Answered step by step

Verified Expert Solution

Question

1 Approved Answer

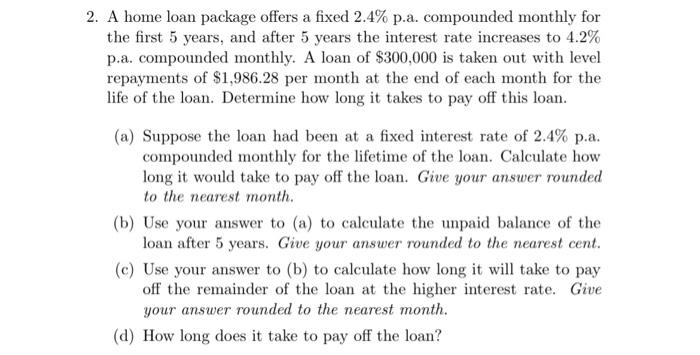

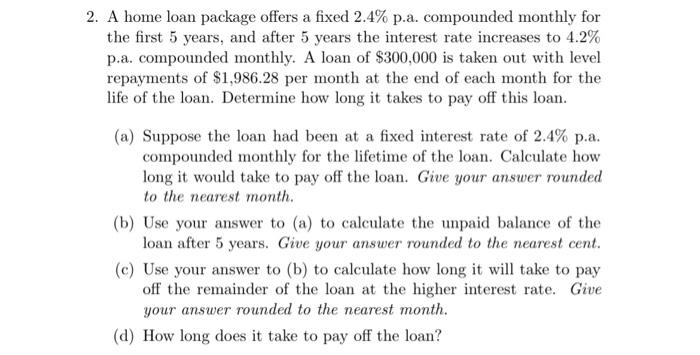

need help with this one 2. A home loan package offers a fixed 2.4% p.a. compounded monthly for the first 5 years, and after 5

need help with this one

2. A home loan package offers a fixed 2.4% p.a. compounded monthly for the first 5 years, and after 5 years the interest rate increases to 4.2% p.a. compounded monthly. A loan of $300,000 is taken out with level repayments of $1,986.28 per month at the end of each month for the life of the loan. Determine how long it takes to pay off this loan. (a) Suppose the loan had been at a fixed interest rate of 2.4% p.a. compounded monthly for the lifetime of the loan. Calculate how long it would take to pay off the loan. Give your answer rounded to the nearest month. (b) Use your answer to (a) to calculate the unpaid balance of the loan after 5 years. Give your answer rounded to the nearest cent. (c) Use your answer to (b) to calculate how long it will take to pay off the remainder of the loan at the higher interest rate. Give your answer rounded to the nearest month. (d) How long does it take to pay off the loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started