Answered step by step

Verified Expert Solution

Question

1 Approved Answer

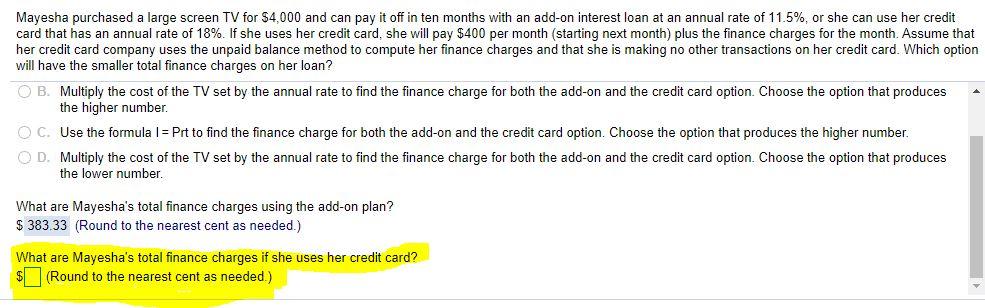

need help with the highlighted question Mayesha purchased a large screen TV for $4,000 and can pay it off in ten months with an add-on

need help with the highlighted question

Mayesha purchased a large screen TV for $4,000 and can pay it off in ten months with an add-on interest loan at an annual rate of 11.5%, or she can use her credit card that has an annual rate of 18%. If she uses her credit card, she will pay $400 per month (starting next month) plus the finance charges for the month. Assume that her credit card company uses the unpaid balance method to compute her finance charges and that she is making no other transactions on her credit card. Which option will have the smaller total finance charges on her loan? OB Multiply the cost of the TV set by the annual rate to find the finance charge for both the add-on and the credit card option. Choose the option that produces the higher number OC. Use the formula I = Prt to find the finance charge for both the add-on and the credit card option. Choose the option that produces the higher number. OD. Multiply the cost of the TV set by the annual rate to find the finance charge for both the add-on and the credit card option. Choose the option that produces the lower number. What are Mayesha's total finance charges using the add-on plan? $ 383.33 (Round to the nearest cent as needed.) What are Mayesha's total finance charges if she uses her credit card? $(Round to the nearest cent as needed.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started