Answered step by step

Verified Expert Solution

Question

1 Approved Answer

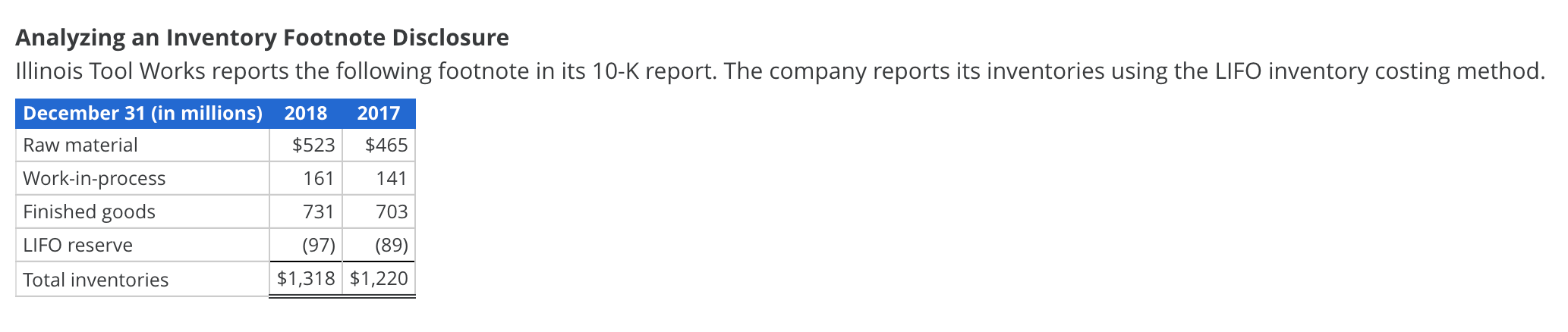

Need help with Questions D and E Thank you Analyzing an Inventory Footnote Disclosure Illinois Tool Works reports the following footnote in its 10-K report.

Need help with Questions D and E

Thank you

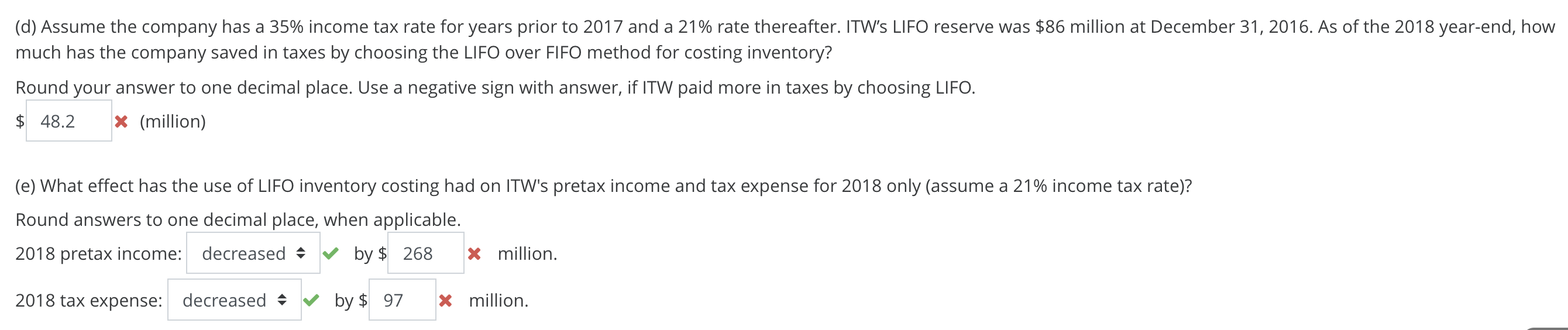

Analyzing an Inventory Footnote Disclosure Illinois Tool Works reports the following footnote in its 10-K report. The company reports its inventories using the LIFO inventory costing method. December 31 (in millions) 2018 2017 Raw material $523 $465 Work-in-process 161 141 Finished goods 731 703 LIFO reserve (97) (89) Total inventories $1,318 $1,220 (d) Assume the company has a 35% income tax rate for years prior to 2017 and a 21% rate thereafter. ITW'S LIFO reserve was $86 million at December 31, 2016. As of the 2018 year-end, how much has the company saved in taxes by choosing the LIFO over FIFO method for costing inventory? Round your answer to one decimal place. Use a negative sign with answer, if ITW paid more in taxes by choosing LIFO. $ 48.2 X (million) (e) What effect has the use of LIFO inventory costing had on ITW's pretax income and tax expense for 2018 only (assume a 21% income tax rate)? Round answers to one decimal place, when applicable. 2018 pretax income: decreased - by $ 268 x million. 2018 tax expense: decreased - by $ 97 X millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started