need help with these two req thank you!

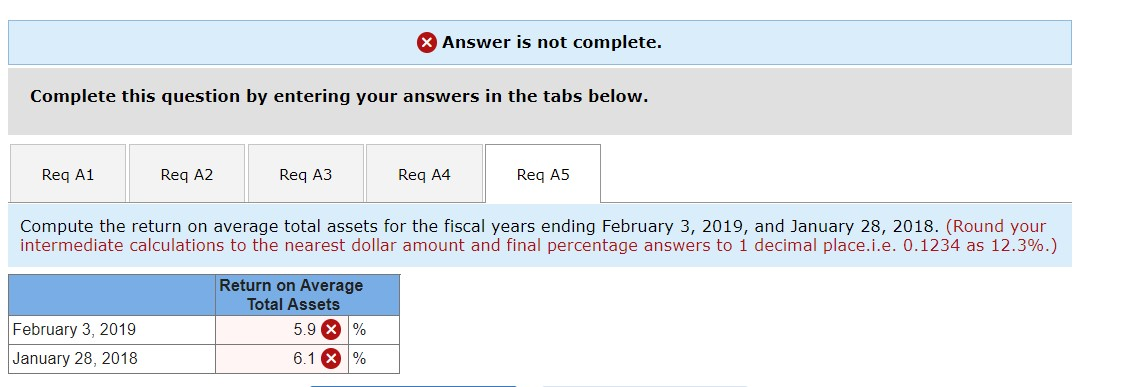

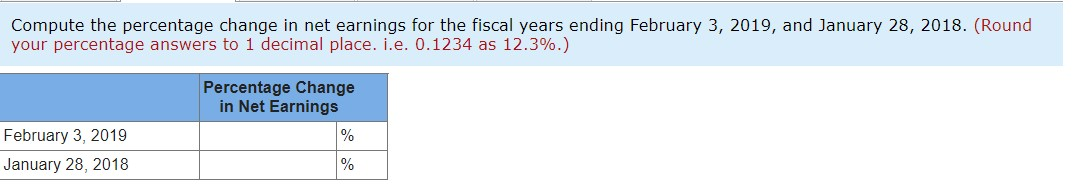

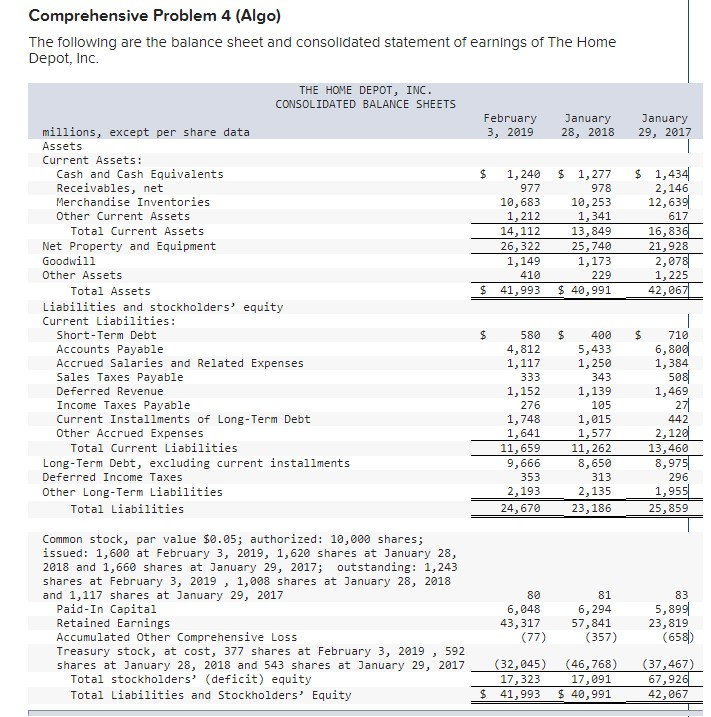

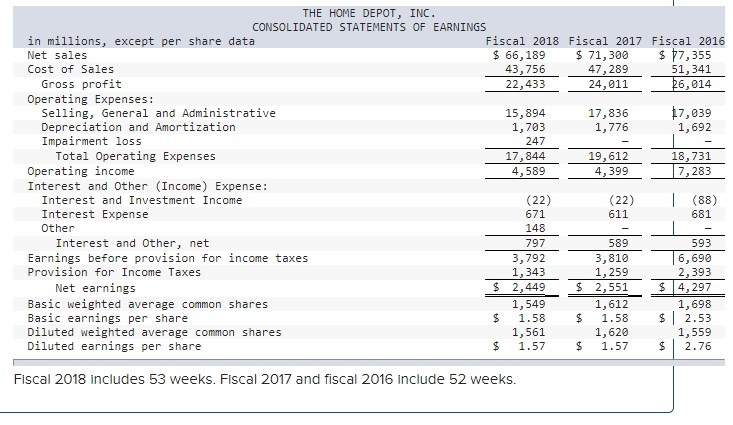

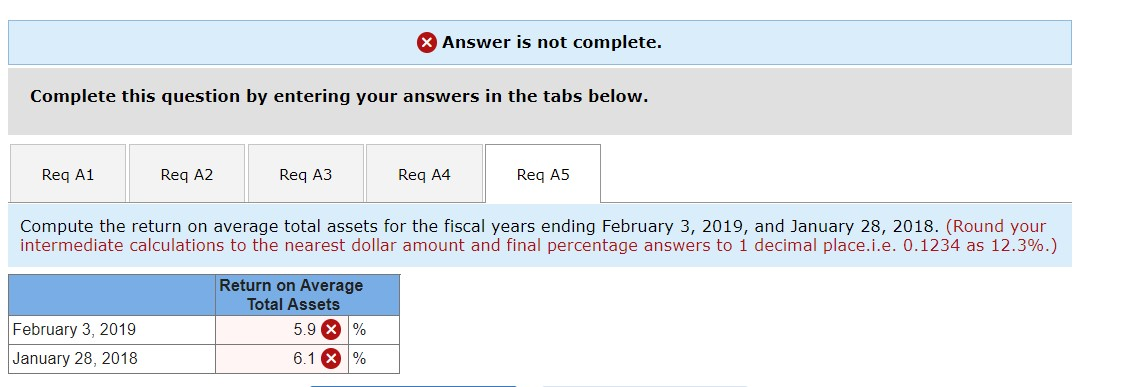

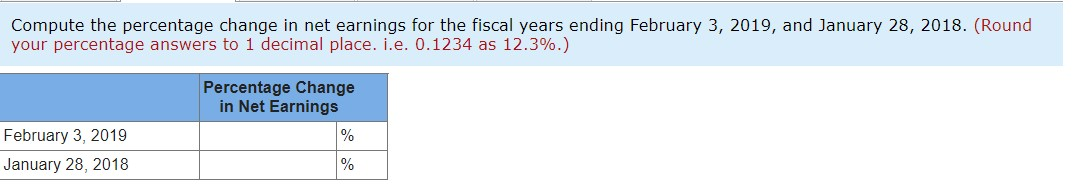

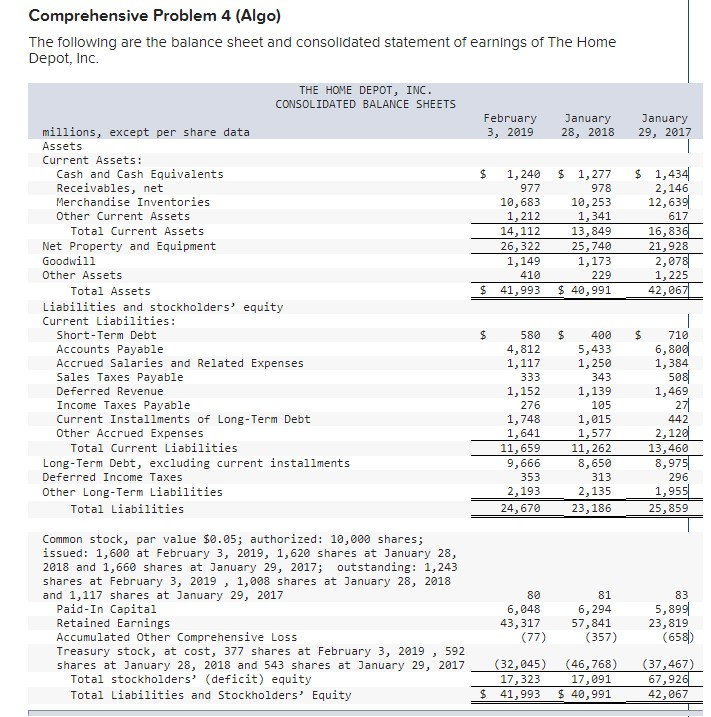

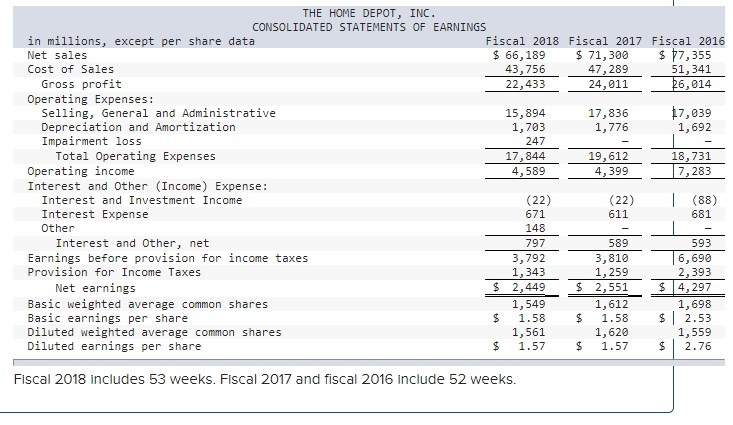

X Answer is not complete. Complete this question by entering your answers in the tabs below. Reg A1 Req A2 Reg A3 Reg A4 Reg A5 Compute the return on average total assets for the fiscal years ending February 3, 2019, and January 28, 2018. (Round your intermediate calculations to the nearest dollar amount and final percentage answers to 1 decimal place.i.e. 0.1234 as 12.3%.) Return on Average Total Assets 5.9 X % February 3, 2019 January 28, 2018 6.1 X % Compute the percentage change in net earnings for the fiscal years ending February 3, 2019, and January 28, 2018. (Round your percentage answers to 1 decimal place. i.e. 0.1234 as 12.3%.) Percentage Change in Net Earnings % February 3, 2019 January 28, 2018 % January 29, 2017 Comprehensive Problem 4 (Algo) The following are the balance sheet and consolidated statement of earnings of The Home Depot, Inc. THE HOME DEPOT, INC. CONSOLIDATED BALANCE SHEETS February January millions, except per share data 3, 2019 28, 2018 Assets Current Assets: Cash and Cash Equivalents $ 1,240 $ 1,277 Receivables, net 977 978 Merchandise Inventories 10,683 10, 253 Other Current Assets 1,212 1,341 Tot Current ssets 14,112 13,849 Net Property and Equipment 26,322 25,740 Goodwill 1,149 1,173 Other Assets 410 229 Total Assets $ 41,993 $ 40,991 Liabilities and stockholders' equity Current Liabilities: Short-Term Debt $ 580 $ 400 Accounts Payable 4,812 5,433 Accrued Salaries and Related Expenses 1,117 1,250 Sales Taxes Payable 333 343 Deferred Revenue 1,152 1,139 Income Taxes Payable 276 105 Current Installments of Long-Term Debt 1,748 1,015 Other Accrued Expenses 1,641 1,577 Total Current Liabilities 11,659 11,262 Long-Term Debt, excluding current installments 9,666 8,650 Deferred Income Taxes 353 313 Other Long-Term Liabilities 2,193 2,135 Total Liabilities 24,670 23,186 $ 1,434 2,146 12,639 617 16,836 21,928 2,078 1,225 42,067 $ $ 710 6,800 1,384 508 1,469 27 442 2,120 13,460 8,975 296 1,955 25,859 Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,600 at February 3, 2019, 1,620 shares at January 28, 2018 and 1,660 shares at January 29, 2017; outstanding: 1,243 shares at February 3, 2019 , 1,008 shares at January 28, 2018 and 1,117 shares at January 29, 2017 Paid-In Capital Retained Earnings Accumulated Other Comprehensive Loss Treasury stock, at cost, 377 shares at February 3, 2019 592 shares at January 28, 2018 and 543 shares at January 29, 2017 Total stockholders' (deficit) equity Total Liabilities and Stockholders' Equity 80 6,048 43,317 (77) 81 6,294 57,841 (357) 83 5,899 23,819 (658) (32,045) (46,768) 17,323 17,091 $ 41,993 $ 40,991 (37,467) 67,926 42,067 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data Fiscal 2018 Fiscal 2017 Fiscal 2016 Net sales $ 66,189 $ 71,300 $ 17,355 Cost of Sales 43,756 47,289 51,341 Gross profit 22,433 24,011 26,014 Operating Expenses: Selling, General and Administrative 15,894 17,836 17,039 Depreciation and Amortization 1,703 1,776 1,692 Impairment loss 247 Total Operating Expenses 17,844 19, 612 18,731 Operating income 4,589 4,399 7,283 Interest and Other (Income) Expense: Interest and Investment Income (22) (22) | (88) Interest Expense 671 611 681 Other 148 Interest and Other, net 797 589 593 Earnings before provision for income taxes 3,792 3,810 16,690 Provision for Income Taxes 1,343 1,259 2,393 Net earnings $ 2,449 $ 2,551 $ 4,297 Basic weighted average common shares 1,549 1,612 1,698 Basic earnings per share $ 1.58 $ 1.58 $ 2.53 Diluted weighted average common shares 1,561 1,620 1,559 Diluted earnings per share $ 1.57 $ 1.57 $ 2.76 Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks