need help with solutions!

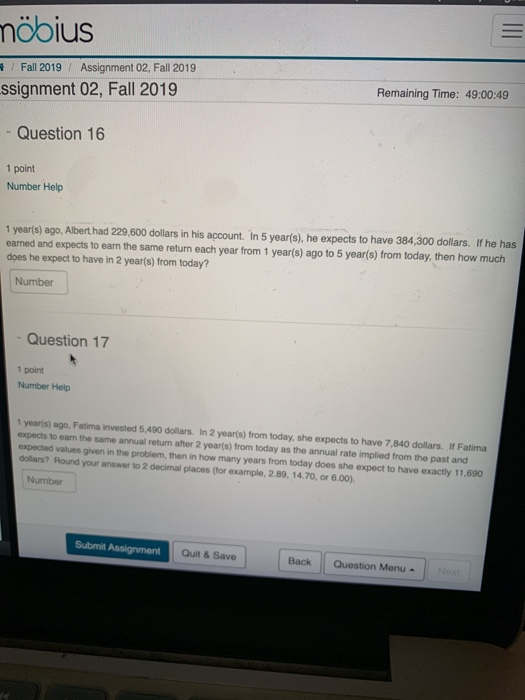

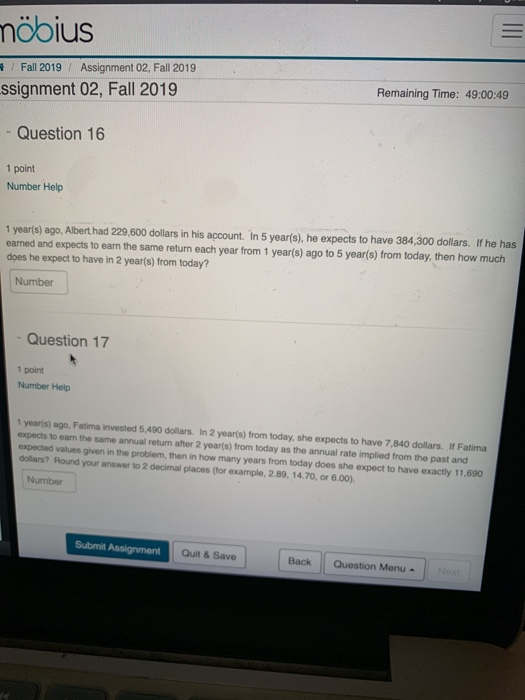

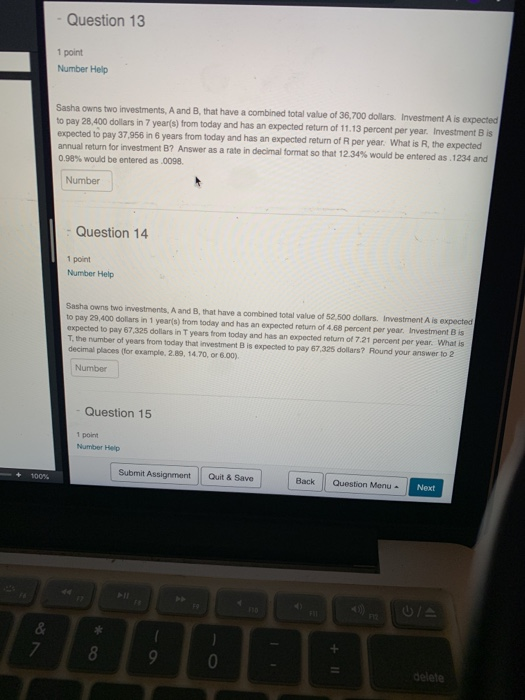

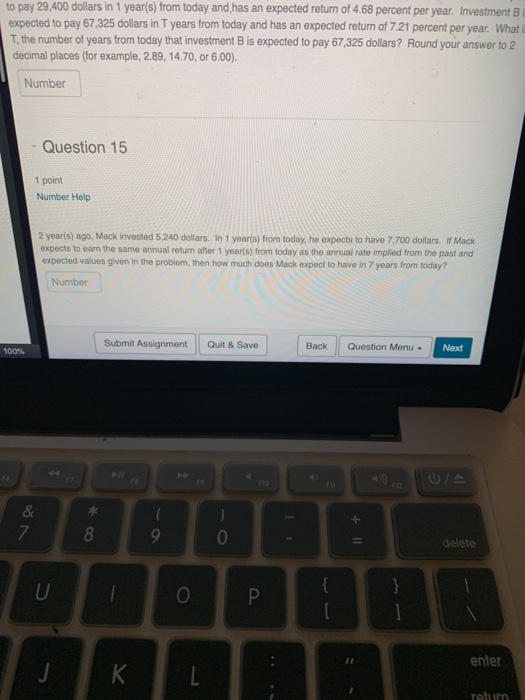

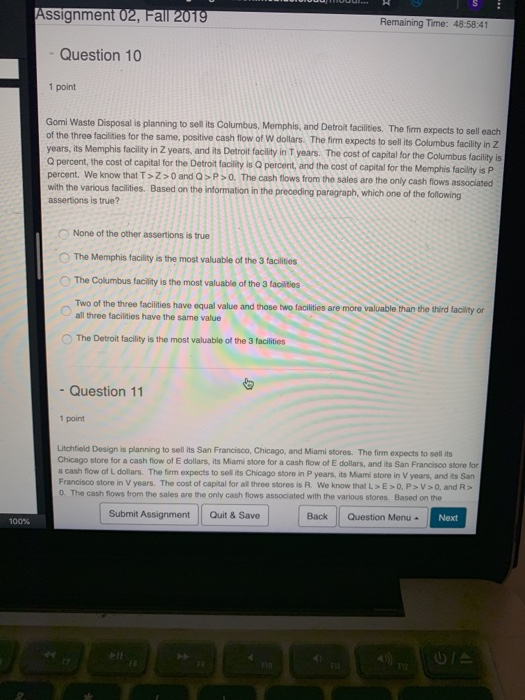

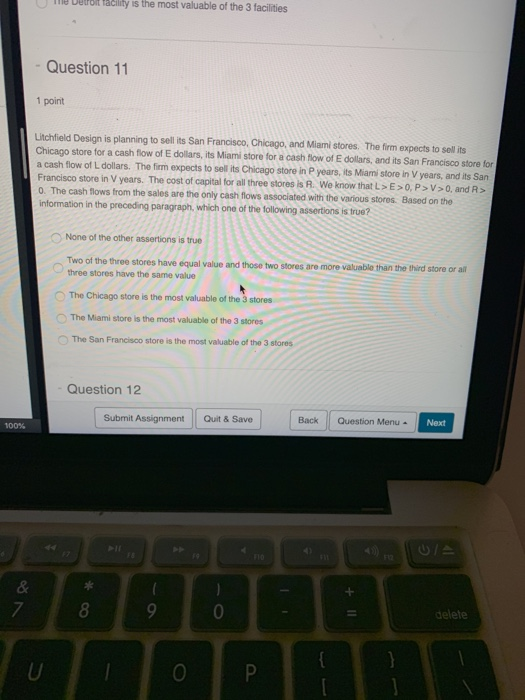

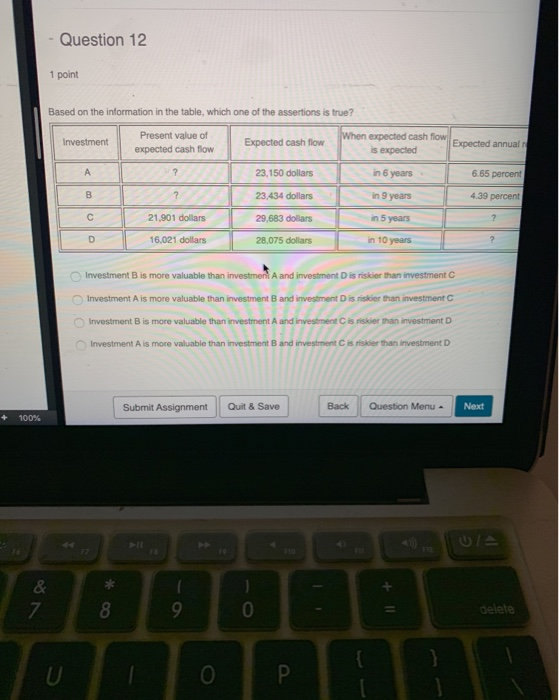

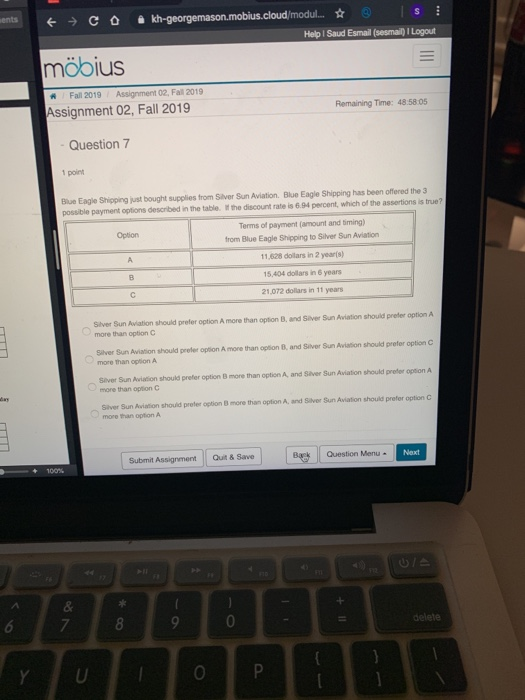

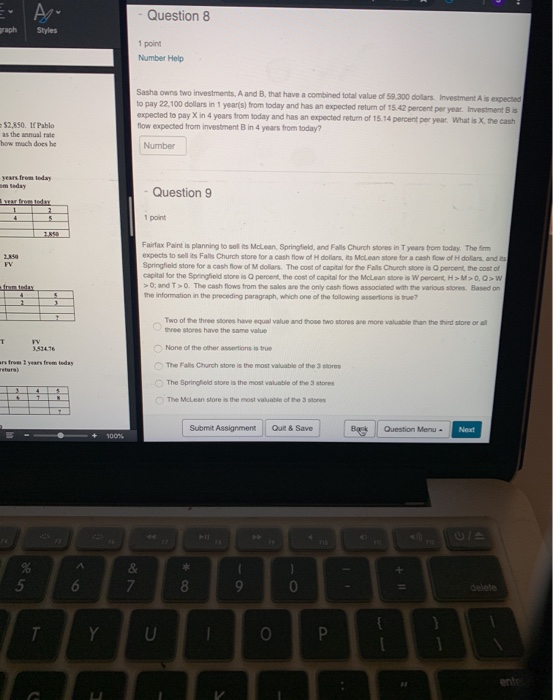

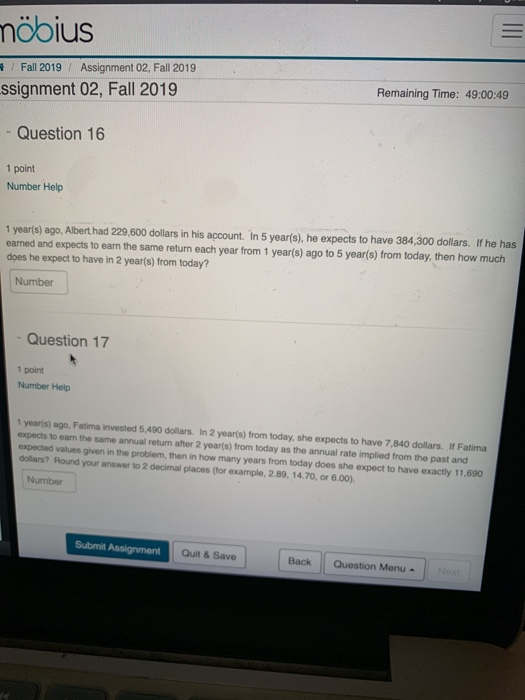

nbius Assignment 02, Fall 2019 Fall 2019 Remaining Time: 49:00:49 ssignment 02, Fall 2019 Question 16 1 point Number Help 1 year(s) ago, Albert.had 229,600 dollars in his account. In 5 year(s), he expects to have 384,300 dollars. If he has earned and expects to earn the same return each year from 1 year(s) ago to 5 year(s) from today, then how much does he expect to have in 2 year(s) from today? Number Question 17 1 point Number Help 1 year(s) ago, Fatima invested 5,490 dollars. In 2 year(s) from today, she expects to have 7,840 dollars. If Fatima expects to eam the same annual return after 2 year(s) from today as the annual rate implied from the past and expected values given in the problem, then in how many years from today does she expect to have exactly 11,690 dollars? Round your answer to 2 decimal places (for example, 2.89, 14.70, or 6.00) Number Submit Assignment Quit & Save Back Question Menu Next Question 13 1 point Number Help Sasha owns two investments, A and B, that have a combined total value of 36,700 dollars. Investment A is expected to pay 28,400 dollars in 7 year(s) from today and has an expected return of 11.13 percent per year. Investment B is expected to pay 37,956 in 6 years from today and has an expected return of R per year. What is R, the expected annual return for investment B? Answer as a rate in decimal format so that 12.34% would be entered as.1234 and 0.98% would be entered as .0098. Number Question 14 1 point Number Help Sasha owns two investments, A and B, that have a combined total value of 52,500 dollars. Investment A is expected to pay 29,400 dollars in 1 year(s) from today and has an expected retum of 4.68 percent per year Investment B is expected to pay 67,325 dollars in T years from today and has an expectted return of 7.21 percent per year. What is T, the number of years from today that investment B is expected to pay 67,325 dollars? Round your answer to 2 decimal places (for example, 2.89, 14.70, or 6.00) Number Question 15 1 point Number Help Submit Assignment Question Menu Quit & Save Back Next 100% no 7 10 delete II to pay 29,400 dollars in 1 year(s) from today and has an expected return of 4.68 percent per year. Investment B expected to pay 67,325 dollars in T years from today and has an expected return of 7.21 percent per year. What i T, the number of years from today that investment B is expected to pay 67,325 dollars? Round your answer to 2 decimal places (for example, 2.89, 14.70, or 6.00). Number Question 15 1 point Number Help 2 year(s) ago, Mack invested 5,240 dollars. In 1 year(s) from today, he expects to have 7,700 dollars. If Mack expects to earn the same annual return after 1 year(s) from today as the annual rate implied from the past and expected values given in the problem, then how much does Mack expect to have in 7 years from today? Number Question Menu Submit Assignment Next Quit & Save Back 100% G/P F12 & 7 delete U enter K return +II PP Assignment 02, Fall 2019 Remaining Time: 48:58:41 Question 10 1 point Gomi Waste Disposal is planning to sell its Columbus, Memphis, and Detroit facilities. The firm expects to sell each of the three facilities for the same, positive cash flow of W dollars. The firm expects to sell its Columbus facility in Z years, its Memphis facility in Z years, and its Detroit facility in T years. The cost of capital for the Columbus facility is Q percent, the cost of capital for the Detroit facility is Q percent, and the cost of capital for the Memphis facility is P percent. We know that T> Z>0 and Q> P>0. The cash flows from the sales are the only cash flows associated with the various facilities. Based on the information in the preceding paragraph, which one of the following assertions is true? None of the other assertions is true The Memphis facility is the most valuable of the 3 facilities The Columbus facility is the most valuable of the 3 facilities Two of the three facilities have equal value and those two facilities are more valuable than the third facility or all three facilities have the same value The Detroit facility is the most valuable of the 3 facilities Question 11 1 point Litchfield Design is planning to sell its San Francisco, Chicago, and Miami stores. The firm expects to sell its Chicago store for a cash flow of E dollars, its Miami store for a cash flow of E dollars, and its San Francisco store for a cash flow of L dollars. The firm expects to sell its Chicago store in P years, its Miami store in V years, and its San Francisco store in V years. The cost of capital for all three stores is R. We know that L> E> 0, P> V>0 , and R> 0. The cash flows from the sales are the only cash flows associated with the various stores. Based on the Submit Assignment Quit & Save Back Question Menu Next 100% FIO Fit Te Detroit tacility is the most valuable of the 3 facilities Question 11 1 point Litchfield Design is planning to sell its San Francisco, Chicago, and Miami stores. The firm expects to sell its Chicago store for a cash flow of E dollars, its Miami store for a cash flow of E dollars, and its San Francisco store for a cash flow of L dollars. The firm expects to sell its Chicago store in P years, its Miami store in V years, and its San Francisco store in V years. The cost of capital for all three stores is R. We know that L> E> 0, P> V> 0, and R> 0. The cash flows from the sales are the only cash flows associated with the various stores. Based on the information in the preceding paragraph, which one of the following assertions is true? None of the other assertions is true Two of the three stores have equal value and those two stores are more valuable than the third store or all three stores have the same value The Chicago store is the most valuable of the 3 stores The Miami store is the most valuable of the 3 stores The San Francisco store is the most valuable of the 3 stores Question 12 Question Menu Next Quit & Save Back Submit Assignment 100% 4) * delete 7 P Question 12 1 point Based on the information in the table, which one of the assertions is true? When expected cash flow Expected annual r Present value of Investment Expected cash flow expected cash flow is expected A 6.65 percent 23,150 dollars in 6 years 4.39 percent in 9 years 23,434 dollars C 29,683 dollars 21,901 dollars in 5 years D 16,021 dollars in 10 years 28,075 dollars Investment B is more valuable than investmenA and investment D is riskier than investment C Investment A is more valuable than investment B and investment D is riskier than investment C Investment B is more valuable than investment A and investment C is riskier than investment D Investment A is more valuable than investment B and investment C is riskier than investment D Question Menu Back Next Submit Assignment Quit & Save + 100% FI0 7 delete P U +II ents kh-georgemason.mobius.cloud/modul... Help I Saud Esmail (sesmail) I Logout mbius Fall 2019 Assignment 02, Fall 2019 Assignment 02, Fall 2019 Remaining Time: 48 58:05 Question 7 1 point Blue Eagle Shipping just bought supplies from Silver Sun Aviation. Blue Eagle Shipping has been offered the 3 possible payment options described in the table. i the discount rate is 6.94 percent, which of the assertions is true? Terms of payment (amount and timing) Option from Blue Eagle Shipping to Silver Sun Aviation 11,628 dolars in 2 year(s) A 15.404 dollars in 6 years B 21.072 dollars in 11 years C Slver Sun Aviation should prefer option A more than option B, and Silver Sun Aviation should prefer option A more than option C Silver Sun Aviation should prefler option A more than option B, and Silver Sun Aviation should prefer option C more than cption A Slver Sun Aviation should prefer option B more than option A, and Silver Sun Aiation should prefer option A more than option C day Siver Sun Aviation should prefer option B more than option A, and Silver Sun Aviation should prefer option C more than option A Question Menu Submit Assignment Quit & Save Back Next 100% & 6 7 8 delete Y 1P +II As- Question 8 raph Styles 1 point Number Help Sasha owns two investments, A and B, that have a combined total value of 59,300 dollars. Investment A is expected to pay 22,100 dollars in 1 years) from today and has an expected return of 15.42 percent per year. Investment B is expected to pay X in 4 years from today and has an expected retum of 15.14 percent per year. What is X, the cash flow expected from investment B in 4 years from today $2,850. If Pablo as the annual rate how much does he Number years from today m teday Question 9 vear from todan 1 point 2850 Fairfax Paint is planning to sell its McLean, Springfield, and Falls Church stores in T years from today. The firm expects to sell its Falls Church store for a cash flow of H dollars, its Mclean store for a cash flow of H dollars, and its Springfield store for a cash flow of M dollars. The cost of capital for the Fals Church store is Q percent, the cost of capital for the Springfield store is Q percent, the cost of capital for the McLean store is W percent, H> M>0, Q>W >0; and T>0. The cash flows from the sales are the only cash flows associated with the various stores. Based on the information in the preceding paragraph, which one of the following assertions is true? 2850 FV fram teday Two of the three stores have equal value and those two stores are more valuable than the third store or all three stores have the same value T None of the other assertions is true 3,52476 ars from 2 years frem teday returs) The Falls Church store is the most valuable of the 3 stores The Springfield store is the most valuable of the 3 stores The McLean store is the most valuable of the 3 stores i Quit &Save Submit Assignment Question Menu Bak Next 100% & 5 8 delete T Y U P ente +I 7