Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need Help with the second part Presented here are selected transactions for Sheridan Limited for 2018. Sheridan uses straight-line depreciation and records adjusting entries annually.

need Help with the second part

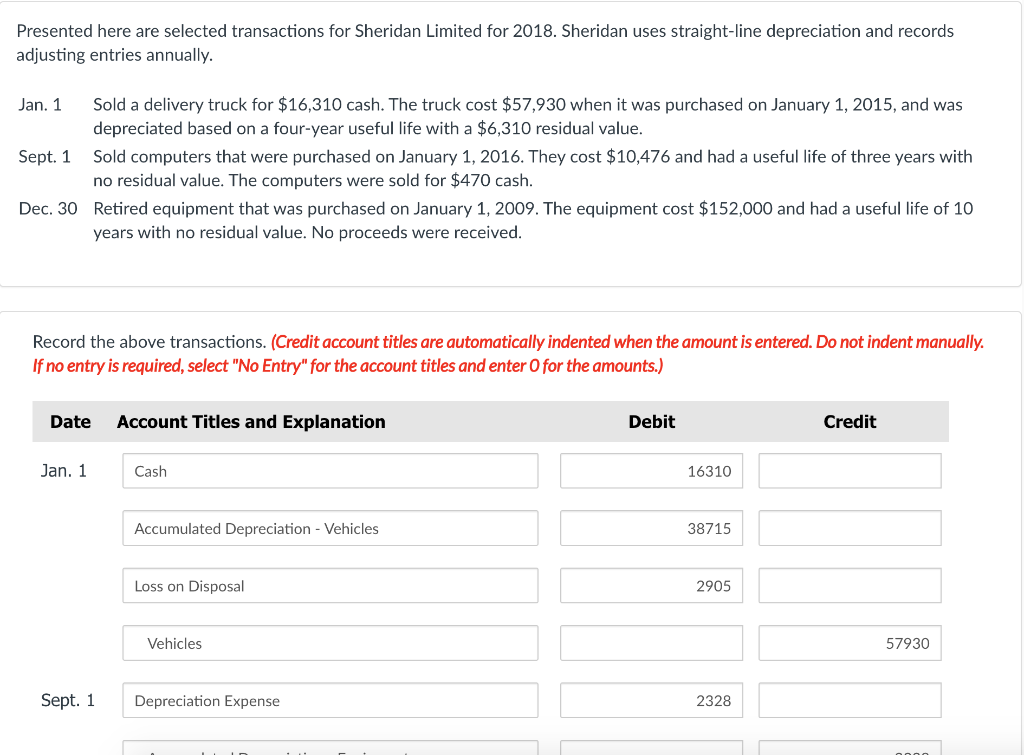

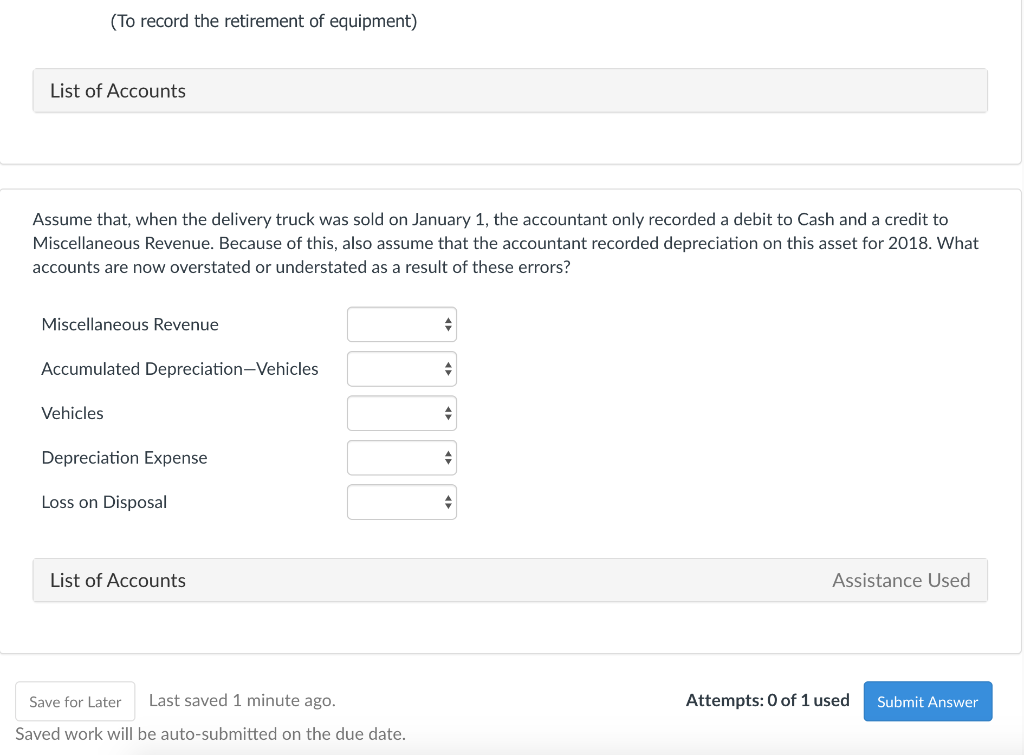

Presented here are selected transactions for Sheridan Limited for 2018. Sheridan uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a delivery truck for $16,310 cash. The truck cost $57,930 when it was purchased on January 1, 2015, and was depreciated based on a four-year useful life with a $6,310 residual value. Sept. 1 Sold computers that were purchased on January 1, 2016. They cost $10,476 and had a useful life of three years with no residual value. The computers were sold for $470 cash. Dec. 30 Retired equipment that was purchased on January 1, 2009. The equipment cost $152,000 and had a useful life of 10 years with no residual value. No proceeds were received. Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1 Cash 16310 Accumulated Depreciation - Vehicles 38715 Loss on Disposal 2905 Vehicles 57930 Sept. 1 Depreciation Expense 2328 (To record the retirement of equipment) List of Accounts Assume that, when the delivery truck was sold on January 1, the accountant only recorded a debit to Cash and a credit to Miscellaneous Revenue. Because of this, also assume that the accountant recorded depreciation on this asset for 2018. What accounts are now overstated or understated as a result of these errors? Miscellaneous Revenue Accumulated Depreciation-Vehicles Vehicles Depreciation Expense Loss on Disposal List of Accounts Assistance Used Save for Later Last saved 1 minute ago. Attempts: 0 of 1 used Submit Answer Saved work will be auto-submitted on the due dateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started