Answered step by step

Verified Expert Solution

Question

1 Approved Answer

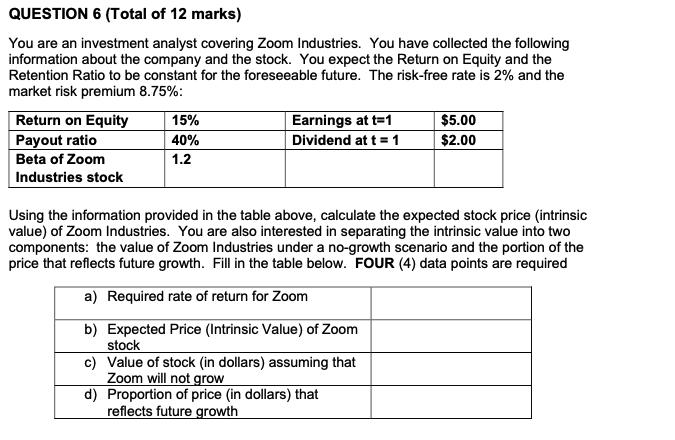

Need help with question 6 QUESTION 6 (Total of 12 marks) You are an investment analyst covering Zoom Industries. You have collected the following information

Need help with question 6

QUESTION 6 (Total of 12 marks) You are an investment analyst covering Zoom Industries. You have collected the following information about the company and the stock. You expect the Return on Equity and the Retention Ratio to be constant for the foreseeable future. The risk-free rate is 2% and the market risk premium 8.75%: 15% 40% Earnings at t=1 Dividend at t = 1 $5.00 $2.00 Return on Equity Payout ratio Beta of Zoom Industries stock Using the information provided in the table above, calculate the expected stock price (intrinsic value) of Zoom Industries. You are also interested in separating the intrinsic value into two components: the value of Zoom Industries under a no-growth scenario and the portion of the price that reflects future growth. Fill in the table below. FOUR (4) data points are required a) Required rate of return for Zoom b) Expected Price (Intrinsic Value) of Zoom stock c) Value of stock (in dollars) assuming that Zoom will not grow d) Proportion of price in dollars) that reflects future growthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started