Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with this accounting mini practice set 4. thanks. ignore the pen marks please. MINI PRACTICE SET 4 Recording Business Transactions in Special Journals

need help with this accounting mini practice set 4. thanks. ignore the pen marks please.

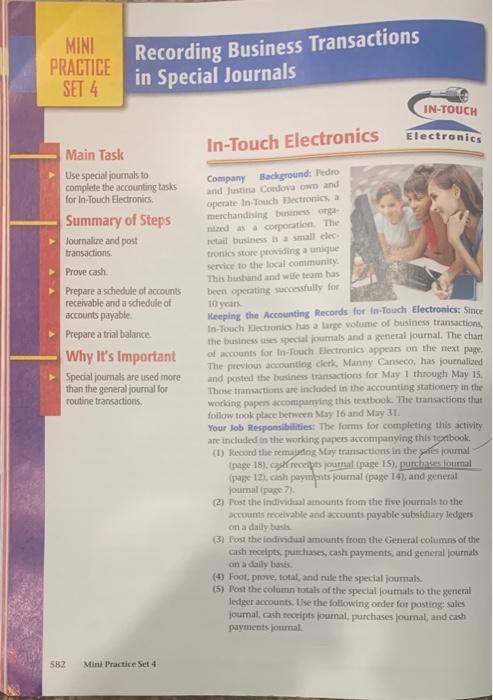

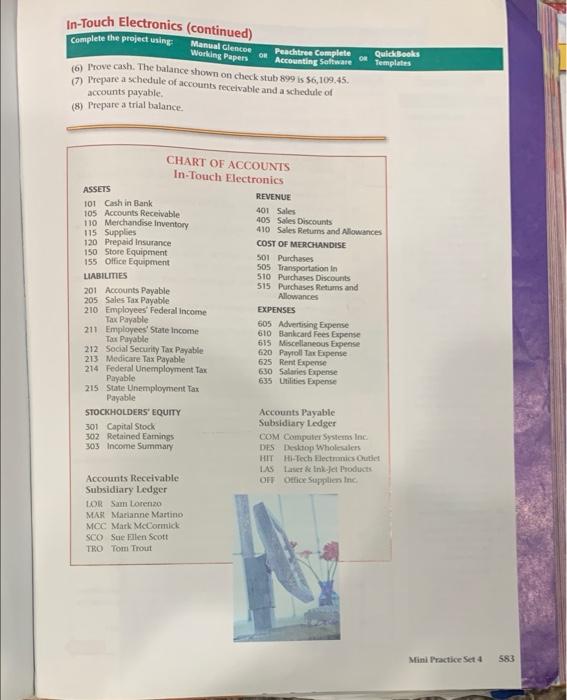

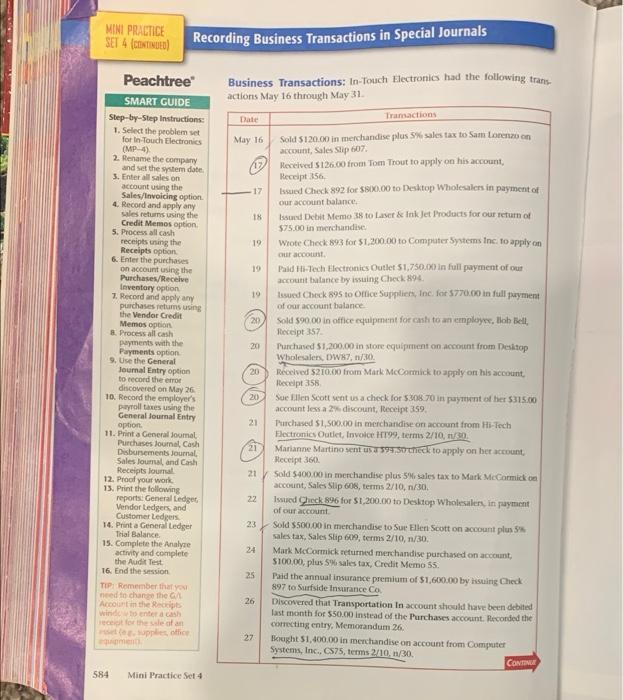

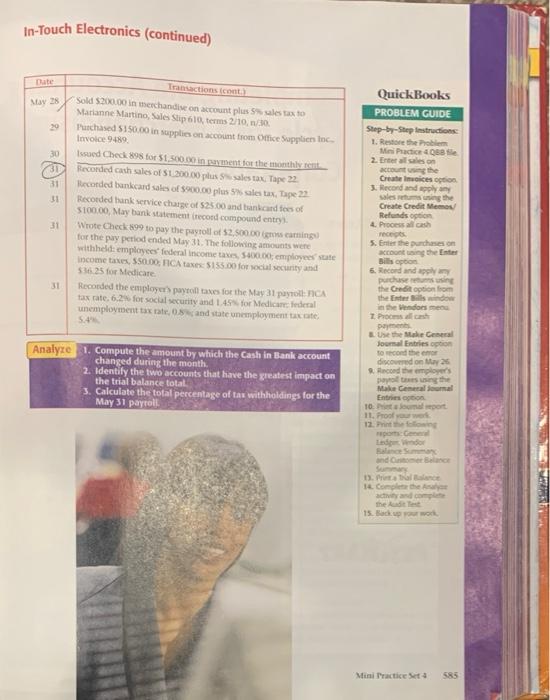

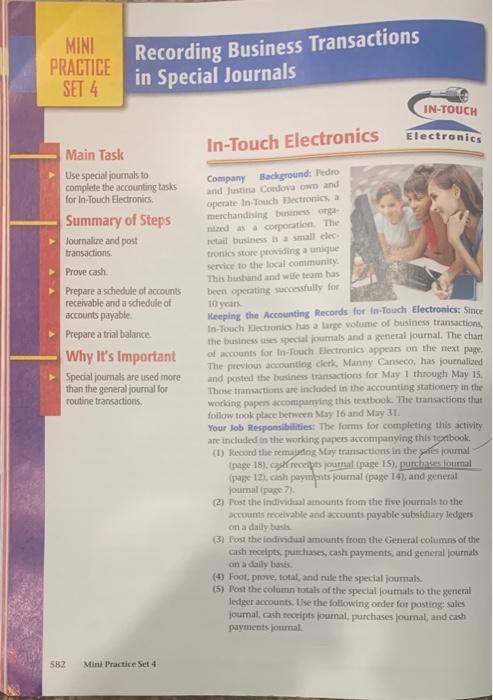

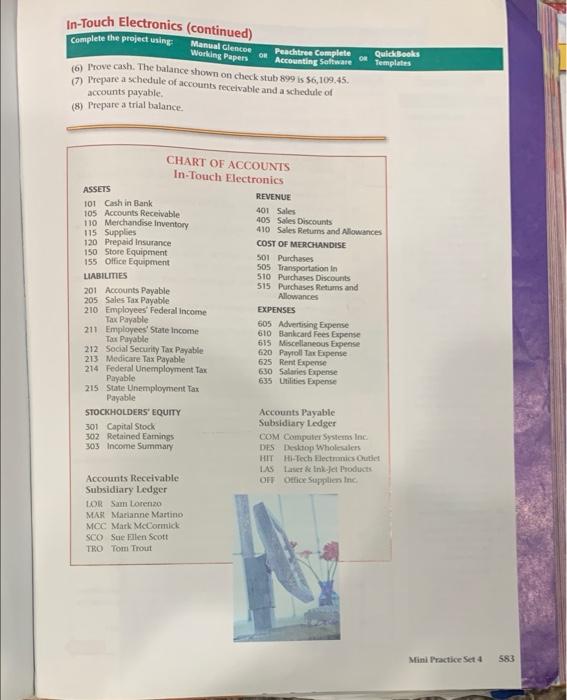

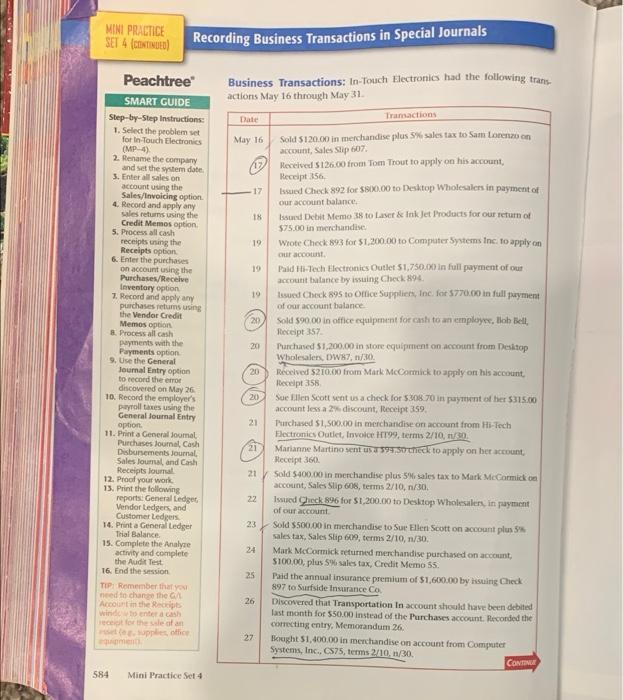

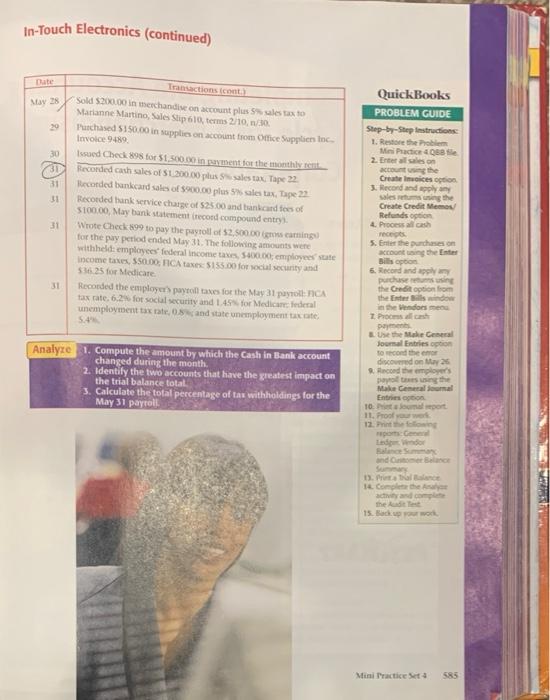

MINI PRACTICE SET 4 Recording Business Transactions in Special Journals IN-TOUCH Electronics In-Touch Electronics Main Task Use special joumals to complete the accounting tasks for In-Touch Electronics Summary of Steps Journalize and post transactions Prove cash Prepare a schedule of accounts receivable and a schedule of accounts payable Prepare a trial balance Why It's important Special journals are used more than the general journal for routine transactions Company Background: Pedro and Justin Condo Own and operate in Touch Bectronics, a merchandising business og nized as corporation. The retail business a small clec tronics store providing a unique service to the local community This husband and wife team has been operating successfully for 10 years Keeping the Accounting Records for la-Touch Electronics: Since In-Touch Electronics has a large volume of business transactions, the business ses special journals and a general journal. The chant of accounts for In-Touch Electronics appears on the next page The previous accounting clerk, Manny Canseco, has journalized and posted the business transactions for May 1 through May 15 Those transactions are included in the accounting stationery in the working papers accompanying this textbook. The transactions that follow took place between May 16 and May 31. Your Job Responsibilities: The forms for completing this activity are included in the working papers accompanying this textbook. (1) Record the remaining May transactions in the garnis journal (page 18). cak recepes journal page 15). purchases Journal (page 12). cash payments journal (page 14), and general journal page 7 (2) Post the individual amounts from the five journals to the accounts receivable and accounts payable subsidiary ledgers on a daily basis (3) Post the individual amounts from the General columns of the cash receipts, purchases, cash payments, and general journals on a daily basis (4) Foot, prove, total, and make the special journals. (5) Post the column total of the special joumals to the general ledger accounts. Use the following order for posting sales Journal, cash receipts jumal, purchases Journal, and cash payments journal 582 Mini Practice Set 4 Manual Glencoe Working Papers ON OM In-Touch Electronics (continued) Complete the project using Peachtree Complete Accounting Software (0) Prove cash. The balance shown on check stub 899 is 56,109.45. 1) Prepare a schedule of accounts receivable and a schedule of accounts payable (8) Prepare a trial balance QuickBooks Templates CHART OF ACCOUNTS In-Touch Electronics ASSETS REVENUE 101 Cash in Bank 105 Accounts Receivable 401 Sales 110 Merchandise Inventory 405 Sales Discounts 410 Sales Returns and Allowances 115 Supplies 120 Prepaid Insurance COST OF MERCHANDISE 150 Store Equipment 501 Purchases 155 Olfice Equipment 505 Transportation in LIABILITIES 510 Purchases Discounts 515 Purchases Returns and 201 Accounts Payable Allowances 205 Sales Tax Payable 210 Employees' Federal income EXPENSES Tax Payable 605 Advertising Expense 211 Employees' State Income 610 Bankcard Fees Expense Tax Payable 615 Miscellaneous Expense 212 Social Security Tax Payable 620 Payroll Tax Expense 213 Medicare Tax Payable 625 Rent Expense 214 Federal Unemployment Tax 630 Salaries Expense Payable 635 Utilities Expense 215 State Unemployment Tax Payable STOCKHOLDERS' EQUITY Accounts Payable 301 Capital Stock Subsidiary Ledger 302 Retained Earnings COM Computer Systems Inc. 303 Income Summary DES Desktop Wholesalers HIT Hi-Tech Electronics Outlet LAS Laser Ink Jet Products Accounts Receivable OFF Office Supplies Inc Subsidiary Ledger LOR San Lorenzo MAR Marianne Martino MOC Mark McCormick SCO Suellen Scott TRO Tom Trout Min Practice Set 4 583 MINI PRACTICE SET 4 CONTINUED) Recording Business Transactions in Special Journals 18 19 Peachtree SMART GUIDE Step-by-Step Instructions: 1. Select the problem set for InTouch Electronics (MP4) 2. Rename the company and set the system date 3. Enter sales on account using the Sales/Invoicing option 4. Record and apply any sales returns using the Credit Memos option 5. Process all cash receipts using the Receipts option 6. Enter the purchases on account using the Purchases/Receive Inventory option 7. Record and apply any purchases returns using the Vendor Credit Memes option 8. Process all cash payments with the Payment option 9. Use the General Journal Entry option to record the error discovered on May 26 10. Record the employer's payroll taxes using the General Journal Entry option 11. Print a General Joumal Purchases loumal Cash Disbursements Journal Sales lounal and Cash Receipts lournal 12. Proof your work 13. Print the following reports. General Ledger Vendor Ledgers, and Customer Ledgers 14. Print a General Ledger Trial Balance 15. Complete the Analyse activity and complete the Audit Test 16. End the session TIPI Remember that need to chance the Account in the receipts Windonteca et forth of an opplies, office Business Transactions: In-Touch Electronics had the following trans actions May 16 through May 31 Date Transactions May 16 Sold S120.00 in merchandise plus 5% sales tax to Sam Lorenzo cn account, Sales Slip 607 0 Received 126.00 from Tom Trout to apply on his account, Receipt 356, 17 Issued Check 892 for $800.00 to Desktop Wholesalers in payment of Our account balance Issued Debit Memo 38 to Laser & Ink Jet Products for our return of $75.00 in merchandise Wrote Check 893 for $1.200.00 to Computer Systems Inc. to apply on our account Paid Ti-Tech Electronics Outlet 51,750.00 in full payment of our account balance by issuing Check 894 19 tesued Check 895 to Office Supplies, Inc. fent 5770.00 in full payment of our account balance. 20 Sold 990.00 in office equipment for cash to an employee, Bob Bell, Receipt 357 20 Purchased $1,200.00 in store equipment on account from Desktop Wholesalers, DW87, 1/30. Received 52 TOXO from Mark McCormick to apply on his account, Recept 358 Sue Ellen Scott went us a check for 5.308.70 in payment of her 5315.00 accountless a 2% discount, Receipt 359 21 Purchased $1,000 in merchandise on account from Hi-Tech Electronics Outlet, Invoice HT99, terms 2/10, na 21 Marianne Martino sent usa 599,50 thiet to apply on her account Receipt 360 19 20 20 21 22 24 Sold 5400.00 in merchandise plus 5 sales tax to Mark McCormick on account, Sales Slip 608, terms 2/10, 1/30. Issued Queck 896 for $1.200.00 to Desktop Wholesalers, in payment of our account Sold 500.00 in merchandise to Sue Ellen Scott on account plus sales tax, Sales Slip 69, terms 2/10, 1/30 Mark McCormick returned merchandise purchased on account $100,00, plus 5% sales tax, Credit Memo 55. Paid the annual insurance premium of $1,600.00 by issuing Check 897 to Surfside Insurance Co Discovered that Transportation in account should have been debited last month for 550.00 instead of the Purchases account. Recorded the correcting entry, Memorandum 26. Bought 51,400.00 in merchandise on account from Computer Systems, Inc., CS75, terms 2/10, 1/30 CONTINUE 25 26 27 584 Mini Practice Set 4 In-Touch Electronics (continued) Date May 28 2 30 31 31 11 Transactions tot Sold 520000 in merchandise on account plus les Marianne Martino, Sales Slip 610 terms 2/10, 1/30 Purchased 5350.00 in supplies on account from Office Supplier Inc. Invoice 9489 Issued Check 898 for $1.500.00 inment for the monthly Recorded cash sales of $200.00 sales tax, Tape 22 Recorded bankcard sales of $400.00 plus 5 sales tax, Tape 22 Recorded bank service charge of $25.00 and acades of $100.00 Maybank statement record compound entry) Wrote Check 899 to pay the payroll of $2.500.00 ating for the pay period ended May 31. The following amounts were withheld employees' federal income taxes, employees' state Income taxes, 550D: RICA taxes: 5155.00 for social security and SM25 for Medicare Recorded the employer payroll taxes for the May 31 part ICA tax rate. 6.2 for social security and 1.45 for Medicare decal unemployment taxta, cand state unemployment inte 5.4 31 QuickBooks PROBLEM GUIDE Step-by-Step Instructions 1. Rest the Problem Mini Practic4088 2. Er sales account the Camics option 3. Recond and apply alessing the Create Credit Menu Refunds option 4. Process reces 5. Enter the purchases on accounting the Enter Bill option 6. Record and apply purchasing the Crot option from the Eastern in the end z Poch payment the Male General Journal Entries option to record the discovered on taas econd the employer's pays in the Mak Gamal Entition 10. Pumaport 11. Proof 12. Printing pon Ceneril Led Salesman and 31 Analyze 1. Compute the amount by which the Cash in Bank account changed during the month. 2. Identify the two accounts that have the greatest impact on the trial balance total 3. Calculate the total percentage of tas withholdings for the May 31 payroll 1) Prata 14. Complete the acad.com the di 15. Back up your work 585 MINI PRACTICE SET 4 Recording Business Transactions in Special Journals IN-TOUCH Electronics In-Touch Electronics Main Task Use special joumals to complete the accounting tasks for In-Touch Electronics Summary of Steps Journalize and post transactions Prove cash Prepare a schedule of accounts receivable and a schedule of accounts payable Prepare a trial balance Why It's important Special journals are used more than the general journal for routine transactions Company Background: Pedro and Justin Condo Own and operate in Touch Bectronics, a merchandising business og nized as corporation. The retail business a small clec tronics store providing a unique service to the local community This husband and wife team has been operating successfully for 10 years Keeping the Accounting Records for la-Touch Electronics: Since In-Touch Electronics has a large volume of business transactions, the business ses special journals and a general journal. The chant of accounts for In-Touch Electronics appears on the next page The previous accounting clerk, Manny Canseco, has journalized and posted the business transactions for May 1 through May 15 Those transactions are included in the accounting stationery in the working papers accompanying this textbook. The transactions that follow took place between May 16 and May 31. Your Job Responsibilities: The forms for completing this activity are included in the working papers accompanying this textbook. (1) Record the remaining May transactions in the garnis journal (page 18). cak recepes journal page 15). purchases Journal (page 12). cash payments journal (page 14), and general journal page 7 (2) Post the individual amounts from the five journals to the accounts receivable and accounts payable subsidiary ledgers on a daily basis (3) Post the individual amounts from the General columns of the cash receipts, purchases, cash payments, and general journals on a daily basis (4) Foot, prove, total, and make the special journals. (5) Post the column total of the special joumals to the general ledger accounts. Use the following order for posting sales Journal, cash receipts jumal, purchases Journal, and cash payments journal 582 Mini Practice Set 4 Manual Glencoe Working Papers ON OM In-Touch Electronics (continued) Complete the project using Peachtree Complete Accounting Software (0) Prove cash. The balance shown on check stub 899 is 56,109.45. 1) Prepare a schedule of accounts receivable and a schedule of accounts payable (8) Prepare a trial balance QuickBooks Templates CHART OF ACCOUNTS In-Touch Electronics ASSETS REVENUE 101 Cash in Bank 105 Accounts Receivable 401 Sales 110 Merchandise Inventory 405 Sales Discounts 410 Sales Returns and Allowances 115 Supplies 120 Prepaid Insurance COST OF MERCHANDISE 150 Store Equipment 501 Purchases 155 Olfice Equipment 505 Transportation in LIABILITIES 510 Purchases Discounts 515 Purchases Returns and 201 Accounts Payable Allowances 205 Sales Tax Payable 210 Employees' Federal income EXPENSES Tax Payable 605 Advertising Expense 211 Employees' State Income 610 Bankcard Fees Expense Tax Payable 615 Miscellaneous Expense 212 Social Security Tax Payable 620 Payroll Tax Expense 213 Medicare Tax Payable 625 Rent Expense 214 Federal Unemployment Tax 630 Salaries Expense Payable 635 Utilities Expense 215 State Unemployment Tax Payable STOCKHOLDERS' EQUITY Accounts Payable 301 Capital Stock Subsidiary Ledger 302 Retained Earnings COM Computer Systems Inc. 303 Income Summary DES Desktop Wholesalers HIT Hi-Tech Electronics Outlet LAS Laser Ink Jet Products Accounts Receivable OFF Office Supplies Inc Subsidiary Ledger LOR San Lorenzo MAR Marianne Martino MOC Mark McCormick SCO Suellen Scott TRO Tom Trout Min Practice Set 4 583 MINI PRACTICE SET 4 CONTINUED) Recording Business Transactions in Special Journals 18 19 Peachtree SMART GUIDE Step-by-Step Instructions: 1. Select the problem set for InTouch Electronics (MP4) 2. Rename the company and set the system date 3. Enter sales on account using the Sales/Invoicing option 4. Record and apply any sales returns using the Credit Memos option 5. Process all cash receipts using the Receipts option 6. Enter the purchases on account using the Purchases/Receive Inventory option 7. Record and apply any purchases returns using the Vendor Credit Memes option 8. Process all cash payments with the Payment option 9. Use the General Journal Entry option to record the error discovered on May 26 10. Record the employer's payroll taxes using the General Journal Entry option 11. Print a General Joumal Purchases loumal Cash Disbursements Journal Sales lounal and Cash Receipts lournal 12. Proof your work 13. Print the following reports. General Ledger Vendor Ledgers, and Customer Ledgers 14. Print a General Ledger Trial Balance 15. Complete the Analyse activity and complete the Audit Test 16. End the session TIPI Remember that need to chance the Account in the receipts Windonteca et forth of an opplies, office Business Transactions: In-Touch Electronics had the following trans actions May 16 through May 31 Date Transactions May 16 Sold S120.00 in merchandise plus 5% sales tax to Sam Lorenzo cn account, Sales Slip 607 0 Received 126.00 from Tom Trout to apply on his account, Receipt 356, 17 Issued Check 892 for $800.00 to Desktop Wholesalers in payment of Our account balance Issued Debit Memo 38 to Laser & Ink Jet Products for our return of $75.00 in merchandise Wrote Check 893 for $1.200.00 to Computer Systems Inc. to apply on our account Paid Ti-Tech Electronics Outlet 51,750.00 in full payment of our account balance by issuing Check 894 19 tesued Check 895 to Office Supplies, Inc. fent 5770.00 in full payment of our account balance. 20 Sold 990.00 in office equipment for cash to an employee, Bob Bell, Receipt 357 20 Purchased $1,200.00 in store equipment on account from Desktop Wholesalers, DW87, 1/30. Received 52 TOXO from Mark McCormick to apply on his account, Recept 358 Sue Ellen Scott went us a check for 5.308.70 in payment of her 5315.00 accountless a 2% discount, Receipt 359 21 Purchased $1,000 in merchandise on account from Hi-Tech Electronics Outlet, Invoice HT99, terms 2/10, na 21 Marianne Martino sent usa 599,50 thiet to apply on her account Receipt 360 19 20 20 21 22 24 Sold 5400.00 in merchandise plus 5 sales tax to Mark McCormick on account, Sales Slip 608, terms 2/10, 1/30. Issued Queck 896 for $1.200.00 to Desktop Wholesalers, in payment of our account Sold 500.00 in merchandise to Sue Ellen Scott on account plus sales tax, Sales Slip 69, terms 2/10, 1/30 Mark McCormick returned merchandise purchased on account $100,00, plus 5% sales tax, Credit Memo 55. Paid the annual insurance premium of $1,600.00 by issuing Check 897 to Surfside Insurance Co Discovered that Transportation in account should have been debited last month for 550.00 instead of the Purchases account. Recorded the correcting entry, Memorandum 26. Bought 51,400.00 in merchandise on account from Computer Systems, Inc., CS75, terms 2/10, 1/30 CONTINUE 25 26 27 584 Mini Practice Set 4 In-Touch Electronics (continued) Date May 28 2 30 31 31 11 Transactions tot Sold 520000 in merchandise on account plus les Marianne Martino, Sales Slip 610 terms 2/10, 1/30 Purchased 5350.00 in supplies on account from Office Supplier Inc. Invoice 9489 Issued Check 898 for $1.500.00 inment for the monthly Recorded cash sales of $200.00 sales tax, Tape 22 Recorded bankcard sales of $400.00 plus 5 sales tax, Tape 22 Recorded bank service charge of $25.00 and acades of $100.00 Maybank statement record compound entry) Wrote Check 899 to pay the payroll of $2.500.00 ating for the pay period ended May 31. The following amounts were withheld employees' federal income taxes, employees' state Income taxes, 550D: RICA taxes: 5155.00 for social security and SM25 for Medicare Recorded the employer payroll taxes for the May 31 part ICA tax rate. 6.2 for social security and 1.45 for Medicare decal unemployment taxta, cand state unemployment inte 5.4 31 QuickBooks PROBLEM GUIDE Step-by-Step Instructions 1. Rest the Problem Mini Practic4088 2. Er sales account the Camics option 3. Recond and apply alessing the Create Credit Menu Refunds option 4. Process reces 5. Enter the purchases on accounting the Enter Bill option 6. Record and apply purchasing the Crot option from the Eastern in the end z Poch payment the Male General Journal Entries option to record the discovered on taas econd the employer's pays in the Mak Gamal Entition 10. Pumaport 11. Proof 12. Printing pon Ceneril Led Salesman and 31 Analyze 1. Compute the amount by which the Cash in Bank account changed during the month. 2. Identify the two accounts that have the greatest impact on the trial balance total 3. Calculate the total percentage of tas withholdings for the May 31 payroll 1) Prata 14. Complete the acad.com the di 15. Back up your work 585

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started