Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with Required 1 and 3 please. Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always

Need help with Required 1 and 3 please.

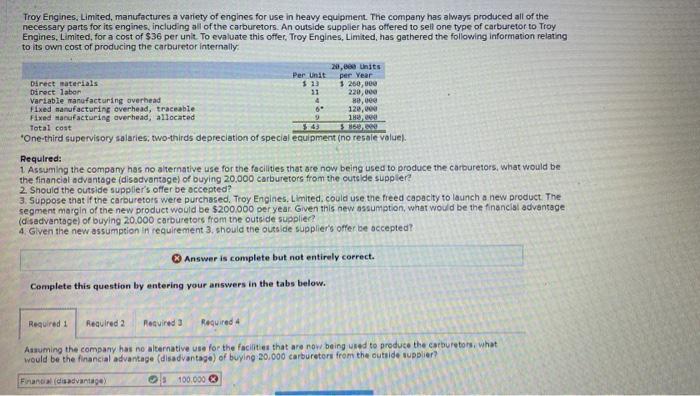

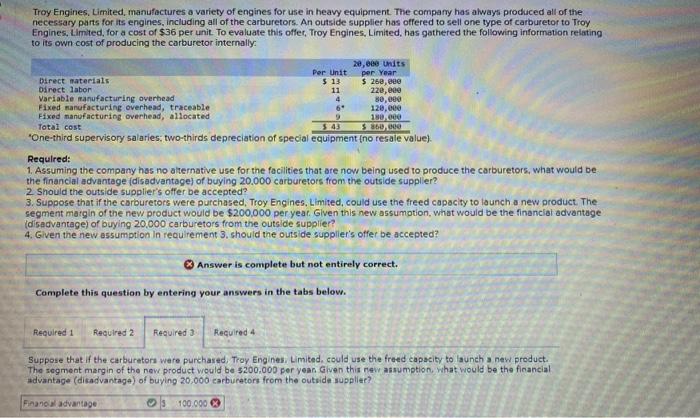

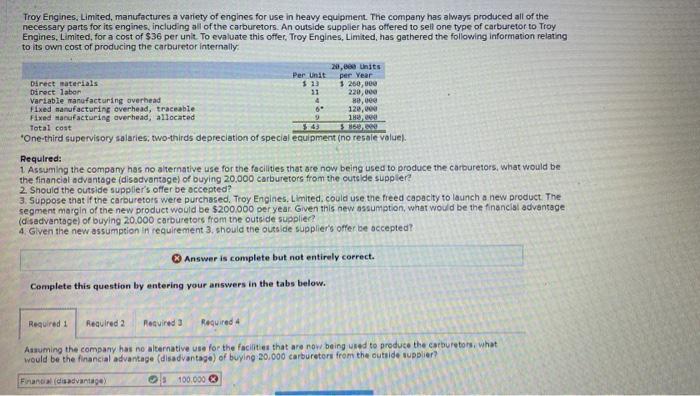

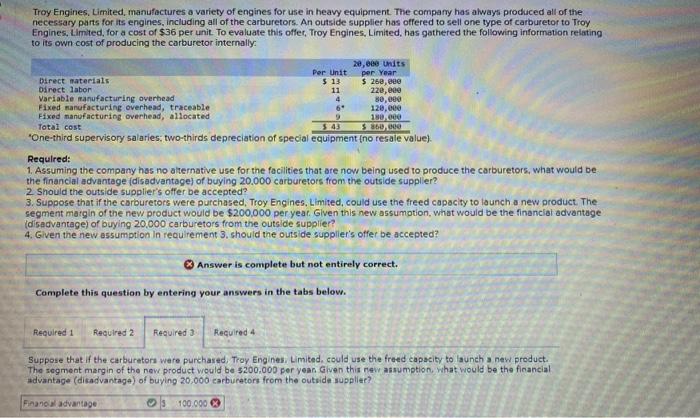

Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has otfered to sell one type of carburetor to Troy Engines, Limited, for a cost of $36 per unit. To cvaluate this ofter, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally: Required: 1. Assuming the company has no alternative use for the facilites that are now being used to produce the carburetors, what would be the financial ndvantage (disadvantage) of buying 20,000 earburetore from the ours lde suppler? 2. Should the outside supplier's offer be occepted? 3. Suppose that if the carouretors were purchased. Troy Englaes. Limited, could use the fieed capacity to launch a new product. The segment margin of the new product would be $200.000 peryear. Gwen this new assumption, what would be the financial adivantage (disadvantage) of buylng 20.000 carburetors from tne oureide supplier? 4. Given the new assumption in requirement 3, should the outside supplier's offer be occepted?. (3) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Asaming the company has no alternative use for the facilites shat are row being uned to produte the carburetors, what would be the financial advantage (disadvantage) of buying. 20 iodo carbureteri from the outide supplier? Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplief has offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $36 per unic. To evaluate this offer, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally. Requlred: 1. Assuming the company has tho alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 20.000 carburetors from the outside supplier? 2. Should the outside supplier's offer be accepted? 3. Suppose that if the carouretors were purchased, Troy Engines, Limited, could use the freed capacity to la unch a new product. The segment matgin of the new product would be $200,000 per year. Glven this new assumption, what would be the financial advantage (oisadvantage) of buying 20.000 carburetors from the outslde supplier? 4. Given the new assumption In reoulrement 3 . should the outs de supplier's offer be accepted? Q) Answer is complete but not entirely correct. Camplete this question by entering your answers in the tabs below. Suppose that if the carburetors were purchased. Troy Enginesi Limited. could use the freed capacity to launch a new product. The segment margin of the new product would be 5200,000 per yean Given this rew assumption. Wihat would be the financial advantage (disadvantage) of buying 20,000 carburators from the outside supplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started