Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with this please and thank you Required: 1. Find the items that need to be reconciled between the company's general ledger and the

need help with this please and thank you

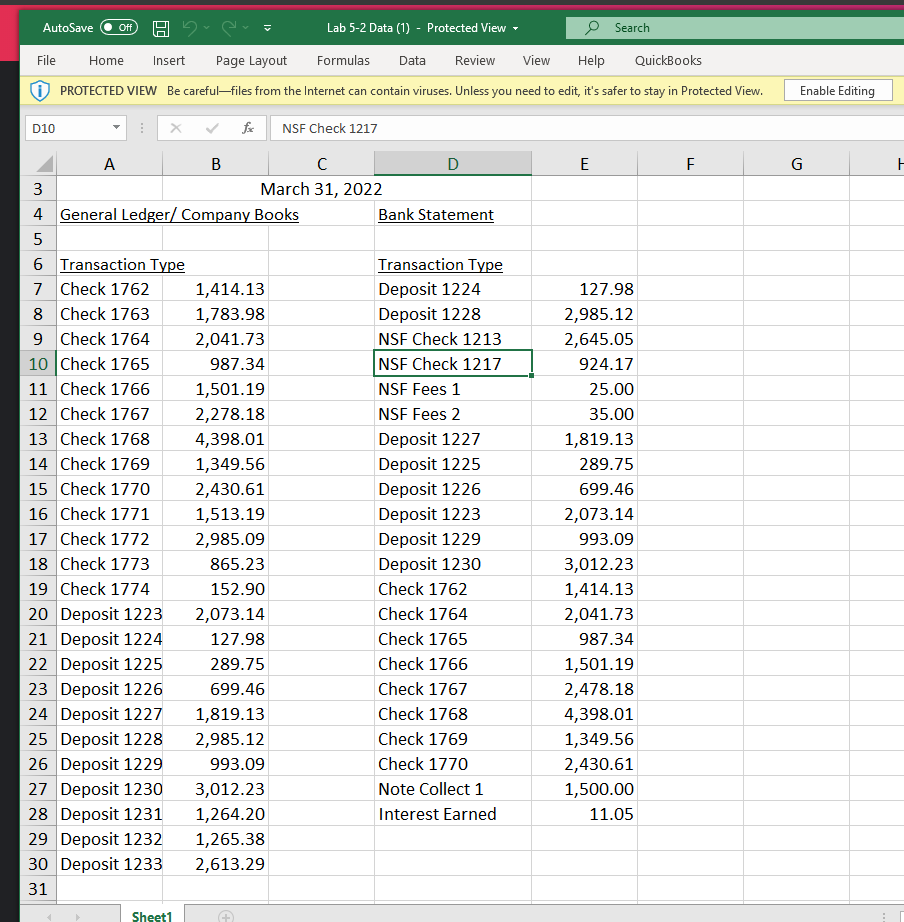

Required: 1. Find the items that need to be reconciled between the company's general ledger and the bank statement. Ask the Question: Can we use conditional formatting to highlight reconciling items for a bank reconciliation? Master the Data We Consult You has cash transactions recorded in the general ledger and cash transactions reported on the bank statement, including checks, deposits, bank notes, NSF checks, and bank fees. There are several different ways the company and the bank might report different cash items, including the following: Outstanding checks are checks written by the company but not yet processed by the bank. Outstanding deposits are deposits recorded by the company but not yet processed by the bank. NSF checks are checks reported as received by the company, but the bank does not recognize them because the check writer has insufficient funds. Notes (loans made to customers collected by the bank) and interest (owed on notes from the customers and collected by the bank) collected by banks. The company may not find out about these items until it receives the bank statement. Bank service fees are fees the bank charges for its banking services and checking accounts. The bank deducts these fees directly from the company's checking account. The company may not find out about the fee until it receives the monthly bank statement. Errors are sometimes made by the company or the bank in recording a transaction. Accountants do not find these errors until they compare the amounts for each transaction in the general ledger and each transaction in the bank statement. Software needed Excel Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) Data: Excel File Lab 5-2 Data.xlsx Perform the Analysis: Refer to Lab 5-2 in the text for instructions and steps for each the of lab parts. Share the Story: Bank reconciliations are a basic internal control used by companies to ensure that their cash transactions are properly recorded. By comparing the cash transactions to the independent records of a bank, the company and its auditors can be more certain that its cash transactions are properly recorded. The company may also use this to identify bank errors. Part 1: Upload Your Files Part 2: Assessment are 1.1 Inload Varir Files AutoSave Off Lab 5-2 Data (1) Protected View Search File Home Insert Page Layout Formulas Data Review View Help QuickBooks PROTECTED VIEW Be carefulfiles from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing D10 fax NSF Check 1217 E F. G 3 A B C D 3 March 31, 2022 4 General Ledger/ Company Books Bank Statement 5 6 Transaction Type Transaction Type 7 Check 1762 1,414.13 Deposit 1224 8 Check 1763 1,783.98 Deposit 1228 9 Check 1764 2,041.73 NSF Check 1213 10 Check 1765 987.34 NSF Check 1217 11 Check 1766 1,501.19 NSF Fees 1 12 Check 1767 2,278.18 NSF Fees 2 13 Check 1768 4,398.01 Deposit 1227 14 Check 1769 1,349.56 Deposit 1225 15 Check 1770 2,430.61 Deposit 1226 16 Check 1771 1,513.19 Deposit 1223 17 Check 1772 2,985.09 Deposit 1229 18 Check 1773 865.23 Deposit 1230 19 Check 1774 152.90 Check 1762 20 Deposit 1223 2,073.14 Check 1764 21 Deposit 1224 127.98 Check 1765 22 Deposit 1225 289.75 Check 1766 23 Deposit 1226 699.46 Check 1767 24 Deposit 1227 1,819.13 Check 1768 25 Deposit 1228 2,985.12 Check 1769 26 Deposit 1229 993.09 Check 1770 27 Deposit 1230 3,012.23 Note Collect 1 28 Deposit 1231 1,264.20 Interest Earned 29 Deposit 1232 1,265.38 30 Deposit 1233 2,613.29 31 127.98 2,985.12 2,645.05 924.17 25.00 35.00 1,819.13 289.75 699.46 2,073.14 993.09 3,012.23 1,414.13 2,041.73 987.34 1,501.19 2,478.18 4,398.01 1,349.56 2,430.61 1,500.00 11.05 Sheet1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started