Need help with this no idea where to start fixing all the blocks highlighted in red

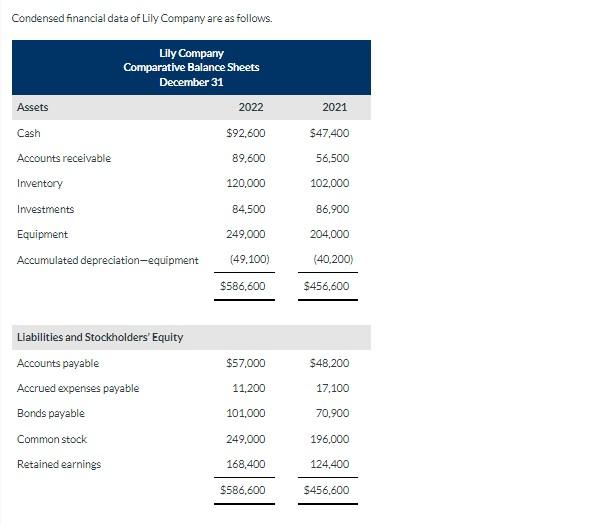

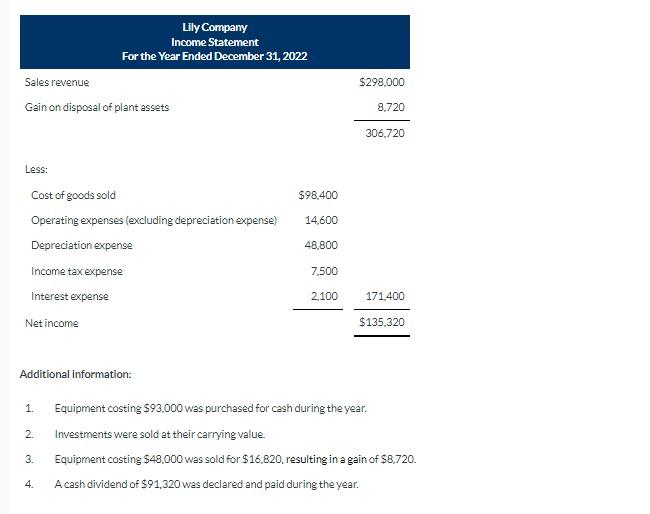

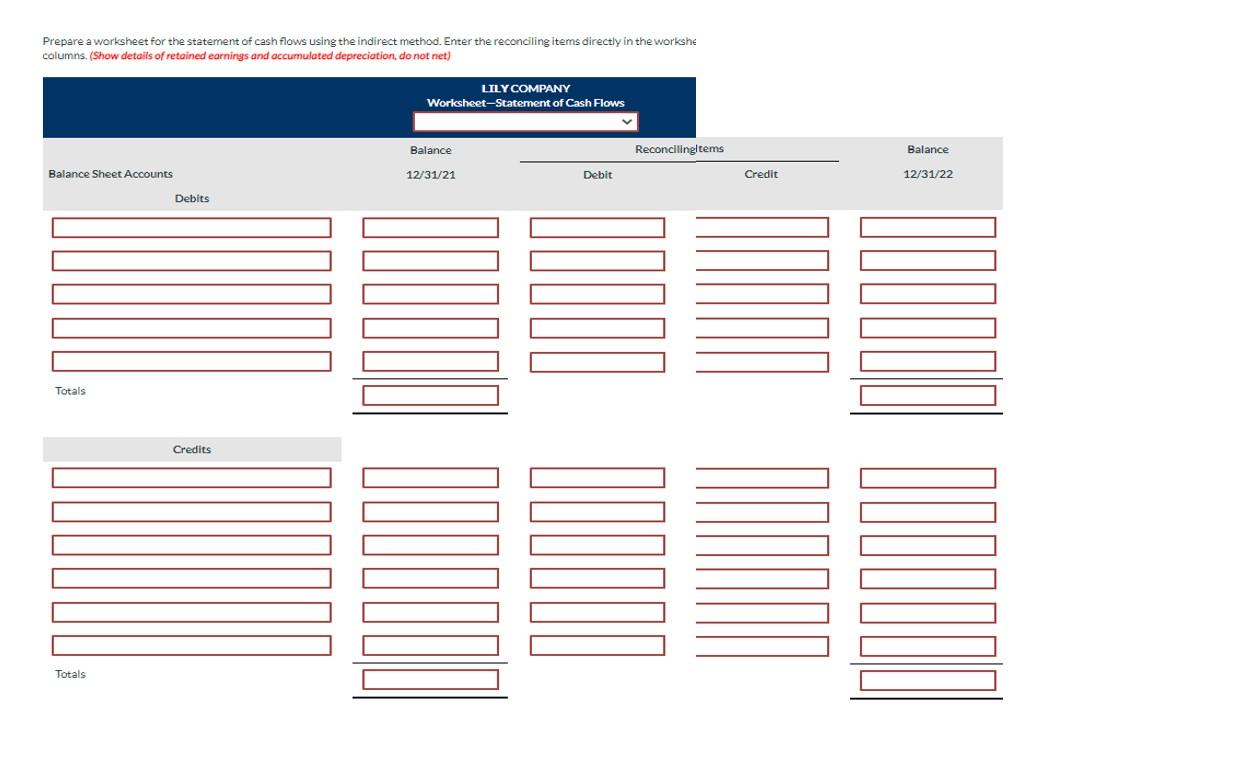

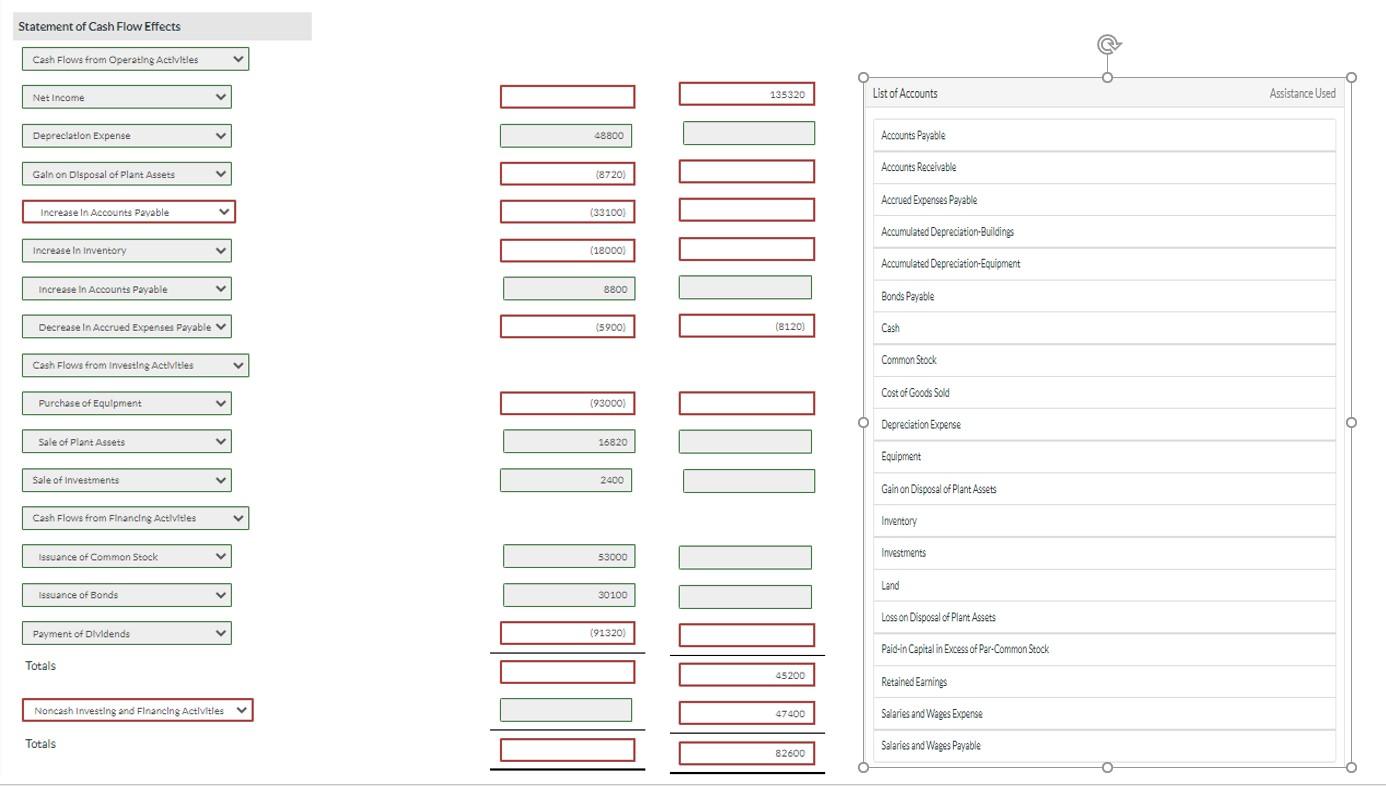

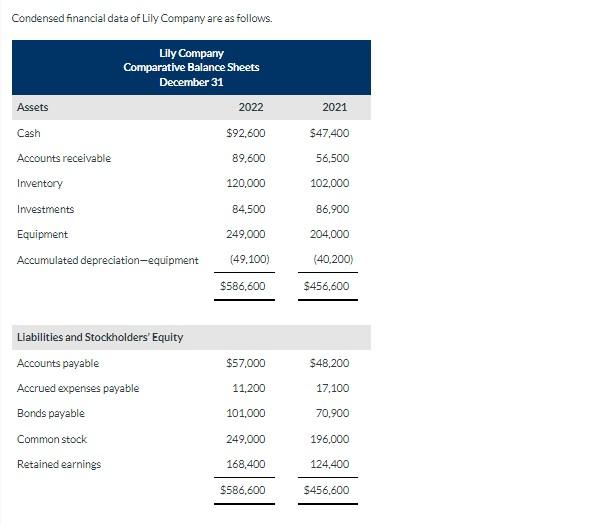

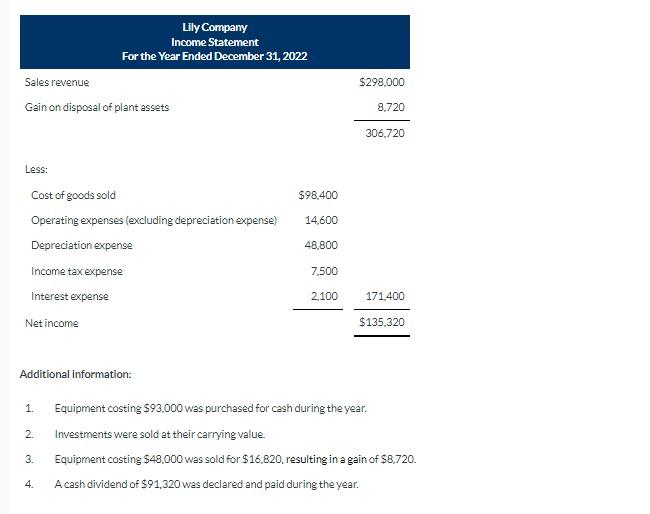

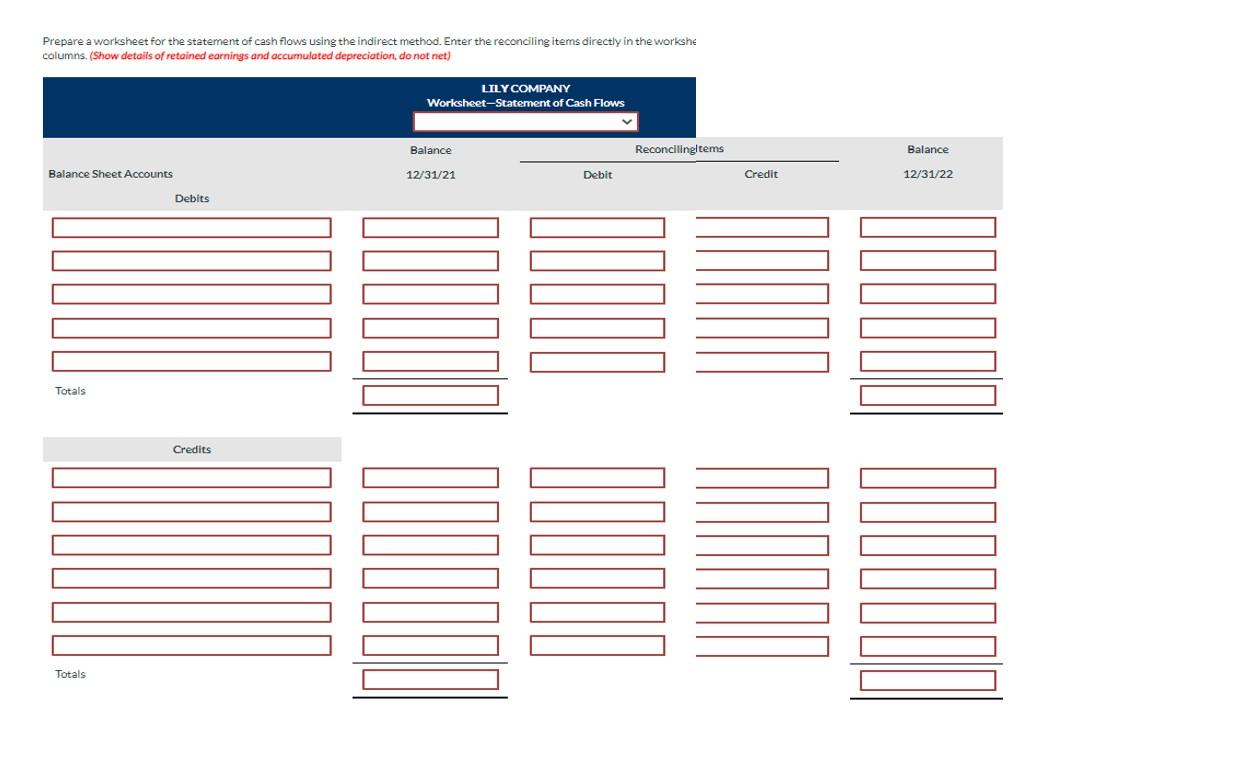

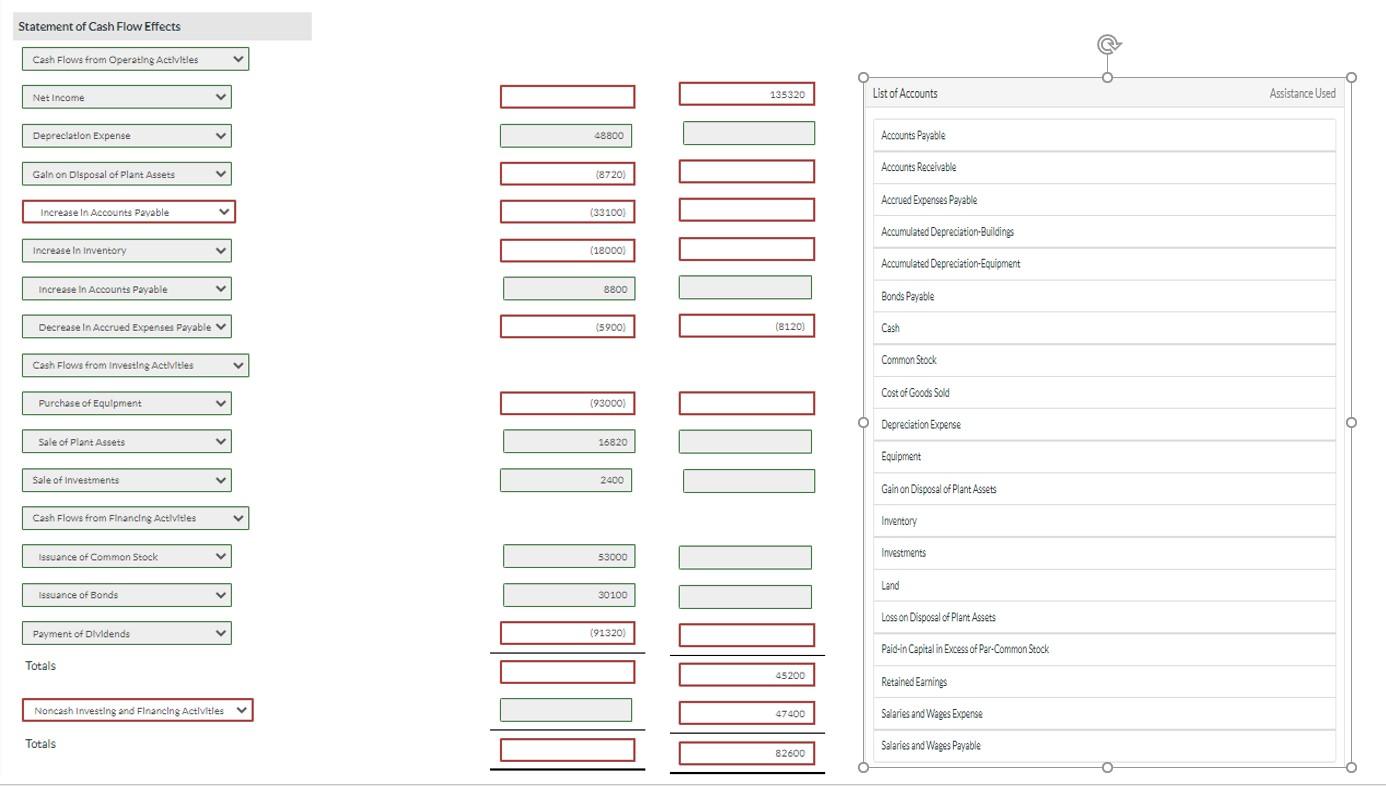

Condensed financial data of Lily Company are as follows. Lily Company Comparative Balance Sheets December 31 Assets 2022 2021 Cash $92,600 89,600 $47.400 56,500 102,000 120,000 Accounts receivable Inventory Investments Equipment Accumulated depreciation-equipment 84,500 86.900 249,000 204,000 (49.100) (40,200) $586,600 $456,600 $57.000 $48.200 11,200 17,100 Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings 101.000 70.900 249,000 196,000 168,400 124.400 $586,600 $456,600 Lily Company Income Statement For the Year Ended December 31, 2022 Sales revenue $298.000 Gain on disposal of plant assets 8.720 306.720 Less: $98.400 14.600 48.800 Cost of goods sold Operating expenses (excluding depreciation expense) Depreciation expense Income tax expense Interest expense Net income 7.500 2.100 171.400 $135,320 Additional information: 1. 2. Equipment costing $93,000 was purchased for cash during the year. Investments were sold at their carrying value Equipment costing $48.000 was sold for $16.820, resulting in a gain of $8,720. A cash dividend of $91,320 was declared and paid during the year. 3 3. 4. Prepare a worksheet for the statement of cash flows using the indirect method. Enter the reconciling items directly in the workshe columns. (Show details of retained earnings and accumulated depreciation, do not net) LILY COMPANY Worksheet-Statement of Cash Flows Balance Reconcilingltems Balance Balance Sheet Accounts 12/31/21 Debit Credit 12/31/22 Debits Totals Credits TIIOODI blood Totals Statement of Cash Flow Effects Cash Flows from Operating Activities 135320 Net Income List of Accounts Assistance Used Depreciation Expense V 48800 Accounts Payable Accounts Receivable Gain on Disposal of Plant Assets (8720) Accrued Expenses Payable Increase in Accounts Payable (33100) () 1000070 Accumulated Depreciation-Buildings Increase in Inventory (18000) Accumulated Depreciation-Equipment Increase in Accounts Payable 8800 Bonds Payable Decrease in Accrued Expenses Payable (5900) (8120) Cash Common Stock Cash Flows from investing Activities Cost of Goods Sold Purchase of Equipment V (93000) O Depreciation Expense O Sale of Plant Assets 16820 Equipment Sale of investments 2400 Gain on Disposal of Plant Assets Cash Flows from Financing Actitles Inventory Issuance of Common Stock V 53000 Investments Land Issuance of Bonds 30100 Loss on Disposal of Plant Assets Payment of Dividends V (91320) Paid-in Capital in Excess of Par-Common Stock Totals 00000 45200 Retained Earnings Noncash Investing and Financing Activities 47400 Salaries and Wages Expense Totals Salaries and Wages Payable 82600