Need help with these exercises to understand it better.

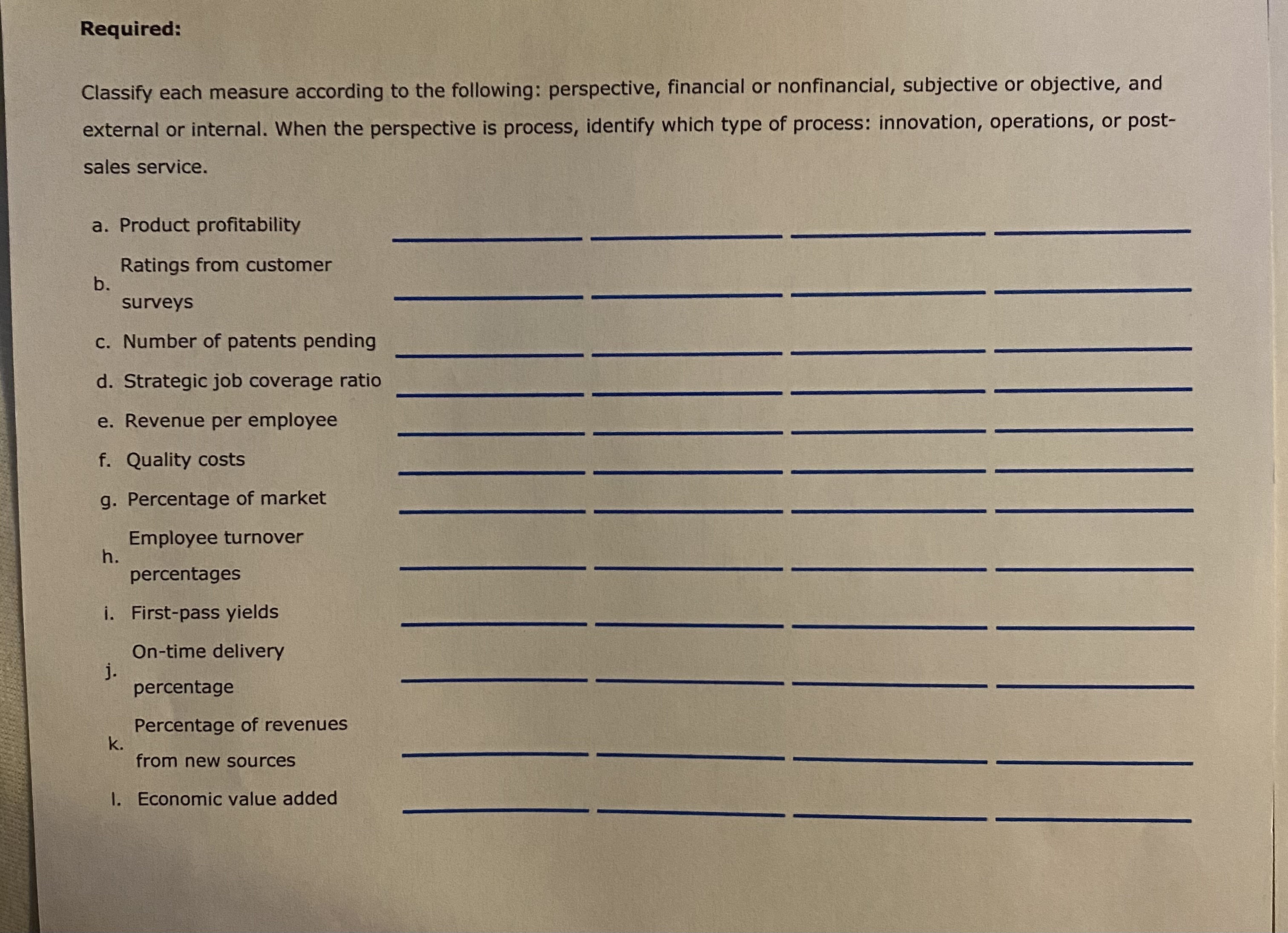

1. CEX. 10.03.ALGO (Algorithmic) Calculating Weighted Average Cost of Capital and Economic Value Added (EVA) Ignacio, Inc., had after-tax operating income last year of $1,200,000. Three sources of financing were used by the company: $2 million of mortgage bonds paying 4 percent interest, $5 million of unsecured bonds paying 6 percent interest, and $10 million in common stock, which was considered to be relatively risky (with a risk premium of 8 percent). The rate on long-term treasuries is 3 percent. Ignacio, Inc., pays a marginal tax rate of 30 percent. Required: 1. Calculate the after-tax cost of each method of financing. Enter your answers as decimal values rounded to three places. For example, 4.36% would be entered as ".044". Mortgage bonds Unsecured bonds Common stock 2. Calculate the weighted average cost of capital for Ignacio, Inc. Round intermediate calculations to four decimal places. Round your final answer to four decimal places before converting to a percentage. For example, .06349 would be rounded to .0635 and entered as "6.35" percent. /o Calculate the total dollar amount of capital employed for Ignacio, Inc. tA 3. Calculate economic value added (EVA) for Ignacio, Inc., for last year. If the EVA is negative, enter your answer as a negative amount. $ Is the company creating or destroying wealth? 4. What if Ignacio, Inc., had common stock which was less risky than other stocks and commanded a risk premium of 5 percent? How would that affect the weighted average cost of capital? What is the new EVA? In your calculations, round weighted average percentage cost of capital to four decimal places. If the EVA is negative, enter your answer as a negative amount.per unit Do you suppose that Alamosa and Tavaris divisions would choose to transfer at that price? Alamosa Tavaris 4. What if Alamosa Division plans to produce and sell only 65,000 units of the 2.6 cm blade next year? The Carreker, Inc., policy is that all transfers be at full cost. Which division sets the minimum transfer price, and what is it? per unit Which division sets the maximum transfer price, and what is it? $ per unit Do you suppose that Alamosa and Tavaris divisions would choose to transfer? 3. CEX. 13.01.ALGO (Algorithmic) Cycle Time and Velocity Norton Company has the following data for one of its production departments: Theoretical velocity: 770 units per hour Productive minutes available per year: 49,000,000 Annual conversion costs: $245,000,000 Actual velocity: 385 units per hour Required: 1. Calculate the actual conversion cost per unit using actual cycle time and the standard cost per minute. Round your actual cycle time answer to three decimal places and your cost per unit answer to the nearest cent. Actual cycle time minutes per unit Standard cost per minute $ per minute Conversion cost per unit $ per unit 2. Calculate the ideal conversion cost per unit using theoretical cycle time and the standard cost per minute. If required, round your intermediate calculations and final answers to two decimal places. Theoretical cycle time minutes per unit Conversion cost per unit $ per unit2. CEX. 10.05.ALGO (Algorithmic) Determining Market-Based and Negotiated Transfer Prices Carreker, Inc., has a number of divisions, including the Alamosa Division, producer of surgical blades, and the Tavaris Division, a manufacturer of medical instruments. Alamosa Division produces a 2.6 cm steel blade that can be used by Tavaris Division in the production of scalpels. The market price of the blade is $21.00. Cost information for the blade is: Variable product cost $ 10.00 Fixed cost 5.20 Total product cost $15.20 Tavaris needs 15,000 units of the 2.6 cm blade per year. Alamosa Division is at full capacity (90,000 units of the blade). Required: Round your answers to the nearest cent. 1. If Carreker, Inc., has a transfer pricing policy that requires transfer at full product cost, what would the transfer price be? $ per unit Do you suppose that Alamosa and Tavaris divisions would choose to transfer at that price? Alamosa Tavaris 2. If Carreker, Inc., has a transfer pricing policy that requires transfer at full cost plus 25 percent, what would the transfer price be? $ per unit Do you suppose that Alamosa and Tavaris divisions would choose to transfer at that price? Alamosa lavaris 3. If Carreker, Inc., has a transfer pricing policy that requires transfer at variable product cost plus a fixed fee of $2.00 per unit, what would the transfer price be? $ https://v2.cengagenow.com/ilrn/takeAssignment/printUntakenAssignment.do?assWhat incentive exists for managers when cycle time costing is used? 3. What if the actual velocity is 539 units per hour? What is the conversion cost per unit? If required, round your intermediate calculations and final answers to two decimal places. Actual cycle time minutes per unit Conversion cost per unit $ per unit 4. CEX. 13.02.ALGO (Algorithmic) MCE Craig, Inc., has provided the following information for one of its products for each hour of production: Actual velocity: 200 units (per hour) Move time: 20 minutes Inspection time: 14 minutes Rework time: 10 minutes Required: 1. Calculate MCE. If required, round your answer to two decimal places. 2. What is the theoretical cycle time? Calculate MCE using actual and theoretical cycle times. If required, round y answers to two decimal places. Theoretical cycle time minutes Actual cycle time minutes MCE 3. What if waste is reduced by 30 percent? New waste = minutes What is the new MCE? If required, round your answer to two decimal places. What is the new cycle time? minutes 5. EX. 13.07 Balanced Scorecard, Perspectives, Classification of Performance Measures Consider the following list of scorecard measures:Required: Classify each measure according to the following: perspective, financial or nonfinancial, subjective or objective, and external or internal. When the perspective is process, identify which type of process: innovation, operations, or post- sales service. a. Product profitability Ratings from customer b. surveys c. Number of patents pending d. Strategic job coverage ratio e. Revenue per employee f. Quality costs g. Percentage of market Employee turnover h . percentages i. First-pass yields On-time delivery j. percentage Percentage of revenues k. from new sources 1. Economic value added