Answered step by step

Verified Expert Solution

Question

1 Approved Answer

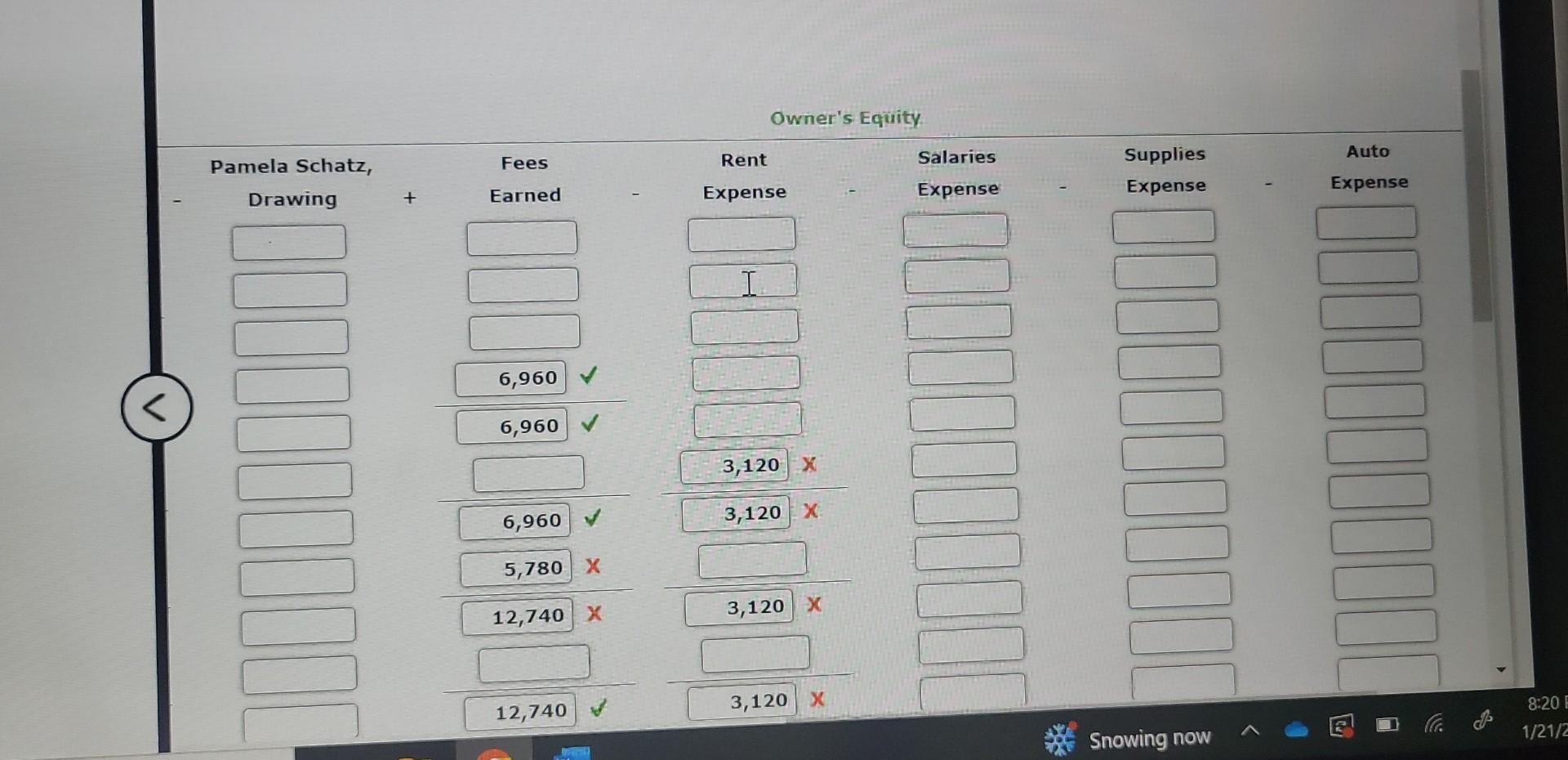

need help with the wrong ones On June 1 of the current year, Pamela Schatz established a business to manage rental property. She completed the

need help with the wrong ones

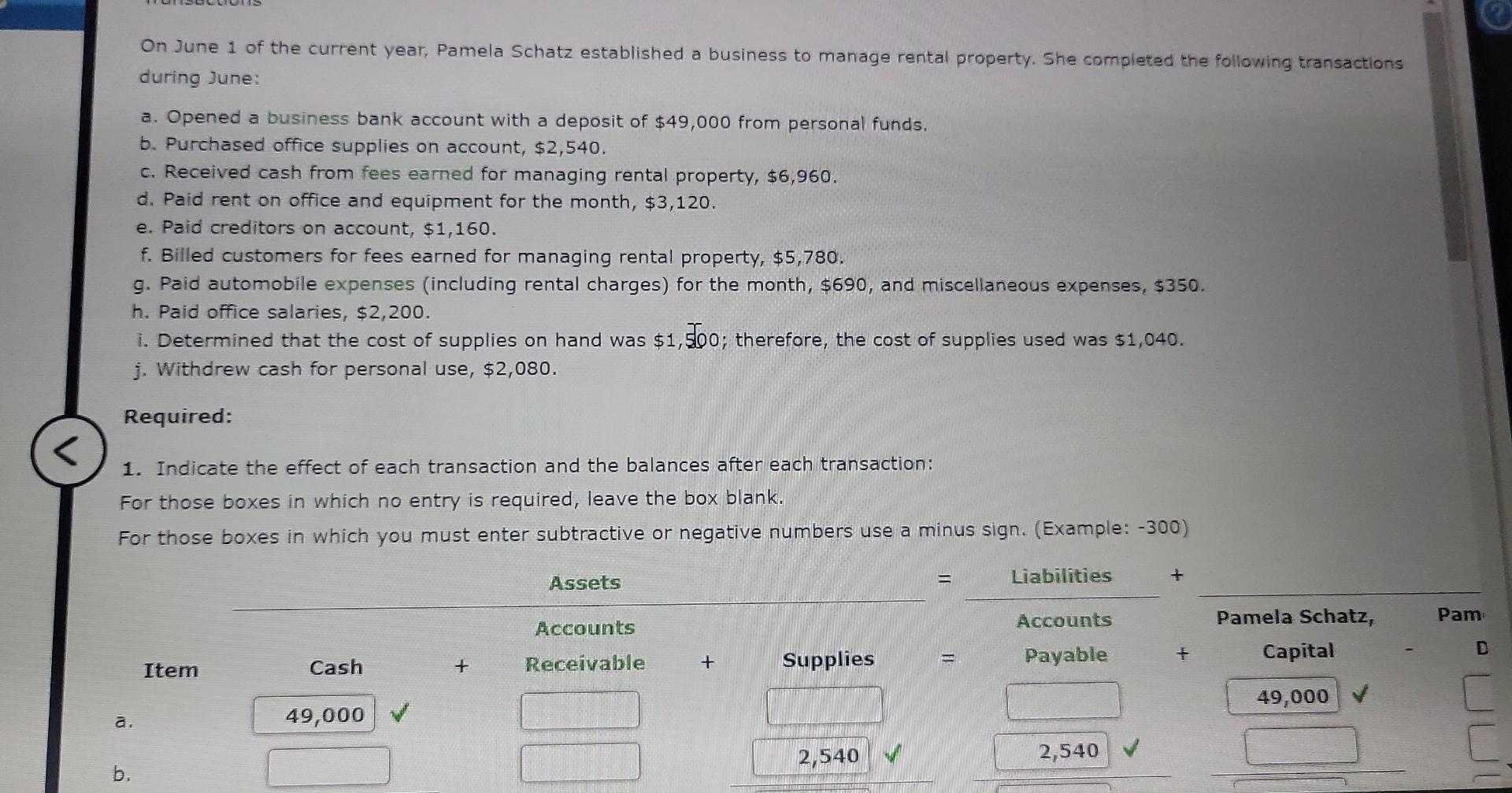

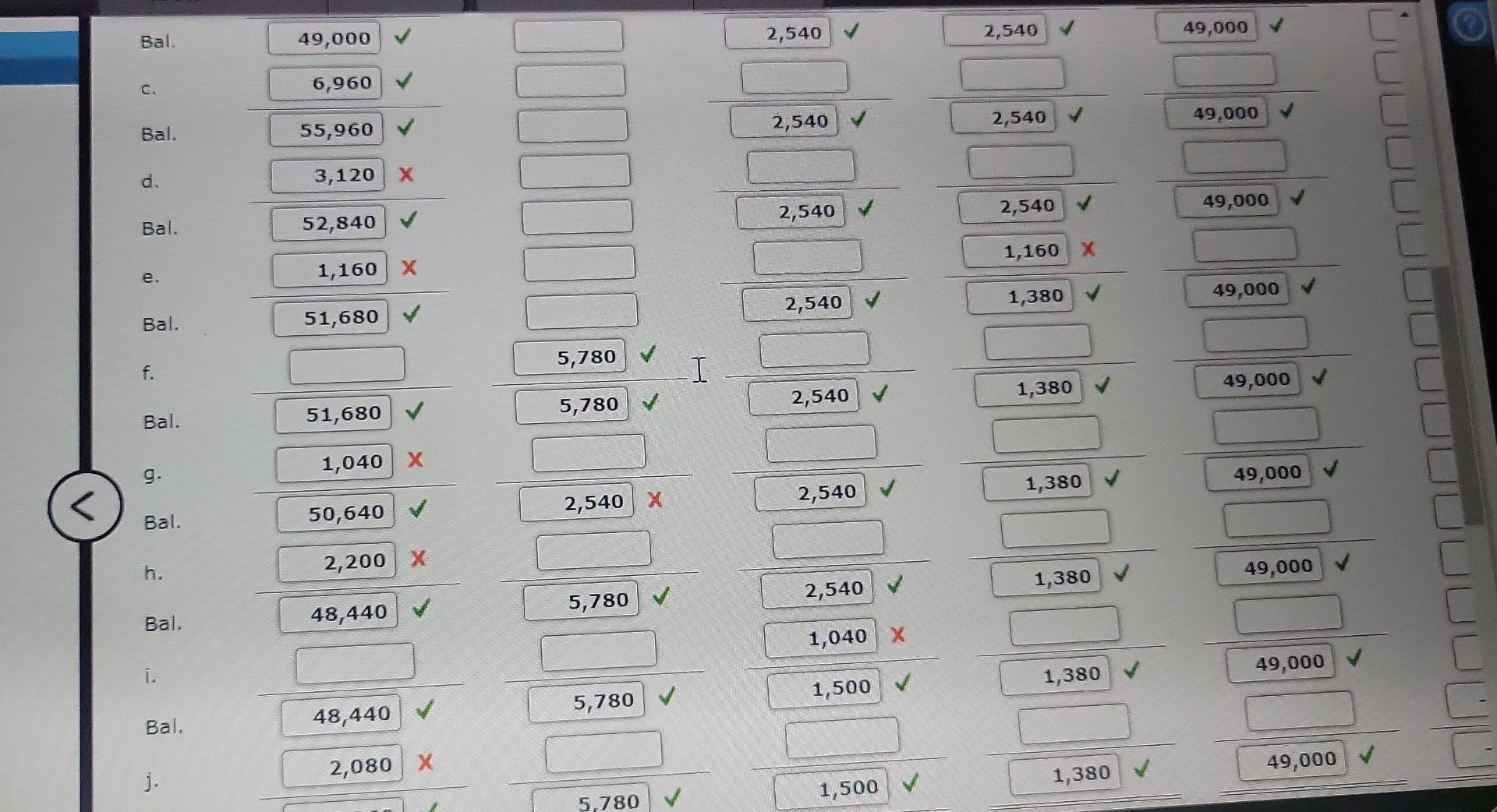

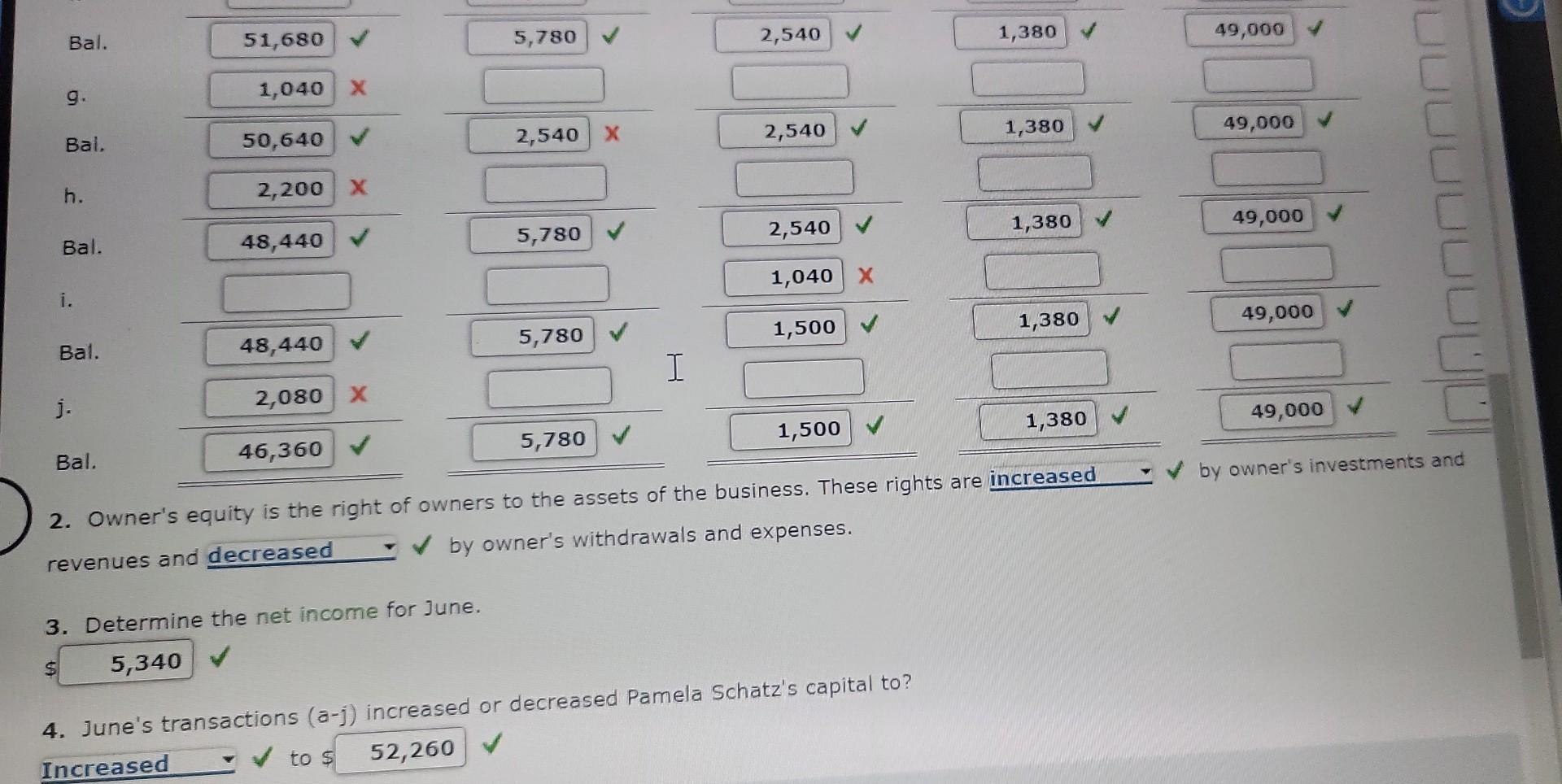

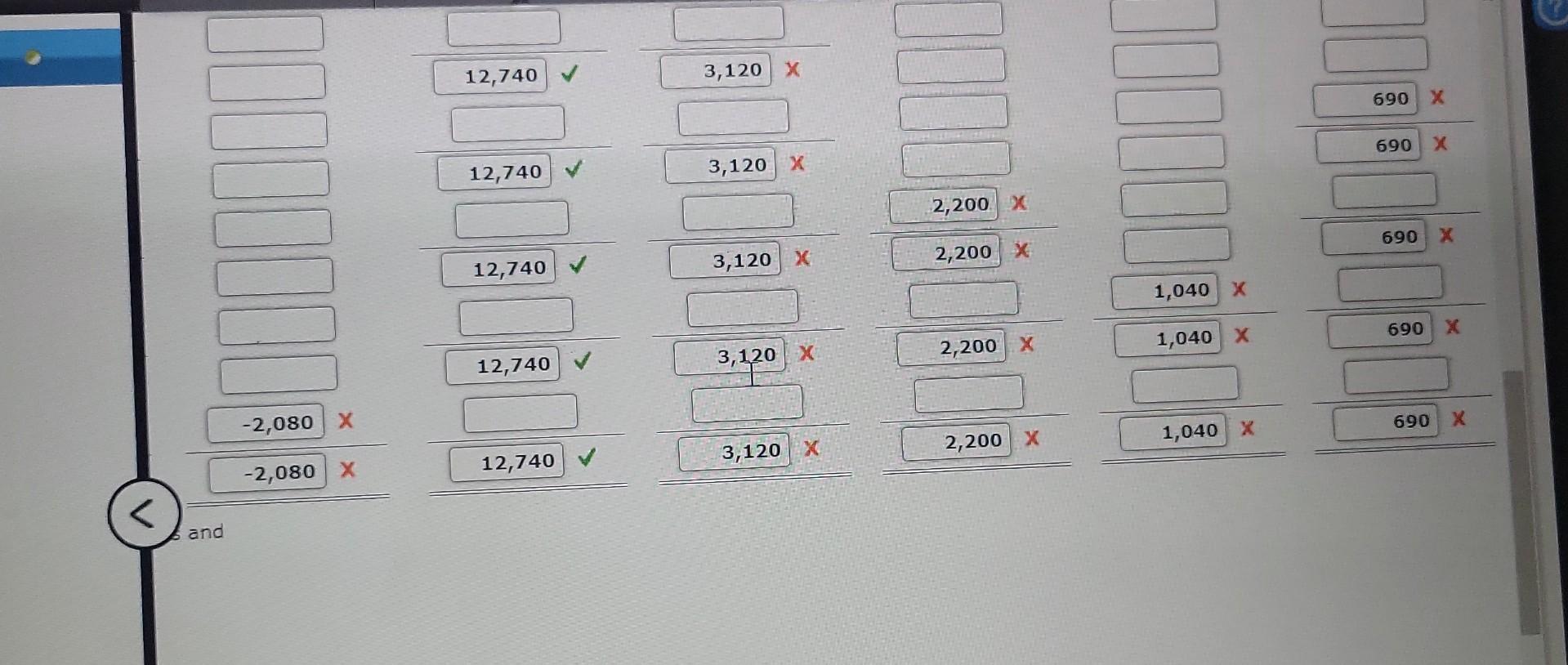

On June 1 of the current year, Pamela Schatz established a business to manage rental property. She completed the following transactlons during June: a. Opened a business bank account with a deposit of $49,000 from personal funds. b. Purchased office supplies on account, $2,540. c. Received cash from fees earned for managing rental property, $6,960. d. Paid rent on office and equipment for the month, $3,120. e. Paid creditors on account, $1,160. f. Billed customers for fees earned for managing rental property, $5,780. 9. Paid automobile expenses (including rental charges) for the month, $690, and miscellaneous expenses, $350. h. Paid office salaries, $2,200. i. Determined that the cost of supplies on hand was $1,500; therefore, the cost of supplies used was $1,040. j. Withdrew cash for personal use, $2,080. Required: 1. Indicate the effect of each transaction and the balances after each transaction: For those boxes in which no entry is required, leave the box blank. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300) 2. Owner's equity is the right of owners to the assets of the business. These rights are revenues and by owner's withdrawals and expenses. 3. Determine the net income for June. 4. June's transactions (aj) increased or decreased Pamela Schatz's capital to? to s 12,740 3,120 12,740 3,120 x 690 12,740 3,120 x2,200 12,740 3,120 x2,200 x 690x 2,080]x 2,080 x12,740 3,120 x2,200 x 1,040 X. 690 and numinarle Ernitity On June 1 of the current year, Pamela Schatz established a business to manage rental property. She completed the following transactlons during June: a. Opened a business bank account with a deposit of $49,000 from personal funds. b. Purchased office supplies on account, $2,540. c. Received cash from fees earned for managing rental property, $6,960. d. Paid rent on office and equipment for the month, $3,120. e. Paid creditors on account, $1,160. f. Billed customers for fees earned for managing rental property, $5,780. 9. Paid automobile expenses (including rental charges) for the month, $690, and miscellaneous expenses, $350. h. Paid office salaries, $2,200. i. Determined that the cost of supplies on hand was $1,500; therefore, the cost of supplies used was $1,040. j. Withdrew cash for personal use, $2,080. Required: 1. Indicate the effect of each transaction and the balances after each transaction: For those boxes in which no entry is required, leave the box blank. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300) 2. Owner's equity is the right of owners to the assets of the business. These rights are revenues and by owner's withdrawals and expenses. 3. Determine the net income for June. 4. June's transactions (aj) increased or decreased Pamela Schatz's capital to? to s 12,740 3,120 12,740 3,120 x 690 12,740 3,120 x2,200 12,740 3,120 x2,200 x 690x 2,080]x 2,080 x12,740 3,120 x2,200 x 1,040 X. 690 and numinarle ErnitityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started