Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with the inventory stock card, I think I have the first entry correct but not the second entry and don't know where I

Need help with the inventory stock card, I think I have the first entry correct but not the second entry and don't know where I am going wrong.

Need help with the inventory stock card, I think I have the first entry correct but not the second entry and don't know where I am going wrong.

Thank you!

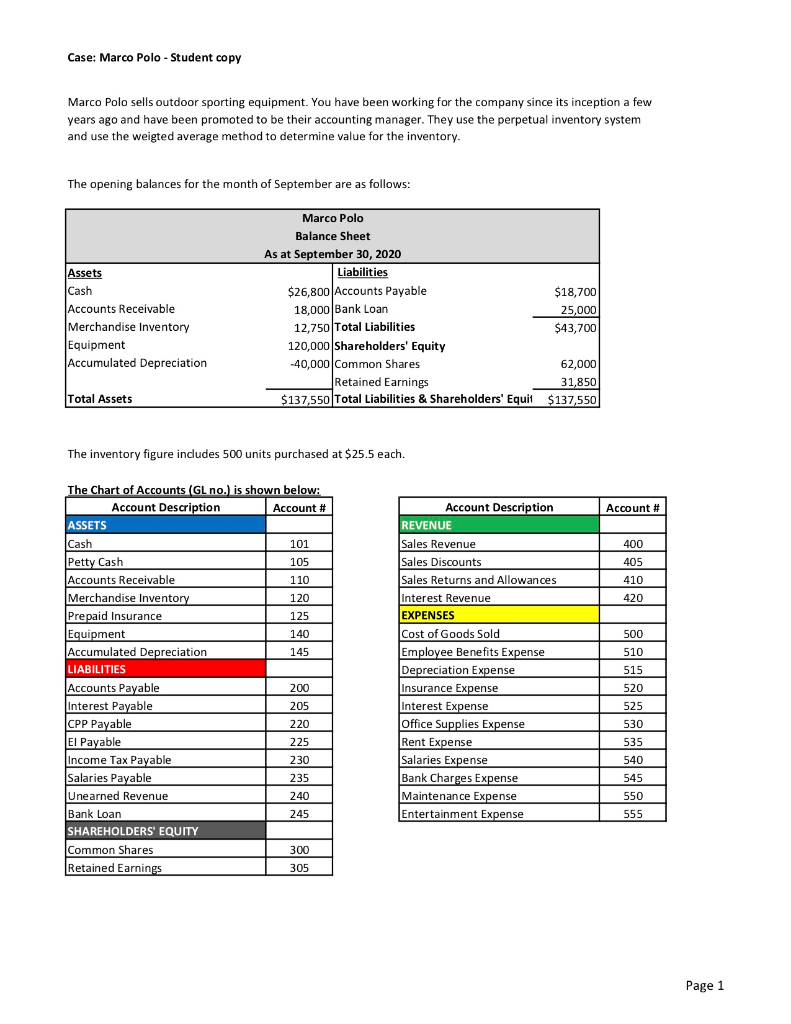

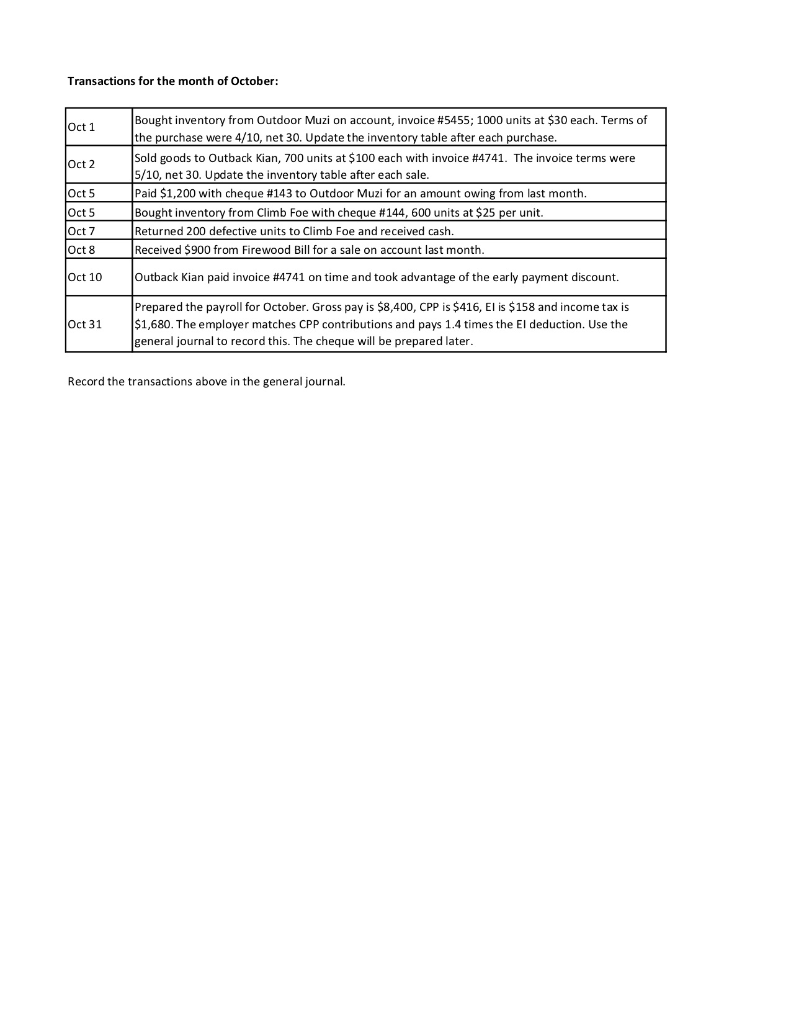

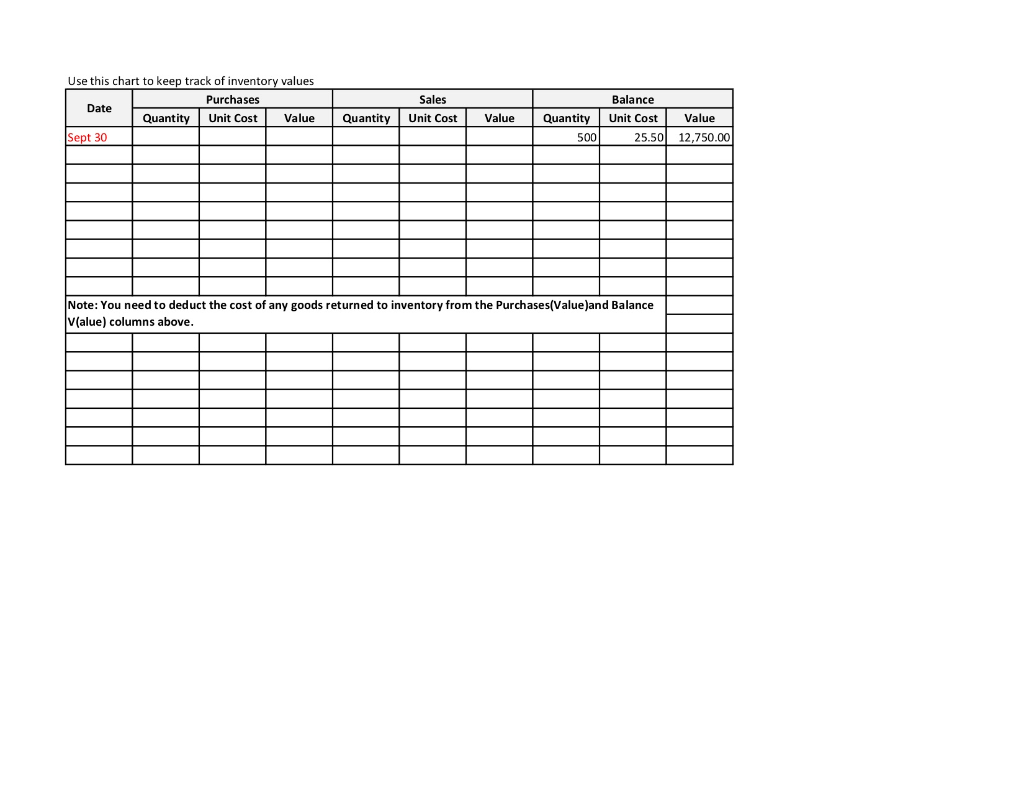

Case: Marco Polo - Student copy Marco Polo sells outdoor sporting equipment. You have been working for the company since its inception a few years ago and have been promoted to be their accounting manager. They use the perpetual inventory system and use the weigted average method to determine value for the inventory. The opening balances for the month of September are as follows: Assets Cash Accounts Receivable Merchandise Inventory Equipment Accumulated Depreciation Marco Polo Balance Sheet As at September 30, 2020 Liabilities $26,800 Accounts Payable $18,700 18,000 Bank Loan 25,000 12,750 Total Liabilities $43,700 120,000 Shareholders' Equity -40,000 Common Shares 62,000 Retained Earnings 31,850 $137,550 Total Liabilities & Shareholders' Equit $137,550 Total Assets The inventory figure includes 500 units purchased at $25.5 each. Account # 400 405 410 420 81 The Chart of Accounts GL no.) is shown below: Account Description Account # ASSETS Cash 101 Petty Cash 105 Accounts Receivable 110 Merchandise Inventory 120 Prepaid Insurance 125 Equipment 140 Accumulated Depreciation 145 LIABILITIES Accounts Payable 200 Interest Payable 205 CPP Payable 220 El Payable 225 Income Tax Payable 230 Salaries Payable Unearned Revenue Bank Loan 245 SHAREHOLDERS' EQUITY Common Shares 300 Retained Earnings 305 Account Description REVENUE Sales Revenue Sales Discounts Sales Returns and Allowances Interest Revenue EXPENSES Cost of Goods Sold Employee Benefits Expense Depreciation Expense Insurance Expense Interest Expense Office Supplies Expense Rent Expense Salaries Expense Bank Charges Expense Maintenance Expense Entertainment Expense allolla 235 555 Page 1 Transactions for the month of October: Oct 1 Oct 2 Oct 5 Oct 5 Oct 7 Oct 8 Bought inventory from Outdoor Muzi on account, invoice #5455; 1000 units at $30 each. Terms of the purchase were 4/10, net 30. Update the inventory table after each purchase. Sold goods to Outback Kian, 700 units at $ 100 each with invoice #4741. The invoice terms were 5/10, net 30. Update the inventory table after each sale. Paid $1,200 with cheque #143 to Outdoor Muzi for an amount owing from last month. Bought inventory from Climb Foe with cheque #144, 600 units at $25 per unit. Returned 200 defective units to Climb Foe and received cash. Received $900 from Firewood Bill for a sale on account last month. Oct 10 Outback Kian paid invoice #4741 on time and took advantage of the early payment discount. Oct 31 Prepared the payroll for October. Gross pay is $8,400, CPP is $416, El is $158 and income tax is $1,680. The employer matches CPP contributions and pays 1.4 times the El deduction. Use the general journal to record this. The cheque will be prepared later. Record the transactions above in the general journal. Use this chart to keep track of inventory values Purchases Date Quantity Unit Cost Value Sept 30 Quantity Sales Unit Cost Value Quantity 500 Balance Unit Cost 25.50 Value 12,750.00 Note: You need to deduct the cost of any goods returned to inventory from the Purchases(Value)and Balance Value) columns aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started