Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with these four MC questions! 1. Which of the following statements is TRUE? A. Value investors focus on stocks with high book/market price

Need help with these four MC questions!

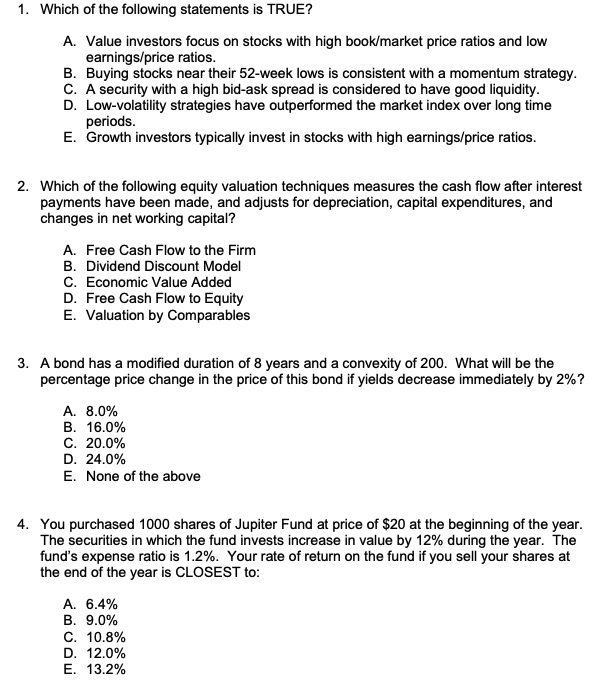

1. Which of the following statements is TRUE? A. Value investors focus on stocks with high book/market price ratios and low earnings/price ratios. B. Buying stocks near their 52-week lows is consistent with a momentum strategy. C. A security with a high bid-ask spread is considered to have good liquidity. D. Low-volatility strategies have outperformed the market index over long time periods. E. Growth investors typically invest in stocks with high earnings/price ratios. 2. Which of the following equity valuation techniques measures the cash flow after interest payments have been made, and adjusts for depreciation, capital expenditures, and changes in net working capital? A. Free Cash Flow to the Firm B. Dividend Discount Model C. Economic Value Added D. Free Cash Flow to Equity E. Valuation by Comparables 3. A bond has a modified duration of 8 years and a convexity of 200. What will be the percentage price change in the price of this bond if yields decrease immediately by 2%? A. 8.0% B. 16.0% C. 20.0% D. 24.0% E. None of the above 4. You purchased 1000 shares of Jupiter Fund at price of $20 at the beginning of the year. The securities in which the fund invests increase in value by 12% during the year. The fund's expense ratio is 1.2%. Your rate of return on the fund if you sell your shares at the end of the year is CLOSEST to: A. 6.4% B. 9.0% C. 10.8% D. 12.0% E. 13.2%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started