Need help with sections B and C. Thanks!

Need help with sections B and C. Thanks!

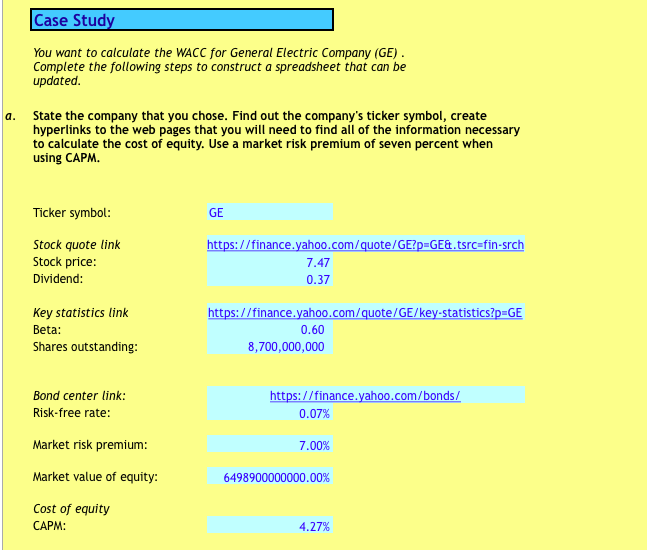

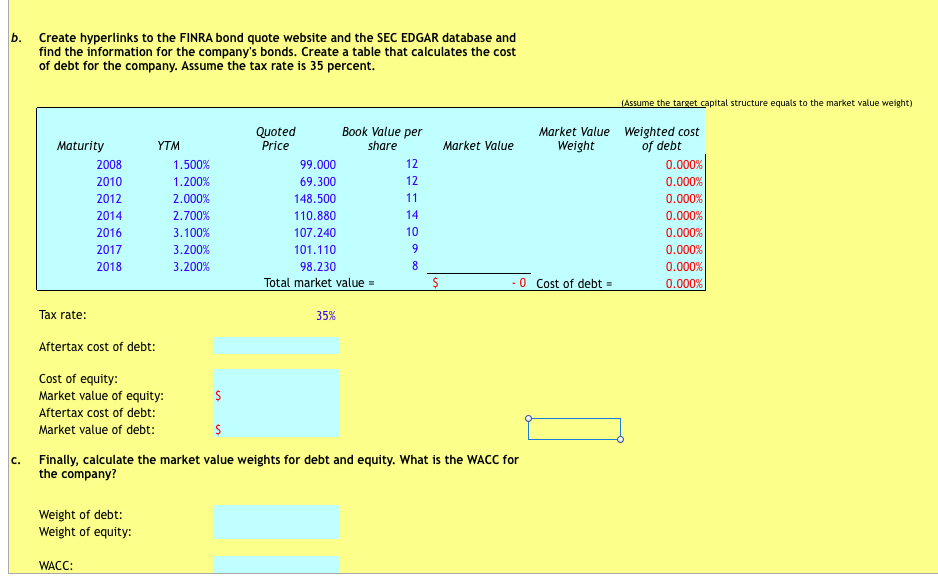

Case Stud You want to calculate the WACC for General Electric Company (GE) Complete the following steps to construct a spreadsheet that can be updated State the company that you chose. Find out the company's ticker symbol, create hyperlinks to the web pages that you will need to find all of the information necessary to calculate the cost of equity. Use a market risk premium of seven percent when using CAPM a. Ticker symbol GE Stock quote link Stock price Dividend //finance com/quote/GE?D GE&.tsrc-fin-srch 7.47 0.37 Key statistics link Beta: Shares outstanding https://finance om/quote/GE/key-statistics?p GE 0.60 8,700,000,000 Bond center link Risk-free rate: ://finance.vahoo.com/bonds/ 0.07% Market risk premium Market value of equity: Cost of equity 700% 6498900000000.00% CAPM: 4.27% b. Create hyperlinks to the FINRA bond quote website and the SEC EDGAR database and find the information for the company's bonds. Create a table that calculates the cost of debt for the company. Assume the tax rate is 35 percent. l structure equals to the market value weight) Quoted Price Book Value per Market Value Weight Weighted cost Maturity YTM share Market Value of debt 2008 2010 12 12 1. 500% 1.200% 2.000% 2.700% 3.100% 3. 200% 3. 200% 99.000 69.300 148.500 110.880 107.240 101.110 98.230 Total market value 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 2014 2016 2017 2018 14 10 0 Cost of debt- Tax rate: 35% Aftertax cost of debt: Cost of equity: Market value of equity: Aftertax cost of debt: Market value of debt: Finally, calculate the market value weights for debt and equity. What is the WACC for the company? c. Weight of debt: Weight of equity: WACC: Case Stud You want to calculate the WACC for General Electric Company (GE) Complete the following steps to construct a spreadsheet that can be updated State the company that you chose. Find out the company's ticker symbol, create hyperlinks to the web pages that you will need to find all of the information necessary to calculate the cost of equity. Use a market risk premium of seven percent when using CAPM a. Ticker symbol GE Stock quote link Stock price Dividend //finance com/quote/GE?D GE&.tsrc-fin-srch 7.47 0.37 Key statistics link Beta: Shares outstanding https://finance om/quote/GE/key-statistics?p GE 0.60 8,700,000,000 Bond center link Risk-free rate: ://finance.vahoo.com/bonds/ 0.07% Market risk premium Market value of equity: Cost of equity 700% 6498900000000.00% CAPM: 4.27% b. Create hyperlinks to the FINRA bond quote website and the SEC EDGAR database and find the information for the company's bonds. Create a table that calculates the cost of debt for the company. Assume the tax rate is 35 percent. l structure equals to the market value weight) Quoted Price Book Value per Market Value Weight Weighted cost Maturity YTM share Market Value of debt 2008 2010 12 12 1. 500% 1.200% 2.000% 2.700% 3.100% 3. 200% 3. 200% 99.000 69.300 148.500 110.880 107.240 101.110 98.230 Total market value 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 2014 2016 2017 2018 14 10 0 Cost of debt- Tax rate: 35% Aftertax cost of debt: Cost of equity: Market value of equity: Aftertax cost of debt: Market value of debt: Finally, calculate the market value weights for debt and equity. What is the WACC for the company? c. Weight of debt: Weight of equity: WACC

Need help with sections B and C. Thanks!

Need help with sections B and C. Thanks!