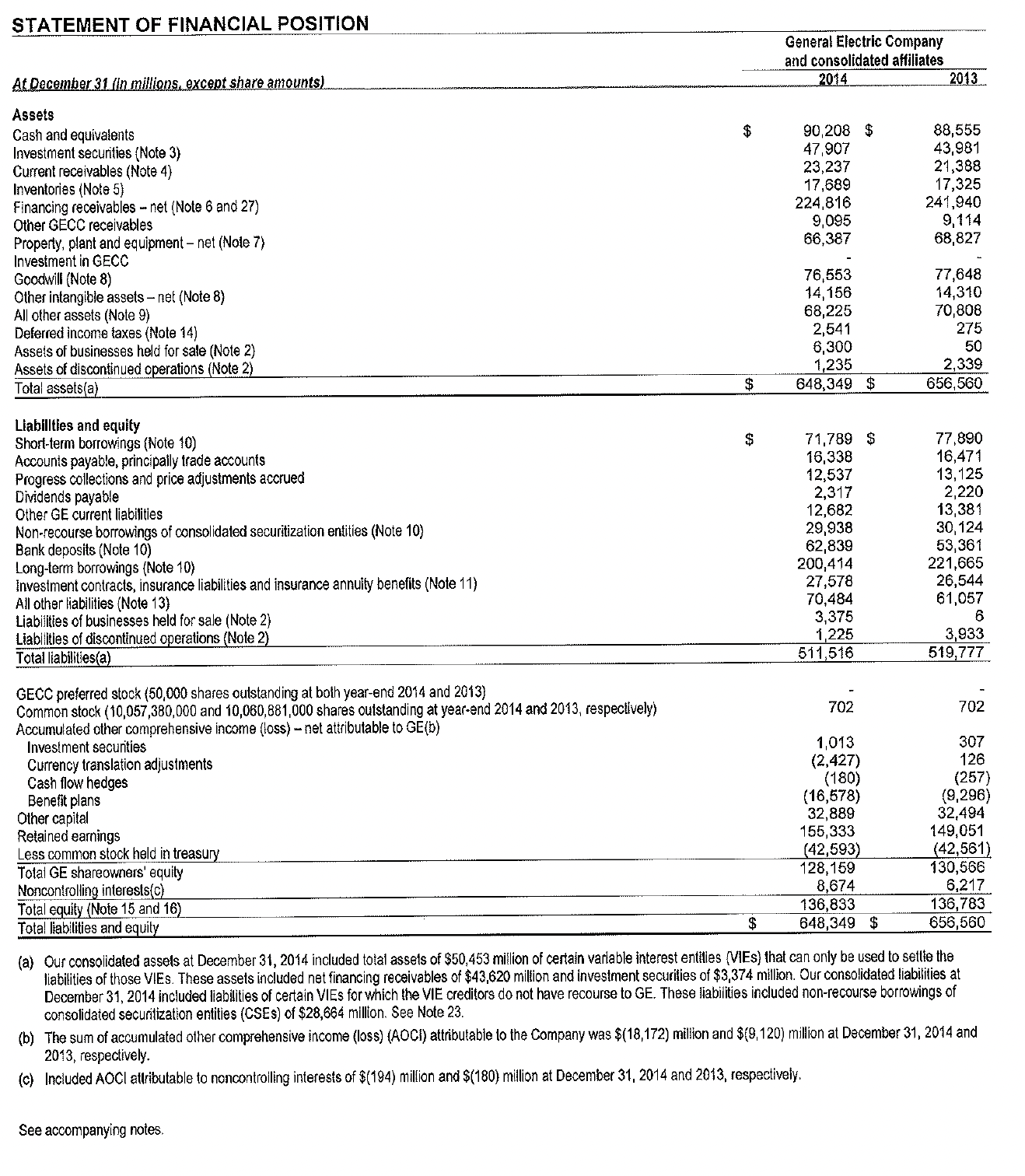

Attached please find Income Statement, Balance Sheet, and footnote 5 on LIFO inventories from General Electric's 2014 Annual Report. Answer the following questions for 2014. GE 's oeginning and ending LIFO inventories were: 10,427 and 9,203, respectively. GE had a pre-tax iquidation gain of 507. Note that inventory increased despite the liquidation, because GE uses FIFO for some inventories. 1. Calculate the firm's inventory turnover ratio (COGS/average of beginning and ending inventory). 2. Recalculate the ratio in \#1 assuming that the firm used only FIFO. 3. Recalculate the ratio in \#1 assuming that the firm used LIFO but did not liquidate any inventory (i.e., kept its beginning balance intact). 4. Calculate the firm's approximate inventory inflation rate, for its LIFO inventories. FINANCIAL STATEMENTS STATEMENT OF EARNINGS See Note 3 for other-than-femporary impairment amounts. NOTE 5. INVENTORHES \begin{tabular}{|c|c|c|c|c|} \hline December 31 (in millions) & & 2014 & & 2013 \\ \hline GE & & & & \\ \hline Raw materials and work in process & $ & 9,820 & $ & 9,760 \\ \hline Finished goods & & 7,126 & & 7,161 \\ \hline Unbilled shipments & & 755 & & 609 \\ \hline Less revaluation to LIFO & & \begin{tabular}{r} 17,701 \\ (62) \end{tabular} & & \begin{tabular}{r} 17,530 \\ (273) \end{tabular} \\ \hline Total GE & & 17,639 & & 17,257 \\ \hline GECC & & & & \\ \hline Finished goods & & 50 & & 68 \\ \hline Total consolidated & $ & 17,689 & $ & 17,325 \\ \hline \end{tabular} (a) Our consolidated assels at December 31,2014 included total assets of $50,453 million of certain varlable interest entities (VIEs) that can only be used to settte the liabilities of those VIEs. These assets included net financing receivables of $43,620 million and investment securities of $3,374 million. Our consolidated liabilities at December 31, 2014 included liabilities of certain VIEs for which the VIE creditors do not have recourse to GE. These liabilities included non-recourse borrowings of consolidated securitization entities (CSEs) of $28,664 million. See Note 23 . (b) The sum of accumulated other comprehensive income (loss) (AOCl) attributable to the Company was $(18,172) million and $(9,120) million at December 31,2014 and 2013, respectively. (c) Inciuded AOCl attributable to noncontrolling interests of $(194) million and $(180) million at December 31,2014 and 2013 , respectively

Attached please find Income Statement, Balance Sheet, and footnote 5 on LIFO inventories from General Electric's 2014 Annual Report. Answer the following questions for 2014. GE 's oeginning and ending LIFO inventories were: 10,427 and 9,203, respectively. GE had a pre-tax iquidation gain of 507. Note that inventory increased despite the liquidation, because GE uses FIFO for some inventories. 1. Calculate the firm's inventory turnover ratio (COGS/average of beginning and ending inventory). 2. Recalculate the ratio in \#1 assuming that the firm used only FIFO. 3. Recalculate the ratio in \#1 assuming that the firm used LIFO but did not liquidate any inventory (i.e., kept its beginning balance intact). 4. Calculate the firm's approximate inventory inflation rate, for its LIFO inventories. FINANCIAL STATEMENTS STATEMENT OF EARNINGS See Note 3 for other-than-femporary impairment amounts. NOTE 5. INVENTORHES \begin{tabular}{|c|c|c|c|c|} \hline December 31 (in millions) & & 2014 & & 2013 \\ \hline GE & & & & \\ \hline Raw materials and work in process & $ & 9,820 & $ & 9,760 \\ \hline Finished goods & & 7,126 & & 7,161 \\ \hline Unbilled shipments & & 755 & & 609 \\ \hline Less revaluation to LIFO & & \begin{tabular}{r} 17,701 \\ (62) \end{tabular} & & \begin{tabular}{r} 17,530 \\ (273) \end{tabular} \\ \hline Total GE & & 17,639 & & 17,257 \\ \hline GECC & & & & \\ \hline Finished goods & & 50 & & 68 \\ \hline Total consolidated & $ & 17,689 & $ & 17,325 \\ \hline \end{tabular} (a) Our consolidated assels at December 31,2014 included total assets of $50,453 million of certain varlable interest entities (VIEs) that can only be used to settte the liabilities of those VIEs. These assets included net financing receivables of $43,620 million and investment securities of $3,374 million. Our consolidated liabilities at December 31, 2014 included liabilities of certain VIEs for which the VIE creditors do not have recourse to GE. These liabilities included non-recourse borrowings of consolidated securitization entities (CSEs) of $28,664 million. See Note 23 . (b) The sum of accumulated other comprehensive income (loss) (AOCl) attributable to the Company was $(18,172) million and $(9,120) million at December 31,2014 and 2013, respectively. (c) Inciuded AOCl attributable to noncontrolling interests of $(194) million and $(180) million at December 31,2014 and 2013 , respectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started