Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with questions listed at the top. suppose to use data below to anseer the following 13 Questions 34 35 Note the significant difference

need help with questions listed at the top. suppose to use data below to anseer the following

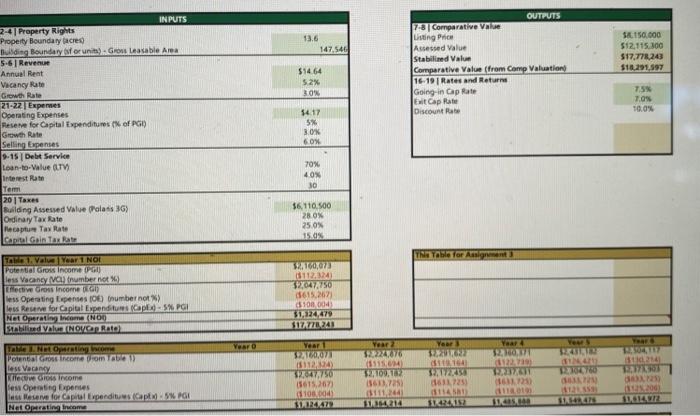

13 Questions 34 35 Note the significant difference between this NOI and the Offering Memorandum NOI (which is the actual NOI). What does this tell us about current rents versus market rents? Why is there such a diconnect? 36 37 Is there an opportunity to add value? 38 Why is there such a difference between the different values? What does this tell us about the asset? 39 INPUTS 2-41 Property Rights Property Boundary acres) Building Boundary of or units)- Gross Leasable Area 5-61 Revenue Annual Rent Vacancy Rate Growth Rate 21-22 Expenses Operating Expenses Reserve for Capital Expenditures (% of PGI) Growth Rate Selling Expenses 9-15 | Debt Service Loan-to-Value (LTV) Interest Rate Tem 20 Taxes Building Assessed Value (Palass 36) Ordinary Tax Rate Recapture Tax Rate Capital Gain Tax Rate Table 1. Value Year 1 Not Potential Gross Income (PG) less Vacancy (VCL) (number not %) Effective Gross Income (G) less Operating Expenses (OE) (number not %) less Reserve for Capital Expenditures (Capl)-5% PGI Net Operating Income (NO) Stabilized Value (NOVCap Rate) Table 3. Net Operating income Potential Gross Income From Table 1) less Vacancy Effective Gross income less Operating Expenses less Reserve for Capital Expenditures (Cap)5% PG Net Operating Income Year O 13.6 $14.64 5.2% 3.0% $4.17 5% 3.0% 6.0% 70% 4.0% 30 $6,110,500 28.0% 25.0% 15.0% $2,160,073 ($112,324) $2,047,750 d615,267) $108,004) $1,324,479 $17.778,243 Year 1 $2,360,073 ($112,324) $2,047,750 ($615,267) 108,004) $1.324.479 147,546 Year 2 $2,224,876 ($115,694) $2,109,182 (5633,725) ($111,244) $1,364,214 OUTPUTS 7-8 Comparative Value Listing Price Assessed Value Stabilized Value Comparative Value (from Comp Valuation) 16-19 Rates and Returns Going-in Cap Rate Exit Cap Rate Discount Rate This Table for Assignment 3 Year 3 $2,291,622 119.164) $2,172,458 (633,725) $114581) $1424352 Year 4 $2,300.371 122.739) 12.337431 (1633.725) Year S $2,431, 182 124,425) 12.304760 (635,725) 14121.559 $1.548.476 $8.150.000 $12,115,300 $17,778,243 $10,291,597 7,5% 7.0% 10.0% $130,214) 12.378,305 3433, 223) ($125.206) $1,614,972 13 Questions 34 35 Note the significant difference between this NOI and the Offering Memorandum NOI (which is the actual NOI). What does this tell us about current rents versus market rents? Why is there such a diconnect? 36 37 Is there an opportunity to add value? 38 Why is there such a difference between the different values? What does this tell us about the asset? 39 INPUTS 2-41 Property Rights Property Boundary acres) Building Boundary of or units)- Gross Leasable Area 5-61 Revenue Annual Rent Vacancy Rate Growth Rate 21-22 Expenses Operating Expenses Reserve for Capital Expenditures (% of PGI) Growth Rate Selling Expenses 9-15 | Debt Service Loan-to-Value (LTV) Interest Rate Tem 20 Taxes Building Assessed Value (Palass 36) Ordinary Tax Rate Recapture Tax Rate Capital Gain Tax Rate Table 1. Value Year 1 Not Potential Gross Income (PG) less Vacancy (VCL) (number not %) Effective Gross Income (G) less Operating Expenses (OE) (number not %) less Reserve for Capital Expenditures (Capl)-5% PGI Net Operating Income (NO) Stabilized Value (NOVCap Rate) Table 3. Net Operating income Potential Gross Income From Table 1) less Vacancy Effective Gross income less Operating Expenses less Reserve for Capital Expenditures (Cap)5% PG Net Operating Income Year O 13.6 $14.64 5.2% 3.0% $4.17 5% 3.0% 6.0% 70% 4.0% 30 $6,110,500 28.0% 25.0% 15.0% $2,160,073 ($112,324) $2,047,750 d615,267) $108,004) $1,324,479 $17.778,243 Year 1 $2,360,073 ($112,324) $2,047,750 ($615,267) 108,004) $1.324.479 147,546 Year 2 $2,224,876 ($115,694) $2,109,182 (5633,725) ($111,244) $1,364,214 OUTPUTS 7-8 Comparative Value Listing Price Assessed Value Stabilized Value Comparative Value (from Comp Valuation) 16-19 Rates and Returns Going-in Cap Rate Exit Cap Rate Discount Rate This Table for Assignment 3 Year 3 $2,291,622 119.164) $2,172,458 (633,725) $114581) $1424352 Year 4 $2,300.371 122.739) 12.337431 (1633.725) Year S $2,431, 182 124,425) 12.304760 (635,725) 14121.559 $1.548.476 $8.150.000 $12,115,300 $17,778,243 $10,291,597 7,5% 7.0% 10.0% $130,214) 12.378,305 3433, 223) ($125.206) $1,614,972

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started