Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with Question 5. Thanks! The bank's manager thinks rates will increase by 0.50 percent in the next three months. To hedge this interest

Need help with Question 5. Thanks!

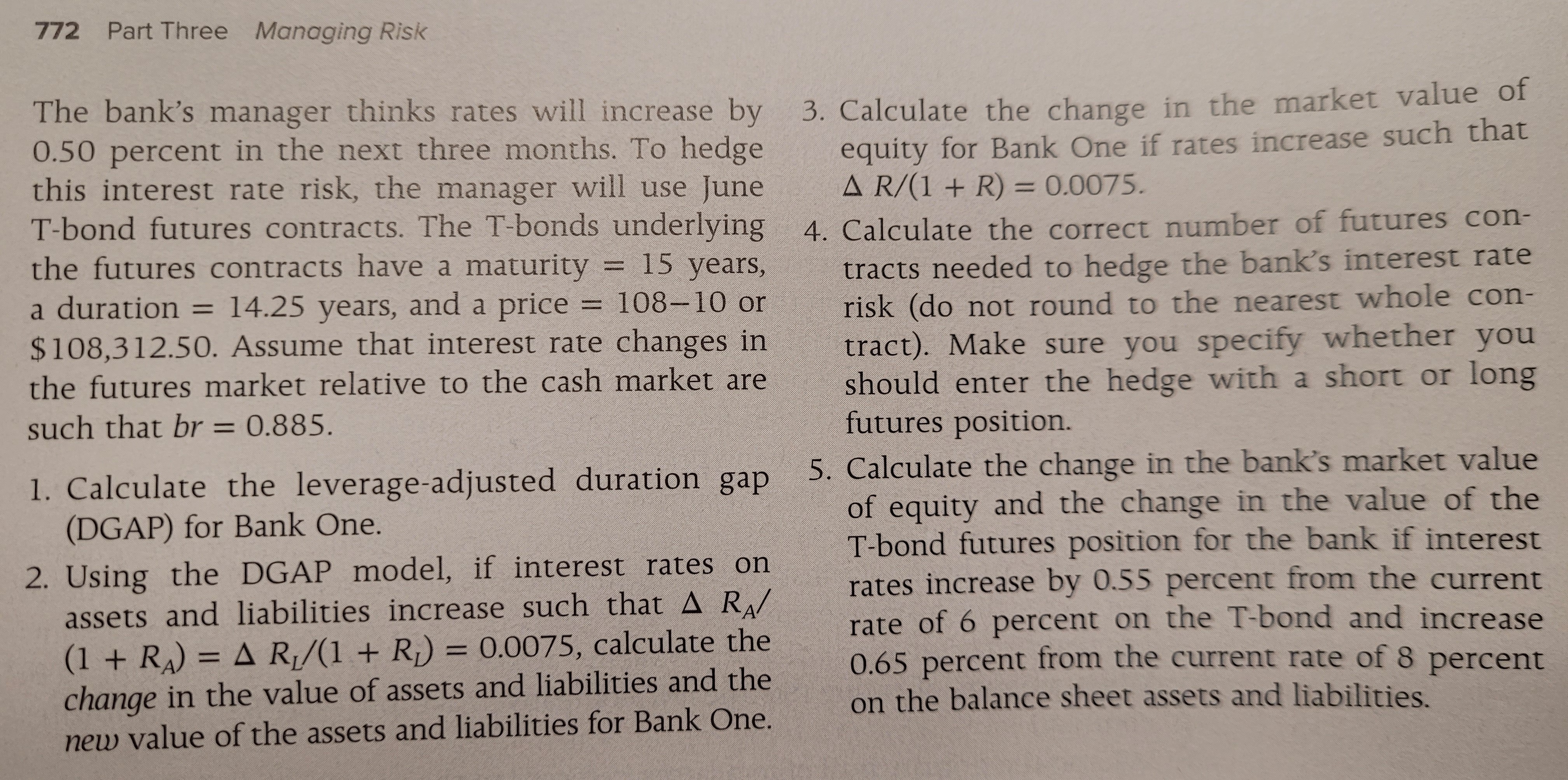

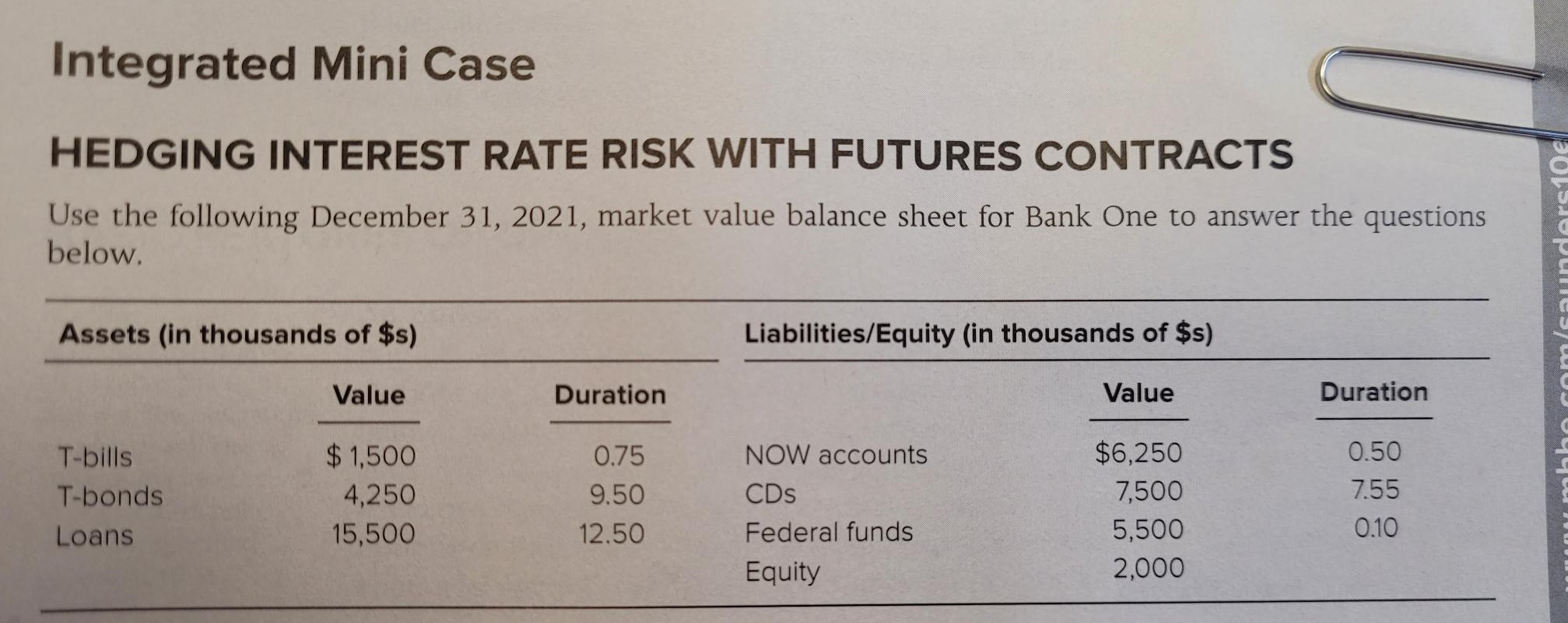

The bank's manager thinks rates will increase by 0.50 percent in the next three months. To hedge this interest rate risk, the manager will use June T-bond futures contracts. The T-bonds underlying the futures contracts have a maturity =15 years, a duration =14.25 years, and a price =10810 or $108,312.50. Assume that interest rate changes in the futures market relative to the cash market are such that br=0.885. 1. Calculate the leverage-adjusted duration gap (DGAP) for Bank One. 2. Using the DGAP model, if interest rates on assets and liabilities increase such that RA / (1+RA)=RL/(1+RL)=0.0075, calculate the change in the value of assets and liabilities and the new value of the assets and liabilities for Bank One. 3. Calculate the change in the market value of equity for Bank One if rates increase such that R/(1+R)=0.0075. 4. Calculate the correct number of futures contracts needed to hedge the bank's interest rate risk (do not round to the nearest whole contract). Make sure you specify whether you should enter the hedge with a short or long futures position. 5. Calculate the change in the bank's market value of equity and the change in the value of the T-bond futures position for the bank if interest rates increase by 0.55 percent from the current rate of 6 percent on the T-bond and increase 0.65 percent from the current rate of 8 percent on the balance sheet assets and liabilities. Integrated Mini Case HEDGING INTEREST RATE RISK WITH FUTURES CONTRACTS Use the following December 31, 2021, market value balance sheet for Bank One to answer the questions below

The bank's manager thinks rates will increase by 0.50 percent in the next three months. To hedge this interest rate risk, the manager will use June T-bond futures contracts. The T-bonds underlying the futures contracts have a maturity =15 years, a duration =14.25 years, and a price =10810 or $108,312.50. Assume that interest rate changes in the futures market relative to the cash market are such that br=0.885. 1. Calculate the leverage-adjusted duration gap (DGAP) for Bank One. 2. Using the DGAP model, if interest rates on assets and liabilities increase such that RA / (1+RA)=RL/(1+RL)=0.0075, calculate the change in the value of assets and liabilities and the new value of the assets and liabilities for Bank One. 3. Calculate the change in the market value of equity for Bank One if rates increase such that R/(1+R)=0.0075. 4. Calculate the correct number of futures contracts needed to hedge the bank's interest rate risk (do not round to the nearest whole contract). Make sure you specify whether you should enter the hedge with a short or long futures position. 5. Calculate the change in the bank's market value of equity and the change in the value of the T-bond futures position for the bank if interest rates increase by 0.55 percent from the current rate of 6 percent on the T-bond and increase 0.65 percent from the current rate of 8 percent on the balance sheet assets and liabilities. Integrated Mini Case HEDGING INTEREST RATE RISK WITH FUTURES CONTRACTS Use the following December 31, 2021, market value balance sheet for Bank One to answer the questions below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started