Answered step by step

Verified Expert Solution

Question

1 Approved Answer

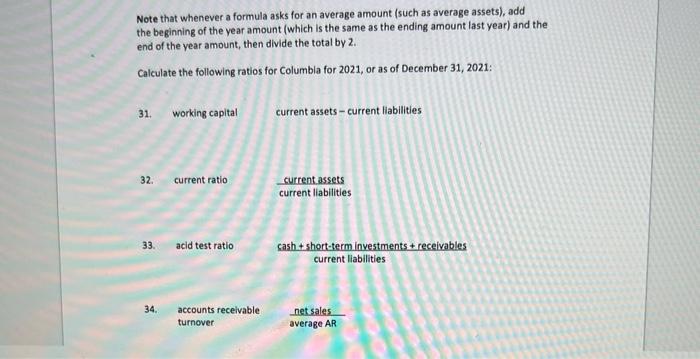

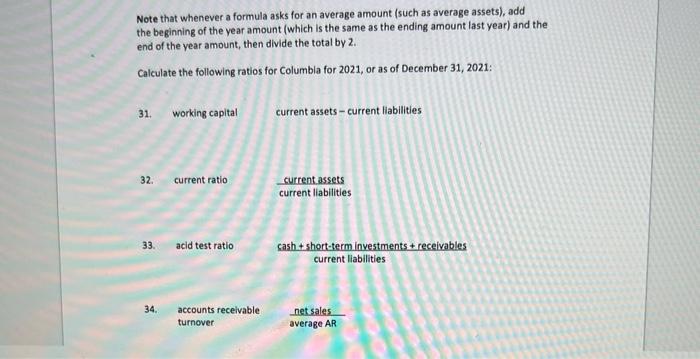

need help with these questions Note that whenever a formula asks for an average amount (such as average assets), add the beginning of the year

need help with these questions

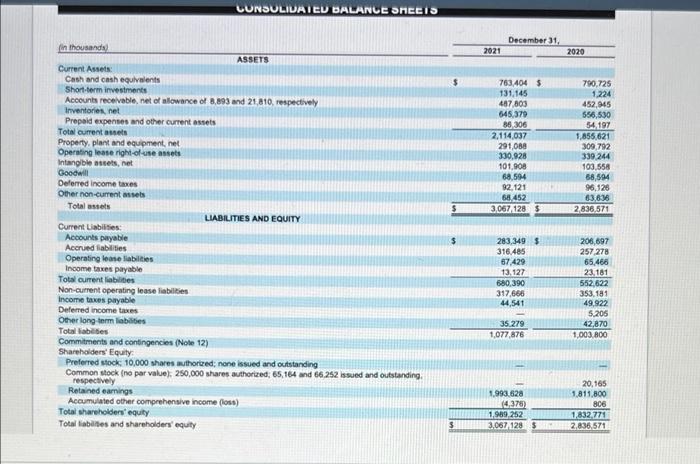

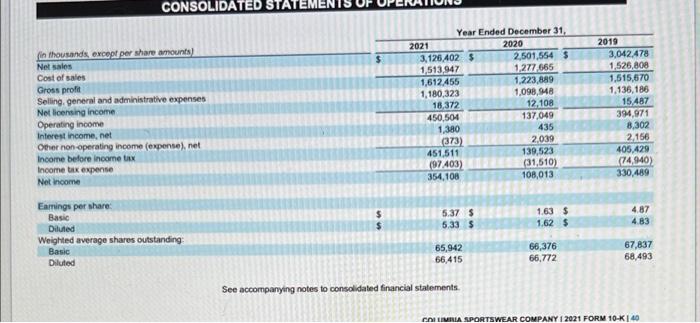

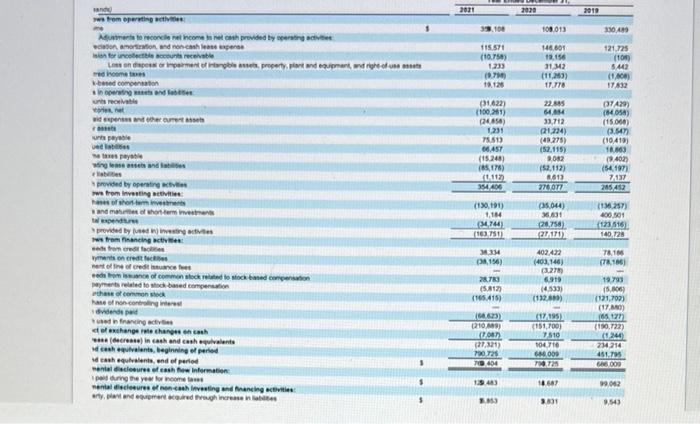

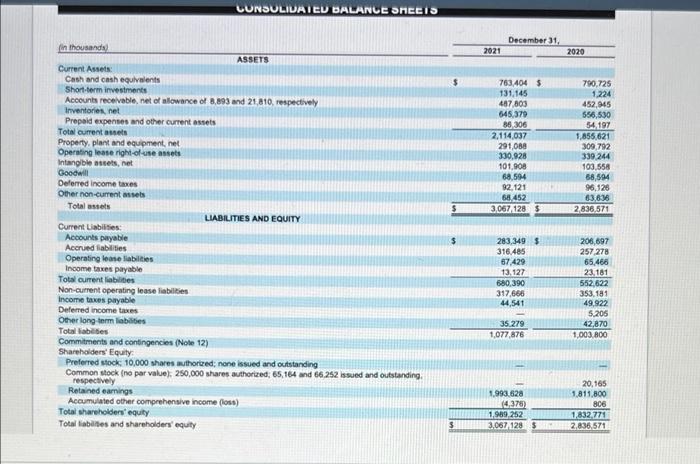

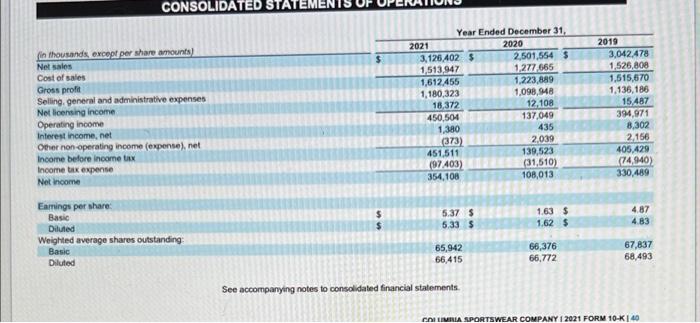

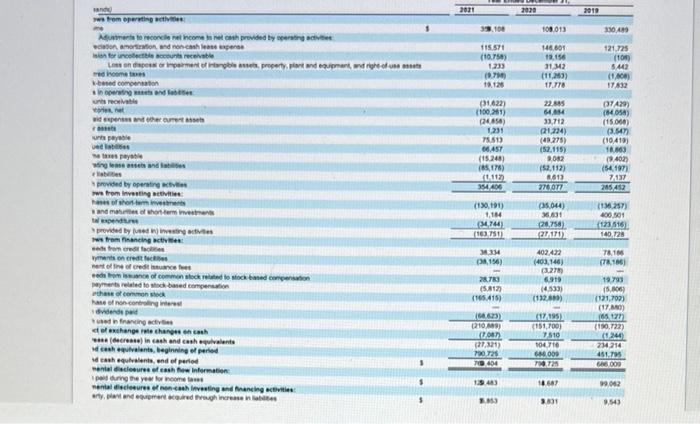

Note that whenever a formula asks for an average amount (such as average assets), add the beginning of the year amount (which is the same as the ending amount last year) and the end of the year amount, then divide the total by 2. Calculate the following ratios for Columbia for 2021, or as of December 31, 2021: 31. 32. 33. 34. working capital current ratio acid test ratio accounts receivable turnover current assets-current liabilities current assets current liabilities cash + short-term investments + receivables current liabilities net sales average AR (in thousands) Current Assets Cash and cash equivalents Total current assets Property, plant and equipment, net Operating lease right-of-use assets Intangible assets, net Goodwill Deferred income taxes Other non-current assets Total assets Short-term investments Accounts receivable, net of allowance of 8,893 and 21,810, respectively Inventories, net Prepaid expenses and other current assets Current Liabilities: Accounts payable Accrued liabilities Operating lease liabilities Income taxes payable Total current liabilities Non-current operating lease liabilities Income taxes payable Deferred income taxes Other long-term liabilities Total labides CONSOLIDATED BALANCE SHEETS ASSETS Total shareholders' equity Total liabilites and shareholders' equity LIABILITIES AND EQUITY Commitments and contingencies (Note 12) Shareholders' Equity Preferred stock: 10,000 shares authorized: none issued and outstanding Common stock (no par value); 250,000 shares authorized; 65,164 and 66,252 issued and outstanding. respectively Retained earnings Accumulated other comprehensive income (loss) $ $ $ $ 2021 December 31, 763,404 $ 131,145 487,803 645,379 86,306 2,114,037 291,088 330,928 101,908 68,594 92,121 1931 68,452 3,067,128 $ 283,349 $ 316,485 67,429 13.127 680,390 317,666 44,541 35.279 1,077,876 1,993.628 (4.376) 1,989,252 3,067,128 $ 2020 790,725 1,224 452,945 556,530 54.197 1,855,621 309,792 339,244 103,558 68,594 96,126 63,636 2,836,571 206,697 257,278 65,466 23,181 552,622 353.181 49,922 5,205 42,870 1,003,800 20,165 1,811,800 806 1,832,771 2,836,571 CONSOLIDATED STATEMENT (in thousands, except per share amounts) Net sales Cost of sales Gross profit Selling, general and administrative expenses Net licensing income Operating income Interest income, net Other non-operating income (expense), net Income before income tax Income tax expense Net income Eamings per share: Basic Diluted Weighted average shares outstanding Basic Diluted $ 2021 Year Ended December 31, 2020 3,126,402 $ 1,513,947 1,612,455 1,180,323 18,372 450,504 1,380 (373) 451,511 (97 403) 354,108 5.37 S 5.33 S 65,942 66.415 See accompanying notes to consolidated financial statements. 2,501,554 $ 1,277,665 1,223,889 1,098,948 12,108 137,049 435 2,039 139,523 (31,510) 108,013 1.63 $ 1.62 $ 66,376 66,772 2019 3,042,478 1,526,808 1,515,670 1,136,186 15,487 394,971 8,302 2,156 405,429 (74,940) 330,489 4.87 4.83 67,837 68,493 COLUMBIA SPORTSWEAR COMPANY 12021 FORM 10-K 140 and ws from operating activities Adjustments to reconcile net income is net cash provided by operating activities ciation, amortization, and non-cash lease expense ision for uncollectible accounts receivable Loss on dispessi or impairment of intangible assets, property, plant and equipment, and right-of-use assets med income taxes k-based compensation in operating assets and b unts receivable net aid expenses and other current assets unts payable und bes me taxes payable sing lease assets and s abes provided by operating acti w from Investing activities: hases of short-term investments and matures of short-term investments tal expenditures provided by used in) investing activite ws from financing activites sed from credit faces vyments on credit facies nent of line of credit issuance fees eeds from issuance of common stock related to stock based compensation payments related to stock-based compensation thase of common stock hase of non-controlling interest dividends paid used in financing activi et of exchange rate changes on cash esse (decrease) in cash and cash equivalents d cash equivalents, beginning of period id cash equivalents, end of period mental disclosures of cash flow information paid during the year for income ta mental disclosures of non-cash investing and financing activities arty, plant and equipment acquired through increase in labilities S 2021 3.108 115.571 (10.754) 1,233 (9.79) 19.126 (31.622) (100,201) (24,858) 1,231 75.513 06.457 (15.248) (85,176) (1.112) 354,400 (130,191) 1,104 (34,744) (163.751) 34.334 (38,156) 28.783 (5812) (165.415) (66.623) (2109) (7.087) (27,321) 790.725 719,404 139,483 8.853 2020 108,013 146,601 19.156 31,342 (11,263) 17.778 22.885 64,054 33,712 (21,224) (49.275) (52.115) 9.082 (52,112) 8613 276.077 (35,044) 36,631 (28.758) (27-171) 402,422 (403,146) (327) 6.919 (4.533) (132,889) (17,195) (151,700) 7,510 104,716 64.009 704.725 14.687 3.831 2019 330,489 121,725 (108) 5442 (1,000) 17,832 (37429) (84,058) (15.000) (3.547) (10,419) 18,063 (402) (54,197) 7137 285,452 (136,257) 400,501 (123.516) 140.728 78,106 (78,166) 19,793 (5,806) (121,702) (17,0) (65127) (190,722) (1244) 234,214 451.795 686.009 99,062 9,543

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started